ASX Small Caps Lunch Wrap: Could this be the most hilariously terrible Nigerian scammer ever?

News

News

Local markets are down a little this morning, despite broadly positive results from major markets around the globe overnight.

The somewhat sombre start to proceedings was likely down to investors waiting for the Australian Bureau of Spreadsheets to drop the highly anticipated October unemployment figures this morning – which landed with a 3.7% thud a short time ago.

Before I dig too much further into the numbers and stuff, there’s a small story that is deserving of our attention this morning, from our friends in the United Kingdom.

The UK has a bit of a torrid history when it comes to refugees, and every now and then someone who has been the beneficiary of the national largesse trundles into the limelight for all the wrong reasons.

This time round, it’s reportedly a fella called Saheed Azeez, a 33-year-old from Nigeria who applied for permission to settle in the UK on the basis that he was facing severe persecution from local Boko Haram militants for being gay.

Granted refugee status, Azeez settled into his new life in Wigan, making the most of his new-found freedom to be himself and live his best life – by fathering three kids with three different women, marrying one of those women, and becoming, by his own admission, an integral part of a $420,000 parcel fraud syndicate.

The scam was simple enough – Azeez would contact people selling high-value goods on Facebook Marketplace and convince them to send him the goods, promising payment on arrival.

However, the goods were sent to addresses of the fraudsters’ accomplices, collected by Azeez and then sold in his brother’s brick-and-mortar electronics shop – without a cent being paid to the original owners.

Azeez is facing up to six years in prison for his troubles, and is due to be sentenced next week.

Local markets have fallen this morning, despite an upbeat performance from other regional markets overnight.

The dip has been largely attributed to today’s October unemployment figures, which have come in at 3.7% – up 0.1% despite the creation of some 55,000 jobs in the same period.

It’s not a disaster by any reasonable measure, and it’s broadly in line with the trend that the RBA is on record as saying it is actively pursuing, having set an unemployment rate of around 4.5% as the optimal point to help get the nation’s economy back under control.

But on the heels of yesterday’s record wage growth figures – the Wage Price Index jumped 1.3% for the September quarter, the biggest single leap in the 26-year history of the WPI – the message on how the economy is tracking is becoming more than a little bit muddied.

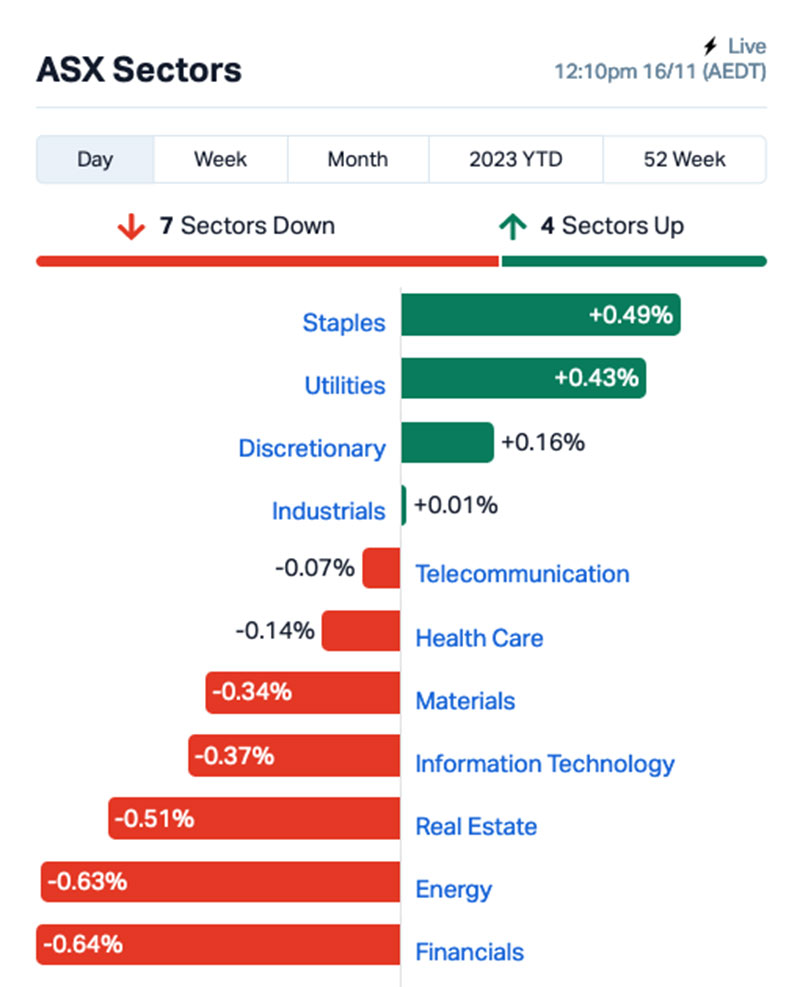

The end result today is a weak effort from investors, who seem a little gun-shy today. There’s some moderate buying action among Consumer Staples and Utilities, but that’s been more than offset by selloffs in Energy, and particularly in Financials.

Australia and New Zealand Banking Group (ASX:ANZ) in particular took a knock this morning, dropping more than 3% on news of an on-market purchase of ANZ employee shares – around $130 million worth, the company says, in order to “settle certain amounts due under ANZ’s share-based compensation plans”.

Meanwhile, Qantas (ASX:QAN) is down this morning after being found guilty of a criminal charge relating to the standing down of a health and safety rep as the Covid-19 pandemic kicked off in early 2020.

The NSW district court has found that Qantas breached part of the Work Health and Safety Act when it benched Theo Seremetidis for directing workers not to clean possibly-infected planes without appropriate safety gear on.

Qantas CEO at the time of the incident, Alan Joyce, remains retired and in possession of $14.4 million that the airline could still conceivably claw back.

Looking overseas, Wall Street had a positive – if not exactly breathtaking – session overnight that left the S&P 500 up by +0.18%, while the blue chips Dow Jones index was up by +0.47%, and the tech-heavy Nasdaq climbed by +0.07%.

Earlybird Eddy Sunarto reports that US traders combed through a bunch of economics data including retail sales, which beat estimates for October but still couldn’t avoid a drop from September, while US treasuries fell (bond yields higher by 10bp) as traders took profits on yesterday’s big gains.

In US stock news, big box retailer Target Corp surged 18% after its Q3 earnings smashed estimates.

Semiconductor stocks like Nvidia, AMD and TSM all fell after Microsoft launched its first custom AI powered chip, the Maia 100. Microsoft shares closed flat, but the company is now on par with its peers Google and Amazon which have also developed their own custom chips for their cloud platforms.

Media stock Sirius XM jumped as much as 12% after Warren Buffett’s Berkshire Hathaway said it has purchased a new stake in the company.

Also trending higher were Chinese stocks Alibaba and JD.com, after JD reported a Q3 earnings beat.

In Japan, the Nikkei is down 0.32% this morning because nothing particularly weird happened there overnight.

In China, Shanghai markets are down 0.37% after President Xi and US President Joe Biden reached an agreement on how much illicit fentanyl China can ship to the US to control the American public.

And in Hong Kong, the Hang Seng is down 1.26% for reasons known only to a select handful of lizard people who control the markets there.

Here are the best performing ASX small cap stocks for 16 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap KGD Kula Gold Limited 0.033 57% 39,729,555 $7,837,450 OCN Oceana Lithium 0.195 56% 727,701 $6,634,563 GCR Golden Cross 0.003 50% 9,325 $2,194,512 EEL ENRG Elements Ltd 0.007 40% 4,119,760 $5,049,825 FRE Firebrickpharma 0.093 35% 20,204,853 $7,832,480 AVE Avecho Biotech Ltd 0.004 33% 3,254,140 $8,094,876 SCT Scout Security Ltd 0.015 25% 133,488 $2,771,129 MHK Metalhawk 0.225 25% 849,466 $14,260,600 EDE Eden Inv Ltd 0.0025 25% 1,936,578 $6,727,274 BTR Brightstar Resources 0.016 23% 15,241,028 $24,905,834 MSG MCS Services 0.017 21% 185,023 $2,773,395 CHK Cohiba Min Ltd 0.003 20% 86,833 $5,533,110 FHS Freehill Mining Ltd. 0.003 20% 100,000 $7,112,003 IVX Invion Ltd 0.006 20% 1,038,079 $32,108,161 LVT Livetiles Limited 0.006 20% 4,223,917 $5,885,553 LDR Lode Resources 0.105 19% 431,128 $9,397,005 MXC MGC Pharmaceuticals 1.04 18% 20,834 $31,178,832 NGS NGS Ltd 0.013 18% 801,991 $2,763,501 AQX Alice Queen Ltd 0.007 17% 346,138 $872,909 GES Genesis Resources 0.007 17% 50,000 $4,697,048 SGC Sacgasco Ltd 0.007 17% 1,000,000 $4,641,496 TOY Toys R Us 0.014 17% 1,093,294 $11,789,562 G1A Galena Mining 0.078 16% 1,467,092 $50,422,102 OZM Ozaurum Resources 0.15 15% 2,188,230 $20,637,500

Leading the Small Caps winners this morning wasKula Gold (ASX:KGD), which has added another 57% to yesterday’s solid results, off the back of yesterday’s two-banger announcement bundle that told the market that drilling is about to commence at the company’s “substantial” Cobra Lithium Prospect approximately 20km west of the world’s largest hard rock lithium mine, Greenbushes in Western Australia.

Drills are set to spin next week, with Kula revealing that the target strike has been increased to ~3km and up to 500m wide, and that the “initial RC drilling programme is 1,000m but is flexible to extend the programme for a prolonged period based on favourable mineralisation/rock types”.

The drilling programme is also now fully-funded, thanks to the completion of a $650,000 boost from a placement of shares at the issue price of $0.013 per share.

Oceana Lithium (ASX:OCN) is also flying high this morning, on fresh news that the company has identified a gaggle of high priority targets at its Monaro lithium project, following successful fieldwork at the James Bay site.

175 rock samples have been submitted to ALS Laboratories in Val-d’Or, Québec for whole-rock analysis, with results due sometime in December – but in the meantime, the company says that the fieldwork revealed “Elevated levels of Rubidium (Rb) and low Potassium (K) to Rubidium ratios coincident with favourable geology and magnetic signatures”, which have helped pinpoint where Oceana is going to point the drills next time around.

And in third place, ENRG Elements (ASX:EEL) posted a 40% bump this morning on news that the sale of 90% of its Ghanzi West Copper-Silver Project has been completed.

Kavango Resources has emerged as the buyer, snagging 90% of the issued capital of the company’s wholly owned subsidiaries Icon Trading Company and Ashmead Holdings for a cool $2.5 million.

Here are the most-worst performing ASX small cap stocks for 16 November [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

Code Company Price % Volume Market Cap CCEDA Carnegie Clean Energy 0.065 -35% 518,928 $31,285,147 MCT Metalicity Limited 0.0015 -25% 457,039 $8,502,172 SIX Sprintex Ltd 0.01 -23% 1,740,694 $4,437,635 CUS Copper Search 0.12 -23% 151,622 $13,887,442 TTA TTA Holdings Ltd 0.011 -21% 247,678 $1,923,928 IBXDA Imagion Biosys Ltd 0.35 -20% 52,174 $14,363,432 FBM Future Battery 0.072 -20% 5,597,089 $45,891,539 ASP Aspermont Limited 0.008 -20% 250,000 $24,387,637 ESR Estrella Res Ltd 0.005 -17% 627,366 $10,554,431 RR1 Reach Resources Ltd 0.005 -17% 23,320,256 $19,261,783 MCL Mighty Craft Ltd 0.011 -15% 133,734 $4,737,753 JGH Jade Gas Holdings 0.034 -15% 63,387 $63,073,367 AMP AMP Limited 0.8675 -15% 47,297,044 $2,792,046,603 RKN Reckon Limited 0.5 -15% 4,206,781 $66,277,477 OKJ Oakajee Corp Ltd 0.019 -14% 25,000 $2,011,813 1CG One Click Group Ltd 0.013 -13% 544,343 $9,226,473 CR9 Corellares 0.026 -13% 142,911 $13,952,726 BTH Bigtincan Hldgs Ltd 0.215 -12% 2,371,774 $148,777,007 WIA WIA Gold Limited 0.029 -12% 2,702,371 $30,382,604 IHL Incannex Healthcare 0.051 -12% 3,236,670 $92,046,686 AMN Agrimin Ltd 0.22 -12% 11,154 $76,521,455 DAL Dalaroo Metals 0.031 -11% 172,625 $2,856,000 8VI 8Vi Holdings Limited 0.08 -11% 1,512 $3,772,028 SRX Sierra Rutile 0.12 -11% 1,072,238 $57,271,920 AHF Aust Dairy Limited 0.016 -11% 1,759,115 $11,805,602