You might be interested in

Tech

‘Identify trading opportunities with greater accuracy’: Moomoo’s Nasdaq partnership gives investors deeper insights into Nasdaq traded stocks

Tech

InvestmentMarkets launches the ‘Google for Investors’

News

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Ahh. Back and refreshed from the time at the disaster recovery site.

Quick check on the farms and things are looking good. Grass is still thick and what was a clear drop in prices from the peak last year has stabilised and is still strong. A little like property if I’m being honest.

We’ve seen a decline from a ludicrous top. Don’t panic. Having a really good look at water supply and security even now while things are looking great but I’ll get to that in a moment.

I was driving back on Saturday with the youngest and needing the conversation so I brought up some of the biggest topics a 10 year old could face.

Johnny Cash’s “When The Man Comes Around” popped up on the shuffle and it’s a good chance to ask her about an apocalypse (obviously).

I posed the question, having already couched it in the context that maybe people weren’t always nice to each other, what God would think of all this that we’ve become. Whilst I’m not an overly religious person, anyone who knows me knows that I’m a vehement proponent of the premise that being kind to each other needs no religion. However, the little one does scripture at school so it’s still something to guide her actions.

Me: “What would She think?” I asked. (I always prefer to gender a creator as a woman and if you’d met my wife you’d know how this would be more believable for my daughters.)

Her: “I think She’d be unhappy about us not being nice to each other. And about us always driving cars instead of walking.”

Me: “Sorry, how so?”

Her: “Because the pollution”

That was a fascinating exchange. Amazing that the kids have the right idea that we should be looking after the place. They’ll save us one day. Will it stop me investing China or India’s massive consumption-driven and polluting economies? Absolutely not.

That’s not my business. Small moves, I guess.

This had me thinking about some things that have been appearing more and more in the news which I’ve mentioned a few times recently. The weather is turning again. At the low of early Covid in 2020 I crowed really loudly about the food trade that was presenting itself due to the La Nina effect causing droughts in the US along with supply chains disintegrating.

The long FOOD investment did well and the exit was sound.

Recently we were able to see that Europe would travel along “ok” compared to the panic because their winter was set to be milder than average, meaning less of a reliance on Russian gas and a chance to get their storage back to required levels. (Europe now has a shortage not of gas but of space to store it!! Take that Putin!)

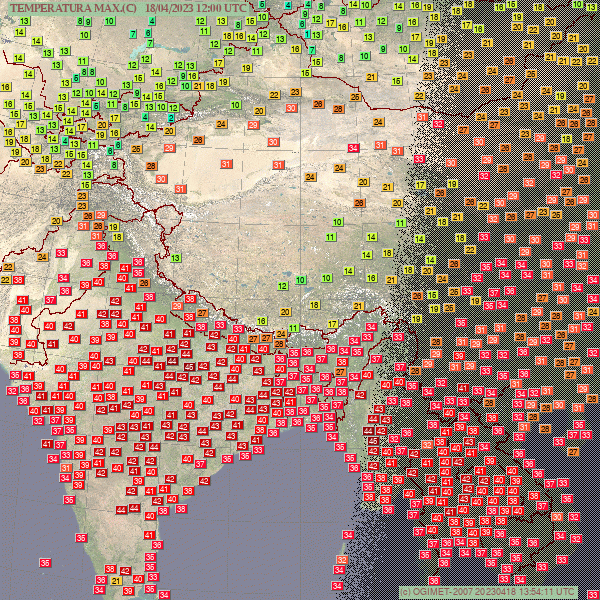

Now I’m looking at the weather in Asia and, putting it mildly (Ed: ha), it has me concerned.

Link here and it’s scary.

Looking at the temperatures in Asia and there’s country records being set across the board. Thailand, Vietnam, China, India, Turkmenistan in the +40s showing anomalies +8 degrees above normal levels.

Funnily enough China was in the middle of a cold and heat wave at the same time.

Leaving the reasons aside there is a clear shift in the weather and one that we need to be mindful of.

Locally, La Nina was declared over in mid-March by the BOM and they’re expecting neutral conditions through autumn with a 50% chance of a drier El Nino at year end.

Last week the US national Oceanic and Atmospheric Administration had an alert that El Nino was likely to develop this US summer. 62% chance.

This one is going to be an absolute corker as well. Not in a good way.

Already here’s where surface sea temps have left us.

Black line is now. Means and previous years all below it. It really is something.

If you think an obliteration of the rice supply is something big then keep an eye on food for the next few years.

Trouble is I don’t see this flowing though to companies in the FOOD ETF the same way I did in 2020. This one has more of an Aerospace and Defence feel to it actually, which is really troubling.

Food prices are already high and I don’t see that going backwards. Water will be the next big thing.

After a week flicking through plenty of grim outlooks on the weather I’ve found an ETF we can put on the short list.

IH2O – The iShares Global Water ETF

It invests in companies within the S&P Global Water Index which contains companies involved in water-related businesses.

Water, utilities, infrastructure, equipment & materials.

In the same way my excitement for FOOD was raised by people needing to pay more for farming “stuff” (think better Deere harvesters and more fertiliser to get the most out of a struggling crop etc) I believe governments paying up for better water.

That’s the best I’ve got for now.

Keep an eye on it.

It’s the last week in April and we take a moment to remember that it’s almost Sell in May season with the S&P 500 looking a little shaky. This week is the week to thin out some holdings.

In the aftermath of the third largest quarter for equity purchases by individual investors.

Also the head of Blackrock sold $25m worth of company stock, or about 7% of his total holding.

Probably nothing.

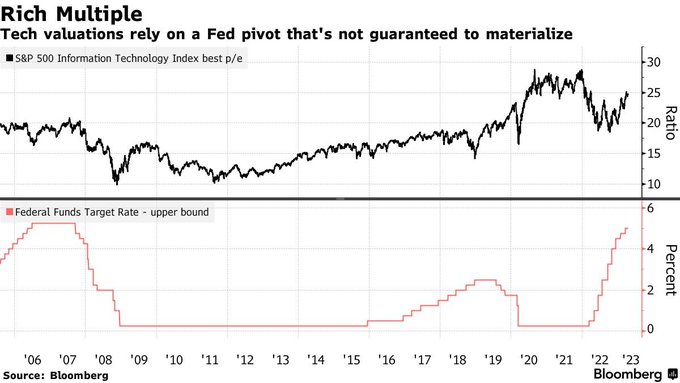

Also, and you sort of need to ‘want’ this one but tech valuations (if you’re running that kind of model) need a lot more pivot than is currently possible.

I think we need to just calm down a little. 25x forward earnings is traditionally high but especially for rates where they are we need a lot of things to work to justify it.

Aside from that have a great week, see your way to a service tomorrow if you can and make sure the young ones see some role models in a march.

They’re the future.

All the best and stay safe, latest episode of the podcast is here.

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.