Closing Bell: Markets up almost 0.1pc on Friday as the cows take control

News

News

Local markets have wavered either side of the happy line on Friday after the US blue chip S&P500 index briefly slapped the Hand of God 5,000 mark for the first time overnight. No one here cares. We lack the tech firepower to join those kind of shennanigans.

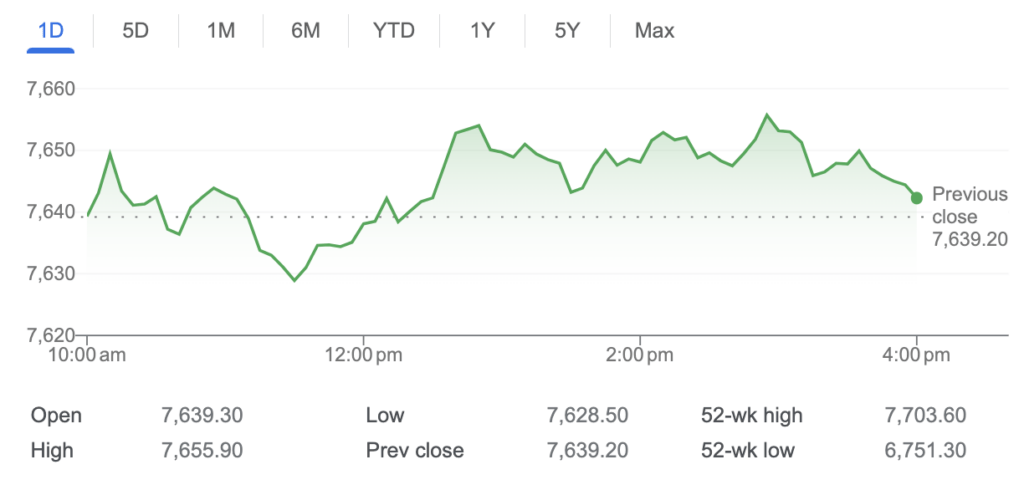

At 4.165pm on February 9, the S&P/ASX200 was up 5.5 points or 0.073%% to 7,644.80:

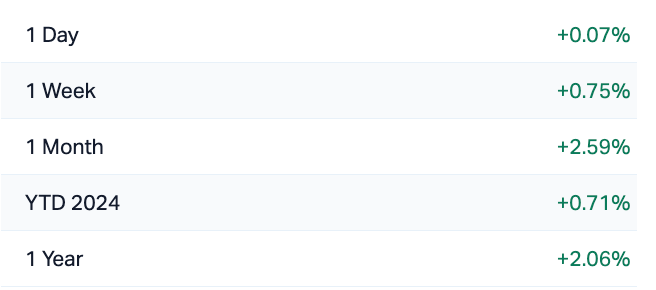

The Aussie benchmark lifted for a third straight post-RBA session. But not with anything its mum might read in a letter home.

It was a lacklustre day of trade – aside from some smashing small cap news outlined below by my colleague Gregor ‘The Wee One’ Stronach, indicative of an index sorely lacking a Magnificent Seven, a Superlative Six or even a Fortunate Five.

The index is certainly bovine right now. Though more more cow than bull, if we’re honest.

Both the ASX small ordinaries (XSO) indeed and the (XEC) emerging companies index were 0.15% and 0.25 lower respectively.

The XEC is having a shocker. Here it vs the ASX200 over the last 12 months. Katana Asset Management’s Romano Sala Tenna, is onto this.

At home, it was 6 plays 5 for the 11 local sectors by end of business on Friday.

Decent gains from the IT Sector were offset by worse losses for Energy stocks which did have a good run up to the coal face before more bad nuptual news from prospective gassy buds, Messrs Woodside Energy Group (ASX:WDS) and Santos (ASX:STO) .

And that’s despite Brent crude oil prices rallying more than 3% overnight where form suggests Israeli prime minister Benjamin Netanyahu has parked some offshore running away funds after he dismissed out of hand the Gaza ceasefire talk, indefinitely prolonging the Israel-Hamas conflagration.

Elsewhere Legend of Bricks Boral (ASX:BLD) surged 9% after lifting earnings guidance on strong volumes.

And the Healthcare Sector climbed dragged higher largely by Cochlear (ASX:COH) but with a fair effort from the medical equipment supplier EBOS Group (ASX:EBO).

Computershare (ASX:CPU) and Xero (ASX:XRO) led IT on a welcome 1.13% jaunt.

![]()

Around the neighborhood…

The Nikkei 225 Index is at a 34 year high on Friday as robust corporate earnings, a softening yen and a dovish outlook on Bank of Japan monetary policy this week pushed the markets to absurd new heights.

On Thursday, China consumer prices fell at their fastest pace since 2009 in January, with deflationary pressures hurting earnings and weighing on an already heavy stock market.

However, for any remaining optimists amongst us the muted market reaction to the abysmal data was nothing less than uplifting.

The Shanghai Composite Index just kept keeping on – extending its recent advance by more than 1% while the Hang Seng slid a more 1%.

One could almost imagine flailing Chinese equity markets with their big toe stretched out right now… seeking the muddy bottom somewhere near…

We’re watching oil on Friday…

Because West Texas Intermediate is sitting back at around $76.50 per barrel as prices rebounded on last week’s tremendous losses. In fact the deteriorating state of the Middle Easy has all but recaputured the 7% slide oil made on last week’s sniff of a truce.

On the demand side, official data showed that US gasoline inventories declined by 3.15 million barrels last week, far exceeding forecasts for a 140,000 barrel draw. US crude stockpiles rose 5.5 million barrels during the same period, above market expectations for a 1.895 million barrel build.

Meanwhile, in the States…

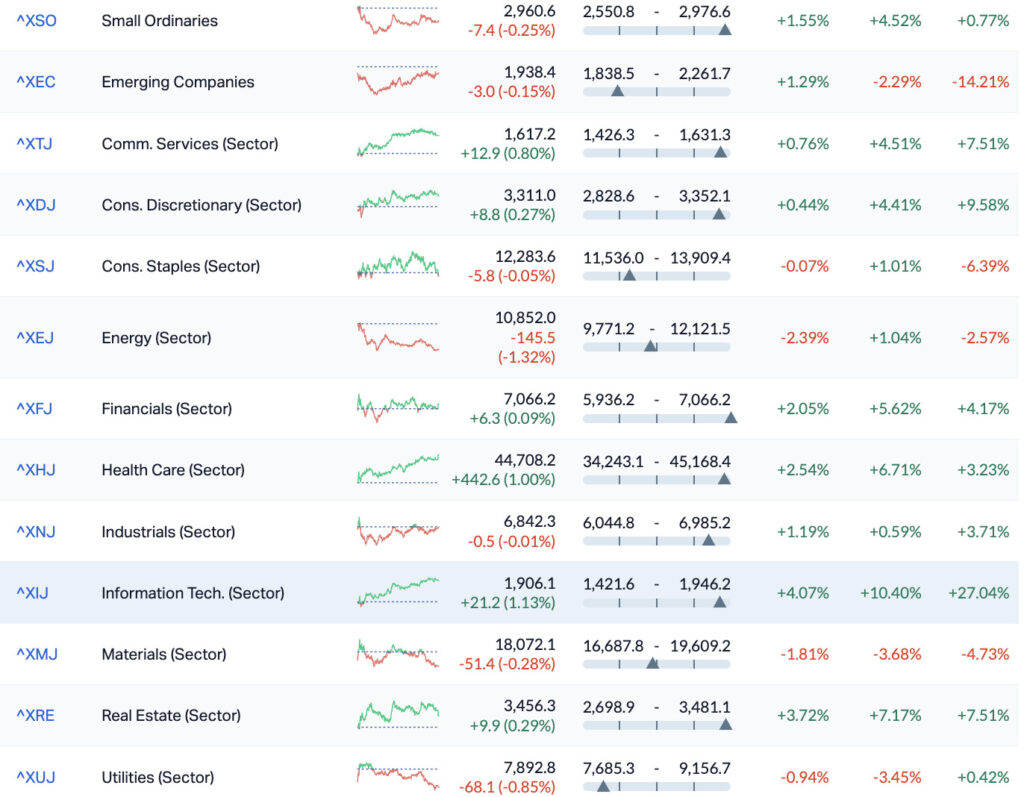

In regular trading on Thursday in New York, the Dow rose 0.13%, the S&P 500 inched up 0.06% and the Nasdaq Composite gained 0.24%.

In years when the US S&P500 made new highs in both January and February, the full-year return averaged +15.8%, well above the +9.2% annual average since 1954.

Market Matters James Gerrish says this this dovetails pretty good into historically strong markets that usually play out during US election years – offering a couple of strong supporting factors for equities as the year progresses.

“Right now, the S&P 500’s forward PE ratio is currently ~20x, above its 10-year average of 17.6x hence, many investors are becoming increasingly nervous as the US market climbs a wall of worry.

“Our view though, is the market looks good through 2024/5 as the Fed Pivot approaches, but it simply needs a rest as valuations are stretched and Jerome Powell is threatening to cut rates slower than the markets both anticipating and pricing in,” James says.

Meanwhile, in extended Wall Street trading, Pinterest has fallen more than 10% after missing revenue estimates in the latest quarter and issuing a weak forecast.

Expedia also shed 13% after the company’s Q4 profit and gross bookings fell short of expectations.

If anyone still has the passion, Bitcoin and Ether are on the rise. BTC is up 2.5% over the last 24 hours.

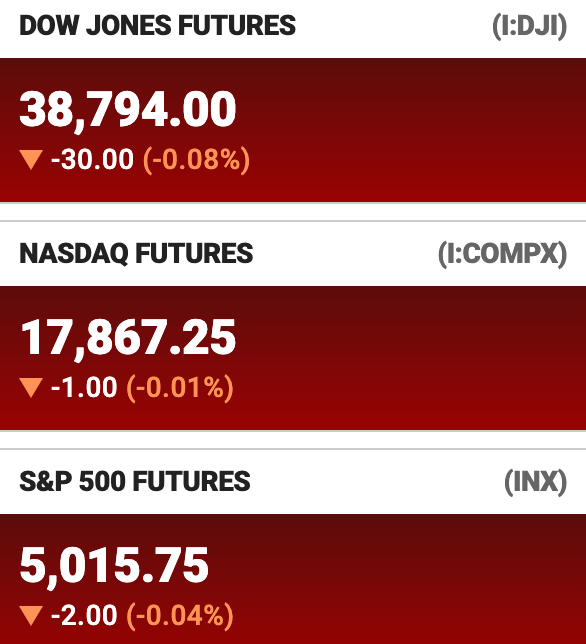

And US Futures are mixed in Sydney (at 4pm on Friday).

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| VMS | Venture Minerals | 0.0145 | 81% | 140,015,951 | $17,680,104 |

| TGM | Theta Gold Mines Ltd | 0.14 | 54% | 1,159,271 | $64,750,125 |

| AOA | Ausmon Resorces | 0.003 | 50% | 129,936 | $2,117,999 |

| YPB | YPB Group Ltd | 0.003 | 50% | 578,341 | $1,580,923 |

| BMG | BMG Resources Ltd | 0.016 | 33% | 15,179,628 | $7,605,566 |

| IS3 | I Synergy Group Ltd | 0.008 | 33% | 10,114 | $1,824,482 |

| IR1 | Iris Metals | 0.82 | 30% | 238,499 | $81,575,539 |

| EG1 | Evergreen Lithium | 0.115 | 28% | 3,734 | $5,060,700 |

| DUB | Dubber Corp Ltd | 0.225 | 25% | 1,263,874 | $70,426,851 |

| KNM | Kneomedia Limited | 0.0025 | 25% | 2,017,798 | $3,066,543 |

| KPO | Kalina Power Limited | 0.005 | 25% | 5,459,489 | $8,840,512 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 3,994,500 | $9,878,481 |

| RDN | Raiden Resources Ltd | 0.0285 | 24% | 41,084,079 | $61,101,457 |

| ZAG | Zuleika Gold Ltd | 0.021 | 24% | 769,599 | $12,513,454 |

| AN1 | Anagenics Limited | 0.016 | 23% | 353,966 | $4,924,112 |

| AVA | AVA Risk Group Ltd | 0.2 | 23% | 2,237,194 | $41,622,119 |

| HYD | Hydrix Limited | 0.023 | 21% | 462,098 | $4,830,158 |

| EMS | Eastern Metals | 0.035 | 21% | 20,000 | $2,390,361 |

| OPL | Opyl Limited | 0.035 | 21% | 470,806 | $4,873,696 |

| HIQ | Hitiq Limited | 0.024 | 20% | 45,913 | $7,036,899 |

| TG1 | Techgen Metals Ltd | 0.037 | 19% | 1,027,820 | $3,941,110 |

| ARV | Artemis Resources | 0.019 | 19% | 7,473,852 | $27,059,138 |

| DRO | Droneshield Limited | 0.7 | 19% | 13,194,647 | $361,170,630 |

| ERW | Errawarra Resources | 0.07 | 19% | 1,272,922 | $5,659,319 |

| RNO | Rhinomed Ltd | 0.033 | 18% | 2,121,243 | $7,938,678 |

Top of the Pops among the small caps on Friday was Venture Minerals (ASX:VMS), up 63% before lunch on news that the company has delivered a record drill hit at its large-scale, clay hosted Jupiter Rare Earths prospect in the Mid-West region of Western Australia, with the intercept measuring in at 48m @ 3,025ppm TREO, alongside assays up to 10,266ppm and 20,538ppm TREO from nearby holes.

Aussie tech minnow AVA Risk Group (ASX:AVA) was also rising nicely on news that it has inked a Telstra Supply Agreement with Telstra Group (of course… duh) that will see the telco putting the company’s risk assessment tech to use.

The deal follows 10 months of collaboration through product trials with Telstra and its customers, including monitoring the urban fibre network in metropolitan Melbourne and the subsea fibre cables in the Port of Darwin.

However, there seems to be some kind of problem with the announcement. AVA was evidently pinged by the ASX over the initial announcement, and trading was paused at 10.45am.

The company issued another announcement with more details at 2:54pm, and was immediately suspended again, “pending the release of a satisfactory response to an ASX Query Letter regarding the announcements it has made today.”

BPH Global (ASX:BP8) got in on the Chinese New Year festivities, up 33% ahead of what is likely to be a productive period for the company.

BPH Global’s wholly-owned subsidiary Foshan Gedishi Biotechnology recently signed a major supply deal with Chinese tobacco company China Tobacco, to supply birds’ nests for distribution and consumption throughout Guangzhou City and the surrounding Province of Guangdong.

Novonix (ASX:NVX) gained weight in the morning on news that it has signed a binding off-take agreement for high-performance synthetic graphite anode material to be supplied to Panasonic Energy’s North American operations from Novonix’s Riverside facility in Chattanooga, Tennessee.

Theta Gold Mines (ASX:TGM) went screaming for the stratosphere in the middle of the day, and was almost as quickly put into a trading halt before the bell rang, after moving rapidly to +52% on no news – no doubt there will be something on the lists on Monday.

BMG Resources (ASX:BMG) enjoyed a late surge on Friday on the previous day’s news that it had signed a binding option agreement pursuant to which it has the right to acquire a 90% interest in three exploration licences (one granted and two in application) in the West Arunta region of Western Australia, with plans to name the bundle the Dragon Niobium-REE Project.

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| ARC | ARC Funds Limited | 0.125 | -34% | 3,284 | $5,714,506.88 |

| RBR | RBR Group Ltd | 0.002 | -33% | 374 | $4,855,213.98 |

| RR1 | Reach Resources Ltd | 0.002 | -33% | 31,545,616 | $9,630,891.34 |

| INV | Investsmart Group | 0.105 | -32% | 51 | $22,115,475.02 |

| RHY | Rhythm Biosciences | 0.125 | -29% | 996,078 | $38,699,953.08 |

| MXO | Motio Ltd | 0.023 | -28% | 101,399 | $8,582,347.07 |

| M24 | Mamba Exploration | 0.033 | -25% | 1,794,358 | $8,099,620.14 |

| ENT | Enterprise Metals | 0.003 | -25% | 18,318 | $3,207,883.73 |

| DOU | Douugh Limited | 0.004 | -20% | 1,297 | $5,410,344.60 |

| DY6 | DY6 Metals | 0.052 | -20% | 70,000 | $2,567,228.69 |

| IEC | Intra Energy Corp | 0.002 | -20% | 307,143 | $4,151,953.96 |

| QXR | Qx Resources Limited | 0.022 | -19% | 9,148,083 | $29,972,102.06 |

| PIM | Pinnacle Minerals | 0.09 | -18% | 1,306,484 | $3,812,942.87 |

| BUR | Burley Minerals | 0.074 | -18% | 144,843 | $9,296,708.04 |

| LCL | LCL Resources Ltd | 0.01 | -17% | 1,602,787 | $11,413,758.84 |

| M4M | Macro Metals Limited | 0.0025 | -17% | 2,511,235 | $7,401,233.27 |

| NVQ | Noviqtech Limited | 0.0025 | -17% | 64,257 | $3,928,335.89 |

| T88 | Taitonresources | 0.105 | -16% | 8,000 | $6,721,818.00 |

| RNE | Renu Energy Ltd | 0.011 | -15% | 227,523 | $8,774,575.36 |

| CXU | Cauldron Energy Ltd | 0.047 | -15% | 12,987,614 | $63,438,430.44 |

| GMN | Gold Mountain Ltd | 0.003 | -14% | 2,702,121 | $7,941,775.05 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 405,380 | $7,302,977.75 |

| PLN | Pioneer Lithium | 0.12 | -14% | 237,727 | $3,979,500.14 |

| PTR | Petratherm Ltd | 0.024 | -14% | 234,813 | $6,293,031.89 |

Venture Minerals (ASX:VMS) has received its first batch of assay results from Stage 1 resource definition drilling at the Jupiter REE prospect, hitting a record 48m @ 3,025ppm in total rare earth oxides (TREO).

BPH Energy (ASX:BPH) plans to further unlock the potential of its gas projects in NSW, while advancing the next phase of investee company Cortical Dynamic’s expansion strategy, following a $2.25m raising.

Tech venture firm Fatfish Group (ASX:FFG) says its subsidiary SF Direct Sdn Bhd (SF Direct) has obtained a full digital lending license from Malaysia’s Ministry of Local Government Development after being granted a conditional approval.

Phase 2 drilling has returned wide intersections of relatively modest lithium mineralisation at each prospect area, broadening the overall potential of Reach Resources’ (ASX:RR1) Morrissey Hill project in Yinnetharra, WA.

Closed-spaced shallow reverse circulation drilling aimed at converting the exploration target at Mt Malcolm Mines’ (ASX:M2M) Golden Crown prospect into resources has returned visible gold in numerous intersections.

Strike Energy (ASX:STX) – pending an announcement to the market regarding well test results at South Erregulla-3.

GreenTech Metals (ASX:GRE) – pending the completion of the analysis of assay results.

AVA Risk Group (ASX:AVA) – Made an announcement, got halted, made a new announcement and then was immediately suspended again, “pending the release of a satisfactory response to an ASX Query Letter regarding the announcements it has made today.”

Artemis Resources (ASX:ARV) – pending the finalising of assay results on recent exploration work.

Theta Gold Mines (ASX:TGM) – speeding ticket.