CLOSING BELL: Late rally sees the ASX almost emerge from day-long lurk in the bog

News

News

It’s the end of the day for the ASX, and there’s been a tremendous amount of stuff happening today, both on the market and out in the wider community.

Any attempt to cover all of it in full in the scant few minutes I’ve left myself today would be ill-advised foolishness of the highest order, so here’s a quick-fire run-down of the important stuff that’s been yanking and tanking the ASX today.

ACCC says a hearty ‘yeah, nah…’ to ANZ plans to buy Suncorp’s bank

The title there says it all, really… ANZ had all-but stitched up a $4.9 billion deal to take over Suncorp’s banking arm, but the ACCC has scuttled it because any of the potential benefits are likely to be outweighed by some fairly compelling negatives.

According to ACCC deputy chair Mick Keogh, the deal is “not likely to substantially lessen competition in the supply of home loans nationally, small to medium enterprise banking in Queensland, and agribusiness banking in Queensland.”

“The acquisition by ANZ would also remove the potential for a Bendigo and Adelaide Bank deal with Suncorp Bank. That potential combination would likely strengthen and diversify the competitive power of second-tier banks, reducing the likelihood of coordination,” Keogh said.

At the moment, the Big Four are in an uneasy state of truce – they’re all so enormous that they know there’s no point in really going to war with each other, on the basis that the end result will just put whoever’s scrapping at the mercy of the other two at the top of the heap.

Keogh said a bunch of other stuff, but that’s the meat of the comments – but it’s clear that’s enough to have put a gigantic sad face on the ANZ today, and an even sadder one on Suncorp, which fell around 4.0% on the news.

RBA drops its quarterly Statement on Monetary Policy

The RBA has released its quarterly Statement on Monetary Policy, compiled following prolonged sessions of staring deep into its crystal balls, to judge which way the wind’s about to blow.

T’is a foul, fetid breeze indeed, apparently – as the RBA expects economic growth to slow to 0.9% this year, which is well below the optimistic +1.2% it reckoned was on the cards last time it offered up its wisdom.

The sunny-ish upside is a prediction that headline inflation will dip to just 4.1% by the end of the year offers some small measure of comfort, despite the ongoing inflationary pressure of greedy landlords hammering tenants for appallingly high rent costs – something the RBA acknowledges is likely to remain a major contributor to inflation for months and months to come.

Iron Ore sinks towards $100 a tonne

This news is very, very not-great for Australia’s iron-dependent resources sector, and the dramatic fall from the 2020 highs around $240/t is making the market very skittish indeed.

The fall is being attributed to the ongoing slow-mo collapse of China’s building industry, which accounts for a disastrously high percentage of Australia’s iron ore sales.

And recent ‘tough talk’ from China at its recent semi-annual economic conference, which pledged to make “adjustments” – such as bringing forward infrastructure spending to its ailing building sector – aren’t exactly instilling a lot of confidence, either.

That’s largely because the plans for that infrastructure spending put forward by China lack a few, small details – like “when” and “how much”.

That said, it’s not all doom and gloom from China, because Beijing has officially ditched the completely outrageous 80% tariff on barley imports from Australia, which is really great news for Aussie barley growers, and all of our country’s iron ore producers who know the secret to making their ore look just like barley.

Looking at the ASX today, things kicked off flat and then got slowly worse for the benchmark, which was basically running even-stevens at lunch time before ducking below the waterline to close above zero, but not by much.

At the end of the day, it was technically a win, but the gains were in millimetres, not miles at just +0.07%.

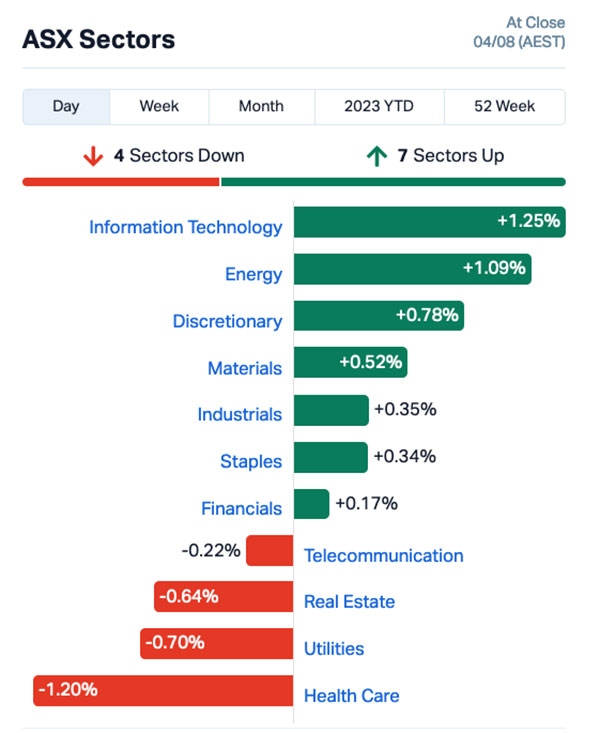

The saving grace appeared to be an early afternoon surge among tech stocks, which pushed the XTX All Ords Tech index from well below the benchmark to a few inches above it by around 3pm, which in turn pumped a flailing InfoTech sector to +1.25%.

It was enough of a boost to add the right kind of momentum to the Energy (+1.1%) and Materials (+0.5%) push that’s been on a slow, rolling boil since the ASX opened, which combined with Consumer Discretionary (+0.78%) to drag a clearly reluctant benchmark out into the sunlight once more.

The hugest stock news for the day, outside of the Small Caps Deathmatch Arena, was a thumper of an announcement from Azure Minerals (ASX:AZS), which says that the company’s been drilling at its Andover lithium project, where things just got explosively fat.

How fat? This fat…

More good news for $AZS! Very broad zones of #lithium mineralisation intersected in the AP0011 pegmatite at #Andover:

⭐ 209.4m @ 1.42% Li2O in hole ANRD0017

⭐ 2nd hole intersected: 183.1m @ 1.25% Li2O in hole ANDD0228✅ #ASX ➡️ https://t.co/hABMLsc23v$AZS.ax #ASXNews 🇦🇺 pic.twitter.com/QBkoOlBjmi

— Azure Minerals (@AzureMinerals) August 3, 2023

It’s beyond hefty, and huge enough news that sent AZS went screaming through the $1 billion market cap barrier on its way to a better-than 23% climb for the day – for a company that was already tipping the scales well into the heavyweight category, it’s the kind of value spike that’s possible to see from space.

Azure’s now boasting gains in excess of 1,230% for the past 12 months, a mere 1,210% better than the rest of the sector’s average.

It had a profound knock-on Nearology effect as well, which I’ll get to in a few moments, because the Small Caps winners’ list includes Errawarra and Raiden, both of which are conveniently located just over the fence from Azure’s girthy Andover find.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.002 | 100% | 150,783 | $5,824,681 |

| RDN | Raiden Resources Ltd | 0.0115 | 44% | 92,252,731 | $16,442,151 |

| ERW | Errawarra Resources | 0.115 | 42% | 1,978,174 | $4,900,824 |

| KNB | Koonenberrygold | 0.044 | 42% | 261,375 | $2,348,450 |

| AHI | Advanced Health | 0.235 | 34% | 1,886,366 | $38,098,195 |

| EDE | Eden Inv Ltd | 0.004 | 33% | 639,822 | $8,990,833 |

| CMX | Chemxmaterials | 0.115 | 28% | 78,788 | $4,559,501 |

| CCX | City Chic Collective | 0.61 | 27% | 9,198,816 | $111,321,641 |

| VMM | Viridismining | 0.58 | 26% | 585,197 | $14,356,139 |

| M2M | Mtmalcolmminesnl | 0.03 | 25% | 46,000 | $1,914,420 |

| AW1 | Americanwestmetals | 0.2875 | 25% | 21,682,258 | $80,333,768 |

| BIO | Biome Australia Ltd | 0.125 | 25% | 1,676,674 | $16,245,300 |

| ROG | Red Sky Energy. | 0.005 | 25% | 2,342,552 | $21,208,909 |

| VAL | Valor Resources Ltd | 0.005 | 25% | 2,117,836 | $15,212,139 |

| MPR | Mpower Group Limited | 0.021 | 24% | 351,978 | $4,992,956 |

| GSM | Golden State Mining | 0.043 | 23% | 3,721,699 | $6,688,090 |

| AZS | Azure Minerals | 2.66 | 23% | 12,091,819 | $846,812,276 |

| GRE | Greentechmetals | 0.435 | 23% | 1,635,374 | $20,091,422 |

| VGL | Vista Group Int Ltd | 1.71 | 21% | 6,977 | $333,102,689 |

| ID8 | Identitii Limited | 0.018 | 20% | 2,150,623 | $3,191,977 |

| MVL | Marvel Gold Limited | 0.012 | 20% | 29,420 | $8,637,907 |

| NAE | New Age Exploration | 0.006 | 20% | 120,000 | $7,179,495 |

| HRZ | Horizon | 0.038 | 19% | 5,610,371 | $22,303,478 |

| BBT | Bluebet Holdings Ltd | 0.26 | 18% | 665,055 | $44,057,477 |

| SIX | Sprintex Ltd | 0.039 | 18% | 270,112 | $9,615,089 |

Top of the Small Caps pops, by a considerable margin today, is Errawarra Resources (ASX:ERW), which piled on an added 66.6% this morning by living next door to Azure Minerals.

Similarly, Raiden Resources (ASX:RDN) has leapt 37.5% into the air for much the same reason, as has Greentech Metals (ASX:GRE) which climbed more than 21% today.

In a shock second-place on the winners list is Advanced Health Intelligence (ASX:AHI) on its news about a deal that will see the company re-enter China through Shanghai-based Changlin Network Technology.

I say it’s a ‘shock’ second place, because I’ll be honest – the news is obviously good, but none of us were expecting to strike quite the nerve that it clearly has – so all the details of the deal were written into Last Orders below… so you can read about it all there, instead.

Third, but not last and most definitely not least, is Koonenberry Gold (ASX:KNB) up 42% for the day after announcing that the NSW Regulator has granted approval to commence drilling at the company’s Bellagio prospect in the state’s northwest.

KNB says that an aircore drilling program is scheduled to commence in August and has been designed to test multiple high grade gold assays from outcropping quartz veins, including the 39.4g/t gold and 22.5g/t gold rock chips previously reported, as well as a “robust” gold in soil anomaly with a maximum result of 33ppb Au.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MSB | Mesoblast Limited | 0.475 | -56% | 65,812,650 | $887,483,259 |

| CCE | Carnegie Cln Energy | 0.001 | -50% | 2,792,894 | $31,285,147 |

| GBE | Globe Metals &Mining | 0.042 | -39% | 3,890,555 | $34,967,040 |

| CLE | Cyclone Metals | 0.001 | -33% | 18,381,323 | $15,396,757 |

| NGY | Nuenergy Gas Ltd | 0.021 | -25% | 377,671 | $41,466,754 |

| LRL | Labyrinth Resources | 0.007 | -22% | 6,666,186 | $9,941,029 |

| BDX | Bcaldiagnostics | 0.1025 | -21% | 551,274 | $27,487,692 |

| NYM | Narryermetalslimited | 0.135 | -21% | 564,649 | $5,182,875 |

| H2G | Greenhy2 Limited | 0.012 | -20% | 26,035 | $6,281,337 |

| AJQ | Armour Energy Ltd | 0.002 | -20% | 191,023 | $12,303,355 |

| DCX | Discovex Res Ltd | 0.002 | -20% | 1,720,265 | $8,256,420 |

| ENT | Enterprise Metals | 0.004 | -20% | 1,071,232 | $3,747,355 |

| PHL | Propell Holdings Ltd | 0.03 | -17% | 100,000 | $4,332,799 |

| BLU | Blue Energy Limited | 0.02 | -17% | 7,878,339 | $44,423,366 |

| LML | Lincoln Minerals | 0.005 | -17% | 880,365 | $8,524,271 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 782,042 | $11,677,079 |

| BTE | Botalaenergyltd | 0.11 | -15% | 135,000 | $6,931,167 |

| 1TT | Thrive Tribe Tech | 0.028 | -15% | 2,614,819 | $9,788,510 |

| RLF | Rlfagtechltd | 0.14 | -15% | 26,420 | $15,125,037 |

| AZL | Arizona Lithium Ltd | 0.018 | -14% | 60,981,487 | $58,022,723 |

| HLX | Helix Resources | 0.006 | -14% | 62,000 | $16,262,021 |

| MEL | Metgasco Ltd | 0.012 | -14% | 38,488 | $14,894,414 |

| PIL | Peppermint Inv Ltd | 0.006 | -14% | 7,583,706 | $14,264,998 |

| BNZ | Benzmining | 0.475 | -14% | 916,470 | $60,458,736 |

| 8VI | 8Vi Holdings Limited | 0.16 | -14% | 18,266 | $7,753,613 |

A special thank you to the indefatigable Nadine “The Den Mother” McGrath, who has compiled today’s Last Orders and Trading Halts, because I was insanely busy and run off my feet and maybe might have possibly ducked out at lunchtime to watch my son win his soccer semi-final.

(Don’t tell the boss, though. It can be our little secret…)

Nadine writes:

Potash player Kalium Lakes (ASX:KLL) has collapsed and called in the receivers. McGrathNicol Restructuring announced that Rob Brauer, Jason Preston and Rob Kirman were appointed Receivers and Managers of struggling KLL yesterday.

The appointment of receivers followed the directors’ decision to appoint Martin Jones, Matthew Woods, and Clint Joseph from KPMG as voluntary administrators yesterday.

McGrathNicol says the receivers have assumed control of KLL’s operations which will continue on a business as usual basis while an urgent assessment of the options for the sale and/or recapitalisation of the Group is undertaken.

Shares of KLL have declined more than 63% in the past year with its flagship Beyondie project reportedly consistently failing to meet its targets with increased funding costs and operational challenges.

Advanced Health Intelligence (ASX:AHI) has inked a binding exclusive, perpetual licence deal with Shanghai-based Changlin Network Technology.

AHI says Changlin is backed by founders with 50 years of global health insurance sector experience with the licence agreement including an upfront payment of US$10 million.

Furthermore, AHI will receive an annual licence fee of US$5 million along with 25% revenue share of gross sales.

AHI will initially hold shares of 50% in Changlin, which is planning on an IPO in 2024. Upon IPO AHI will maintain up to a 25% holding but not less than 20%.

“The collaboration between AHI and Changlin signifies a transformative leap into the future of healthcare in China – a future that seamlessly blends cutting-edge technology with unparalleled accessibility,” Changlin co-founder and CEO Russell Bateman says.

Omega Oil & GAS (ASX:OMA) – Capital raise

Melodiol Global Health (ASX: ME1) – Capital raise

West Cobar Metals (ASX:WC1) – Update on Mineral Resource Estimate for the Salazar Project

Respiri Limited (ASX: RSH) – Announcement regarding placement of shortfall from share purchase plan