This ASX explorer is looking to drill new pasture inside Brazil’s booming Lithium Valley

Perpetual Resources is one of a few ASX explorers with exposure to Brazil's Lithium Valley. Pic via Getty Images

A growing list of explorers and advanced developers have swooped into Brazil’s Lithium Valley in the mining friendly state of Minas Gerais, where a strong influx of lithium investment is taking place under the reign of new president Luiz Inacio da Silva.

Da Silva promises to use an investor-friendly model similar to Australia’s to tap booming demand for the metal with a long-term view of developing the whole lithium supply chain, including batteries.

Brazil was the world’s fifth largest producer of the white metal in 2022 and plays host to some of the biggest producers in the game including Atlas Lithium, Sigma Lithium Corp, and Latin Resources (ASX:LRS).

These companies are investing in the extraction of lithium and spodumene concentrate production and have plans to ramp up production in the coming years.

Brazil is quickly becoming a key player in the lithium industry with its unique geological features in the Jequitinhonha Valley including being one of a few countries to have hard-rock lithium (pegmatites) as opposed to the brine found in the Atacama Desert.

Hard rock spodumene assets have the potential to reduce technical complexity and capex intensity of projects and can lower the barriers to entry for small miners.

Small-cap explorer to begin drilling in Brazil’s ‘Lithium Valley’

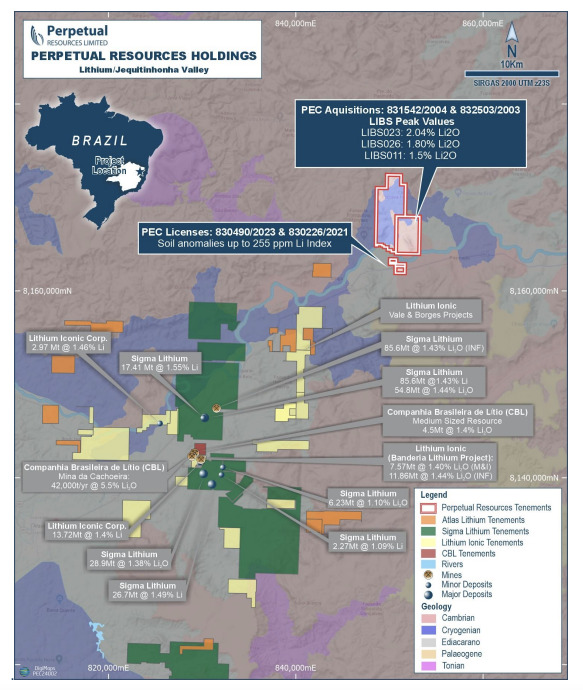

$7m market cap explorer Perpetual Resources (ASX:PEC) is one of a handful of ASX explorers with exposure to region that is looking to start maiden drilling in the coming weeks at its newly acquired project.

The newly acquired permits were secured from local landowners and complement PEC’s existing Itinga tenement position, including extensions of the interpreted pegmatite trend and soil anomalies already identified by Perpetual in the region.

Interestingly, PEC’s new landholdings are within 30km of Sigma Lithium’s Grota do Cirilo project, which underwent a 27% increase in resources to 109Mt in January and is the site of a second lithium concentrate production plant the Vancouver-based company is looking to build.

Lithium Ionic’s Banderia project is also nearby, boasting a post-tax NPV of US$1.6b, internal rate of return of 121%, 20-year mine life and an average LOM annual production of 217,700t of spodumene concentrate at 5.5% Li2O equivalent.

Other ASX-listed Brazilian lithium hunters include Adelong Gold (ASX:ADG), Alderan Resources (ASX:AL8), Oceana Lithium (ASX:OCN), Gold Mountain (ASX:GMN), SI6 Metals (ASX:SI6), OzAurum (ASX:OZM) and Solis Minerals (ASX:SLM) (TSX.V: SLMN).

Sniffing for Sigma-like success

PEC believes its new tenements demonstrate potential for lithium mineralisation with peak rock chip values (based on initial LIBS analysis, still to be confirmed by assay) returning up to 2.1% Li2O.

It also boasts a variety of favourable geological settings for lithium mineralisation, including fertile S-type granites hosting extensive NE-striking pegmatites, providing excellent exposure to geometry and sub-surface mineralogy through numerous artisanal workings.

Preliminary work on the new permits has begun, including targeted mapping and sampling efforts.

Drilling will begin once logistics and program planning activities wrap up.

“These findings highlight significant exploration potential in an expansive, under-explored region near Brazil’s major lithium producers,” PEC exploration manager Allan Stephens says.

“We note that our limited due diligence rock chipping covered less than 5% of the new tenement area.

“We will now implement a systematic and broader exploration program to understand the initial prospects in greater detail as we aim to develop drill-ready targets later this year”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.