Mooners and Shakers: AI coins hit overdrive, led by The Graph; Crypto market pumps after Jerome Powell speaks

Getty Images

“Welcome to the party, Powell!” Didn’t John McClane once say that? In any case, Bitcoin and pals are liking the mood Fed boss Jerome Powell is laying down, as are AI coins The Graph, SingularityNET and Fetch.ai.

Okay, let’s settle back down in our chair again for a sec. The Fed boss isn’t exactly doing a bare-chested, shirt-waving, inflation-combatting victory lap on a rainbow unicorn float just yet. Nevertheless, he did repeat a word he uttered that saw the markets pump about a week ago: “disflationary”.

The central banker was in conversation overnight (AEDT) with Carlyle Group co-founder David Rubenstein at the Economic Club in Washington, D.C. and he reiterated that the “disflationary process” had started.

That said, he did caveat that more interest rate hikes will be necessary… while also adding that the recent surprising US positive jobs report hasn’t changed the Fed’s stance it conveyed post FOMC meeting last week.

Righto, then, not much change there then, although it’s a welcome reprise of a not entirely unpleasant tune for the stock and crypto markets, hence the little bump up we’re seeing today.

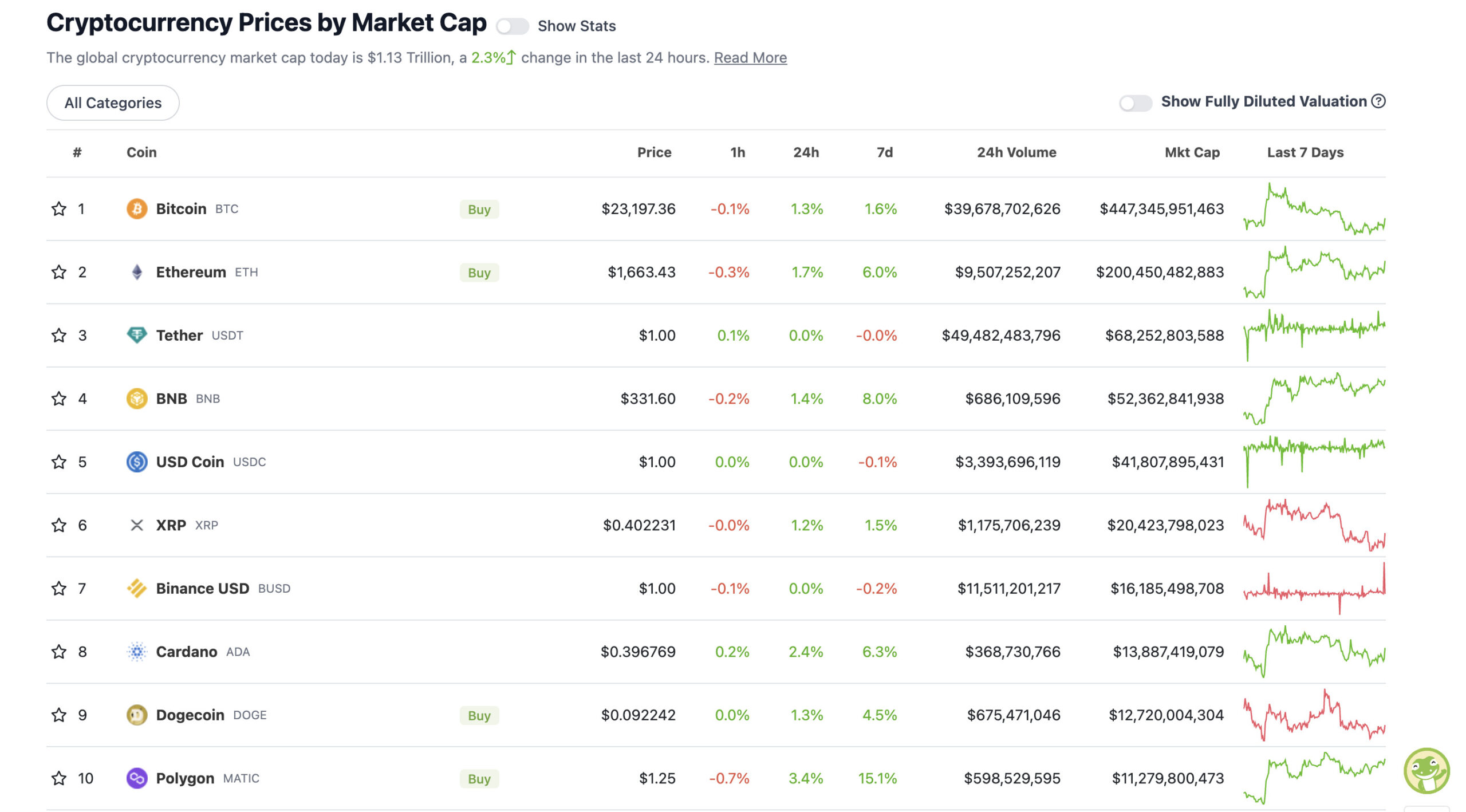

Top 10 overview

With the overall crypto market cap at US$1.13 trillion, up more than 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

Bitcoin’s reclaimed the US$23k psychological, round-number level again for now. Let’s see if it can Powell-surge it’s way past US$23,400 and stay above there come the weekly close – as that’d make Rekt Capital, among other crypto analysts, reasonably happy.

Uppers and downers: 11–100

Sweeping a market-cap range of about US$11 billion to about US$471 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• The Graph (GRT), (mc: US$1.84 billion) +57%

• SingularityNET (AGIX), (market cap: US$662 million) +28%

• The Sandbox (SAND), (mc: US$1.57 billion) +26%

• ImmutableX (IMX), (mc: US$841 million) +21%

• Fetch.ai (FET), (mc: US$546 million) +20%

Well look at that, AI-related coins are pumping again like there’s no tomorrow for us humans. And the big, bull-goose surger? It’s The Graph (GRT) again.

This big-data indexing protocol, touted by some as “the Google of blockchain”, is pretty much the tip of the spear of this narrative du jour. And it’s been on quite a run, surging more than 65% at one point overnight, and up 218% now over the past 30 days.

GRT’s price exploded onto the scene back in late 2020/early ’21, but faded due to a combo of bear market creep and unhelpful tokenomics (a huge amount of tokens vested to founders and early participants and backers have been unlocked bit by bit over the past couple of years).

Re the unlocks, though, the positive thing now is that a good deal of that is in the rear-view mirror. GRT now has close to 90% of its total and max supply in circulation. That, combined with an AI-crest-riding narrative, has it pretty well positioned as a potential mid-high-cap gem if bullish market conditions take hold.

Other AI coins, including SingularityNET (AGIX), Fetch.ai (FET), Numeraire (NMR), Oraichain (ORAI), Big Data Protocol (BDP) and iExec (RLC) are faring well, too. Along with most AI cryptos we’ve mentioned recently.

It’s absolutely a frothy little sector of crypto right now – in part thanks to the rise of ChatGPT and big tech firms such as Microsoft and Google making forays into AI more generally.

It’s a “narrative” (gotta stop saying that damn word) to keep an eye on, especially if we see some profit-taking pullbacks soon. That said, crypto is obviously a risky play in general, and you should approach any jump into pumping narra… niches with caution. Not financial advice and so forth.

The next #AI project to pump is ____ pic.twitter.com/QNP1lc8xls

— Crypto Tony (@CryptoTony__) February 7, 2023

DAILY SLUMPERS

• Radix (XRD), (market cap: US$509 million) -5%

• LEO Token (LEO), (market cap: US$3.14 billion) -1%

And, other than very fractionally fluctuating stablecoins, that’s all, folks. A largely green day so far.

Around the blocks

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

🚨BREAKING:

Cryptocurrency commercials have been banned from the Super Bowl 🏈

We all know why

Thanks again @SBF_FTX

— Bankless (@BanklessHQ) February 7, 2023

Meanwhile, Michael “Big Short” Burry has pulled his occasional reappearing/disappearing/reappearing act on Twitter once again, with a healthy slice of sarcasm for risk markets.

https://twitter.com/michaeljburry/status/1623021394039562240?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1623021553092009984%7Ctwgr%5E5db74834e15d53ec0095e2467c0c1a75940b53e1%7Ctwcon%5Es2_&ref_url=https%3A%2F%2Fstockhead.com.au%2Fwp-admin%2Fpost.php%3Fpost%3D267713action%3Dedit

We quite like this response from one “reply guy”, though…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.