CLOSING BELL: CBA makes bank from rising rates, then issues a warning about mortgage arrears

News

News

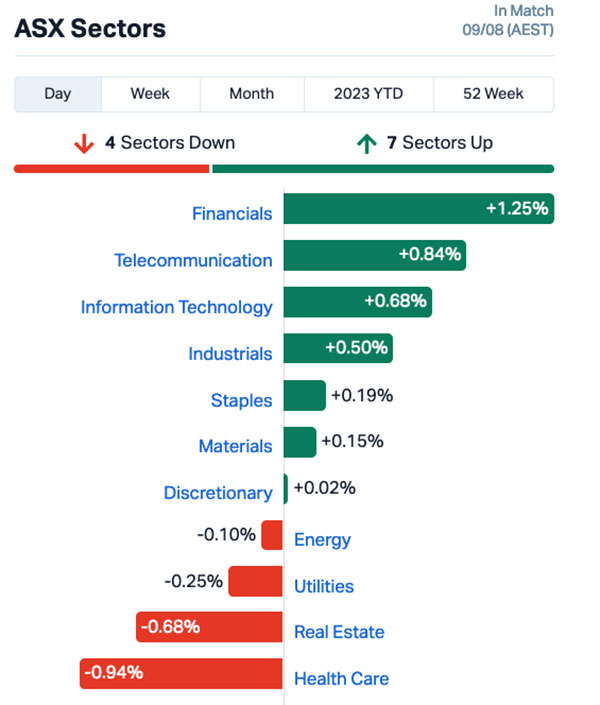

It’s been a lumpy old day for the ASX, which has recovered from a lunchtime flatline to finish 0.35% higher at the end of the session.

Financials did most of the heavy lifting this afternoon, spurred on by the CBA’s record profit announcement this morning, which I’ll dig into in a bit more detail shortly.

The Telcos also delivered nicely late in the day, as did the broader InfoTech sector – but a form slump for Health Care and Real Estate took a lot of the wind out of the market’s sails overall.

There’s a fair bit happening today, but the standouts from the headlines include the Commonwealth Bank’s record $10.2 billion profit, announced this morning and attributed directly to a huge boost in income via the RBA’s relentless pursuit of higher interest rates to curb inflation.

The CBA immediately announced a $1 billion dollar on-market buy-back, before chief executive of the nation’s biggest home lender Matt Comyn fronted the media to issue a dire warning that he’s expecting more and more families to fall behind on their mortgages, thanks to the very same interest rates that his company’s profits are built on.

Join me tomorrow, when I reveal the link to a GoFundMe I’ll be setting up later tonight, to raise money to help Mr Comyn overcome the cruel, soul-destroying tragedy of being born without a sense of irony.

And WeWork – the company that seems to have been born to be run into the ground – has taken a massive blow to the head, after its US-listed shares fell more than 27% overnight.

The company, which has famously never turned a profit since its inception 13 years ago, has warned that it needs even more capital just to remain afloat, after it recently lost CEO Sandeep Mathrani and CFO Andre Fernandez in surprise resignations, and turned itself inside out in March under the debilitating weight of $1.5 billion in debt.

I could happily spend hours explaining why I suspect that WeWork’s DNA is a combination of Crocodile and Herpes Virus, but – thankfully – Stockhead’s Secret Broker put his own brilliant spin on it, waaaay back in September 2019.

You should definitely take the time to read it, if you haven’t already done so… it’s as scathing as it is glorious.

Lastly, in some very late mail today, data out of Beijing reveals that China has stepped into deflation, following a 0.3% fall in consumer prices in July against the same period last year, marking the first decline since February 2021.

That’s despite China’s Consumer Price Index rising 0.2% from June, but consistent with figures released yesterday showing that Chinese imports and exports slumped from July last year.

I hope that Chinese fella in the bear suit has limbered up sufficiently… as he’s got a starring role out the front of the Shanghai exchange coming up.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.002 | 100% | 250,000 | $1,721,315 |

| LNU | Linius Tech Limited | 0.003 | 50% | 1,850,002 | $7,577,581 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | 4,810,483 | $6,147,446 |

| PEC | Perpetual Res Ltd | 0.032 | 45% | 45,007,286 | $12,000,647 |

| IR1 | Irismetals | 2.235 | 44% | 7,684,015 | $123,581,500 |

| AXP | AXP Energy Ltd | 0.002 | 33% | 255,473 | $8,737,021 |

| CHK | Cohiba Min Ltd | 0.004 | 33% | 250,000 | $6,639,733 |

| ENV | Enova Mining Limited | 0.008 | 33% | 452,537 | $2,345,576 |

| MCT | Metalicity Limited | 0.002 | 33% | 500,000 | $5,604,129 |

| OPN | Oppenneg | 0.008 | 33% | 1,575,001 | $6,700,078 |

| TYM | Tymlez Group | 0.004 | 33% | 678,787 | $3,714,586 |

| FTL | Firetail Resources | 0.125 | 30% | 1,152,050 | $9,240,000 |

| PET | Phoslock Env Tec Ltd | 0.028 | 27% | 3,791,872 | $13,736,591 |

| AGR | Aguia Res Ltd | 0.024 | 26% | 190,000 | $8,243,231 |

| BMM | Balkanminingandmin | 0.22 | 26% | 72,061 | $10,687,602 |

| WC1 | Westcobarmetals | 0.1 | 25% | 7,559,649 | $6,910,699 |

| CCO | The Calmer Co Int | 0.005 | 25% | 25,149,279 | $2,968,477 |

| LYN | Lycaonresources | 0.345 | 23% | 661,416 | $10,897,250 |

| ID8 | Identitii Limited | 0.019 | 23% | 442,847 | $3,298,397 |

| SP3 | Specturltd | 0.029 | 21% | 536,632 | $5,418,837 |

| AW1 | Americanwestmetals | 0.355 | 20% | 27,820,125 | $103,036,790 |

| CT1 | Constellation Tech | 0.003 | 20% | 241,989 | $3,678,001 |

| FAU | First Au Ltd | 0.003 | 20% | 23,752,988 | $3,629,983 |

| GTG | Genetic Technologies | 0.003 | 20% | 806,186 | $28,854,145 |

| TMX | Terrain Minerals | 0.006 | 20% | 12,000 | $5,415,997 |

There’s been a reshuffle at the top of the small caps ladder this arvo, leaving Perpetual Resources (ASX:PEC) well out in front, jumping 50% today on news that the company has entered into an additional binding option agreement to acquire a further three highly prospective exploration permits, covering approximately 5,000ha in Brazil’s “Lithium Valley” region, within Brazil’s mining-friendly state of Minas Gerais.

On top of that big news, PEC has also revealed that it’s received firm commitments from professional and sophisticated investors to raise $1.5 million (before costs) through a placement of shares at $0.022 per share.

In second place at the close of play is IRIS Metals (ASX:IR1), coming out of a trading halt waving exploration results that have been welcomed by investors to the tune of a 47% pop.

Iris says it’s bitten into multiple wide, high-grade and shallow lithium intersections at its Beecher project in South Dakota, USA, with assays from the first six drillholes of a 38-hole RC program “confirming the potential for economic lithium”.

The intercepts include 60m @ 1.21% Li₂O (true width) from 16m in hole BDH-23-001, including 40m @ 1.40% Li₂O from 36m, and 22m @ 1.90% Li₂O from 46m.

And hole BDH-23-009 has returned 54m @ 1.30% Li₂O (true width) from 1m, including 35m @ 1.58% Li₂O from 4m, and 13m @ 2.10% Li₂O from 24m.

And in third place this afternoon, Firetail Resources (ASX:FTL) has jumped 30.2% on news that Valor Resources (ASX:VAL) has secured permission from the Peruvian Ministry of Energy and Mines to get the drills spinning at the Picha project in – obviously – Peru.

It’s important news for Firetail, as the company’s already signed a deal with Valor to buy the Picha project, finalised early last month.

The maiden drilling program at Picha is set to consist of 5,000m of diamond drilling, to initially test four key targets – Cobremani, Cumbre Coya, Maricate and Fundicion – under the permit that allows for up to 120 drillholes in this initial phase of exploration.

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MEB | Medibio Limited | 0.001 | -33% | 150,000 | $7,725,891 |

| YPB | YPB Group Ltd | 0.003 | -25% | 39,109 | $2,973,846 |

| RNU | Renascor Res Ltd | 0.135 | -25% | 43,205,702 | $457,093,350 |

| FRS | Forrestaniaresources | 0.079 | -25% | 1,573,742 | $9,777,853 |

| TZL | TZ Limited | 0.023 | -23% | 1,414,428 | $7,702,743 |

| PNR | Pantoro Limited | 0.0545 | -22% | 73,071,420 | $329,282,136 |

| ADS | Adslot Ltd. | 0.004 | -20% | 57,648 | $16,333,088 |

| EMU | EMU NL | 0.002 | -20% | 712,500 | $3,625,053 |

| RGS | Regeneus Ltd | 0.008 | -20% | 50,000 | $3,064,369 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1,094,310 | $26,511,136 |

| BME | Blackmountainenergy | 0.021 | -19% | 101,000 | $4,763,829 |

| XAM | Xanadu Mines Ltd | 0.093 | -19% | 11,162,857 | $188,349,782 |

| OAU | Ora Gold Limited | 0.0065 | -19% | 13,071,083 | $35,495,401 |

| OXT | Orexploretechnologie | 0.041 | -18% | 150,489 | $5,183,210 |

| BDG | Black Dragon Gold | 0.032 | -18% | 426,207 | $7,826,132 |

| CI1 | Credit Intelligence | 0.165 | -18% | 2,133 | $16,699,832 |

| CF1 | Complii Fintech Ltd | 0.03 | -17% | 2,153,966 | $19,862,752 |

| CWX | Carawine Resources | 0.125 | -17% | 2,562 | $29,522,620 |

| SCT | Scout Security Ltd | 0.015 | -17% | 516,942 | $4,152,024 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 500,000 | $2,085,100 |

| IVX | Invion Ltd | 0.005 | -17% | 1,170,371 | $38,529,793 |

| M4M | Macro Metals Limited | 0.0025 | -17% | 830,842 | $5,961,233 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | 3,821,128 | $3,124,130 |

| RML | Resolution Minerals | 0.005 | -17% | 75,000 | $7,543,751 |

| ZNC | Zenith Minerals Ltd | 0.071 | -16% | 859,259 | $29,952,375 |

European Lithium (ASX:EUR) has delivered an update on how things are going with its drive into a merger transaction and NASDAQ listing, telling the ASX that things are progressing well.

“The latest F-4 amendment was lodged on Monday, 7 August. When declared effective by the SEC, the board of Sizzle will convene a shareholder meeting to approve the transaction. We will work to finalise the NASDAQ listing process shortly thereafter.”

The Sizzle EUR is referring to is Sizzle Acquisition Corp. (NASDAQ:SZZL), a publicly traded special purpose acquisition company that European Lithium is teaming with to build a lithium exploration and development company around the Wolfsberg Lithium project.

That newly-formed company will be called Critical Metals Corp, and is expected to be listed on NASDAQ under the symbol “CRML”.

Meanwhile, in Kalgoorlie, the Australian mining industry’s “lunch of lunches” has been held, with the annual Resources Roadhouse Steak Sandwich Showdown attracting plenty of interest in the midst of the hectic Diggers and Dealers Mining Conference.

QEM (ASX:QEM), which is working on a vanadium and oil shale project in the Julia Creek area of NW Queensland, was there – and took the time to shoot through a few photos from inside the historic – and, I dare say, quite magnificent – Kalgoorlie Hotel.

The rules are simple: 150 punters turn up for a steak sandwich and a few buckets of “amber refreshment”, while reps from 8 ASX listed resources companies each get a 5-minute chance to wow the audience.

By all accounts, it’s one of the many highlights of the week at Diggers, which our very own Reuben and Josh have heroically stepped up to report on here, here and even here.

And lastly for today, Cyclopharm (ASX:CYC) would like everyone to know that its manufacturing premises in the Sydney suburb of Kingsgrove have passed muster, after a visit from The Feds over the past week.

The US Food and Drug Administration (USFDA), as part of its approval process, took a long, careful look at the Cyclopharm facility, to determine its suitability for manufacturing the company’s Technegas technology, designed to be used in the diagnosis of pulmonary embolism.

“While the inspection report will require further internal FDA review before it is final, we are pleased with the process and are confident that our USFDA’s goal review date of 29 September 2023 remains on track,” Cyclopharm CEO James McBrayer said.

FDA approval will open the door for Cyclopharm to delve into an initial addressable market in the USA of US$180 million per annum.

Respiri (ASX:RSH) – Placement of new shares over and above Respiri’s recently completed share purchase plan.

Green Critical Minerals (ASX:GCM) – Test results from the Mcintosh Graphite project.