Bitcoin, and the crypto market on the whole, have retraced somewhat overnight. Wall Street benchmarks did the same thing – funny, that. Meanwhile, guess this had to happen: those AI-related cryptos that were pumping? Dumped back down again.

No, this doesn’t mean they’ve lost all recent gainage, but the old adage “what goes up, must come down” has always been particularly pertinent when applied to crypto.

Must go up again? Not necessarily, of course. That said, there has been a hell of a lot of Google-search froth and big-tech interest regarding AI crypto just lately – Microsoft has reportedly invested US$10 billion into ChatGPT creator OpenAI, for instance, while Google has spooned about US$400m into rival Anthropic.

For those who believe AI is a “narrative” that will continue to play into the crypto-investing zeitgeist, then perhaps they’ll see a bit of a dip now as a non-financially advised opportunity.

One thing, though – we’ve been noticing some heavy pushback on the crypto/AI theme here and there. For instance, here’s well-known lead developer with the Fantom blockchain, Andre Cronje and his thoughts on the subject…

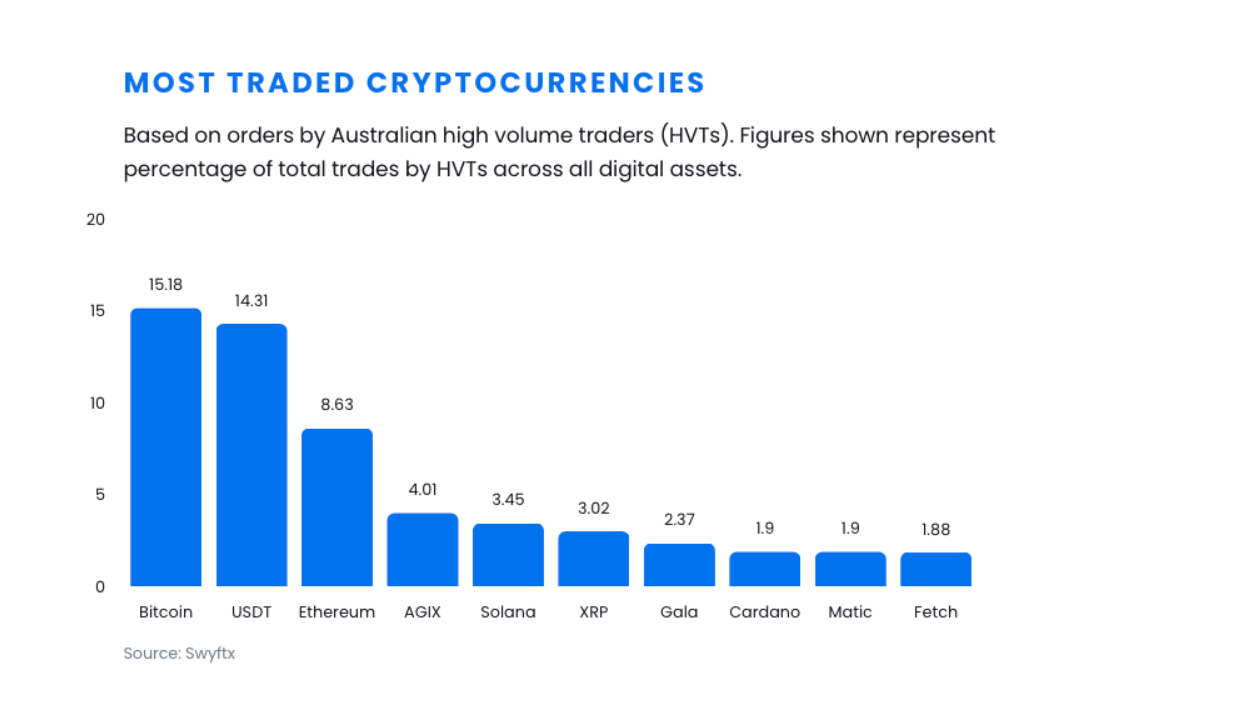

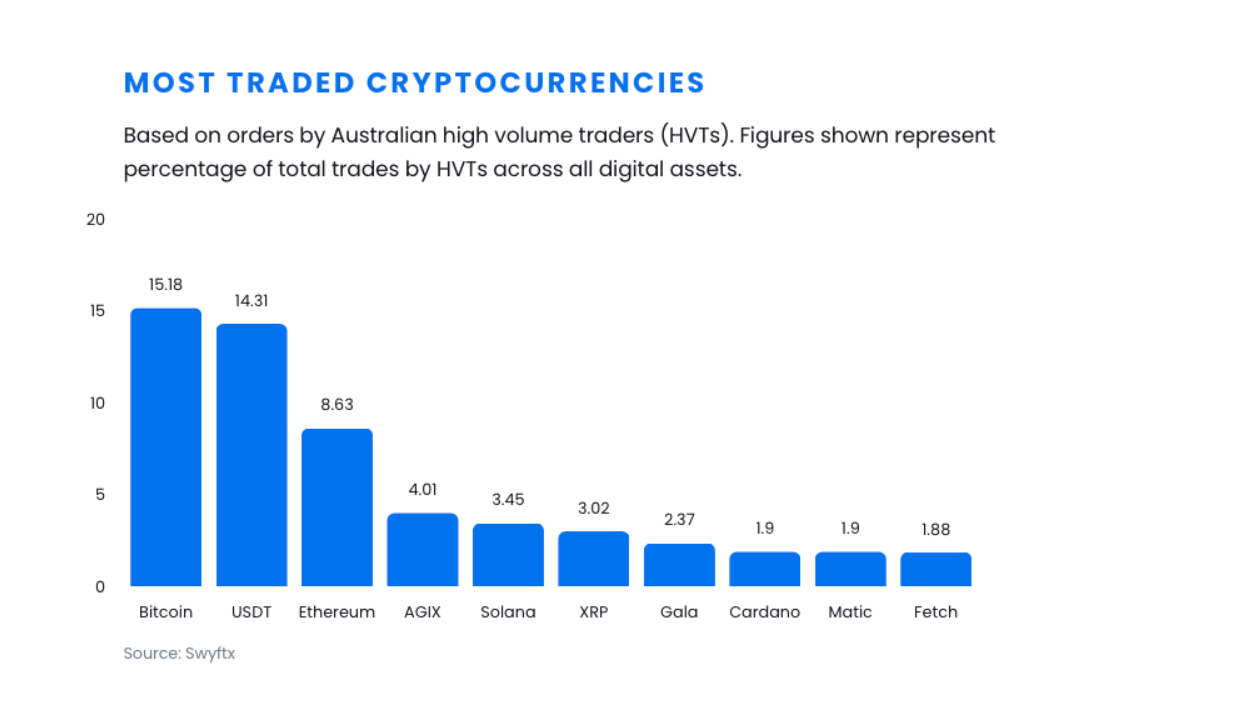

High-volume crypto traders have been active: Swyftx

According to data supplied to us by Swyftx, one of Australia’s leading crypto exchanges, high-volume crypto traders re-entered the digital assets market in January amid a resurgence in the price of Bitcoin.

In total, says the exchange, there was an 105.4% increase in month-on-month trading volumes by Swyftx’s top traders following a subdued December. This outstripped global growth in trading volumes of 70% over the period.

“Bitcoin’s January price rise triggered a bounce back in trading activity among the most experienced Swyftx digital asset traders,” said Swyftx analyst Pav Hundal. “Expectations of less hawkish central bank activity and China’s reopening are certainly factoring into increased trading activity.”

But the main reason Swyftx believes Aussie high-volume traders are outpacing the market is “because Australia has a high household savings rate and a comparatively large cohort of experienced, long-term crypto users compared to other jurisdictions,” added Hundal. “Many Aussie crypto users have experienced multiple cycles of volatility.”

Swyftx saw a significant trading increase in January across top altcoins such as Solana (SOL), Cardano (ADA), XRP and Polygon (MATIC), as well as a trading bump into… yep, you guessed it – AI coins, such as Fetch.ai (FET) and SingularityNET (AGIX).

Hundal did, however, caveat with:

“But the market is a long way off its peak and the FTX effect is still playing out. You can see risk aversion in the increased Bitcoin dominance compared to last year. In total, 15% of all trades were in Bitcoin last month compared to 8.8% over the same period last year. We’re expecting that risk-on sentiment to remain for some time.”

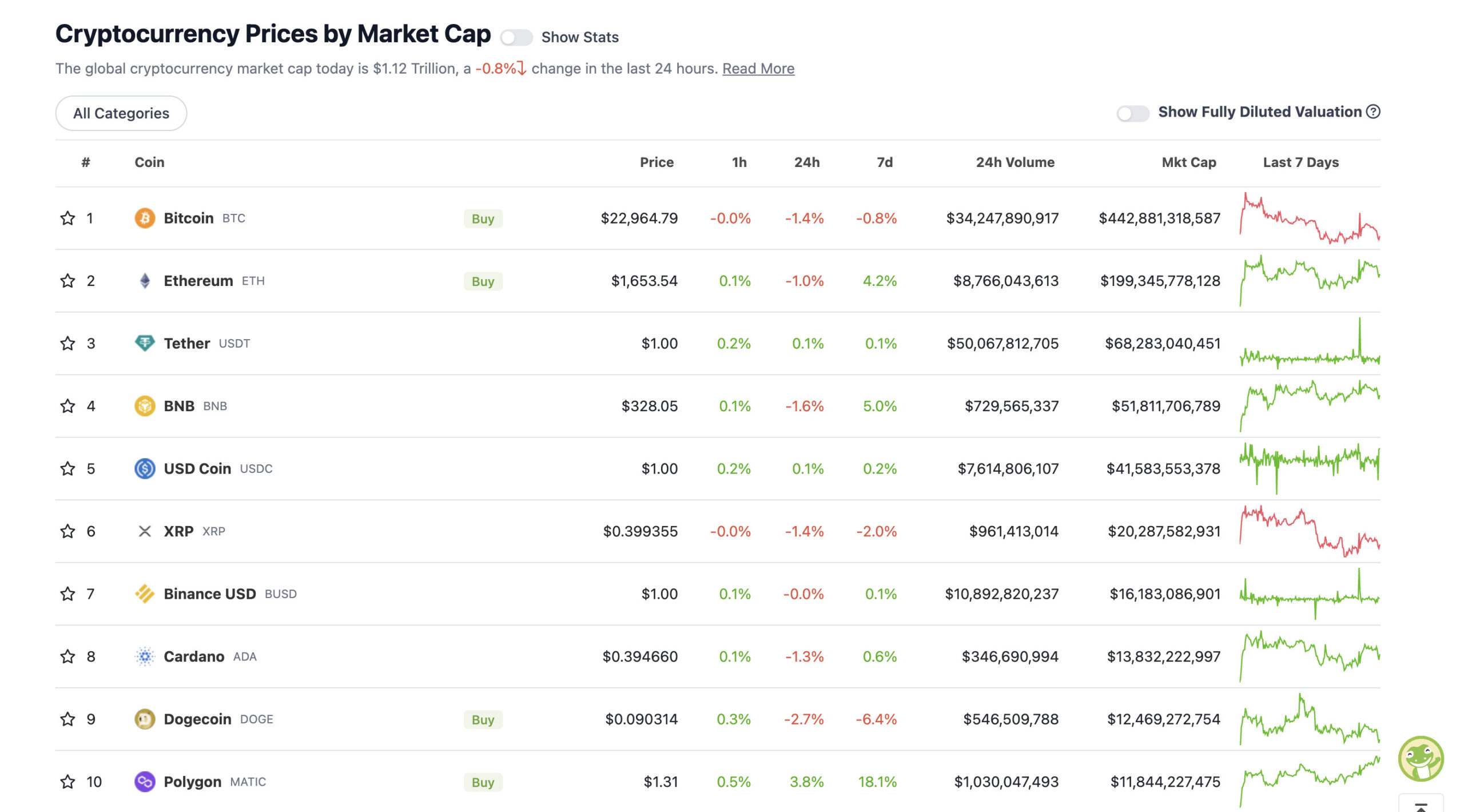

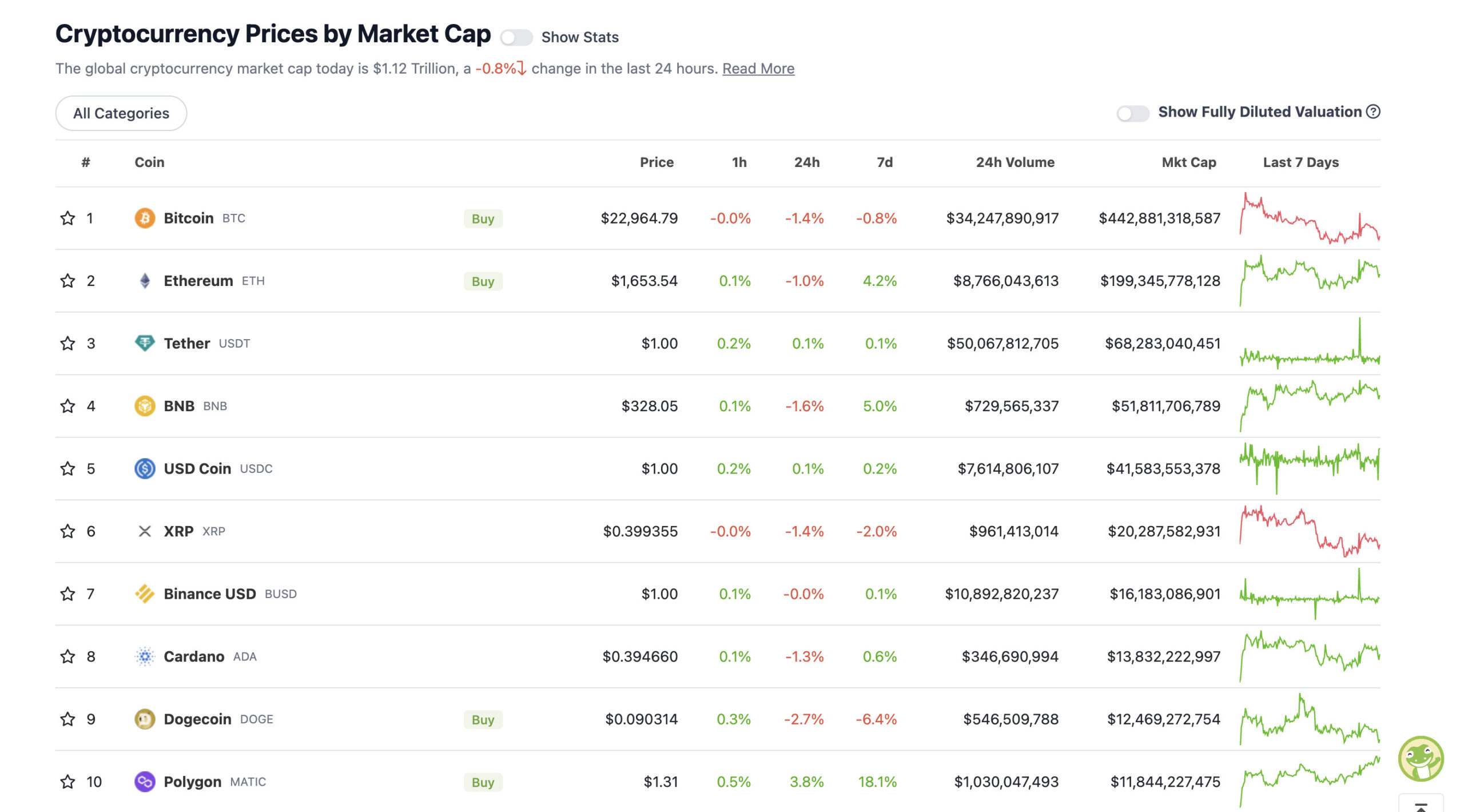

Top 10 overview

With the overall crypto market cap at US$1.12 trillion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s not drastic dippage in the majors, but nevertheless, a stall-out from where they appeared to be momentarily heading yesterday.

Meanwhile, Bitcoin’s weekly “death cross” is approaching, which is an apparently bearish event. (Or could it actually signal the tail end of the bear market?)

But there’s also that daily-timeframe BULLISH “golden cross” happening right now, too, as Lark “Just a Dude on the Internet” shows below. So… really, go figure! We pointed out this confusing scenario last week, actually. And unfortunately, it’s still as clear as mud as to what’s likely to happen next.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11 billion to about US$463 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• NEAR Protocol (NEAR), (mc: US$2.29 billion) +8%

• Baby Doge Coin (BABYDOGE), (market cap: US$553 million) +6%

• Algorand (ALGO), (mc: US$2 billion) +4%

• Curve DAO (CRV), (mc: US$844 million) +4%

• Axie Infinity (AXS), (mc: US$1.38 billion) +3%

DAILY SLUMPERS

• Render (RNDR), (market cap: US$517 million) -20%

• SingularityNET (AGIX), (market cap: US$569 million) -18%

• The Graph (GRT), (market cap: US$1.57 billion) -15%

• Fetch.ai (FET), (market cap: US$496 million) -11%

• Optimism (OP), (market cap: US$587 million) -9%

As mentioned further above, AI-related tokens, including AGIX, GRT and FET are copping a bit of a hammering today, which might have something to do with profit skimming after the narrative surge earlier this week and last week.

Scepticism about the sustainability of the AI-coin pump seems to have crept in here and there, too.

One thing to note about at least one token mentioned there… The Graph doesn’t necessarily pitch itself as an “AI project” as such. Rather, it’s actually a big-data indexing protocol, with tech that some equate to being AI powered, which isn’t strictly the case.

Sure, GRT investors will be happy to ride on any future AI-pump coattails, though.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Yikes, Coinbase CEO Brian Armstrong’s latest post highlights a potential concern for the future of crypto staking in the US. Does the SEC’s Gary Gensler has a new bee in his bonnet? there’s always something, isn’t there?

Now, where’s that Lloyd Christmas “So you’re telling me there’s a chance…” meme when you need it?

You might be interested in