ASX Small Cap Lunch Wrap: Who’s breaking down global barriers with pictures of cats today?

News

News

Aussie markets are up today, following Wall Street higher which shrugged off hotter than expected inflation data released overnight.

At 12.15pm (AEDT) on Wedneday, March 13, the S&P/ASX 200 had risen ~0.30% to 7734.20 points

Are you a cat person? Do you love scrolling on Instagram reels for cats, taking photos, drawing or painting your feline friend? What if you could pay a library fine with a picture or photo of a cat?

The Worcester Public Library (WPL) in the US is making headlines globally for allowing patrons to settle outstanding fines for lost or damaged library materials by submitting cat photos.

The WPL launched ‘March Meowness’ encouraging patrons who have accrued fines to take advantage of the cat photo program as a creative way to waive the fees.

“Show us a picture of your cat, a famous cat, a picture you drew of a cat, a shelter cat – any cat, and we will forgive WPL fees on your library account,” the library says on its website.

Curious to find out more about ‘March Meowness’ Stockhead reached out to the WPL to find out more.

Executive director Jason Homer says in 2020 at the height of the Covid-19 pandemic the WPL got rid of fines for late material and moved to a system of “as long as you return it, you owe us nothing”.

“We do still charge fees for lost/damaged books, however, we also know that life gets in the way,” Homer says.

“For example, at the start of the pandemic, children thought they were going to return to school in two weeks and they left their books behind.”

“We were so busy sanitising our groceries, that we know many people lost books, and we don’t want to punish people who were just trying to keep their families safe.”

Homer says they don’t want people to be afraid to come back to the WPL because of the fees they owe.

“We want them to come and see all the amazing things we do from maker-programs (like 3D printing) to genealogy research to a Library of Things, there is so much more to your public library than you may know.

“March Meowness gives us an opportunity to invite people back into the library without a fear of punishment or not being able to afford our services. ”

Homer says when the WPL New Users Task Force and the library’s marketing manager approached him he was happy to green-light the thoughtful and innovative idea.

“We could not be more excited for the response,” he says.

Homer says across the world, people are sharing photos of their cats with us as an act of solidarity, of community, and of reducing barriers.

“I am so proud of the work of librarians across the world, who stand for intellectual freedom and democracy in its truest form.

“March Meowness may seem silly, but in only a few days we have fixed hundreds of blocked accounts.”

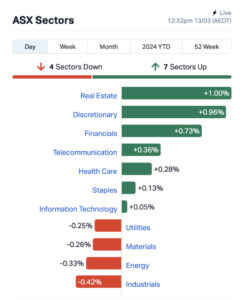

Six of the 11 sectors were in the green at lunchtime with real estate leading the gainers up 1%, followed by discretionary up 0.96% and financials 0.73% higher.

Industrials led the laggards, losing 0.42% followed by energy down 0.33% and materials falling 0.26%.

In some good news for Aussie wine makers the Chinese Ministry of Commerce on Tuesday released an interim draft determination that proposed lifting tariffs.

In an ASX announcement the largest exporter of Australian wine Treasury Wine Estates (ASX:TWE) said it was not a final determination and was subject to change by the ministry.

TWE says its anticipates that MOFCOM will release a final determination in the coming weeks. The news has sent the TWE share price up 0.90% today.

Bisalloy (ASX:BIS) is paying 8 cents fully franked

Brambles (ASX:BXB) is paying 23.09 cents 35 per cent franked

Downer EDI (ASX:DOW) is paying 6 cents unfranked

Data#3 (ASX:DTL) is paying 12.6 cents fully franked

Glennon SML Co Ltd (ASX:GC1) is paying 1 cent fully franked

IVE Group (ASX:IGL) is paying 9.5 cents fully franked

Imdex (ASX:IMD) is paying 1.5 cents fully franked

Mercury NZ (ASX:MCY) is paying 8.7258 cents unfranked

Pepper Money (ASX:PPM) is paying 5 cents fully franked

Perpetual (ASX:PPT) is paying 65 cents 35 per cent franked

Thorney Opp Ltd (ASX:TOP) is paying 1.05 cents fully franked

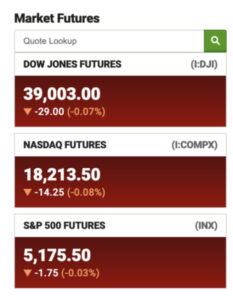

Overnight on Wall Street, the market had a strong session despite higher-than-anticipated US inflation data. Leading the gains were mega tech stocks, propelling the NASDAQ composite up by 1.5%, while the S&P 500 surged to a record high close with a 1.1% increase, and the Dow Jones Industrial Average saw a 0.6% uptick.

Treasury yields also saw an increase, with the US 10-year bond yield hovering around 4.15%.

According to the latest US Consumer Price Index (CPI) figures, headline inflation experienced a monthly rise of 0.4% in February and a 3.2% increase over the previous year, slightly higher than January’s 0.3% monthly rise and 3.1% annual gain, and surpassing expectations.

Core CPI, which excludes food and energy prices, exhibited a 0.4% increase for the month and a 3.1% rise over the year.

These latest inflation statistics mark the final release before the upcoming policy decision by the US Federal Reserve on March 20. Investors are optimistic that the central bank may implement interest rate cuts later this year, although the timing remains uncertain.

Global investment manager ClearBridge Investments director and head of economic and market strategy Jeffrey Schulze says overall February CPI showed cooler services inflation relative to January as well as a slight pick-up in goods prices following three months of outright goods deflation.

He says taking a step back, the broader story on goods versus services inflation looks largely intact, which shouldn’t lead to a change in thinking for the Fed or investors.

“Although CPI came in slightly hotter than expected, the internals show that the read-through to the more important core PCE measure could be more favorable for the Fed and investors,” he says

“Prior to the release, the futures markets were pricing less than a 5% chance that the Fed did anything at their meeting next week and this print all but cements no action occurring (less than 1% now).

“Importantly, the Fed will have additional inflation data in hand by the time of their subsequent meetings that will be more important to their decision-making than this release, which on its own does not preclude nor confirm a rate cut from occurring around mid-year.”

He says overall, there should be relatively little market impact from the the latest US CPI data given it is largely consistent with the prior understanding of the disinflationary process.

Overnight OPEC has maintained its 2024 projection for oil demand growth at 2.2 million barrels while slightly revising downward its forecast for non-OPEC supply growth.

The adjustment reflects the inclusion of supplementary voluntary cuts in the second quarter by OPEC+ nations.

WTI is up 0.68% to US$78.1/barrel while Brent is up 0.61% to US$82.42/barrel.

Iron ore is up 0.44% to US$111/tonne after earlier slides. Coal has fallen 1.77% to US$130.65/tonne.

Gold is also back up 0.05% to US$2158.97/ounce, while copper is up 0.08% to US$3.9283/ounce.

The Aussie dollar is firmer against the greenback trading up 0.07% to US66.17 cents.

Here are the best performing ASX small cap stocks for March 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LBT | LBT Innovations | 0.027 | 93% | 90,674,572 | $17,651,426 |

| SIH | Sihayo Gold Limited | 0.0015 | 50% | 499,999 | $12,204,256 |

| POD | Podium Minerals | 0.04 | 29% | 4,667,825 | $14,097,150 |

| ASP | Aspermont Limited | 0.009 | 29% | 366,000 | $17,189,443 |

| AQC | Auspac Coal Ltd | 0.086 | 26% | 2,121,918 | $34,881,796 |

| LRL | Labyrinth Resources | 0.005 | 25% | 4,219,387 | $4,750,175 |

| VAL | Valor Resources Ltd | 0.0025 | 25% | 273,286 | $9,178,027 |

| NIS | Nickel Search | 0.032 | 23% | 3,730,379 | $5,552,104 |

| WC1 | West Cobar Metals | 0.052 | 18% | 34,519 | $5,315,215 |

| 1MC | Morella Corporation | 0.0035 | 17% | 951,556 | $18,536,398 |

| EQS | Equity Story Group | 0.029 | 16% | 53,965 | $1,065,370 |

| DVL | Dorsavi Ltd | 0.015 | 15% | 150,000 | $7,756,601 |

| ATS | Australis Oil & Gas | 0.016 | 14% | 187,615 | $17,876,118 |

| HOR | Horseshoe Metals Ltd | 0.008 | 14% | 64,495 | $4,525,351 |

| FRB | Firebird Metals | 0.125 | 14% | 33,500 | $15,659,754 |

| GCX | GCX Metals Limited | 0.052 | 13% | 728,487 | $12,809,702 |

| GRV | Greenvale Energy Ltd | 0.079 | 13% | 155,185 | $30,814,726 |

| PAA | PharmAust Limited | 0.355 | 13% | 672,119 | $123,035,355 |

| DOU | Douugh Limited | 0.0045 | 13% | 534,327 | $4,328,276 |

| FHS | Freehill Mining Ltd | 0.009 | 13% | 500,613 | $23,966,755 |

| TSL | Titanium Sands Ltd | 0.009 | 13% | 350,000 | $15,949,842 |

| MYE | Metarock Group Ltd | 0.19 | 12% | 70,107 | $52,109,415 |

| PIM | Pinnacle Minerals | 0.09 | 11% | 53,513 | $2,807,712 |

| ESR | Estrella Resources | 0.005 | 11% | 394,906 | $7,917,173 |

| GSN | Great Southern | 0.02 | 11% | 639,460 | $13,583,433 |

Provider of AI solutions to microbiology labs LBT Innovations (ASX:LBT) has successfully completed primary validation for its APAS PharmaQC product, “the final step in product development and technology commercialisation”.

Explorer LCL Resources (ASX:LCL) has announced its uncovered reasonable nickel grades (plus gold credits) in trenching at Veri Veri, part of the PNG nickel sulphide project.

Highlights include 19m @ 2.46% Ni and 0.65g/t Au, and 14m @ 2.82% Ni and 0.83g/t Au.

Firebird Metals (ASX:FRB) has inked a non-binding strategic agreement with engineering firm China National Chemistry Southern Construction and Investment Co Ltd to collaborate through the development and ultimately building the company’s high-purity manganese sulphate plant, located in Jinshi, Hunan Province.

Greenvale Energy (ASX:GRV) has provided an update on its liquefaction test program 4 and delivery of the maiden preliminary feasibility study (PFS) for its flagship 100%-owned Alpha Torbanite Project in Central Queensland.

GRV says it will adopt a staged development approach to bitumen production, with initial results supporting a conceptual design basis for an initial 100,000tpa bitumen processing plant at the Alpha Project.

Here are the most-worst performing ASX small cap stocks for March 13 [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CPM | Cooper Metals | 0.135 | -51% | 4,536,156 | $21,547,804 |

| OSX | Osteopore Limited | 0.32 | -38% | 97,327 | $5,370,918 |

| FAU | First Au Ltd | 0.002 | -33% | 52,575,146 | $4,985,980 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 5,183,482 | $12,677,188 |

| RR1 | Reach Resources Ltd | 0.003 | -25% | 2,325,000 | $13,114,636 |

| HXL | Hexima | 0.011 | -21% | 302,769 | $2,338,555 |

| ECT | Env Clean Tech Ltd | 0.004 | -20% | 671,801 | $14,321,552 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 701,717 | $9,195,678 |

| MCT | Metalicity Limited | 0.002 | -20% | 858,589 | $11,212,634 |

| RMX | Red Mount Min Ltd | 0.002 | -20% | 23,578,097 | $6,683,940 |

| ROG | Red Sky Energy | 0.004 | -20% | 504,439 | $27,111,136 |

| SKN | Skin Elements Ltd | 0.004 | -20% | 2,497,978 | $2,947,430 |

| NYM | Narryer Metals | 0.05 | -17% | 82,491 | $3,029,615 |

| LPD | Lepidico Ltd | 0.005 | -17% | 1,187,500 | $45,829,848 |

| PNM | Pacific Nickel Mines | 0.04 | -17% | 386,988 | $20,076,149 |

| RGS | Regeneus Ltd | 0.005 | -17% | 220,000 | $1,838,621 |

| K2F | K2Fly Ltd | 0.072 | -15% | 75,318 | $15,815,058 |

| SLZ | Sultan Resources Ltd | 0.017 | -15% | 1,124,256 | $3,314,126 |

| RMI | Resource Mining Corp | 0.032 | -14% | 3,906,454 | $21,916,869 |

| ALM | Alma Metals Ltd | 0.007 | -13% | 2,142,613 | $8,912,006 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | 128,499 | $9,424,610 |

| MEL | Metgasco Ltd | 0.007 | -13% | 525,000 | $8,511,094 |

| POS | Poseidon Nick Ltd | 0.007 | -13% | 2,294,919 | $29,708,278 |

| RIE | Riedel Resources Ltd | 0.0035 | -13% | 13 | $8,895,343 |