ASX Small Caps Lunch Wrap: Who’s been deemed unfit to run a fitness chain this week?

News

News

Local markets opened lower this morning, possibly just because it’s Monday, but far more likely because Wall Street griped and moaned its way to a shuddering loss on Friday, casting a pall over America’s weekend and giving local investors a 48-hour case of the willies.

That’s despite the clear warning labels on every packet of Wall Street that clearly state that if anyone develops a case of the Wall Street Willies that lasts longer than 6 hours, they’ll probably want to speak to a doctor about it sooner, rather than later.

Before I get to the local data and digits, there’s a mystery upholding on Wall Street this weekend, which started on Friday with the firing of Planet Fitness CEO Chris Rondeau.

Rondeau’s an interesting chap, if only for the fact that he’s not only the (now former) CEO of a massive fitness chain, but he looks like the only place he’d be more at home than the boardroom is on on the label of a barrel of WeighGainz 9000 supplements.

Rondeau has been with the company since pretty much the beginning, when he worked the front desk of the first gym in Dover, New Hampshire, about 30 years ago – where he no doubt leveraged his visible arm strength to hone his strong arm sign-up tactics that subscription gyms are notorious for.

From those humble, muscular beginnings, Rondeau worked hard to rise to the top of the company in 2013, taking over from the former CEO by absolutely crushing him in a deadlift competition that culminated in Rondeau lifting the whole of New Hampshire 2¾ inches off the ground… or so the story goes.

But Planet Fitness has waned over the past couple of years – probably because everything was closed because of Covid, and excessive public grunting was very much on the list of Things We Would Prefer You Didn’t Do.

So, Rondeau’s been booted. Kind of.

Because it’s not a clean break – Rondeau’s apparently going to hang around on the board as an “advisor”, with former New Hampshire Governor Craig R. Benson, who owns a Planet Fitness franchise himself, stepping in to run the show until someone can best him in hand-to-hand combat.

The news was not great for Planet Fitness shareholders – the company, already on the ropes and dreaming wearily of a bell to end the round of losses, took a flurry of heavy blows to the face and dumped 12%.

And the world was a slightly darker place, as there’s no doubt that Rondeau’s ultra-wide grin on that brick-shaped noggin of his has been MIA since being forced out.

Things are a bit crap today, after local markets opened lower after hearing Yet Another Wall Street Ghost Story during the sleepover at Wendy’s house on the weekend (which was awesome, by the way. You really should have been there. We had cake, and chips, and then Wendy’s dad made us watch an old movie from the 1970s called Eraserhead and I don’t think I will ever be able to sleep again).

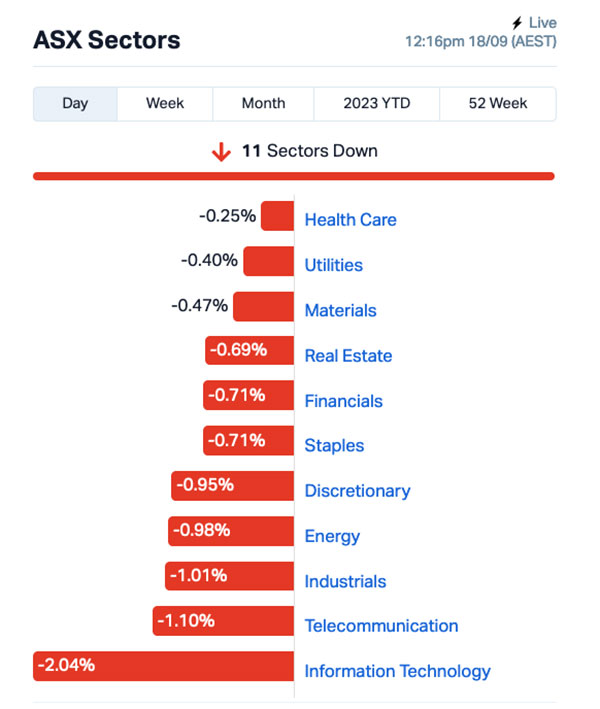

A look at the sectors show that everything is down, redder than a working class banner flying high above the barricades, in response to Tim Gurner’s comments last week.

Yes, he said he regretted saying the quiet bits out loud, but folks are still mad.

Worst performer of the day is InfoTech, which is down just like prices at Coles aren’t, despite what that giant red finger tells you. The best performer, Health Care, has managed to lose only 0.25%, so there’s that.

Pretty much the only safe space to the market today is right where you’d expect to find it. The ASX XGD All Ords Gold index is up 0.39%, and doing it’s very best to be that nice house on the corner with the neighbourhood watch placard by the front door… just in case someone’s following you home from school, or whatever.

At the ritzy end of town, Red 5 (ASX:RED) is having a banger, up $0.05 – about 22% – on… no fresh news. It just is what it is, and at this point is probably best not ask too many questions, because it looks busy.

So, we’ll chalk it up to the recent mineral reserve statement, which shows a 185% increase in open pit Measured Resources and a 102% increase in underground Indicated Resources, and check again tomorrow to see if something else is up.

On the other side of the ledger, market darling Azure Minerals (ASX:AZS) has dropped a long way this morning, down 11.3% after results from recent drilling at the tail end of Target 1 and a chunk of Target 2 at its massive Andover lithium find were not great.

Azure was on a hiding to nothing trying to beat the 104.7m @ 1.61% Li2O / 183.1m @ 1.25% Li2O monster hits from August, so this morning’s revelations of intercepts that barely blip on the radar compared to those have come as something of a massive disappointment.

Those scallywags at the US Federal Reserve have spooked the markets again, sending Wall Street into all of a dither that ended their week on a bum note.

How bummy was the note? It was super-bummy… Bummier than the back end of Rio’s famously cheeky Carnivale parade, and it don’t get much bummier than that.

The S&P 500 sank by -1.22%, blue chips Dow Jones up by -0.83%, and the tech-heavy Nasdaq by -1.56%.

Earlybird Eddy reports that US stocks gave up nearly all of the week’s gains ahead of the Fed’s policy meeting on Tuesday and Wednesday (US time).

Data didn’t help, with the University of Michigan consumer sentiment index falling from 69.5 to 67.7 in September.

Microchip stocks Nvidia and Advanced Micro Devices lost over 4% each, while Arm added another 1% to its +25% debut on Thursday.

Big auto companies meanwhile rose despite the United Auto Workers (UAW) union confirming that it will ask members to strike at the Big Three automaker plants (General Motors, Ford and Stellantis).

There is zero news from Japan this morning, because the whole country is celebrating “Respect for the Aged Day”, by pretending to be super-old and doing absolutely nothing for 24 hours.

In China, Shanghai markets are flatter than a recently-popped air mattress, and Hong Kong’s Hang Seng is down 0.92% because it’s in a bad mood.

Here are the best performing ASX small cap stocks for 18 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap WC8 Wildcat Resources 0.455 90% 35,374,657 $159,748,215 AMD Arrow Minerals 0.003 50% 208,178 $6,047,530 EDE Eden Inv Ltd 0.003 50% 679,090 $6,727,274 MEB Medibio Limited 0.0015 50% 204,039 $6,100,744 VPR Volt Power Group 0.0015 50% 2,429,324 $10,716,208 BUS Bubalus Resources 0.205 41% 4,404,619 $4,128,320 VMC Venus Metals Cor Ltd 0.135 35% 276,317 $18,972,868 CLE Cyclone Metals 0.002 33% 500,000 $15,396,757 TYM Tymlez Group 0.004 33% 3,050,752 $3,714,586 AVM Advance Metals Ltd 0.0065 30% 2,127,722 $2,942,794 KPO Kalina Power Limited 0.009 29% 16,666 $10,606,371 WCG Webcentral Ltd 0.115 26% 577,411 $29,950,487 4DS 4DS Memory Limited 0.18 24% 34,848,560 $248,711,383 RED Red 5 Limited 0.2725 24% 400,688,235 $761,681,635 BXN Bioxyne Ltd 0.016 23% 6,000 $24,721,390 PRX Prodigy Gold NL 0.006 20% 153,296 $8,755,539 PUA Peak Minerals Ltd 0.003 20% 554,463 $2,603,442 RLC Reedy Lagoon Corp. 0.006 20% 190,000 $3,083,418 SGC Sacgasco Ltd 0.006 20% 165,000 $3,867,914 SPA Spacetalk Ltd 0.025 19% 1,306,303 $7,263,179 BUR Burley Minerals 0.16 19% 116,111 $13,675,062 EMP Emperor Energy Ltd 0.013 18% 49,384 $2,957,487 RGL Riversgold 0.013 18% 3,097,677 $10,463,876 1AE Aurora Energy Metals 0.105 17% 2,042,457 $14,328,624 BFC Beston Global Ltd 0.007 17% 2,000,000 $11,982,281

The standout in Small Caps this morning has been Wildcat Resources (ASX:WC8), up 87.5% for the day so far on news that the company’s bagged a “major lithium discovery” at its Tabba Tabba prospect in WA.

That’s the results from the central cluster WC8 drilled, and the second cluster isn’t as good, but it’s still pretty decent, with highlights such as 21m at 1.1% Li2O from 42m, and 20m at 1.3% Li2O from 20m.

In second place, Bubalus Resources (ASX:BUS) because the company went shopping, and came home with tenements prospective for lithium mineralisation in the Gascoyne Region of Western Australia, just 2km east of Delta Lithium’s Malinda Prospect.

The tenements are in an area that has never been the subject of a serious lithium hunt before, which is exciting in and of itself – and the location means that Bubalus can now work year-round, as its other major projects are all a lot further north in the NT, and subject to closure during The Wet.

And in third place (with news), for something a little different, it’s a small mining company that has lithium news!

I know, right?!? What are the odds of that?

This time, it’s Venus Metals (ASX:VMC), which announced this morning that follow-up mapping and sampling field programme has been completed at the Deep South Prospect which delineated two new zones with outcropping LCT pegmatites, south from lithium-rich pegmatites reported on 24 August this year.

Here are the most-worst performing ASX small cap stocks for 18 September [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap MXC MGC Pharmaceuticals 0.002 -33% 60,867 $13,283,905 TD1 Tali Digital Limited 0.001 -33% 450 $4,942,733 SKN Skin Elements Ltd 0.005 -29% 2,750,001 $3,986,403 CCE Carnegie Cln Energy 0.0015 -25% 10,605,948 $31,285,147 AVE Avecho Biotech Ltd 0.004 -20% 15,000 $13,491,460 CTN Catalina Resources 0.004 -20% 111,652 $6,192,434 IVX Invion Ltd 0.004 -20% 555,555 $32,108,161 MRD Mount Ridley Mines 0.002 -20% 2,100,000 $19,462,207 1AD Adalta Limited 0.018 -18% 111,000 $9,713,579 ME1 Melodiol Glb Health 0.005 -17% 4,213,357 $17,683,922 RVS Revasum 0.13 -16% 2,298 $16,417,081 AML Aeon Metals Ltd. 0.016 -16% 130,805 $20,831,612 DTR Dateline Resources 0.0135 -16% 3,054,626 $14,167,085 LIO Lion Energy Limited 0.022 -15% 8,000 $11,157,428 SCT Scout Security Ltd 0.017 -15% 435,418 $4,613,360 BTE Botalaenergyltd 0.12 -14% 83,333 $7,464,333 CAV Carnavale Resources 0.006 -14% 1,447,856 $23,334,862 EEL Enrg Elements Ltd 0.006 -14% 1,921,117 $7,069,755 ELE Elmore Ltd 0.006 -14% 1,024,867 $9,795,687 L1M Lightning Minerals 0.12 -14% 119,939 $5,504,548 MOB Mobilicom Ltd 0.006 -14% 365,003 $9,286,737 RIE Riedel Resources Ltd 0.006 -14% 2,000,351 $14,415,849 RNE Renu Energy Ltd 0.03 -14% 55,675 $15,417,574 OKJ Oakajee Corp Ltd 0.025 -14% 31,250 $2,651,935 HFY Hubify Ltd 0.019 -14% 48 $10,914,998