MoneyTalks: It’s dawn on the Age of the ASX Little Cap

Dawn. Via Getty

MoneyTalks is Stockhead’s regular drill down into what stocks investors are looking at right now. We’ll tap our extensive list of experts to hear what’s hot, their top picks, and what they’re looking out for.

Today we hear from Katana Asset Management portfolio manager Romano Sala Tenna.

It’s been a tough cash rate cycle for everyone, but spare a particular thought for Aussie small caps and emerging companies.

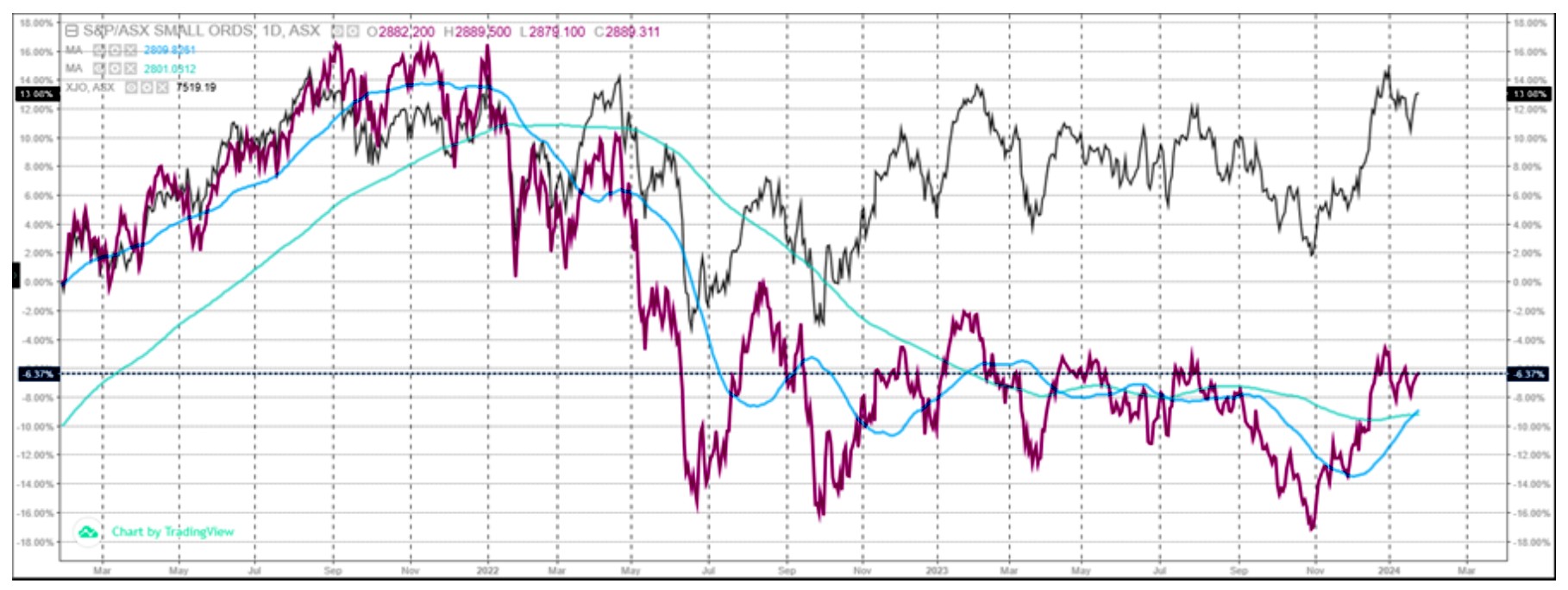

The chart below tracks the adventures of the benchmark ASX200 (XJO) Index (in blue) vs. the ASX Emerging Companies (XEC ) index (yellow) over the last 12 months…

It paints a pretty damning picture.

ASX vs XEC 12 months

And while there’s naturally talk of a turning tide when it comes to Aussie small caps vs the larger companies with strong balance sheets, according to Katana’s Romano Sala Tenna, the mistake is to be thinking this way in the first place.

Go small or go home

“It doesn’t matter if it’s a black cat, or a white cat, as long as it catches mice…”

– Former Chinese Premier Deng Xiao Ping

Romano says that give or take the last few years of COVID-inflamed volatility, the chatter round the investor campfire often falls to the widely-held assumption that ASX large caps inevitably outperform ASX small caps over the long-term.

The proof of this is surely in the latest pudding baked by the recent record run of Reserve Bank rate hikes, something the above index comparison seems to confirm.

“However,” Romano suggests, “the equity cycle is not clockwork – and at various stages the sun appears and shines brightly, on small caps.

“And suddenly the family of lesser valued companies come into their own and outperform the broader indexes.”

The process isn’t shrouded in secrecy and, according to Romano, the signals to don the small cap sunglasses are normally as follows:

-

Large caps have appreciated to the point where valuations are stretched

-

The ‘animal spirits’ (aka market confidence) return such that investors are prepared to take on more risk

-

The economic cycle is constrained, and hence provides limited growth across the broader market (large caps).

-

There has been a period of relative under-performance with small caps

Small Caps vs ASX200 (3 years) ~20% underperformance

Take a look around. Small Caps have now underperformed the ASX200 by ~20% over the past three years.

“So some of these conditions are now in place.”

“And though we haven’t seen any concrete ‘evidence’ that a re-rating is afoot, we are starting to see small caps increasingly mentioned in private discussions, across the media and by professional investors.

“This means that it’s time to do the work and ready the list, in the event that this segment begins to move,” the Katana co-founder suggests.

Small caps: The best of times, the worst of times

“Small cap investing requires a shotgun, not a rifle.”

– Romano Sala Tenna

“Small caps are where fortunes are made and lost,” Romano says. “But it is the latter that is often overlooked.”

Of course, backing smaller companies has a higher risk profile for all sorts of logical reasons.

“The companies often have a shorter operating history. There is likely to be less diversification across clients, geographies and operations. The decent research coverage is often sparse – if anything of quality exists at all.

“Corporate governance can be on the skinny side, which is something a good investor should track… Stocks can also get lost in the market – to be plainer – there’s only one BHP, but there are nearly 2,300 comparative small caps on the ASX all vying for attention.

“And of course, liquidity can be dangerously light.”

Repack your portfolio for a walk among the small caps

Accordingly, Romano reckons investors should take a ‘portfolio approach’ when investing in smaller companies.

“Ok. This means spreading the designated capital amongst a portfolio of stocks to spread the risk. Irrespective of an investor’s expertise or experience, losses are inevitable.

The focus, he advises, is to choose a mix of quality emerging companies so that the overall portfolio generates an appropriate return.

“And remember – if you’re hunting small caps – you’re going to require a shotgun, not a rifle.”

Gunning for bull

Right now the Katana portfolios currently hold in excess of 55 stocks.

For the large part, most of these companies are in the ASX100 or ASX200.

“However, where we see a particularly lucrative risk-return proposition, we are prepared to back our work and take on smaller companies,” Romano says.

“And recently, we’ve been buying four companies in the smaller end of the market which suit our needs in the current climate just fine.”

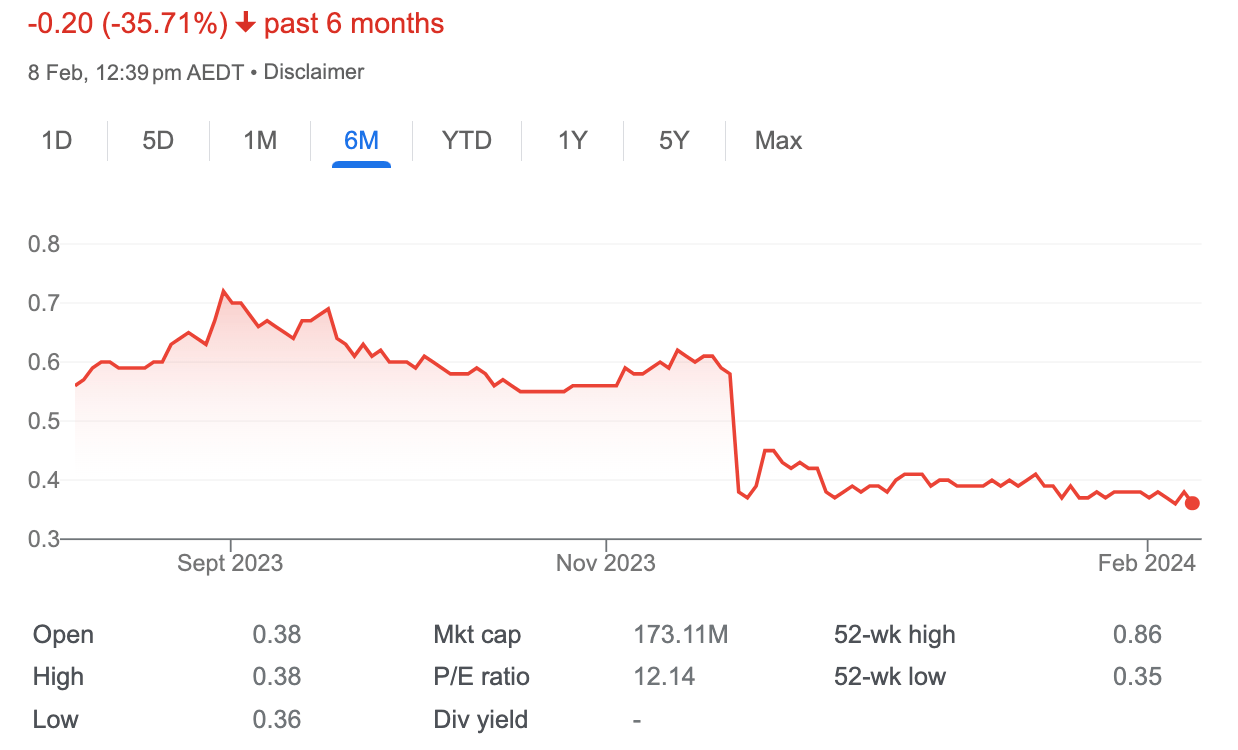

Praemium (ASX:PPS)

There are just under a dozen platforms on the market of any size, and PPS’s SMA and Powerwrap are collectively the eighth largest, Romano says.

“Importantly, PPS is one of the three challenger players along with Netwealth Group (ASX:NWL) and Hub24 (ASX:HUB). And despite its size, PPS regularly ranks fourth for net inflows (in absolute, not relative terms).

And according to Sala Tenna – the platform industry “is a scale game.”

“There’s considerable operating leverage and every incremental dollar of funds under administration (FUA) disproportionately impacts profitability.

“PPS has around 2.5% of the market, yet it has a market capitalisation of <$200 million (or an enterprise value of just ~$160 million if we include the $40 million cash on the balance sheet). Netwealth and Hub 24 have approximately 3x the funds under management, yet they are trading on valuations that mean their market capitalisations are 25x and 20x that of PPS.”

“It’s taken Netwealth and Hub 24 the better part of a decade to get to where they are… Acquiring PPS would grow FUA by more than a third in one relatively quick and easy transaction.

“It’s not surprising therefore that in November 2021, Netwealth lobbed a $1.50 bid for PPS. For a variety of reasons, a deal was not consummated. However, at the current price (circa 36 cents), it’d be hard to see that both Hub24 and Netwealth would not be running the ruler over PPS.”

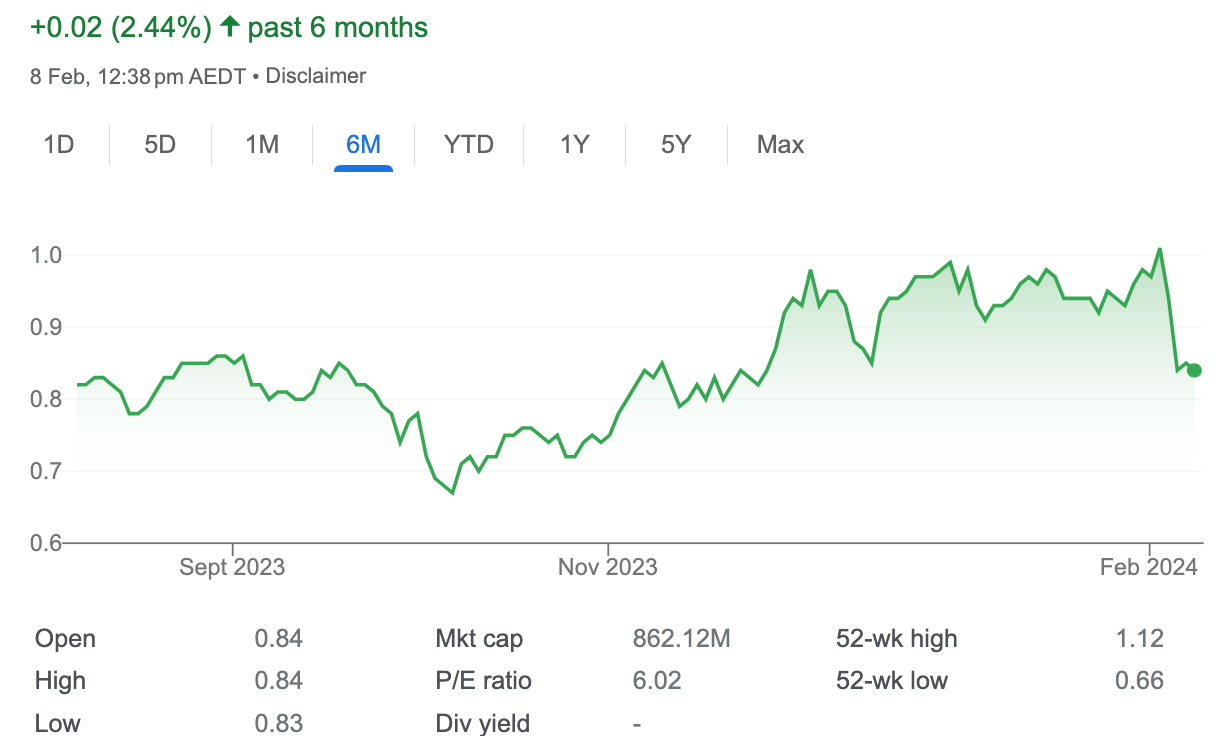

Pepper Money (ASX:PPM)

“PPM is one of the best risk-return opportunities across our entire stock universe,” Romano says.

“Anecdotally, there are some factors that indicate strong management, culture and operational excellence. For example, PPM has won the award for Best Specialist Lender for the past 11 years consecutively. Out of a field of several hundred, they have also been awarded Best Non-Bank Lender in 2017, 2019 and again in 2021 and 2022. In 2023 alone, PPM won a total of 11 awards.”

On the distribution side, he says the PPM brand is well known and respected by mortgage brokers who have more than 22 years of distributing their products.

“Channel checks confirm that PPM is known for fast turnaround times, consistency, and great customer service. This has led to more than 20,000 brokers distributing their product – and this figure is growing by the month. In addition, Pepper has close to 40 white label partnerships with third parties (also increasing). This captive market now accounts for 45% of originations.”

In the days before the RBA’s 13 rate rises, PPM averaged an AUM growth of 21.3% per annum for eight years.

“And considerably more at the bottom line, due to the operating leverage in the business. As the banks continue to retreat from asset financing and impose ever tightening criteria on home loans, non-banks such as PPM are well positioned to continue to grow market share.”

“Companies with high calibre management, strong growth rates and a consistent, definable strategy, normally trade at high double-digit earnings multiples.

“But the hysteria around cyclical fluctuations in net interest margin and loan volumes, has seen the stock sold down from its IPO price of $2.89 to the $1.50 level. Consensus PER is now 6.5x, and the net tangible asset backing is approximately $1.50 per share,” Romano says.

West African Resources (ASX:WAF)

“Now, we’re not aware of any 200,000 ounce per annum low-cost gold producers trading on a market capitalisation of less than $1 billion.

“For the 2023 calendar year, WAF produced 226,000 ounces from its Sanbrado mine at an all-in sustaining cost (AISC) of US$1,126 per ounce. This generated not only a significant paper profit, but more importantly strong operating cashflow.”

According to Katana, this factor alone justifies a notably higher valuation.

“But the real appeal for Katana is the rapidly developing Kiaka gold project south of Sanbrado. This is a mid-scale but world class, low strip, open pit development. Company releases confirm a 19-year mine life averaging 220kozpa. With first production slated for the second half of 2025, this will elevate combined production to >400,000 ounces per annum. On the current market capitalisation, this seems an excellent risk-reward opportunity.”

“As with every company (and especially smaller ones) it is important to understand why we believe it is ‘mispriced’. In the case of WAF, the market would appear to be concerned with two issues: 1) funding and 2) country risk.

“In the case of the first issue, WAF have repeatedly stated that they are fully funded to first production and do not need to raise capital. As a worst case, if they need/choose to raise, it is unlikely to be more than $100 million to $200 million; which is a modest 10-20% of the current market cap. So not material, even in the “worst case scenario”.”

And in respect of Burkina Faso (country risk), Romano agrees that there’s a few superficially valid concerns around sovereignty.

But what investors should also take into account are these four factors:

-

West Africa is now the largest gold producing region globally

-

Burkina Faso is the second largest producer in West Africa

-

Burkina Faso is ranked #1 for gold discoveries over the past decade

-

The country is also ranked #1 globally for permitting times and construction costs

Integrated Research (ASX:IRI)

At a $54 million market capitalisation, Romano says IRI “is a micro-cap in every sense.”

“And given its erratic liquidity (turnover), this stock is not for the novice investor, trader, or anyone with a short time horizon.

“We’ve tracked IRI for more than a decade, and as this short extract below illustrates, the price has experienced wild gyrations. Post-Covid, the stock rallied as high as $4.80, before plunging in early 2022 to the 30 cent mark.

“But over the past 18 months, the stock price has mapped out a clear accumulation phase. We are now awaiting a break-out to confirm that it is time to meaningfully re-build our position.”

Via Iress

As with all stocks in the Katana portfolio, Romano says his team look for the fundamentals and technicals to align.

“And there are signs that this is finally occurring, with IRI recently releasing a positive trading update for the first half of FY24… Statutory revenue, EBITDA and EPS were all up on the previous corresponding period.

“Importantly, net cash (there is nil debt) also grew to $21.5 million, which represents nearly 40% of their market cap. Research coverage is almost non-existent, although one of Bell Potter’s most respected analysts covers the stock and the broker has historically had a good handle on their operations. Their most recent note places IRI on a PER of 5.3x and they have increased their price target to $0.66 per share.”

Romano Sala Tenna is Portfolio Manager at Katana Asset Management.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.