ASX Small Caps and IPO Weekly Wrap: A double-century double-header makes this week one to remember

News

News

It was shaping up to be an absolute banger of a week, after a run from Tuesday through Thursday put the benchmark in the best shape it’s seen for quite some time.

Sadly, that came to a shuddering halt today as overnight weakness in the US tech sector, a priced-in production cut for crude oil and some happy-but-not-manically-so inflation data from America’s national bean counters all added up to a wonky day for local punters.

With the week’s final session done and dusted, the benchmark has finished the week 0.63% better off than it was last Friday.

So… who won? Who didn’t? Who slept through most of it?

Let’s find out together.

Where did we land at the end of the week?

It turns out it was me who slept through most of it – but with the benefit of hindsight, I can quite confidently say that this week would have been an excellent week to have stocked up on goldies the week before.

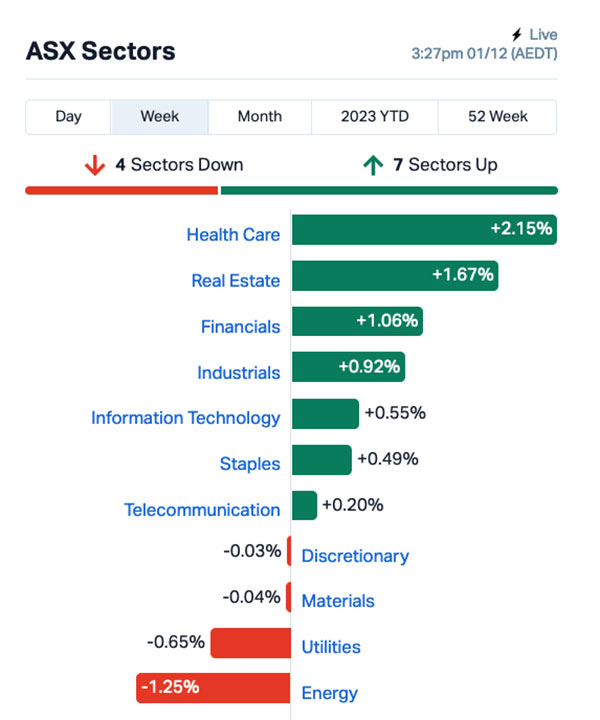

The standout sectors were, as you can see from the chart below, Health Care and Real Estate, while both Utilities and the puzzlingly, almost defiantly negative Energy sector moped around below zero.

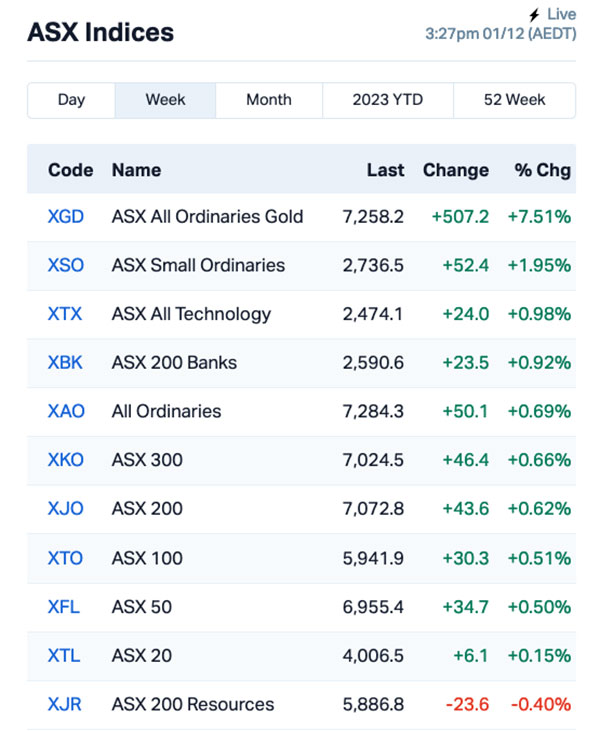

Gold prices went up by quite a sensational margin, pushing through the psychologically significant US$2,000 per ounce mark and (importantly) staying there.

That gave traction to a mini gold-rush this week, which left locally-listed goldies in the box seat for a glorious +7.5%

Here are the best performing ASX small cap stocks from 09-13 October:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| LBT | LBT Innovations | 0.016 | 220% | $15,026,704 |

| SHN | Sunshine Metals Ltd | 0.033 | 200% | $44,064,304 |

| TZN | Terramin Australia | 0.054 | 116% | $118,527,512 |

| BPH | BPH Energy Ltd | 0.053 | 104% | $42,046,011 |

| CPM | Coopermetalslimited | 0.425 | 98% | $27,076,858 |

| PLT | Plenti Group Limited | 0.65 | 88% | $104,156,899 |

| ICR | Intelicare Holdings | 0.026 | 73% | $5,222,885 |

| MCL | Mighty Craft Ltd | 0.019 | 58% | $5,466,638 |

| BUY | Bounty Oil & Gas NL | 0.011 | 57% | $12,334,509 |

| BP8 | Bph Global Ltd | 0.0015 | 50% | $2,423,345 |

| FHS | Freehill Mining Ltd. | 0.003 | 50% | $8,549,503 |

| GTG | Genetic Technologies | 0.003 | 50% | $28,854,145 |

| KEY | KEY Petroleum | 0.0015 | 50% | $2,951,892 |

| PHO | Phosco Ltd | 0.074 | 48% | $20,306,588 |

| RGL | Riversgold | 0.016 | 45% | $15,220,183 |

| JNO | Juno | 0.115 | 44% | $17,754,329 |

| TTT | Titomic Limited | 0.024 | 41% | $18,198,913 |

| 8IH | 8I Holdings Ltd | 0.014 | 40% | $3,573,560 |

| NFL | Norfolkmetalslimited | 0.355 | 39% | $13,423,498 |

| CPV | Clearvue Technologie | 0.62 | 36% | $147,719,033 |

| NAM | Namoi Cotton Ltd | 0.48 | 35% | $97,422,671 |

| FME | Future Metals NL | 0.062 | 35% | $25,579,630 |

| PTX | Prescient Ltd | 0.091 | 34% | $68,452,182 |

| AUH | Austchina Holdings | 0.004 | 33% | $8,311,535 |

| DMG | Dragon Mountain Gold | 0.012 | 33% | $5,130,732 |

| IBG | Ironbark Zinc Ltd | 0.008 | 33% | $10,317,108 |

| MRD | Mount Ridley Mines | 0.002 | 33% | $15,569,766 |

| NVQ | Noviqtech Limited | 0.004 | 33% | $5,237,781 |

| REZ | Resourc & En Grp Ltd | 0.016 | 33% | $7,996,893 |

| RNO | Rhinomed Ltd | 0.04 | 33% | $11,428,788 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | $24,408,512 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| WGR | Westerngoldresources | 0.037 | 32% | $5,993,847 |

| ZNO | Zoono Group Ltd | 0.06 | 30% | $11,585,588 |

| TCG | Turaco Gold Limited | 0.125 | 30% | $56,525,334 |

| DAL | Dalaroometalsltd | 0.039 | 30% | $2,366,400 |

| AYT | Austin Metals Ltd | 0.009 | 29% | $9,142,872 |

| GSR | Greenstone Resources | 0.009 | 29% | $12,313,021 |

| SWP | Swoop Holdings Ltd | 0.25 | 28% | $52,052,234 |

| AKM | Aspire Mining Ltd | 0.096 | 28% | $48,733,151 |

| BMR | Ballymore Resources | 0.14 | 27% | $21,929,590 |

| MRL | Mayur Resources Ltd | 0.215 | 26% | $73,822,604 |

| UBI | Universal Biosensors | 0.24 | 26% | $50,968,664 |

| 1AD | Adalta Limited | 0.024 | 26% | $11,815,896 |

| TSO | Tesoro Gold Ltd | 0.024 | 26% | $23,019,807 |

| EMN | Euromanganese | 0.1325 | 26% | $30,726,935 |

| IRE | IRESS Limited | 7.39 | 26% | $1,313,130,002 |

| AEI | Aeris Environmental | 0.034 | 26% | $8,351,915 |

| TPW | Temple & Webster Ltd | 8.105 | 26% | $998,351,580 |

| SPN | Sparc Tech Ltd | 0.32 | 25% | $26,121,931 |

This week has been a big’un for a couple of Small Cap stocks, with not one but two ASX-listers smashing out a double-century of gains since this time last week.

At the top of the chart is little Aussie med-tech LBT Innovations (ASX:LBT), which is basking in the glow of a 220% jump to $0.016 per share because… and here’s where it all gets a little awkward.

LBT put out an announcement on 27 November, the substance of which was pretty much just the news that non-executive director Damian Lismore was stepping down and leaving the company.

Over the course of the next few days, LBT did make a clear effort to restate its current position in the market, and drew attention to its ongoing work with industry giant Astra Zeneca – so it’s entirely uncharitable to even consider that boardroom movements are behind the sudden change in fortunes.

I’m not making any assertions on that front, at all – just so we’re all clear.

Moving along, and Sunshine Metals (ASX:SHN) also banked a 200%-er this week, the reason for which is spelled out below – but I feel like I have to point out that the week gold breaks through US$2,000 an ounce is probably the ideal week to drop a “17m at 22.14g/t from 67m” intercept report on the market.

That was some truly impeccable timing.

Third best for the week was Terramin Australia (ASX:TZN), which has closed out the week ahead by around +116%.

After a sedate, news-free start to the week – the company did provide the market with an update on how things are progressing at its Tala Hamza zinc project at the end of last week – its share price went zooming off the charts for two news-free days, before the company dropped its September quarterly on the 30th.

Here are the best performing ASX small cap stocks from 18-22 September:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| NPM | Newpeak Metals | 0.02 | -80% | $2,798,762 |

| EWC | Energy World Corpor. | 0.015 | -35% | $46,183,819 |

| ADS | Adslot Ltd. | 0.002 | -33% | $6,448,991 |

| TD1 | Tali Digital Limited | 0.001 | -33% | $3,295,156 |

| VPR | Volt Power Group | 0.001 | -33% | $10,716,208 |

| MPK | Many Peaks Minerals | 0.15 | -32% | $5,456,172 |

| PTR | Petratherm Ltd | 0.039 | -32% | $9,664,299 |

| MHK | Metalhawk. | 0.155 | -31% | $13,638,345 |

| JAY | Jayride Group | 0.028 | -30% | $7,032,274 |

| NGY | Nuenergy Gas Ltd | 0.017 | -29% | $26,657,199 |

| POD | Podium Minerals | 0.037 | -28% | $13,877,217 |

| BUB | Bubs Aust Ltd | 0.12 | -27% | $99,489,264 |

| REM | Remsensetechnologies | 0.02 | -27% | $2,007,983 |

| CSS | Clean Seas Ltd | 0.26 | -27% | $43,854,721 |

| SHV | Select Harvests | 3.26 | -25% | $409,178,284 |

| AMM | Armada Metals | 0.045 | -25% | $7,592,995 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | $9,507,891 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | $3,200,685 |

| CYQ | Cycliq Group Ltd | 0.003 | -25% | $1,072,550 |

| IEC | Intra Energy Corp | 0.003 | -25% | $6,643,126 |

| MOH | Moho Resources | 0.009 | -25% | $5,100,666 |

| MTL | Mantle Minerals Ltd | 0.003 | -25% | $21,516,060 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| WIN | Widgienickellimited | 0.105 | -25% | $32,773,956 |

| C1X | Cosmosexploration | 0.11 | -24% | $4,984,875 |

| ADVDB | Ardiden Ltd | 0.18 | -24% | $11,253,151 |

| ECT | Env Clean Tech Ltd. | 0.005 | -23% | $17,085,331 |

| VAR | Variscan Mines Ltd | 0.01 | -23% | $3,566,147 |

| MRR | Minrex Resources Ltd | 0.017 | -23% | $17,357,880 |

| AIS | Aeris Resources Ltd | 0.115 | -22% | $76,394,801 |

| CCE | Carnegie Cln Energy | 0.051 | -22% | $16,581,234 |

| EML | EML Payments Ltd | 0.8525 | -21% | $320,284,938 |

| 8CO | 8Common Limited | 0.06 | -21% | $13,445,694 |

| KGD | Kula Gold Limited | 0.03 | -21% | $12,161,607 |

| PIM | Pinnacleminerals | 0.15 | -21% | $3,964,125 |

| CXO | Core Lithium | 0.2725 | -21% | $598,341,952 |

| TG6 | Tgmetalslimited | 0.8 | -21% | $33,575,180 |

| MNS | Magnis Energy Tech | 0.046 | -21% | $61,174,406 |

| OZM | Ozaurum Resources | 0.115 | -21% | $17,462,500 |

| ICU | Investor Centre Ltd | 0.054 | -21% | $20,314,269 |

| HAL | Halo Technologies | 0.155 | -21% | $22,014,186 |

| ENR | Encounter Resources | 0.3 | -20% | $120,675,234 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | $5,533,110 |

| EDE | Eden Inv Ltd | 0.002 | -20% | $6,727,274 |

| SBW | Shekel Brainweigh | 0.08 | -20% | $20,328,575 |

| AAU | Antilles Gold Ltd | 0.0225 | -20% | $17,663,955 |

| ITM | Itech Minerals Ltd | 0.125 | -19% | $15,883,863 |

| MEG | Megado Minerals Ltd | 0.025 | -19% | $7,124,756 |

| OXT | Orexploretechnologie | 0.03 | -19% | $6,253,301 |

| DUG | DUG Tech | 1.725 | -19% | $198,447,288 |

Monday 27 November, 2023

Still on a roll after a fabulous week prior to this one was Sunshine Metals (ASX:SHN).

“17m at 22.14g/t from 67m” was the banner headline from drilling at Sunshine’s Ravenswood Consolidated Project in North Queensland, where the heavily diluted $24 million micro cap may have struck paydirt in a gold and copper rich feeder zone to its 2.3Mt zinc, gold, copper, lead and silver VMS resource at the Liontown deposit.

It was a bit of a game changer that drove the stock price to double on Monday.

“The stunning intercepts at Liontown are a great reward for the solid geological work completed by the team,” MD Damien Keys said.

“The decision was made to target the gold-copper rich footwall and feeder zones to the Liontown Resource with a high impact, shallow RC program. The feeder zones have not been recognised by past explorers and are often difficult to target.”

Another 11 holes have already been drilled to target these feeder zones and footwall lodes, with assays due in December this year.

ClearVue was also rising quickly on Monday, with no breaking news, however the sustainable materials company last week struck a new distributor deal, expanding its footprint into large parts of the US mid-west – via Colorado, Missouri and Arizona.

Under a five-year agreement 8G Solutions secured a non-exclusive distribution rights for ClearVuePV solar integrated glass units (IGUs) for those regions with the potential for exclusive rights, subject to performance.

8G Solutions has around 150 staff operating across three US states, with projects typically falling within the US$2million to US$15 million range.

Meanwhile, Riversgold (ASX:RGL) was another stock living in the past on Monday, but living quite well.

The diverse explorer made headlines late in the previous week having acquired ‘a key 74 square kilometre tenement application directly along strike – just 8km northeast of the major Andover lithium (spodumene) pegmatite discovery of Azure Minerals (ASX:AZS).’

Consultants will be commencing exploration efforts ‘in earnest within the week.’ RGL said last week, pointing to a spot on the map in the lithium-famous Andover Corridor where AZS struck spodumene glory with drilling intersections of up to 209.4m at 1.42% Li2O.

Also worth a mention, Haranga Resources (ASX:HAR) was up on no news in particular other than the cut of its jib – well managed, well located and in the right business, at the right time – the uranium spot price last week punching through the US$80/lb mark for the first time in 12 years.

Haranga’s difference here might be the Saraya uranium project in Senegal where a major auger drilling program is currently underway.

Tuesday 28 November, 2023

Romping it in on Tuesday was InteliCare (ASX:ICR), after securing a rather terrific non-binding Memorandum of Understanding (MoU) with Bolton Clarke – hopefully a staging ground for a full-on Strategic Partnership.

ICR is a medtech of sorts, with a fair bit of SaaS and other stuff thrown in. It’s been developing predictive analytics hardware and software for use in the aged care sector.

In this case, the MOU partner also happens to be Australia’s largest independent not-for-profit aged care provider, with ICR saying its platform will find a home somewhere across Bolton Clarke’s various sites and services.

What amounts to a pilot project will assess how ICR gels within the Bolton Clarke operating environment and help ICR assess and identify areas of possible enhancement.

The non-bank lender Plenti Group (ASX:PLT) dropped some decent results for the first half of its 2024 (6-months to September 30), but it’s entirely possible investors have come for the PLT’s results, but stayed for its shiny new partnership with National Australia Bank, one which actually involves money and integration into the bank’s embrace.

PLT says, the tie-in… ” initially launching a “NAB powered by Plenti” car and electric vehicle (EV) loan and then making Plenti renewable energy finance available to NAB customers.”

There’s also an equity investment deal – allowing NAB to ‘acquire up to 15% of Plenti’s share capital’ through placements and market purchases and such. That, in fintech parlance, is commitment.

Meanwhile, the books look strong for Plenti – its closing loan portfolio for the first half was at $2bn – up +29% on the pcp. The key measurement for these chaps – loan originations – amounted to $624mn, a +12% improvement on the same time last year.

Half-year revenue was $97 million, up 52% on pcp. Cash NPAT was $1.5 million, up 10% on pcp. The company had a strong credit performance in the half, with a 0.99% net loss rate.

Imugene (ASX:IMU) – everyone’s fav ‘clinical stage immuno-oncology’ stock – was higher on Tuesday as well, after announcing that its ‘MAST (Metastatic Advanced Solid Tumours) clinical program evaluating the safety and efficacy of novel cancer-killing virus CF33-hNIS (VAXINIA)’, has been given the sought-after “Fast Track Designation (FTD)” from the US Food and Drug Administration (FDA).

The FDA’s FTD for IMU’s Bile Duct Cancer CF33-hNIS (VAXINIA) MAST clinical program is of course great news for the company, according to Imugene CEO and MD Ms Leslie Chong.

“The Fast Track process of drug development is designed to facilitate the development, and the review of drugs to treat serious conditions and fill an unmet medical need, with Fast Track status often leading to earlier drug approval and access by patients.”

The designation provides closer cooperation with the FDA to expedite the MAST clinical program and subsequent potential approval processes, the set up also makes IMU’s MAST program eligible for the FDA’s Accelerated Approval and Priority Review.

Accelerate Resources (ASX:AX8) announced it’s completed the first phase of geological mapping and follow up rock chip sampling across the Prinsep Lithium Project, which is Under Agreement to acquire 100%.

AX8 says the campaign has ‘confirmed extensive strike continuation of lithium-prospective pegmatites up to 60m in width on multiple trends within the project area’.

Accelerate’s Prinsep lithium project is situated within the emerging 40km long hard-rock lithium belt between Karratha and Roebourne, West Pilbara, and the belt hosts the Andover discovery (ASX:AZS) with a number of other ASX listers nearby.

Namoi Cotton (ASX:NAM) announced it is the recipient of a non-binding, indicative and conditional offer from Louis Dreyfus Company Asia (LDC) – Namoi’s joint venture partner in Namoi Cotton Alliance and Namoi Cotton Marketing Alliance also holding a 17% shareholding ownership stake in Namoi.

The offer, by way of a scheme of arrangement and the total cash consideration of $0.51 per share, is for the remaining 83% of issued shares in Namoi that it doesn’t currently own.

The LDC bid also allows Namoi to pay a dividend of $0.01 per share to Namoi shareholders prior to the Scheme implementation, representing a premium of 44% to the last closing share price of $0.355 per share and a premium of 37% to the three-month VWAP of $0.372 per share.

Wednesday 29 November, 2023

It was Euro Manganese (ASX:EMN) all the way on Wednesday, as Rob Badman so eloquently reported.

“This $38m market capped Canadian manganese stock hasn’t had the best time of things since we mentioned it in this column in mid-August … although we’re pretty sure that’s not our fault.

Back then, you see, it was a $52m market capper.

But… its fortunes now look to be making a u-turn in the right direction, with the stock bursting up +45% and making news just about everywhere on the back of a significant project financing deal with $8.2 billion global asset management firm Orion Resource Partners.

It’s a US$100m non-dilutive funding package to advance the development of the Chvaletice manganese project in the Czech Republic – the company’s primary focus.

Slipping into second place was Ballymore Resources (ASX:BMR), which said it’s raised $1.8m via a placement/ entitlement offer – plus another $1.5m from mining royalty firm Taurus – to advance the Dittmer gold mine to production.

And Swoop Telecommunications (ASX:SWP) went gangbusters, too – just because it could, I suspect.

Thursday 30 November, 2023

Cooper Metals (ASX:CPM) has found more copper at its Brumby Ridge Prospect at the Mt Isa East Cu-Au project.

The latest assays look convincing to me – and the company says they “confirm bonanza copper grades” at Brumby Ridge, so must be true.

For example, the drill hole called 23MERC028, has returned:

– 71m @ 2.8% Cu & 0.05 g/t Au from 115m to end of hole at 186m, including: 24m @ 5.4% Cu and 0.10g/t Au from 115m hole 23MERC028 ended in mineralisation – 3m @ 1.88% Cu.

The company says that of the 5 drill holes to date, three have hit significant mineralisation and finished in mineralisation.

This new result builds on the initial RC drill hole 23MERC024, which intercepted 50m at 1.32% Cu and 0.05g/t Au from 80m including 2m @ 6.1% Cu & 0.23g/t Au.

MD Ian Warland says that mineralisation is “open in all directions and appears to increase in copper and gold grade with depth.”

“Seventy-one metres at 2.8% Cu, with a higher-grade intersection of twenty-four metres at 5.4% Cu could be the start of a significant discovery at Brumby Ridge for Cooper Metals.

“DHEM is being trialled at the Brumby Ridge and Raven Prospects, along with plans to conduct a larger program of RC and diamond drilling at Brumby Ridge in first quarter 2024, chasing the higher-grade mineralisation at depth and along strike.

‘This whole Prospect area is well located, just down the road from Mt Isa township and will continue to be our main focus going in to 2024.”

Meanwhile, Dragon Mountain Gold (ASX:DMG) held its AGM, where there was almost wholesale backing of the various resolutions including a 99.97% vote in favour of changing the company name.

Shares are up 50% so it must be a right cracker of a name – ‘cos (as Christian put it) Dragon Mountain Gold was pretty bloody good already.

Friday 1 December, 2023

Hubify (ASX:HFY) gained about 40% on Friday after mopping up some shares, alongside fellow 40%er Mitre Mining (ASX:MMC) which grabbed itself the high grade Cerro Bayo silver and gold project in Chile.

Cerro Bayo was operating as recently as October last year, placed onto care and maintenance after 15 years, 45Moz of silver and 650,000oz of gold production.

But it still has 3.82Mt of ore at a grade of 206g/t for some 24.7Moz of silver equivalent and a string of high grade hits outside its resource including a heroic 5.5m at 868g/t Ag and 23.5g/t Au.]

Another digger up an even third on Friday is Perpetual Resources (ASX:PEC).

According to resident rock genius, Our Josh Chiat, the $7.5 million capped Perpetual has made its second visit to the Itinga prospect in the lithium valley region for Brazil’s Minas Gerais state.

Josh says PEC is prepping investors for imminent rock chip assay results, with geochemical sampling and in field XRF analysis als0 due to begin soon after a first field trip over a month ago.

The ground is located around 15km from major lithium projects including those held by TSX-listed Brazilian lithium giant Sigma Lithium.

And Dalaroo Metals (ASX:DAL) has picked up $500,000 in cash and $500,000 in shares on Delta Lithium’s (ASX:DLI) tightly held register after inking a deal to sell the lithium, caesium and tantalum rights at its Lyons River project in WA’s emerging Gascoyne province.

That’s where the $3.3 million market capped DAL’s been focused on finding more of the high grade gold it’s struck at Goodbody just a few clicks down the road from DLI’s Yinnetharra discovery.

Annnnd that’s about where we’re going to leave this wrap-up of the week. Tune in next week, for the next exciting chapter of whatever outright lunacy the market has in store for us all.