Mooners and Shakers: Bitcoin inches towards bullish ‘golden cross’ signal… or is it a death cross?

Getty Images

Thank Satoshi it’s Friday, eh? Bitcoin and the crypto market have slowed a fraction since the post-Fed-meeting exuberance in the markets. There are still strong daily gainers, however, as BTC moves towards a bullish technical signal – the “golden cross”.

CoinDesk actually noted that Wall Street’s S&P 500 index is forming the same pattern. Yet more correlation with stonks, then.

A golden cross, in the terminology of the dark arts of technical analysis, is when the 50-day simple moving average flips above the 200-day simple moving average. Some traders tend to get a bit frothy about it because it has sometimes been an indicator of a bullish run.

Note, it’s not there yet.

Everyone is waiting for that golden cross🤞#Bitcoin pic.twitter.com/43HrUrAgyP

— Stockmoney Lizards (@StockmoneyL) February 1, 2023

But if it does occur, it’ll be the first Bitcoin golden cross seen since September 2021, which led to a 135% BTC rally, although May 2020’s was far more significant (+740%), which can be put down to the COVID-related money-printing extravaganza.

But wait, there’s also a death cross forming?

One thing that could throw this whole golden-cross narrative out the window tout suite is that bullish crosses have also sometimes faked out the market pretty quickly, depending on surrounding news.

But also, just to show how different things can look on the charts when you zoom in or out on different timeframes, US crypto analyst brainiac Benjamin Cowen has pointed out the following:

So much convergence at $25k #Bitcoin.

We have the 50W SMA moving down into $25k.

We have the 200W SMA moving up into $25k.$25k also marked the summer 2022 top.

The only thing not at $25k is the price of #BTC (for now…) pic.twitter.com/cHfM5iFxI1

— Benjamin Cowen (@intocryptoverse) February 2, 2023

Now that, unfortunately, looks like a “death cross” (50-week MA moving below the 200-week MA) forming on the weekly moving average timeframe… which is bearish. Daily, weekly – which is more significant? Maybe they both are? Maybe it’ll end up in some Ghostbusters-like crossing-of-streams chaos and extreme volatility.

#Bitcoin This is the weirdest setup in the world. Here we have a possible golden cross on the daily but on the weekly a death cross which has never happened in bitcoin history. The whales seem confused lol pic.twitter.com/SspUNvD8Qf

— ₿ᴜʟʟʀᴜɴɴer77 (@BullRunnner77) February 2, 2023

We agree with “Bullrunner77” – it is indeed a weird setup. Time to put on a blindfold and throw darts at a board instead? Probably.

Let’s move on to things we can more easily track – crypto prices that happened no more than five minutes ago (at the time of writing).

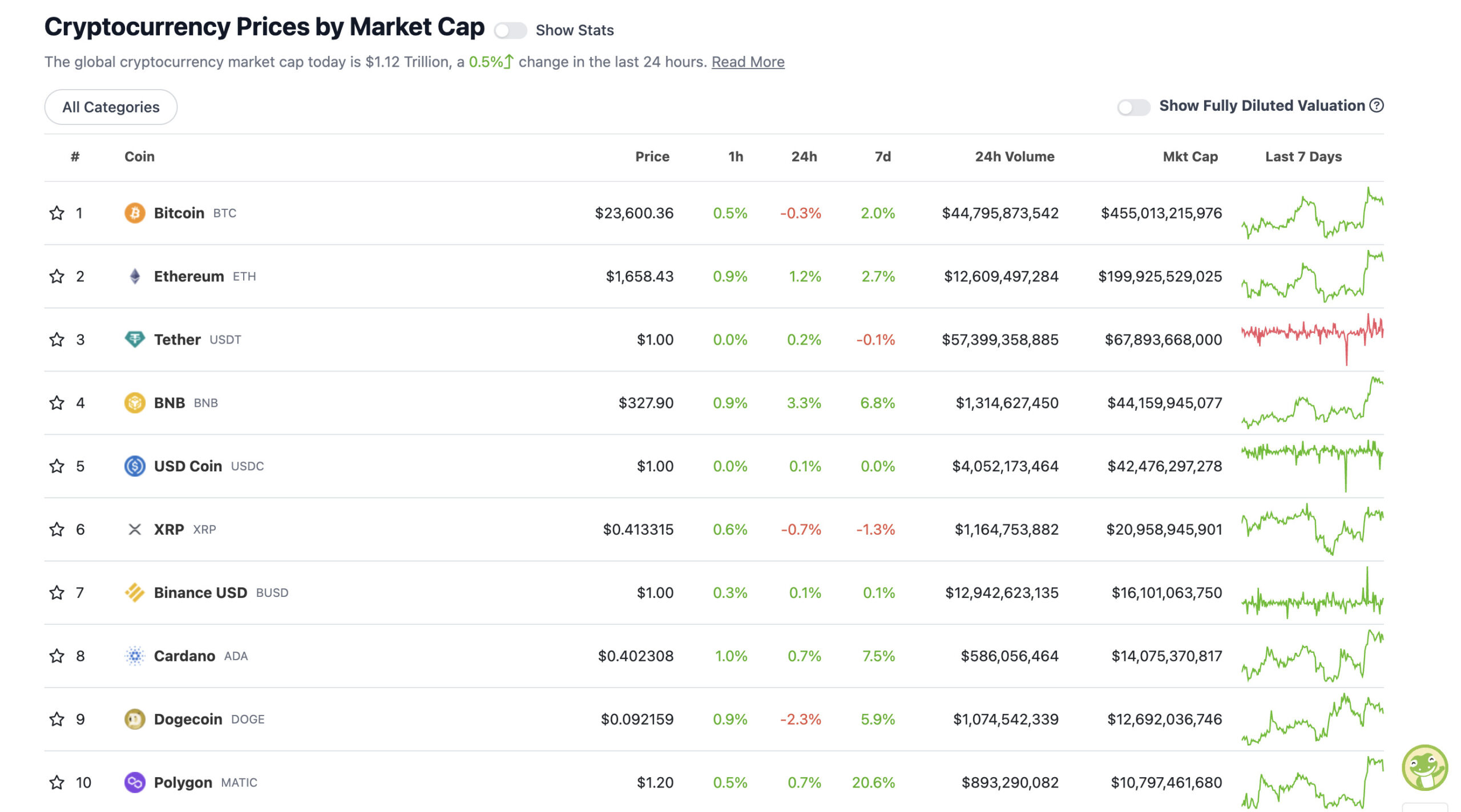

Top 10 overview

With the overall crypto market cap at US$1.12 trillion, pretty flat since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Most of the majors have sat back down in their seats now. The Mexican wave post-Fed-meeting yesterday has pretty much ended for now, although Wall Street benchmarks Nasdaq and S&P 500 did both end up well in the green at close.

Crypto is currently there or thereabouts, although a few hours ago, Bitcoin was pretty much rejected at the US$24k level it briefly breached. Let’s see if it can regain its breath down here around $23.5k and then build strength for another crack.

These are the most bullish rate hikes ever.

— Sven Henrich (@NorthmanTrader) February 2, 2023

Meanwhile, some well-known investor types have differing opinions on Bitcoin and crypto this week. There’s a surprise.

In a Wall Street Journal op-ed, Warren Buffett’s undead offsider and President of the Bitcoin Haters Club, Charlie Munger, yesterday was urging the US government to follow in China’s footsteps and ban crypto.

“A cryptocurrency is not a currency, not a commodity, and not a security,” the 99-year-old Munger said.

“Instead, it’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity.”

Unpopular bet 🎲⏳

I predict the China #Bitcoin ban will last even less than Charlie Munger [who yesterday wrote on the WSJ that communists banning fair, honest money is a good example to the world] pic.twitter.com/l2MlqJt2pG

— Vandelay ₿TC Industries ⚡ (@VandelayBTC) February 2, 2023

If Charlie Munger truly believed in free markets he wouldn’t call for a Bitcoin ban.

— NICO⚡️ (@BITVOLT) February 2, 2023

BREAKING: Charlie Munger's dessicated corpse declares that Bitcoin is bad.

— Jameson Lopp (@lopp) February 2, 2023

Charlie Munger calls for a ban on #Bitcoin, citing it as a form of gambling and a tool for criminals.

However, his company, Berkshire Hathaway, has invested in banks that launder billions of dollars every year 🤡

What's your opinion on this? 👇#BTC #Crypto pic.twitter.com/Mj8q3mmtWn

— CILLIONAIRE.COM (@cillionaire_com) February 2, 2023

Ah well, at least the Cryptoverse has Ark Invest CEO Cathie “Million Dollar Bitcoin” Wood to counter the bad vibes…

₿𝗥𝗘𝗔𝗞𝗜𝗡𝗚: @CathieDWood says, “People living in emerging markets with hyperinflation need a fall back option and an insurance policy. They need #bitcoin" pic.twitter.com/a152H5yr2m

— Documenting ₿itcoin 📄 (@DocumentingBTC) February 2, 2023

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.8 billion to about US$459 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• EthereumPoW (ETHW), (market cap: US$512 million) +23%

• Huobi (HT), (mc: US$958 million) +13%

• Render (RNDR), (mc: US$512 million) +11%

• ImmutableX (IMX), (mc: US$696 million) +8%

• NEO (NEO), (mc: US$629 million) +6%

DAILY SLUMPERS

• Synthetix Network (SNX), (market cap: US$789 million) -6%

• Mina Protocol (MINA), (market cap: US$699 million) -5%

• Internet Computer (ICP), (mc: US$1.65 billion) -5%

• Aptos (APT), (mc: US$2.78 billion) -4%

• Curve DAO (CRV), (mc: US$791 million) -4%

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

One day people will trade houses as NFTs and people will think it was insane we had thousands of proprietary, unique marketplaces to trade stuff and fractured global liquidity.

— Robbie Ferguson 🅧 | Immutable (@0xferg) February 2, 2023

FinTwit after reading the earnings reports for #AAPL #AMZN and #GOOG pic.twitter.com/G9QMU8Ur6y

— Benjamin Cowen (@intocryptoverse) February 2, 2023

NEW: Millionaires understand that #Bitcoin and digital currencies are the future of money, and they “don’t want to be left in the past" – CEO deVere Group

🤝

— Bitcoin Archive (@BTC_Archive) February 1, 2023

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.