Province Resources’ David Frances on the ‘wall of money’ coming for hydrogen projects

Pic: Vertigo3d / E+ via Getty Images

Green hydrogen – which burns cleanly and emits water — is the ‘holy grail’ of a net zero emissions future.

Just as lithium-ion and vanadium batteries are ideally suited for electric vehicles and stationary storage, green hydrogen can be used to clean up ‘dirty’ industries like steel production, manufacturing, long haul trucking, and shipping.

The industry is still in its very nascent stages, but ASX juniors are pouring into the space to take advantage of some very bullish sentiment.

One of the ‘new breed’ of green hydrogen stocks is Province Resources (ASX:PRL), which has gained ~1500% since announcing plans to buy the HyEnergy zero carbon hydrogen project in WA in February this year.

In April, it announced plans to partner with French power producer Total Eren on an 8GW green hydrogen development at HyENERGY. A definitive agreement could be signed within four months.

If the 2020s is going to be ‘the decade of hydrogen’, then Province is one ASX stock to watch. Stockhead spoke to managing director David Frances.

There is a flood of speculative capital moving into hydrogen stocks recently. What has been the catalyst?

“COVID precipitated a massive pendulum swing towards ‘clean and green’, or decarbonisation,” Frances says.

‘But it’s been coming for a long time, driven by Europe who are way ahead of everyone else.

“Having been involved in Europe’s lithium scene a few years ago I got to see the massive push, the legislative changes that actually make these things happen.

“We haven’t seen that here yet, but it will come eventually.”

Is it legislative change that is absolutely crucial to get green hydrogen off the ground?

“100 per cent.”

Is there a consensus outlook for green hydrogen demand?

“It will take a while to transition from fossil fuels to ‘clean and green’,” Frances says.

“But we are seeing almost all the big oil and gas producers transitioning from their traditional business to clean energy.

“They have set all sorts of goals and targets. They want to have ‘x’ amount of their revenue generated from green energy within a certain number of years. These targets vary between companies, but all the big ones are on board.

“These fundamental changes tend to happen a lot quicker than people predict. They build, build … and then the pendulum swings very rapidly.

“Every graph we look at shows exponential growth over the next 10 to 15 years [for green hydrogen].

“But there’s no consensus, because the numbers seem to change daily. I’ve only ever seen the numbers go up.”

Do you think it will mirror the battery metals growth story?

“It will. Absolutely. I think you’ll see exactly the same thing – slow inception and build-up, but once it gets established things will start to grow exponentially,” he says.

“It’s also important to note that currently there aren’t that many taxes imposed on carbon producers, but that is changing.

“That will really swing the pendulum for green hydrogen.

“Plus, all the R&D that has gone into photovoltaic (PV) and wind power means lower costs as efficiencies go up significantly.

“That R&D money has now started to go into the electrolyser side. You’ll find the costs of producing hydrogen will come down significantly, especially as operations scale up.”

You mention electrolysers, which are still very expensive to build and run. Is that one of the things that needs to come down in price for green hydrogen to be widespread?

“Yes, but the biggest input cost –75% — for green hydrogen is power.

“You can scale up the power (usually wind and solar farms) to get the right price, which is about $US20KWh. If you get that, you can generally make green hydrogen comparable to fossil fuel generated hydrogen.

“When you add the electrolyser R&D, efficiencies will continue to improve, and costs will go down.

“Then once you add carbon tariffs green hydrogen becomes extremely attractive.”

Are there advantages to Province Resources being one of the first movers in the hydrogen space?

“Sometimes you can be the ‘guinea pig’ for potential regulatory or technical hurdles, but it is still better to be a first mover than late to the party.”

You guys are up 2000% since acquiring the HyENERGY project. What sets Province Resources apart from the other hydrogen hopefuls on the ASX?

“Project scale and partners.”

“Our partner is Total Eren, a global leader in renewable power. Their parent company – or 30% owner — is Total, one of the oil and gas supermajors.

“To have access to the financial and technical capacity these guys have to deliver big projects is not something many companies [on the ASX] have.

“There are a lot of companies saying they will make some green hydrogen, but being a small producer is more of a niche market — to tap into the domestic and export markets you need to be big.

“Ours is a large 8GW project, the 5th largest in the world currently.”

It seems like everything has happened all at once for Province. Were there conversations with Total happening in the background before you made the acquisition?

“I’ve known Total since I was working in Africa some years ago, so the contacts were already established,” Frances says.

“Once we had started negotiating on the [project acquisition] I engaged with Total Eren on a ‘no names’ basis about what sort of projects they would be interested in.”

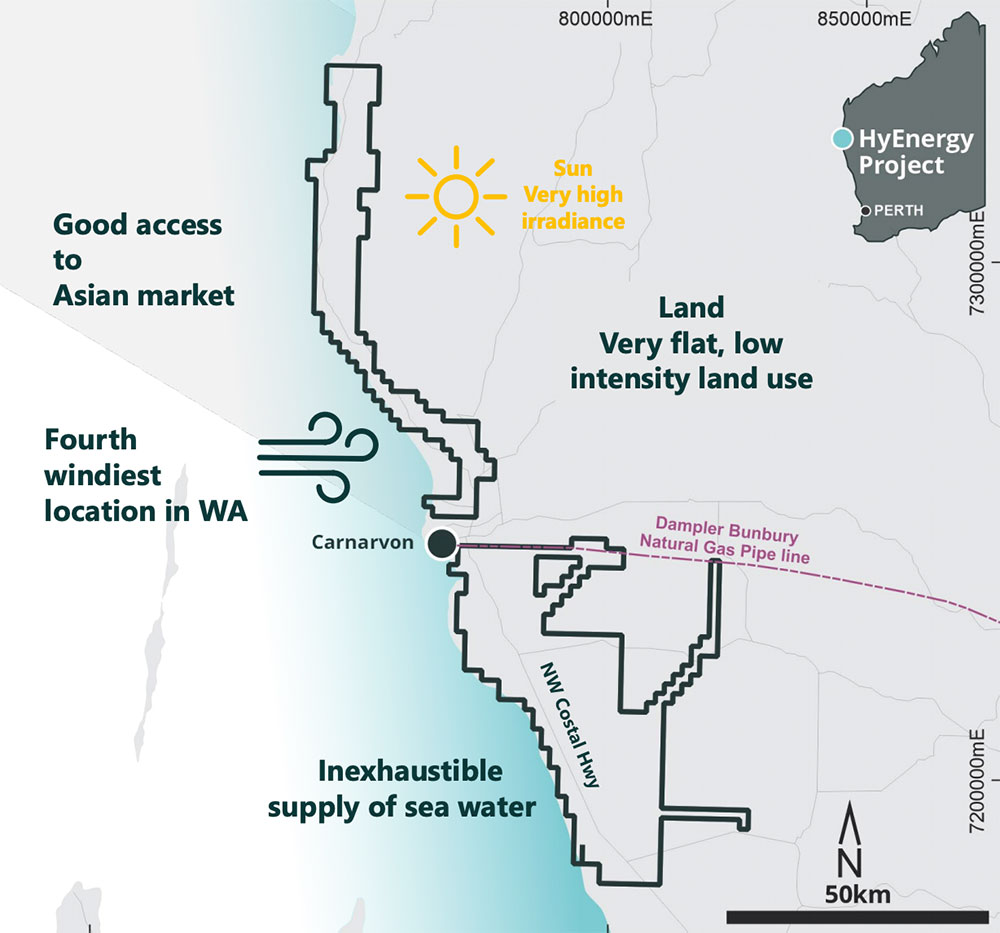

What do they like about the HyENERGY project?

“The location, for one thing.” Frances says.

“It’s sunny, and the 4th windiest place in WA.

“But it’s not just about having wind and sun. They need to be complementary; wind that blows at night – not just the daytime – to get that ‘smooth’ power.

“Also, the project is far enough north not to be affected by southern cold fronts which bring cloudy days, and far enough south not to be affected by most of the tropical cyclone activity.

“It is a bit of ‘sweet spot’, if you like.

“We have wind sun and salt water – the main ingredients [for green hydrogen] — in spades.”

Are you pretty confident this deal with Total Eren will evolve into a binding agreement?

“Yes. The scoping study will happen over the next four months or so, which is when we intend to have the paperwork done,” Frances says.

“If the scoping study shows a viable project, then we don’t have any doubts whatsoever the deal will be inked.”

Are you confident the project is viable?

“Yes, absolutely, from the data we have seen so far.”

Is it too early to talk about who Province Resources plans to supply with green hydrogen?

“We would be aiming to supply both domestic and export markets,” Frances says.

“The government wants to see 10% hydrogen displacing LNG in the Dampier gas pipeline, which runs right through the project area.

“We would look at helping the government hit that 10%.

“And then there’s the export market. One of the beautiful things about having a partner like Total Eren is that they already have a global distribution and offtake network.”

To summarise – why should investors care about Province?

“Location, location, location. To produce world class renewable energy, you need a world class location,” Frances says.

“Also, partners. The project area is attractive, and Total Eren can see that.

“There are also massive tailwinds to get these [green hydrogen] projects up at the moment.

“There is a wall of money coming for these projects, so funding isn’t an issue.

“It about getting down to a feasibility study stage and then – if its stacks up – building it.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.