ASX Small Caps Lunch Wrap: Which weird-looking bear has China up in arms again this morning?

Brian's new job – shaking people down for loose change for the Wilderness Society, was not going well. Pic via Getty Images.

At 8am Sydney time this morning, the ASX 200 index futures was pointing up by +0.35% –a mark it missed by just 0.05% when the local market opened higher.

The RBA is due to deliver a widely-expected interest rate pause this afternoon, so the market’s got a decidedly upbeat feel to it, which is nice.

But before I dig too far into the market news today, there’s been an urgent communique from a zoo in eastern China, after social media lost what was left of its tiny, fragile mind over what many believed was a fraud perpetrated upon the world.

The star of the story is a Malaysian sun bear which suddenly found itself to be world famous after it was filmed standing up on its hind legs to stare at visitors to its enclosure at Hangzhou Zoo.

The video quickly went viral, because of course it did – and upon viewing the footage, The Internet reached the most obvious possible conclusion.

WATCH: A viral video of a black sun bear at the Hangzhou Zoo in China’s Zhejiang province has some netizens convinced that it is a human in disguise. The zoo has since spoken out to quell the rumours, maintaining that it is “definitely a real animal”. pic.twitter.com/hzHOZSnLPT

— TODAY (@TODAYonline) July 31, 2023

“That,” said the internet, “is a man in a bear suit.”

And while the internet – incredibly – got it wrong this time, the amorphous blob of ambulant meatloaf that makes up most of its user base needed some pretty serious convincing.

So, Hangzhou Zoo released a statement that did the facility absolutely no favours, because for some unfathomable reason, zoo officials decided that the best way to convince the world that the bear was not a dude in a costume, was to have the bear itself write the explanation.

“When it comes to bears, the first thing that comes to mind is a huge figure and amazing power,” ‘Angela’ the black sun bear wrote.

“But not all bears are behemoths and danger personified. We Malayan bears are petite, the smallest bear in the world,” the bear continued, fooling absolutely no one with its mastery of the written word.

I’m waiting for for the zoo to send out its crack squad of PR professionals – 19 chickens, and a bear in a human suit – to try to calm the population of China down.

The zoo did offer up a proper response, though, with a representative issuing a statement that “such deception would not happen at a state-run facility” – and people say Chinese officials don’t have a sense of humour.

I’d be inclined to agree with the zoo’s assertions, but then I remembered this absolute horrorshow from Hetaoping Wilderness Training Base in southwest China’s Wolong Nature Reserve.

Good luck ever sleeping again.

TO MARKETS

Local markets are doing okay so far today, reaching a peak of +0.3% in early trade before settling to +0.25% by lunchtime.

Local investors seem to be pretty upbeat about the prospects of the RBA board keeping rates on hold this afternoon, but there’s still an outside possibility that Phillip Lowe – whose departure from the organisation is looming large on his professional horizon – could go completely rogue, spike the punch and fix interest rates at 900%.

Admittedly, the odds of that happening are vanishingly small… but those odds aren’t zero.

If it happens, remember you read it here first.

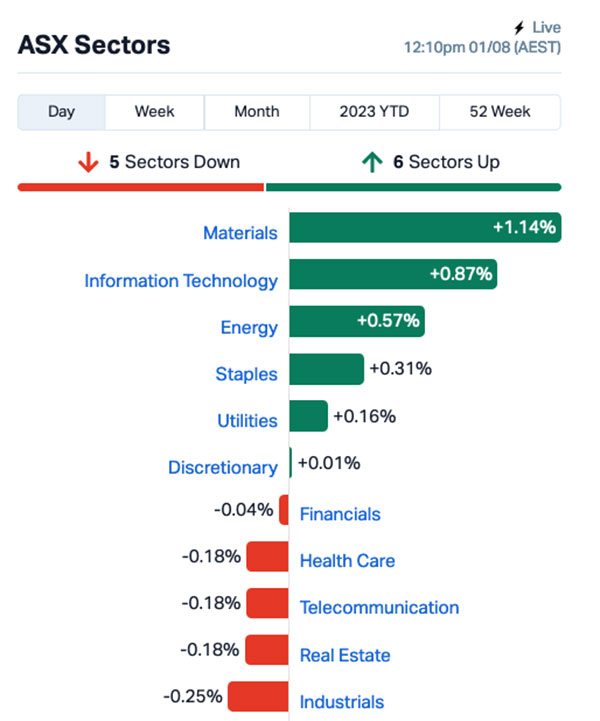

A look at the sectors for today so far reveals that it’s Materials out in front, chalking up +1.14% ahead of InfoTech (+0.87%) and Energy (+0.57%), while the handful of sectors still rubbing the sleep out of their eyes aren’t lagging by terribly huge amounts.

Helping things along from the top end of town are Gold Road Resources (ASX:GOR) with an 8.9% climb, and Latin Resources (ASX:LRS) is up 7.5% this morning, breaking through the $1 billion market cap market for the second time.

NOT THE ASX

On Wall Street overnight, the major indices enjoyed a day in positive territory that left the S&P 500 up by 0.15%, the Dow Jones by +0.28% and tech-heavy Nasdaq by 0.21%.

Last month turned out to have been a pretty good run for the S&P 500, which closed out July up 3.0% – however, JP Morgan analysts “believe that it has been overbought”, Earlybird Eddy reported this morning.

“Equity valuations and multiples are not pricing a soft landing, but rather a continued expansion and simultaneous monetary easing,” JP Morgan wrote in a note.

“With no interest rate cuts in sight, ongoing QT and our base case for macroeconomic slowdown, multiples appear too high.”

“PS: Sally likes you. Do you like her too? YES / NO” the note concluded, according to Year 3 substitute teacher Miss Trundlebroad, who has told JP Morgan to see her after class.

In stock news, US online bank SoFi Technologies was the best performer, up 20% after raising its revenue guidance, and Exxon Mobil climbed 3% as Bloomberg reported it was in talks with Tesla and Ford about supplying them with lithium.

Meanwhile, Nigel Green from deVere Group says he’s “increasing his exposure to semiconductors, energy, and Bitcoin”, while mansplaining that semiconductors are the building blocks of modern tech, powering a wide range of devices and applications, including smartphones, automotive electronics, and AI devices.

“As the world becomes ever-more digitalised and interconnected, the demand for semiconductor components will grow exponentially,” Green said, like the powerhouse oracle he most definitely is.

Gold rose +0.30% to US$1,965.34 ahead of US manufacturing and labour market data, iron ore 62% fe fell -0.2% to $US112.46 a tonne and crude prices lifted by around +1%, with WTI now trading at US$81.73 a barrel.

In Japan, the Nikkei is up 0.59% despite one of the most confusing product launches in that nation’s history – bear with me, there’s a lot going on.

Nissin is a Japanese food manufacturer, most famous for its Cup Noodle brand of instant noodles.

It should be noted that it is different from Nissan, a Japanese automaker most famous for putting leather seats in WWII-era tanks to help bogans get deeper into the Australian bush than ever before.

Takara Tomy is a Japanese toymaker, most famous for its toy car brand Tomica – which as done a deal with Nissin (the noodle one) to create the “Dream Tomica Cup Noodle Collection”.

That’s a limited edition range of Cup Noodles or toy cars – I’ve read through the press release half a dozen times, and I am still unsure whether I’ll die if I eat one – representing the 7 ‘most popular’ Cup Noodle flavours, including Miso, Curry and Aromatic Coriander Tom Yum Kung.

But whether they’re toys, or cups of instant noodles with wheels on, if you’re in the market for something that looks distressingly like a tiny wheelie bin that someone’s been violently ill into, Japan’s got you covered.

In China, Shanghai markets are up just 0.2% after officials in Beijing were forced to issue a statement confirming there are no bears occupying positions at the highest level of government, while in Hong Kong, the Hang Seng is up 0.71% this morning.

In crypto news, those jokers at the US SEC have been at it again, reportedly telling crypto exchange Coinbase to delist all coins except Bitcoin sometime in July.

Coinbase’s CEO Brian Armstrong claimed that SEC’s request came prior to the regulator’s lawsuit against the exchange on July 6.

“They came back to us, and they said . . . we believe every asset other than Bitcoin is a security,” Armstrong told FT.

“And, we said, well how are you coming to that conclusion, because that’s not our interpretation of the law.

“And they said, we’re not going to explain it to you, you need to delist every asset other than Bitcoin.”

And then everyone at Coinbase laughed and laughed and laughed until they realised the SEC was being Deadly Serious, so they went round to Gary Gensler’s place to egg his house or something.

Sadly, Rob “I didn’t write Mooners and Shakers today” Badman didn’t write Mooners and Shakers today.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for August 01 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap VMM Viridis Mining 0.52 108% 1,205,785 $7,802,250 GFN Gefen International 0.006 50% 517,899 $513,119 CTO Citigold Corp Ltd 0.005 25% 109,814 $11,494,636 BBN Baby Bunting Grp Ltd 2.04 23% 2,069,674 $224,619,304 OXT Orexplore Technologies 0.05 22% 48,363 $4,250,232 IMR Imricor Med Sys 0.585 22% 258,454 $74,271,771 FLC Fluence Corporation 0.175 21% 496,539 $94,330,335 KGD Kula Gold Limited 0.018 20% 96,104 $5,598,179 RDN Raiden Resources Ltd 0.009 20% 27,480,843 $15,414,517 MXC MGC Pharmaceuticals 0.003 20% 2,792,886 $9,730,899 29M 29Metals 0.845 17% 6,228,959 $347,098,925 HMY Harmoney Corp Ltd 0.44 17% 186,080 $38,083,345 CCX City Chic Collective 0.52 17% 769,627 $103,204,438 AJL AJ Lucas Group 0.014 17% 3,816,843 $16,508,756 EMP Emperor Energy Ltd 0.014 17% 199,357 $3,226,350 W2V Way2Vatltd 0.015 15% 4,018,669 $8,162,346 MXR Maximus Resources 0.038 15% 395,767 $10,528,840 AON Apollo Minerals Ltd 0.032 14% 170,000 $14,744,321 LRL Labyrinth Resources 0.008 14% 40,546 $7,731,911 VMS Venture Minerals 0.016 14% 9,985,857 $27,300,182 BBC Bnk Bank Corp Ltd 0.445 14% 50,323 $46,300,568 SKS SKS Tech Group Ltd 0.17 13% 30,000 $16,407,323 AQD Ausquest Limited 0.017 13% 1,221,875 $12,377,238 IBG Ironbark Zinc Ltd 0.009 13% 2,211,450 $11,734,274 SKY SKY Metals Ltd 0.046 12% 73,190 $18,636,829

Up the top end of the small cappers this morning is Viridis Mining and Minerals (ASX:VMM), up 100% (and counting) on news that the company has acquired a “potential tier-1 Ionic Adsorption Clay (IAC) Rare Earth Element (REE) Project in the Poços De Caldas Alkaline Complex, Minas Gerais, Brazil.

The company has entered into a binding agreement to acquire 100% of the rights to the REEs comprising the Colossus Rare Earth Project (Colossus Project), consisting of 41 licences (including 2 mining licences) covering 56km2 within South America’s largest known Alkaline Complex.

VMM is set to stump up US$2.0 million for the project, with US$1 million payable upfront and the rest structured as an advanced royalty payment on a royalty from future production.

Meanwhile, Melbourne-based Imricor Medical Systems (ASX:IMR) has stacked on 21.9% this morning after being approved for a VISABL-VT trial from the Medical Ethics Review Committee, Leiden The Hague Delft to take place at Haga Hospital in The Hague.

The VISABL-VT trial is a prospective, single-arm, multi-centre investigation of the safety and efficacy of radiofrequency (RF) ablation of ventricular tachycardia (VT) associated with ischemic cardiomyopathy performed with the Vision-MR Ablation Catheter 2.0 in the iCMR environment.

Loosely translated: It uses 3D MRI imaging to help stop your ticker going boom!

And in third place, Baby Bunting (ASX:BBN) is up 20.7% this morning, on news that the company’s unaudited pro forma NPAT result is towards the upper end of the FY23 guidance provided on 6 June 2023, of $13.5 million to $15.0 million.

While the rest of the numbers (which were released to the market after-hours yesterday) show that as a -49.5% stain against the previous year’s result, Baby Bunting says that it’s identified a range of initiatives to simplify elements of its operating model which will support net cost reductions out of thegroup’s existing cost base of around $6 million to $8 million in FY24.

The company has also revealed plans to open another five stores in the coming year – three in New Zealand, and one each in what I assume are Australia’s current baby-making hotspots, Cranbourne and Maroochydore.

ASX SMALL CAP LOSERS

Here are the most-worst performing ASX small cap stocks for August 01 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap ABPDA Abacus Property Group 1.39 -48% 234,300 $2,377,129,304 NYR Nyrada Inc 0.034 -32% 124,519 $7,800,435 NWM Norwest Minerals 0.036 -31% 1,610,343 $14,436,995 ID8 Identitii Limited 0.017 -26% 5,732,962 $4,894,365 CLE Cyclone Metals 0.0015 -25% 1,024,998 $20,529,010 MTH Mithril Resources 0.0015 -25% 153,000 $6,737,609 EEL Energy Elements 0.0045 -25% 3,127,682 $6,055,405 AJX Alexium Int Group 0.015 -21% 44,204 $12,376,405 STA Strandline Res Ltd 0.175 -20% 11,313,090 $275,635,506 AAP Australian Agri Ltd 0.014 -18% 169,574 $5,186,691 ICI Icandy Interactive 0.043 -17% 1,562,510 $69,794,696 TPD Talon Energy Ltd 0.1575 -17% 12,503,117 $119,215,100 PFT Pure Foods Tas Ltd 0.1 -17% 67,500 $13,168,790 BNO Bionomics Limited 0.01 -17% 5,816,173 $17,624,825 PRX Prodigy Gold NL 0.005 -17% 142,180 $10,506,647 YOW Yowie Group 0.031 -16% 436,763 $8,087,012 SEG Sports Ent Grp Ltd 0.185 -16% 8,952 $57,444,646 MRZ Mont Royal Resources 0.16 -16% 21,461 $13,011,707 RXH Rewardle Holding Ltd 0.023 -15% 643,240 $14,210,680 AVE Avecho Biotech Ltd 0.006 -14% 497,697 $15,135,146 CPT Cipherpoint Limited 0.006 -14% 171,750 $8,114,692 DEL Delorean Corporation 0.03 -14% 181,270 $7,550,232 DOU Douugh Limited 0.006 -14% 17,059 $6,887,289 EDE Eden Inv Ltd 0.003 -14% 36,756 $10,489,305 RDS Redstone Resources 0.006 -14% 6,775,433 $6,099,649

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.