The green hydrogen hype has come and gone – these ASX stocks are left standing

Energy

Energy

While the froth from the initial excitement about green hydrogen seems to have settled, there are several ASX players still in the game making big strides towards production.

In 2021, the word ‘hydrogen’ surged 21pc in company filings as businesses started to seriously consider the clean fuel as the next step in renewable energy.

Phrases such as ‘carbon emissions’, ‘emissions reduction’, and ‘climate change’ became key sustainability themes, according to Globaldata, attracting significant investor traction on the back of net-zero pledges.

Yet, as global demand topped 94Mt – thanks to traditional uses in refining and industry – many governments including Australia remained reluctant to openly invest in green hydrogen.

It was overlooked, probably because the technology for producing it remains fairly new and expensive.

Fast forward to 2022 – it is obvious energy policy and strategy is being rethought the world over as the war in Ukraine deteriorates, the energy crisis deepens, and inflation keeps pushing electricity prices higher.

Hydrogen is now considered the ultimate decarbonisation solution, but the question is, which stocks are left standing?

NOW READ: Here’s everything you need to know about ‘the fuel of the future’

Before diving headfirst into the stocks, it is important to understand how hydrogen is produced.

Hydrogen production is not new, we have been producing the gas for decades now – primarily for industrial purposes.

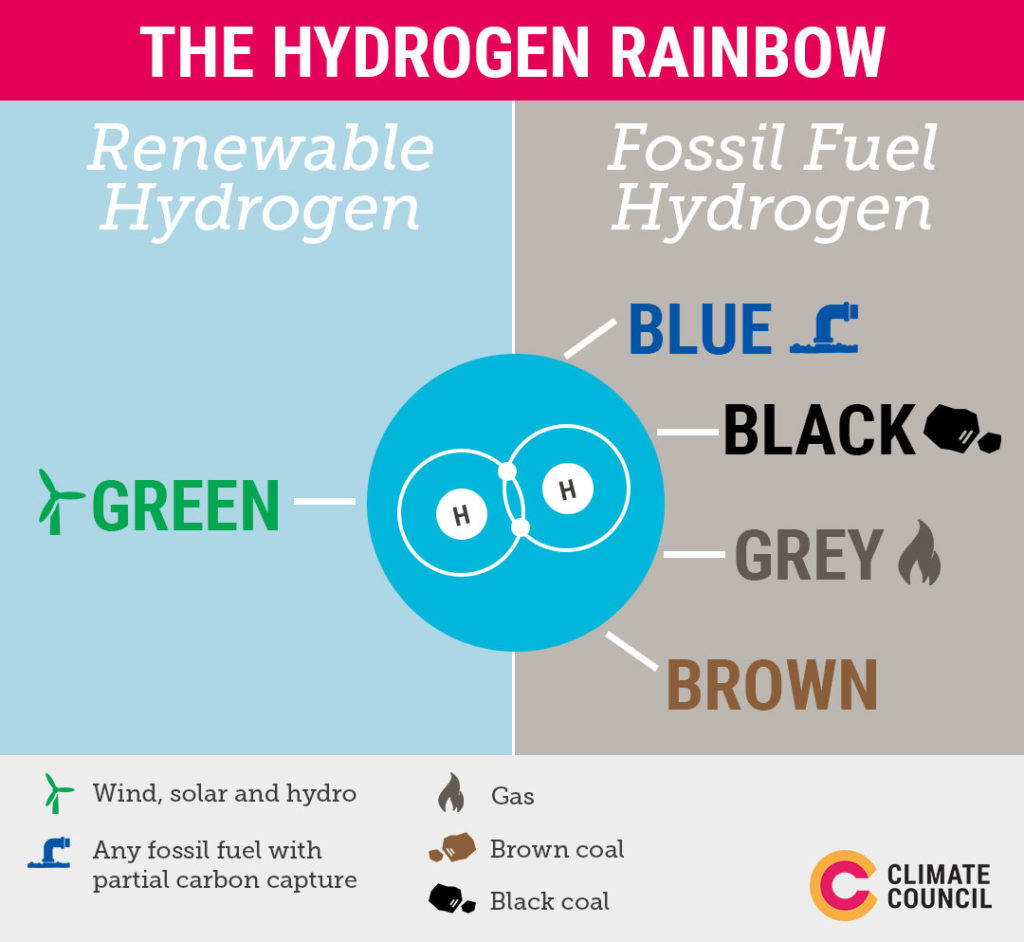

What is new are the many different methods which claim to produce hydrogen cleanly which has resulted in a true rainbow of variety that has proved to be a head-scratcher.

Blue is hydrogen produced from fossil fuel – typically methane reforming or coal gasification. Where it differs from ‘grey’ or ‘brown’ hydrogen is that the resulting carbon emissions are captured and either sequestered or used.

In contrast, the green variety is hydrogen produced from water using electrolysers powered by renewable energy, making it arguably the only truly clean form of producing the gas.

While green is touted as the ‘holy grail’ of the hydrogen world, the argument set by gas companies is that blue hydrogen – based as it is on proven technologies – is expected to lower the cost of production, which will in turn jump-start the industry.

Examples of ASX stocks with blue hydrogen projects include Hexagon Energy (ASX:HXG) with its WAH2 Hydrogen Project and Pilot Energy (ASX:PGY), which just completed a feasibility study into the potential for a Blue Hydrogen and Carbon Capture and Storage (CCS) Project in WA’s Mid-West region with a consortium of other companies.

Somewhere between green and blue hydrogen is turquoise hydrogen, often called ‘low emission hydrogen’, which is produced from methane contained in natural gas or biogas through a decomposition process called ‘methane pyrolysis’.

The process is driven by heat produced with electricity rather than through the combustion of fossil fuels and the carbon contained within the methane or biogas is produced as a solid rather than as carbon dioxide, which has the added bonus of possibly generating a valuable byproduct like graphene.

There are a few stocks on the ASX exploring this method of production including Perth-based Hazer Group (ASX:HZR) who has come up with its own pyrolysis process that isolates hydrogen from methane with iron-ore used as a catalyst and Pure Hydrogen (ASX:PHS) which is proceeding with plans to manufacture turquoise hydrogen through the signing of a binding collaboration and licence term sheet with French technology company Plenesys.

But Climate Energy Finance director Tim Buckley sees green hydrogen as a major new technology in development, one of the many tools to help drive global decarbonisation.

“We need to beware of the excessive hype of green hydrogen, and the associated greenwash of the LNG and methane pipeline industry sectors in promoting so called ‘blue hydrogen’ as the potential road to decarbonise their fossil fuel industry,” he says.

While green hydrogen is expected to be commercially viable in certain sectors such as steel, explosives, fertilisers, and refineries – and in certain geographies with major ongoing energy risks like Japan and Korea – Buckley adds it is still a decade away from commercial viability.

“We need to see ongoing deflation in firmed renewable energy costs as well as a massive upscaling in electrolyser manufacturing capacity, which in turn will likely see installed electrolyser capital costs drop by 50-70% over the coming decade,” he says.

“The global hydrogen hype peaked back at the start of 2021, as evidenced by the share prices of international green hydrogen firms like NASDAQ-listed Plug Power, Norwegian company NEL ASA and UK-based ITM Power.

“However, they have collectively dropped by more than 50% since, even as tangible hydrogen momentum has built.”

The good news?

Many of these hydrogen pure plays raised billions of dollars of equity capital before the bubble burst “so the deployment of this capital has underpinned the much-needed scaling up of hydrogen,” Buckley explains.

Swipe or scroll to reveal full table. Click headings to sort:

| CODE | COMPANY | PRICE | % WEEK | % MONTH | % YEAR | MARKET CAP |

|---|---|---|---|---|---|---|

| HZR | Hazer Group Limited | 0.56 | 5% | -10% | -58% | $94,596,277 |

| HXG | Hexagon Energy | 0.014 | -13% | -18% | -83% | $7,693,739 |

| LIO | Lion Energy Limited | 0.033 | -11% | 3% | -46% | $14,487,748 |

| PV1 | Provaris Energy Ltd | 0.056 | 0% | -8% | -49% | $32,348,547 |

| PRL | Province Resources | 0.086 | -5% | 1% | -46% | $101,608,410 |

| PH2 | Pure Hydrogen Corp | 0.25 | -2% | -2% | -19% | $83,565,613 |

| SPN | Sparc Tech Ltd | 0.75 | -13% | -24% | -9% | $51,511,962 |

| RNE | Renu Energy Ltd | 0.04 | 5% | 3% | -29% | $16,040,905 |

| MR1 | Montem Resources | 0.04 | 0% | 0% | -49% | $12,766,020 |

| FMG | Fortescue Metals Grp | 16.77 | -2% | 1% | 16% | $50,371,866,058 |

| PGY | Pilot Energy Ltd | 0.018 | 0% | 6% | -74% | $11,005,881 |

| EDE | Eden Inv Ltd | 0.0065 | 8% | -41% | -66% | $18,978,603 |

| ADX | ADX Energy Ltd | 0.007 | 0% | -7% | -36% | $24,535,208 |

| WDS | Woodside Energy | 35.61 | 5% | 10% | 49% | $67,348,654,377 |

| FHE | Frontier Energy Ltd | 0.48 | 9% | 37% | 269% | $108,956,761 |

| ORG | Origin Energy | 5.37 | -6% | -6% | 4% | $9,096,107,703 |

| ECT | Env Clean Tech Ltd. | 0.016 | 0% | -16% | 14% | $27,460,027 |

| MEL | Metgasco Ltd | 0.021 | 5% | -13% | -22% | $20,142,434 |

| TNG | TNG Limited | 0.081 | -10% | -10% | -23% | $102,742,948 |

| SRJ | SRJ Technologies | 0.43 | 0% | 0% | 8% | $34,125,795 |

| AGL | AGL Energy Limited. | 6.56 | -4% | -5% | 7% | $4,352,674,598 |

| IPL | Incitec Pivot | 3.63 | -1% | -1% | 17% | $6,875,476,603 |

In Australia when discussing ASX listed stocks with exposure to green hydrogen, there’s the companies at the big end of town with the financial capability and resources to invest in the hydrogen industry over the next decade or two and the smaller, pure play stocks.

Mining majors like Fortescue Metals (ASX:FMG) is currently investing some US$600m per annum in research and development in the space through its green arm Fortescue Future Industries (FFI) with the goal of producing 15Mt per year of green hydrogen by 2030.

“The company has made a huge number of global announcements, press releases and non-binding MOUs but the conversation has shifted more recently to the tangible fossil fuel replacement opportunities in-house in decarbonising its hugely energy intensive iron ore business,” Buckley says.

We’re investing US$6.2b to eliminate #FossilFuel from our operations by 2030. Our Founder and Executive Chairman joins @CNBCi to break down the technology we’ll use to do it, while saving US$818m per year in operational costs. ⬇️ pic.twitter.com/UwMEuuAzs6

— Fortescue Metals (@FortescueNews) September 28, 2022

“This is a captive market to scale up, learn by doing and catch immediate cost savings to justify the proposed US$6bn FMG plans to spend on curbing its iron ore emissions and eliminate fossil fuels altogether by 2030.”

NOW READ: Fortescue pledges US$6.2bn to hit “real zero” by 2030 but New Hope shows coal still pays

Meanwhile, oil and gas giant Woodside (ASX:WDS) is pushing ahead with its H2OK green hydrogen project in Ardmore, Oklahoma where it recently awarded Norway’s Nel Hydrogen Electrolyser a contract for the provision of alkaline electrolyser equipment.

This will support the first phase of Woodside’s project and will be capable of producing 90t of hydrogen per day, more than enough to support the plant’s nameplate capacity of 64,000kg per day.

Another major making waves in the sector is Origin Energy (ASX:ORG).

In February, the energy stock brought forward the closure of its Eraring coal fired power station from 2032 to 2025, with plans to replace it with a 70MW battery.

On the green hydrogen front, the company has signed an agreement with Orica to collaborate on a ‘Hunter Valley Hydrogen Hub’, which will use a grid connected 55MW electrolyser to produce the stuff for use by industry and the region’s heavy transport operators.

One of the biggest players in the small-cap hydrogen space is $16.04m market cap stock ReNu Energy (ASX:RNE), otherwise known as a clean energy incubator.

With a portfolio of four companies, Peak Asset Management’s Ali Ukani says investors get a great deal of exposure to cutting edge technology in the clean energy space.

RNE recently acquired Countrywide Hydrogen, a developer of four renewable hydrogen projects – two in Victoria and two in Tasmania.

One of these projects in Tasmania – the Brighton Project – includes the production of green hydrogen, the construction of a network to distribute the hydrogen, and blending green hydrogen into the existing natural gas distribution network.

“This is going to be one of the first projects to come into production in Australia, if not the first,” Ukani says.

“FMG and Woodside have 2024 and 2025 as their production targets whereas ReNu Energy is aiming for quarter four 2023, which gives them first mover advantage.”

NOW READ: Frontier Energy locks-in collaboration agreement with Waroona Energy

In Western Australia, Frontier Energy (ASX:FHE) is making strong progress at its Bristol Springs Green Hydrogen Project where it recently signed a collaboration agreement with Waroona Energy to explore how they can benefit from sharing resources for renewable energy production.

Waroona Energy is developing a 241MW solar farm adjacent to Bristol Springs and like FHE, key approvals are in place with construction set to kick off in 2023.

Combined, the solar energy potential of the two projects totals roughly 700MW, making it the largest renewable energy project with access to the Southwest Interconnected System (SWIS).

A pre-feasibility study has already found that stage one could power a 36.6MW electrolyser to produce 4.4 million kilograms of green hydrogen per annum at just $2.83/kg – well within reach of the $2/kg price point where the green fuel is considered to be competitive with fossil fuels.

While not purely “green” plays, there has been plenty of movement in 2022 amongst ASX stocks with hydrogen plans.

Here’s a brief summary of some of their highlights for the year so far:

Hazer Group (ASX:HZR) – During the year HZR developed and executed a MOU with Suncor Energy and FortisBC Energy to develop a 2,500tpa low-carbon emission hydrogen production facility in British Columbia, Canada based on the Hazer technology.

Hexagon Energy (ASX:HXG) – HXG has an MOU in place with international solar company FRV who it anticipates will come on as partners for the renewable component of the WAH2 Project. The company is in discussions with two large corporations who are progressing CO2 sequestration and hopes to secure a Heads of Agreement in the coming months.

Lion Energy (ASX:LIO) – Initial front-end engineering and design (FEED) work for a commercial-scale hydrogen production and refuelling station has wrapped up with procurement set for completion in the next few months. LIO expects the facility to start hydrogen production on Australia’s Eastern Seaboard by Q4, 2023.

Provaris (ASX:PV1) – Provaris has lodged its EPBC Referral with the Australian Federal Government’s Department of Climate Change, Energy, the Environment and Water for its proposed Tiwi H2 Project on the Tiwi Islands. The Tiwi H2 project comprises the proposed development of a 100,000tpa green hydrogen production and export facility on Melville Island.

Province Resources (ASX:PRL) – PRL and Total Eren have secured another section 91 licence over an additional 2,217km of land in the Gascoyne region of Western Australia as they expand their footprint for the HyEnergy green hydrogen project.

Pure Hydrogen (ASX:PH2) – PH2 recently signed a Master Supply Agreement with BLK Auto, which will allow Pure Hydrogen to re-sell an expanded range of hydrogen fuelled trucks, buses and storage pods to customers in Asia Pacific, India and Africa.

Sparc Technologies (ASX:SPN) – Sparc completed a preliminary Techno-Economic analysis for its photocatalytic water splitting technology in August, confirming the commercial potential for the ‘Sparc Green Hydrogen process’.

Environmental Clean Technologies (ASX:ECT) – ECT signed of a binding joint venture agreement with GrapheneX. This agreement supports the rollout of Phase 2 of ECT’s Bacchus Marsh COLDry project to deliver a demonstration of its proposed commercial-scale net-zero hydrogen and electricity production.

Montem Resources (ASX:MR1) – MR1 completed pre-feasibility studies for the pumped hydro energy storage and green hydrogen electrolyser elements of the Tent Mountain Renewable Energy Complex in Alberta, Canada as commercial aspects continue to advance.

Eden Innovations (ASX:EDE) – During the quarter, Eden US updated its proprietary Hythane blender (for blending hydrogen and natural gas in specific ratios), which was developed more than 12 years ago, and now needed to have some of its original components replaced with improved and currently available components. Hythane is currently being rolled out in Greater Delhi where 7,000 natural gas buses are being converted to operate on Hythane.

At Stockhead we tell it like it is. While Pure Hydrogen, Pilot Energy, and Frontier Energy are Stockhead advertisers, they did not sponsor this article.