Closing Bell: ASX200 betrayed by big banks. Mollified by minnow metals

Via Getty

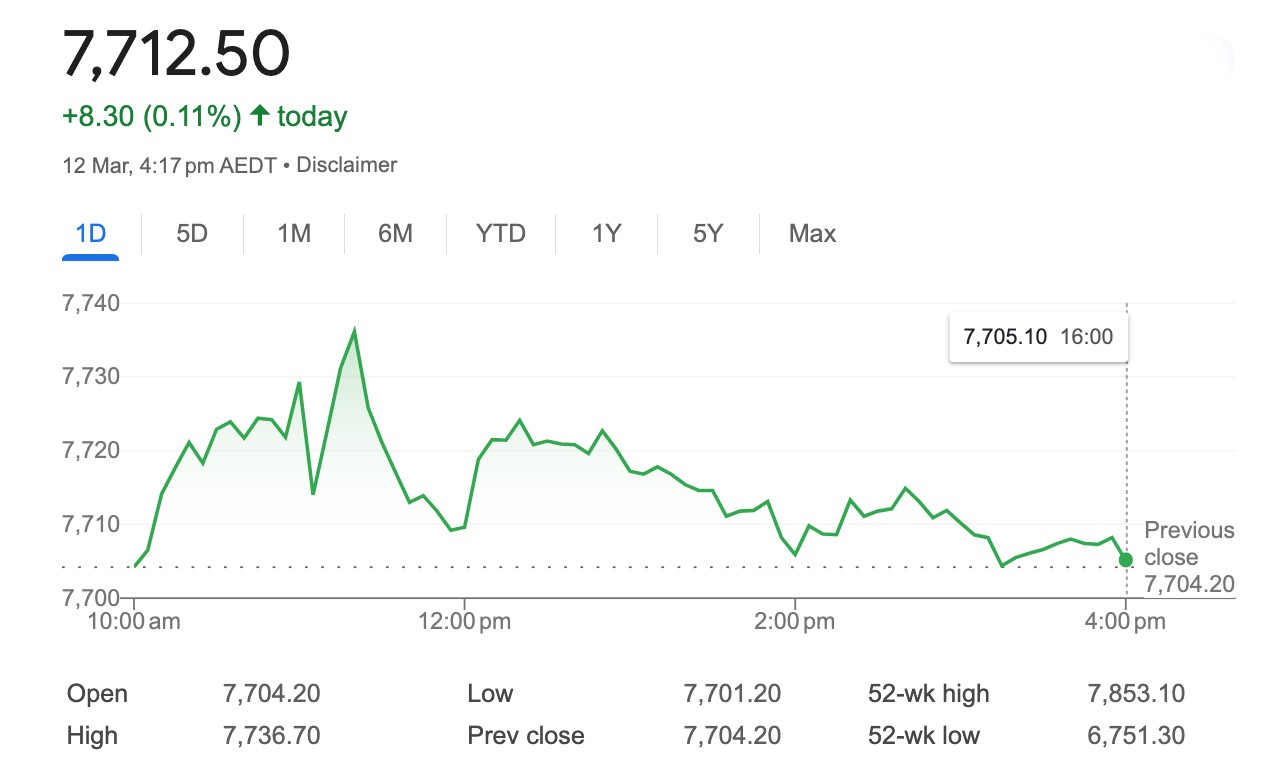

- Local markets gives up early gains, ekes out 0.1pc advantage

- IT and Utilities offset by Energy sector losses

- Small Caps led by RMI and Narryer Metals

We’re slightly higher at match out in Sydney.

But big banks became bad banks after lunch, turning a morning of surprise gains into an arvo of spluttering sales. It was an unedifying sight, especially with the stank of Monday’s circa $50bn sell-off still heavy in the nostrils.

At 4.15pm on Tuesday March 12, the S&P/ASX200 ended eight points or 0.11% higher to…

This afternoon in Sydney a familiar but painfully Australian story unfolded on the local bourse as the big banks, which promised so much in the morning session, gave up all they’d gained and fell in a heap, leaving lots of Aussie battlers (like the ASX200) struggling to stay afloat.

On the mind of everyone, to be fair, is the market-moving impact of a key US CPI (inflation) report, which will dictate the direction of markets thereupon.

The main game remains: what path to lower rates will the US Federal Reserve choose?

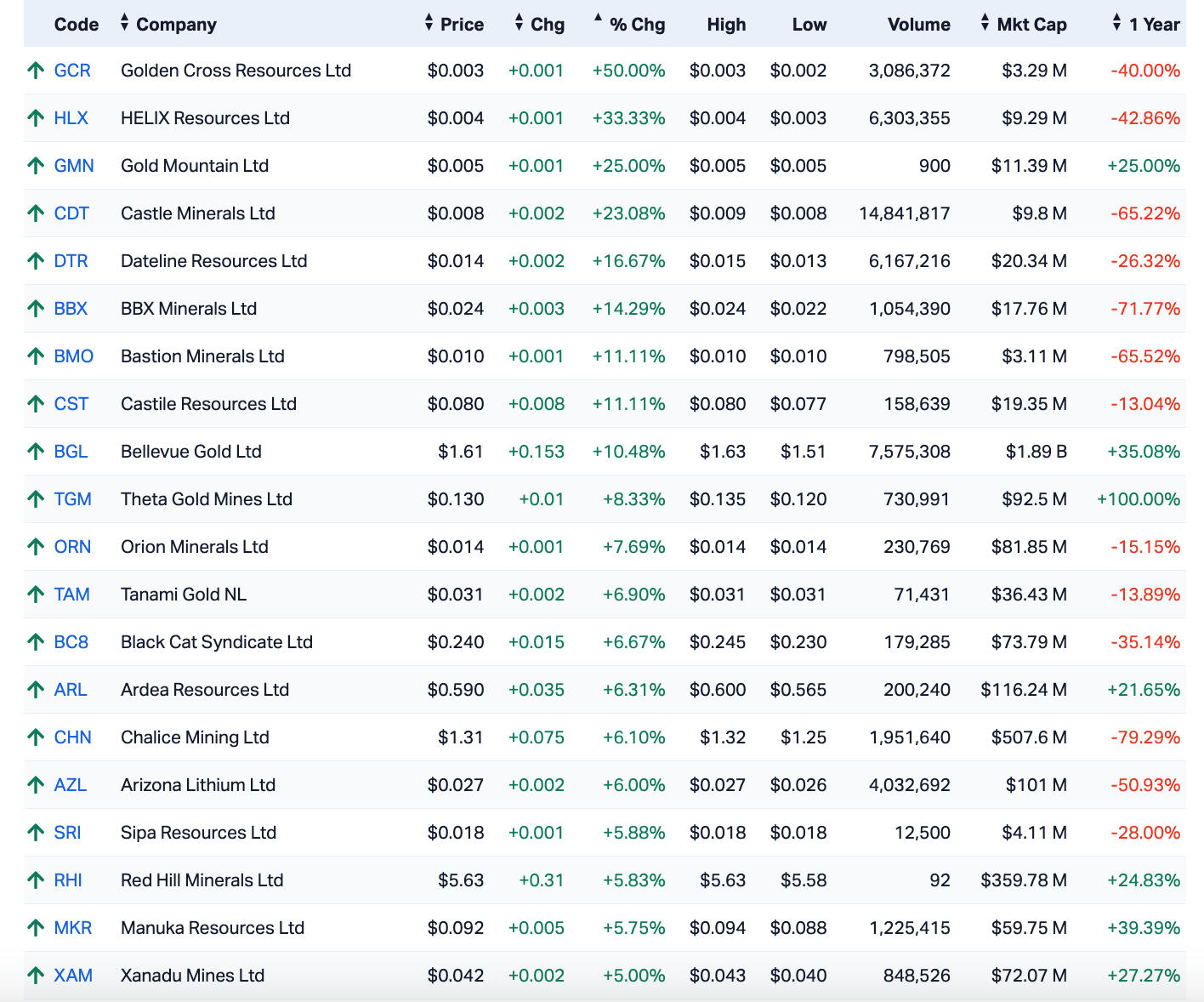

Starting at the happy end of Tuesday… okay, we’ve seen the benchmark and the banks wax and wane around with the passage of the sun, but fans of trusty gold have enjoyed another run of quality fettle.

Gold stocks rally…

Here’s Tuesday’s finest-performing gold minnows on the XAO. Not a heap of market cap between them. And most have a heap of ground to make up if they’d like to turn around their 12-month stock prices.

Among the more familiar names, the bigger producers also enjoyed gains on Tuesday.

Ahead nicely on news it plans to step out onto the Canadian bourse to begin life as a dual-listed goldie is Southern Cross Gold (ASX:SXG), offering some cracking exposure to some hefty North American investors.

Spun out of Mawson Gold and listed post-pandemic, SXG follows a well-trodden path for Aussie diggers, one which has of late been populated more by the battery metals squad than the precious diggers.

SXG says Mawson plans an in-specie distribution of SXG shares to coincide with the segue into Toronto. That might not happen pronto, but traders jumped in this arvo on the promise of it.

Bellevue Gold shot up in the morning on the back of a positive production update, while the other gold majors, such as Newmont, jumped around 4%.

Northern Star and Evolution Mining added between 2% and 3%.

Also in the materials space, Alumina (ASX:AWC) has surged again after Alcoa’s $3.3bn all-stock offer was made official with the Alumina Board backing the play.

Lithium players are also higher with Liontown Resources (ASX:LTR) up 5%.

Elsewhere, Appen (ASX:APX) has been pulled over by the ASX speeding police and wallows in a trading halt while the ASX waits for a few answers.

Appen shares were clocked at 40% before the sirens sounded.

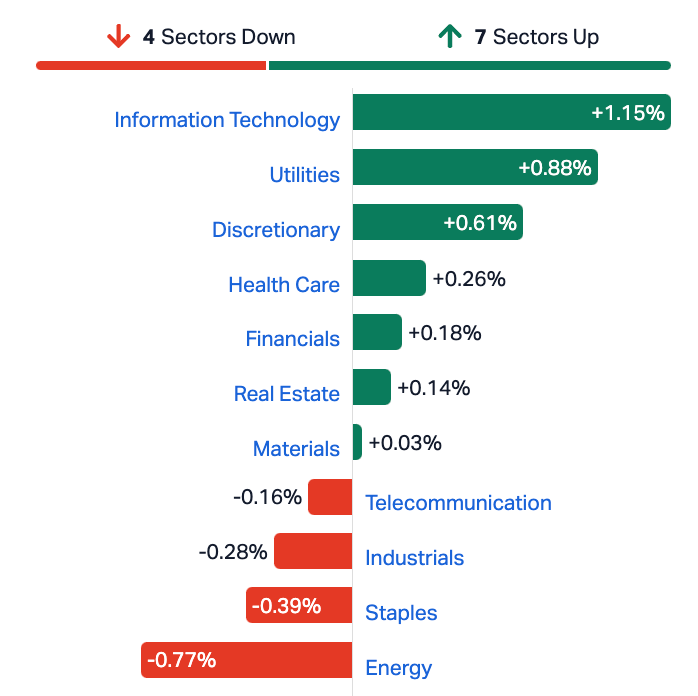

The IT sector remained the standout followed by Utilities and Consumer Discretionary stocks.

Banks betrayed us and Energy names were just awful.

ASX Sectors on Tuesday

US Futures at the close in Sydney on Tuesday:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RMI | Resource Mining Corp | 0.037 | 131% | 4,167,300 | $9,477,565 |

| NYM | Narryer Metals | 0.059 | 111% | 463,511 | $1,343,820 |

| JAV | Javelin Minerals Ltd | 0.002 | 100% | 250,000 | $2,176,231 |

| GCR | Golden Cross | 0.003 | 50% | 3,086,372 | $2,194,512 |

| PKO | Peako Limited | 0.006 | 50% | 11,182,101 | $2,108,339 |

| NYR | Nyrada Inc | 0.145 | 45% | 15,117,633 | $15,600,870 |

| WIN | Widgienickellimited | 0.075 | 34% | 981,426 | $16,684,923 |

| AUK | Aumake Limited | 0.004 | 33% | 1,383,480 | $5,743,220 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 3,629,736 | $9,296,169 |

| RIE | Riedel Resources Ltd | 0.004 | 33% | 250,046 | $6,671,507 |

| TKL | Traka Resources | 0.002 | 33% | 3,604,907 | $2,625,988 |

| VPR | Volt Power Group | 0.002 | 33% | 538,500 | $16,074,312 |

| APX | Appen Limited | 1.08 | 30% | 17,856,416 | $181,970,752 |

| CPO | Culpeo Minerals | 0.045 | 29% | 4,708,563 | $5,767,611 |

| AMM | Armada Metals | 0.019 | 27% | 22,200 | $3,120,000 |

| ESK | Etherstack PLC | 0.245 | 26% | 35,831 | $25,737,465 |

| CCO | The Calmer Co Int | 0.005 | 25% | 14,781 | $4,730,787 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 3,314,137 | $7,356,542 |

| H2G | Greenhy2 Limited | 0.01 | 25% | 100,000 | $3,350,047 |

| RMX | Red Mount Mining | 0.0025 | 25% | 31,832 | $5,347,152 |

| RFA | Rare Foods Australia | 0.036 | 24% | 150,153 | $5,943,530 |

| MSB | Mesoblast Limited | 0.395 | 23% | 23,827,108 | $324,909,516 |

| FTL | Firetail Resources | 0.05 | 22% | 359,866 | $6,105,128 |

| RIM | Rimfire Pacific | 0.04 | 21% | 12,324,092 | $73,268,076 |

| AQC | Auspac Coal | 0.0665 | 21% | 2,307,385 | $28,213,218 |

There’s twin spectacular small cap stock performances on Tuesday.

Rock and soil samples from Stalike have returned assays including:

- 13.58% Cu with 3.24g/t Au (from a rock sample)

- 10.78% Cu with 1.41g/t Au (from a rock sample)

- 4.12% Cu with 0.02g/t Au (from a rock sample)

Not too far behind at around +110% is Narryer Metals (ASX:NYM) ,which has smashed Tuesday out of the park and into the Northwest Territories of Canada, where it says there are plans to buy 70% of two lithium projects – Big Hill and Fran.

Big Hill shares a boundary with $200m capped Li-FT Power (TSXV:LIFT) which is drilling into thick, high grade lithium across multiple pegmatites you can see from space.

Maiden drilling at Big Hill, where channel sampling has returned 5m at 1.15% lithium, is pencilled in for mid-year.

NYM has completed a $1m cap raise at a 43% premium (unheard of, says my man Reuben Papa Adams) to fund initial exploration.

“Canada will be the first part of the supply chain for future lithium battery development in North America, and Narryer Metals sees the future of hard rock lithium exploration in the Archaean cratons of northern Canada,” NYM managing director Gavin England says.

“The Big Hill project area contains spodumene-bearing pegmatites identified along strike from mineralisation currently being drilled by Canadian-listed Li-FT Power at its BIG Lithium Project.”

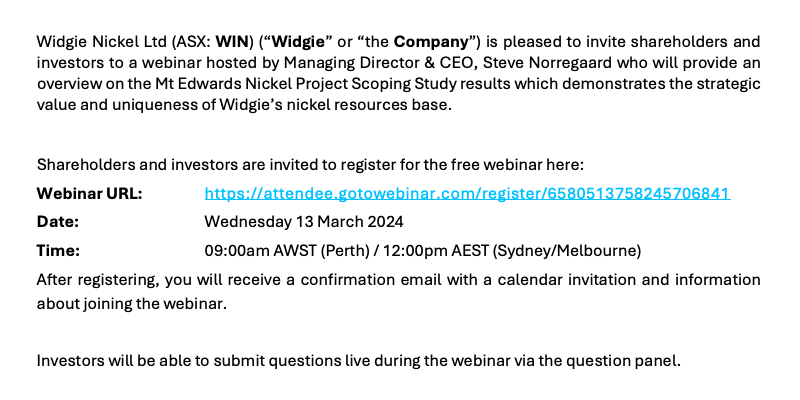

The next closet gainers were all in the +30% range, I thought I’d go with this little outlier, Widgie Nickel (ASX:WIN) , where it seems the promise of an off the cuff presso could only be an update worth sharing…

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 101,123 | $11,649,361 |

| MRQ | MRG Metals Limited | 0.001 | -50% | 25,000 | $4,942,682 |

| IS3 | I Synergy Group Ltd | 0.01 | -29% | 367,055 | $4,257,125 |

| SLZ | Sultan Resources Ltd | 0.02 | -26% | 3,618,724 | $4,001,131 |

| 1AG | Alterra Limited | 0.003 | -25% | 150,000 | $3,482,763 |

| 1MC | Morella Corporation | 0.003 | -25% | 1,265,359 | $24,715,198 |

| NES | Nelson Resources. | 0.003 | -25% | 1,300,000 | $2,454,377 |

| NRZ | Neurizer Ltd | 0.003 | -25% | 15,959,702 | $6,005,643 |

| SFG | Seafarms Group Ltd | 0.003 | -25% | 2,064,344 | $19,346,397 |

| RLG | Roolife Group Ltd | 0.007 | -22% | 221,778 | $6,503,023 |

| AN1 | Anagenics Limited | 0.012 | -20% | 44,069 | $6,286,993 |

| CF1 | Complii Fintech Ltd | 0.02 | -20% | 434,761 | $14,198,013 |

| BNL | Blue Star Helium Ltd | 0.008 | -20% | 14,131,189 | $19,422,653 |

| GCM | Green Critical Minerals | 0.004 | -20% | 7,275 | $5,682,925 |

| NAE | New Age Exploration | 0.004 | -20% | 91,560 | $8,969,495 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 871,984 | $8,755,539 |

| ROG | Red Sky Energy. | 0.004 | -20% | 1,446,217 | $27,111,136 |

| TMX | Terrain Minerals | 0.004 | -20% | 10,160,209 | $7,158,353 |

| EVR | Ev Resources Ltd | 0.01 | -17% | 11,924,682 | $15,855,258 |

| M4M | Macro Metals Limited | 0.005 | -17% | 37,012,429 | $16,872,467 |

| MSI | Multistack Internat. | 0.005 | -17% | 814,969 | $817,824 |

| TX3 | Trinex Minerals Ltd | 0.005 | -17% | 1,900,000 | $8,922,148 |

| VRC | Volt Resources Ltd | 0.005 | -17% | 564,659 | $24,780,640 |

| CR1 | Constellation Res | 0.11 | -15% | 25,000 | $6,487,705 |

| IMC | Immuron Limited | 0.11 | -15% | 3,769,965 | $29,613,785 |

ICYMI – PM Edition

Maronan Metals (ASX:MMA) has updated the resource for its namesake lead-silver-copper-gold project in northwest Queensland, putting the early development potential of the Shallow Starter Zone (11.1Mt @ 5.3% lead, 111g/t silver and 0.13g/t gold) firmly in the spotlight.

Spartan Resources (ASX:SPR) has unveiled an updated exploration target for 1.6-1.9Moz of contained gold at the high-grade Never Never deposit where 952,000oz has been defined since its discovery in late 2022.

Dateline Resources (ASX:DTR) has expanded its ongoing drill program at its Colosseum gold project in California with mobilisation of a second rig to follow up on recent high-grade hits such as 76.2m @ 8.62g/t and 70.1m @ 6.53g/t.

Strickland Metals (ASX:STK) has flagged a potential connection between the emerging Palomino and Clydesdale prospects and the nearby Marwari target at its Yandal gold project in WA.

GCX Metals (ASX:GCX) has launched its maiden RC drilling campaign at the Dante project in the remote but highly prospective West Musgrave region where BHP is developing the giant Nebo-Babel nickel-copper sulphide mine.

Heavy Rare Earths (ASX:HRE) says the results from a diagnostic leaching program over a large part of the Cowalinya rare earths (REE) resource near Esperance have confirmed, and in some metrics exceeded, the outcomes of last year’s sighter work.

Radiometric results from initial drilling over the Hippolyte South and Sadi prospects at Aura Energy’s (ASX:AEE) Tiris uranium project in Mauritania has identified two new, large areas of mineralisation.

Viridis Mining and Minerals (ASX:VMM) continues to accelerate its flagship Colossus ionic adsorption clay REE project in Brazil towards a globally significant resource after receiving the fifth batch of drill assays for Cupim South, which includes hits of up to 24,894ppm TREO, the highest grades seen to date at the prospect.

Anson Resources (ASX:ASN) has confirmed no connectivity exists between the deeper, lithium brines being targeted in the Clastic Zones and shallow aquifers at its Green River project in Utah.

Golden State Mining (ASX:GSM) is reviewing data collected from its 2023 exploration programs to prioritise work for this year’s field season at the Paynes Find, Yule, Eucla and Southern Cross projects.

Tech-focused capital fund Bailador Technology Investments (ASX:BTI) has lauded the elevation of its largest holding SiteMinder (ASX:SDR) into the S&P/ASX200 in the latest rebalance of some key indices.

And Dimerix (ASX:DXB) has announced a capital raise of $20 million just one day after releasing positive long-awaited interim analysis of its ACTION3 Phase 3 trial of DMX-200 in patients with focal segmental glomerulosclerosis.

At Stockhead, we tell it like it is. While Anson Resources, Aura Energy, Bailador Technology Investments, Dateline Resources, Dimerix, GCX Metals, Golden State Mining, Heavy Rare Earths, Maronan Metals, Spartan Resources, Strickland Metals and Viridis Mining and Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.