You might be interested in

News

Closing Bell: ASX's gains erased after strong CPI, winning tickers today include WMS and OZM

News

Market Highlights: Commodity stocks in focus on price moves overnight; and 5 ASX small caps to watch

News

News

Australian shares are set to open lower on Monday after a big drop on Wall Street. At 8am AEST, the ASX 200 index futures was pointing down by -0.55%.

In New York, the S&P 500 sank by -1.22%, blue chips Dow Jones up by -0.83%, and the tech-heavy Nasdaq by -1.56%.

US stocks gave up nearly all of the week’s gains ahead of the Fed’s policy meeting on Tuesday and Wednesday (US time).

Data didn’t help, with the University of Michigan consumer sentiment index falling rom 69.5 to 67.7 in September.

Microchip stocks Nvidia and Advanced Micro Devices lost over 4% each, while Arm added another 1% to its +25% debut on Thursday.

Planet Fitness shares tumbled -16% after CEO stepped down.

Big auto companies meanwhile rose despite the United Auto Workers (UAW) union confirming that it will ask members to strike at the Big Three automaker plants (General Motors, Ford and Stellantis).

Research by personal finance website finder.com shows that the current bull market is outpacing the biggest bull market ever in its first 223 market days.

The S&P 500 is currently in a bull market that began on the 12th of October 2022, and has grown by 26% in its first 223 market days (September 1st).

In contrast, the most successful bull market ever, the tech boom bull market, only saw returns of 24% during the same timeframe.

Here’s what else Finder.com found:

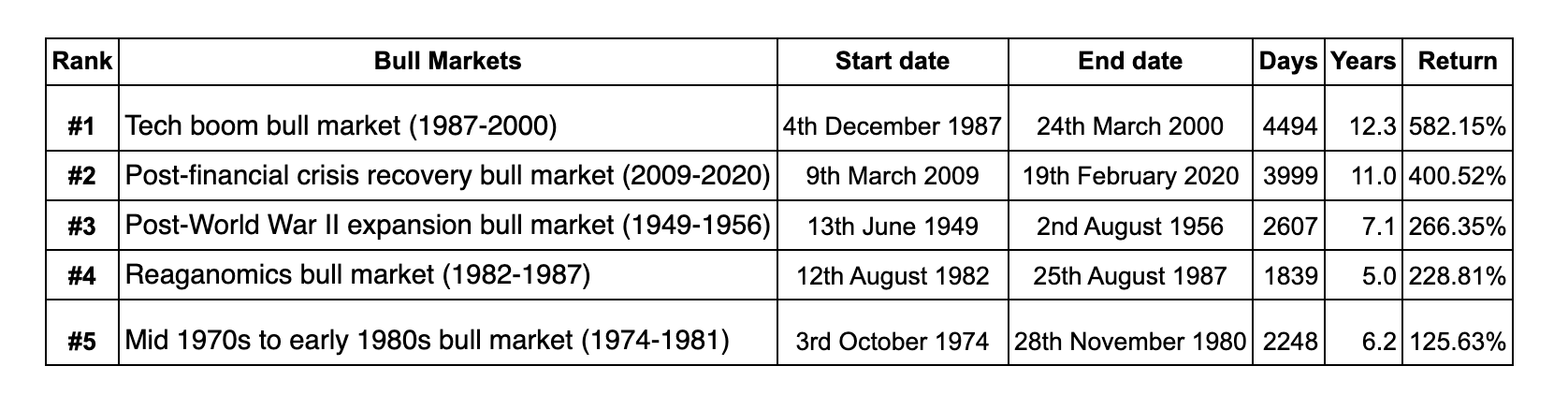

Here’s the list of the 5 biggest bull markets in the history of the S&P 500:

“As the adage goes, investors should make hay while the sun shines and try not to miss out on rebuilding market growth,” said deputy editor of Finder, George Sweeney.

“Yet, they should also be prepared to buckle up for another crash at some stage. How long we get between these moments of despair and joy fluctuates. So, investors must keep a cool head, be patient, and stay invested for the long haul.”

US bond yields rose between 2-8bp on Friday ahead of the Fed policy meeting this week.

Crude prices climbed +0.2% on Friday, lifting for a third straight week. Brent is currently trading at US$94.07 a barrel.

Gold price was flat at US$1,923.81 an ounce.

Base metals fell, with copper futures price sliding 0.5%.

Iron ore futures gained 0.5% to US$121.29 a tonne, the highest price since April this year.

The Aussie dollar traded flat at US64.34c.

Bitcoin meanwhile fell -0.4% in the last 24 hours to US$26,487.

Synlait (ASX:SM1)

A2 Milk (ASX:A2M) has told Synlait that it will cancel the exclusive manufacturing and supply rights enjoyed by Synlait in respect of stages 1 to 3 of a2MC’s current infant milk formula (IMF) products for sale by a2MC in the markets of China, Australia and New Zealand. Stage 4 IMF and other a2MC products supplied by Synlait are not subject to exclusivity. Synlait has advised that it is considering the notice of cancellation, it reserves its rights, and it will respond formally in due course.

Lycaon Resources (ASX:LYN)

A land access agreement has been signed with Parna Ngururrpa traditional owners to allow for exploration work programs to commence. The 100% owned West Arunta Stansmore Niobium-REE Project’ granted tenure extends over 173km². The company says West Arunta is emerging as a significant critical minerals and copper province, with the recent Niobium-REE mineralised carbonatite discoveries by WA1 Resources and Encounter Resources.

Castle Minerals (ASX:CDT)

Commercail grade bulk fine flake graphite concentrate grading 95.1% has been successfully produced at Kambale by test work using a conventional grind and flotation concentration circuit.The bulk concentrate is currently being transported to Germany for appraisal which will include electrochemical and electric vehicle (“EV”) battery performance tests.

Astral Resources (ASX:AAR)

High-grade gold mineralisation has been intersected over a 240 metre strike length at the Kamperman Prospect. Assay results for the six remaining RC holes have now been received, with best results including: 21 metres at 4.16g/t Au from 31 metres, and 35 metres at 2.19g/t Au from 81 metres.

Asra Minerals (ASX:ASR)

Asra has signed an option agreement to acquire the two lithium projects in highly prospective, world-class southern Yilgarn region of WA. Significant exploration activity is already planned including field mapping and sampling, surveys and drilling. Both projects will increase Asra’s exploration footprint to 1,134km2.

At Stockhead we tell it like it is. While Lycaon Resources and Asra Minerals are Stockhead advertisers, they did not sponsor this article.