Resources Top 5: Lithium in the Gascoyne, silver in Chile, M&A brings the gains for buyers and sellers

Mining

Mining

Here are the biggest resources winners in early trade, Friday December 1.

Talk about being in the right place at the right time.

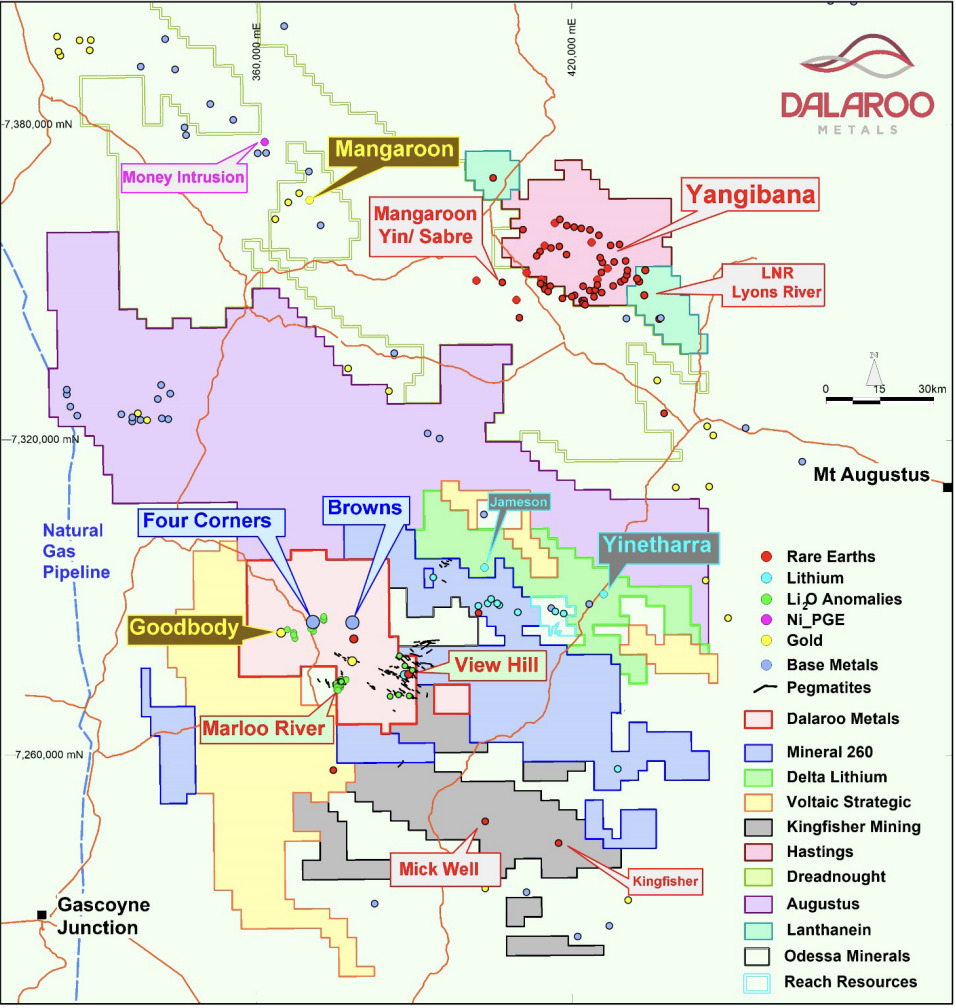

$3.35 million mini-micro cap has picked up $500,000 in cash and $500,000 in shares on Delta Lithium’s (ASX:DLI) tightly held register after inking a deal to sell the lithium, caesium and tantalum rights at its Lyons River project in WA’s emerging Gascoyne province, where Dalaroo is focused on the high grade gold it’s struck at Goodbody just a few kilometres down the road from Delta’s Yinnetharra discovery.

Cue a roughly 80% bump in early trade.

That share pick-up could be well timed for the junior. Delta’s shares have sagged precipitously since major investor Mineral Resources (ASX:MIN) not only muscled in on the register but stationed its MD Chris Ellison and lithium boss Josh Thurlow on the board as a chair and NED respectively in a bid to jettison Delta’s DSO mining plans at its Mt Ida lithium project.

That makes Delta a major cog in Ellison’s plan to consolidate WA’s lithium ‘Corridor of Power’ — a phrase ironically coined by ousted DLI exec chair Dave Flanagan.

Ellison has a stated plan at MinRes to pick up lithium rights on as many gold assets near his existing Mt Marion and Bald Hill operations as he can in a bid to ‘control the rock’ in the EV supply chain. The strategy at Delta looks pretty similar.

Tantalisingly for Dalaroo, Delta is expected to deliver the long-awaited resource for its Malinda prospect at the Yinnetharra lithium project sometime before the end of the year, making it a decent time to trade for some DLI shares.

Dalaroo, which will also see Delta spend a minimum of 50% of the annual statutory expenditure on the Lyons River project tenements ($280,000pa for three years), will now really zero in on the Goodbody gold, Browns base metals and View Hill rare earth prospects.

“The sale of the Lithium Minerals Rights and Dalaroo’s shareholding in Delta Lithium provides potential upside benefits through exposure to future exploration success at the Lyons River Project by DLI and its Yinnetharra and Mt Ida lithium projects. The divestment of the Lithium Minerals Rights will allow Dalaroo to focus on the gold potential at the Lyons River Project in a rising gold price environment that is above US$2,000,” Dalaroo MD Harjinder Kehal said.

“Our Goodbody gold prospect presents itself as a compelling drill target with high grade results of up to 6.25g/t Au in an overall 6km strike length gold anomalous zone. High grade copper with assay results from rock chip sampling over the expanded 3.5km X 2km Browns base metal Pb-Zn-Ag-Cu prospect will be the focus of a deep diamond drilling program in the first quarter of 2024 leading potentially to the discovery of a BHT mineralised system in the Gascoyne Province.”

Delta MD James Croser said the deal also boosted its Gascoyne footprint by 161%, while lithium samples in soils at Lyons River have come in with grades as high as 334ppm Li2O.

“The ground is close to our Yinnetharra Project, where our focus is to undertake

significant resource development drilling at Malinda as we continue to build confidence in this discovery,” he said.

“We will use our existing base to concurrently explore a regional pipeline of promising prospects that could support a long-life lithium operation in the area, starting with Jamesons in 2024 and greenfields exploration on this newly acquired ground.”

Mitre Mining has some big names behind it with Bellevue Gold (ASX:BGL) pair Ray Shorrocks and Steve Parsons on board as executive director and major shareholder respectively.

They’ve been chipping away on some early stage exploration ground in NSW and WA, looking for all the usual suspects — lithium, gold, rare earths, base metals etc. in recent months.

But it didn’t take long for the Shorrocks-led board to get its big boy shoes on and make a major deal.

That’s come today with the acquisition of the high grade Cerro Bayo silver and gold project in Chile.

Cerro Bayo was operating as recently as October last year, placed onto care and maintenance after 15 years, 45Moz of silver and 650,000oz of gold production.

But it still has 3.82Mt of ore at a grade of 206g/t for some 24.7Moz of silver equivalent and a string of high grade hits outside its resource including:

Mitre reckons there’s infrastructure there that would cost around $150m to replicate including a 500,000tpa processing plant and network on underground tunnels, with the whole thing costing $3.5m in cash and $500,000 in Mitre shares, half escrowed for six months and half escrowed for a year.

Another $1m of cash or shares could be paid on top of that if Mitre finds over 100Moz of silver equivalent at upwards of 300g/t AgEq.

The whole thing will be funded via a two-tranche $8.3m placement, $1m of that some extra skin in the game from MMC’s board and management.

“The Cerro Bayo acquisition is an exceptional company-making opportunity for Mitre because it comes with a significant Resource, huge scope for rapid Resource growth and the option of near-term production thanks to the existing plant and infrastructure,” Shorrocks said.

“The infrastructure alone has a replacement value of more than $150m. And in addition to the significant Resource, there is abundant known mineralisation which will help underpin rapid Resource growth and immense district-scale potential.

“We plan to capitalise on this opportunity by starting a drilling program early in the new year.”

The project has been sold by ASX-listed Equus Mining (ASX:EQE), which only acquired Cerro Bayo from Mandalay Resources in December 2021, but shut the mine down due to rising costs less than a year later. The deal, which will include other exploration ground in Chile including the Cerro Diablo and Los Domos project, will help pay off a $2.2 million loan facility with Tribeca’s Global Natural Resources Fund.

Located 2.5 hours by plane from Santiago, Cerro Bayo is located in the world class Deseado Massif province, surrounded by five operating gold and silver mines including Newmont’s 6.7Moz gold, 50Moz silver Cerro Negro project.

Western Mines Group, you may recall, absolutely stonked earlier this year after announcing the discovery of a significant nickel system at its Mulga Tank project in WA.

That drew hasty and hard to match comparisons to BHP’s enormous Mt Keith deposit, the GOAT of WA’s low grade disseminated nickel sulphides.

WMG is still up some 82.14% YTD, but at 26c today sits well shy of its 90c highs from mid-May.

A little spot of cheer today at least for investors who bought in the euphoria earlier in 2023.

WMG shares are back running upwards more than 20% today after the release of assays for six RC holes from Mulga Tank, hitting broad zones of nickel sulphide mineralisation including one strike of 327m at 0.26% nickel, 133ppm cobalt, 74ppm copper, 25ppb platinum and palladium.

Other hits are less broad but similar in nature — large, low grade, the sort of thing that could potentially be mined in a massive open pit but which has largely been the domain of the well-resourced majors in the past.

WMG MD Caedmon Marriott said results have now been received for eight of 22 holes in a recent RC program, all appearing to show broad zones of nickel mineralisation.

“The holes received so far happen to cluster over the western portion of approximately 2.5km x 1km area tested. These are very exciting initial results showing that the drilling has already been successful in demonstrating the lateral continuity, and an

extensive volume, of shallow disseminated mineralisation,” he said.

“The results highlight that around 45-60% of the samples from these first eight holes show the geochemical signature of mineralisation.

“These are positive initial results as the program looks to test a volume of some 650,000,000 cubic metres which could host globally significant tonnes of nickel in sulphide.

“The RC drilling dramatically increases the drilling density in this ‘core’ of the Complex and will yield extremely valuable data, as well as beginning to systematically characterise the geology and geochemistry of the system.”

It comes with nickel in doldrums, as prices have nearly halved this year on weak macroeconomic conditions and a rise in supply of both stainless steel and battery nickel from the market’s largest supplier Indonesia.

Up around a third today, $7.5 million capped Perpetual has made its second visit to the Itinga prospect in the lithium valley region for Brazil’s Minas Gerais state.

It’s prepping investors for imminent rock chip assay results, with geochemical sampling and in field XRF analysis als0 due to begin soon after a first field trip over a month ago.

The ground is located around 15km from major lithium projects including those held by TSX-listed Brazilian lithium giant Sigma Lithium.

Perhaps more excitingly, Perpetual is getting into the community already with some jiu-jitsu classes led by local geo Felix Junior Albuquerque. Lithium and the next Royce Gracie? Say no more.

Well maybe do say something more, exploration manager Allan Stephens:

“Our inaugural reconnaissance site visit has clearly confirmed the presence of several key ingredients in our recently acquired Brazilian ‘Lithium Valley’ exploration permits. Surpassing our expectations, the widespread occurrence of pegmatites across all prospect areas during this initial survey sets a strong foundation for our optimism about the various project’s potential,” he said.

“We eagerly await the results of the rock chip analysis to determine the presence of mineralisation and pathfinder elements and to assist in guiding our exploration team to areas of higher lithium anomalism. Our clear intent with this trip is to deliver tangible data to advance our strategy.”

(Up on no news.)

Nothing new from S2 Resources today, which is up around 12% at the time of writing and was up a little higher at a 17% gain to hit 20c at one point earlier.

Well, there was a little something you can read over at a tasty little resources website called Stockhead, after we travelled out to site to check out the drilling going on at Greater Fosterville in Victoria.

Mark Bennett’s S2, previously focused on projects in Finland and WA, won a tender two years ago for the right to apply for 394km2 of ground surrounding Agnico Eagle’s legendary Fosterville gold mine near Bendigo.

You can read the back story below.

At Stockhead, we tell it like it is. While Dalaroo Metals is a Stockhead advertiser, it did not sponsor this article.