Are AI and big-data cryptos the next big things? The Graph (GRT) leads the category for most searches

Only a matter of time… (Pic via Getty Images.)

Keen crypto investors would’ve noticed that Artificial Intelligence (AI) and big-data-related projects saw a surge just recently, with The Graph (GRT), for instance, charting well.

Can you guess why cryptocurrencies in this sub-sector have been pumping lately? Maybe type it into that ChatGPT thing – it’ll probably give you a half-decent answer.

But don’t bother, it was overloaded and busy plotting the demise of humanity as we know it last time we checked, and we can pretty much tell you the answer anyway. AI and data are particularly buzzy narratives right now, which likely has a bit to do with the increasing popularity and uptake of the aforementioned AI chatbot.

With markets cooling a fraction today, though, ahead of some uncertainty around which direction the US Federal Reserve is set to send prices, most of these tokens have now pulled back a bit over the past couple of days.

So if you have any inclination or belief that AI and data projects are likely to be strong narratives again the next time the crypto market turns particularly bullish, then right now is not such a bad time to discuss some of them.

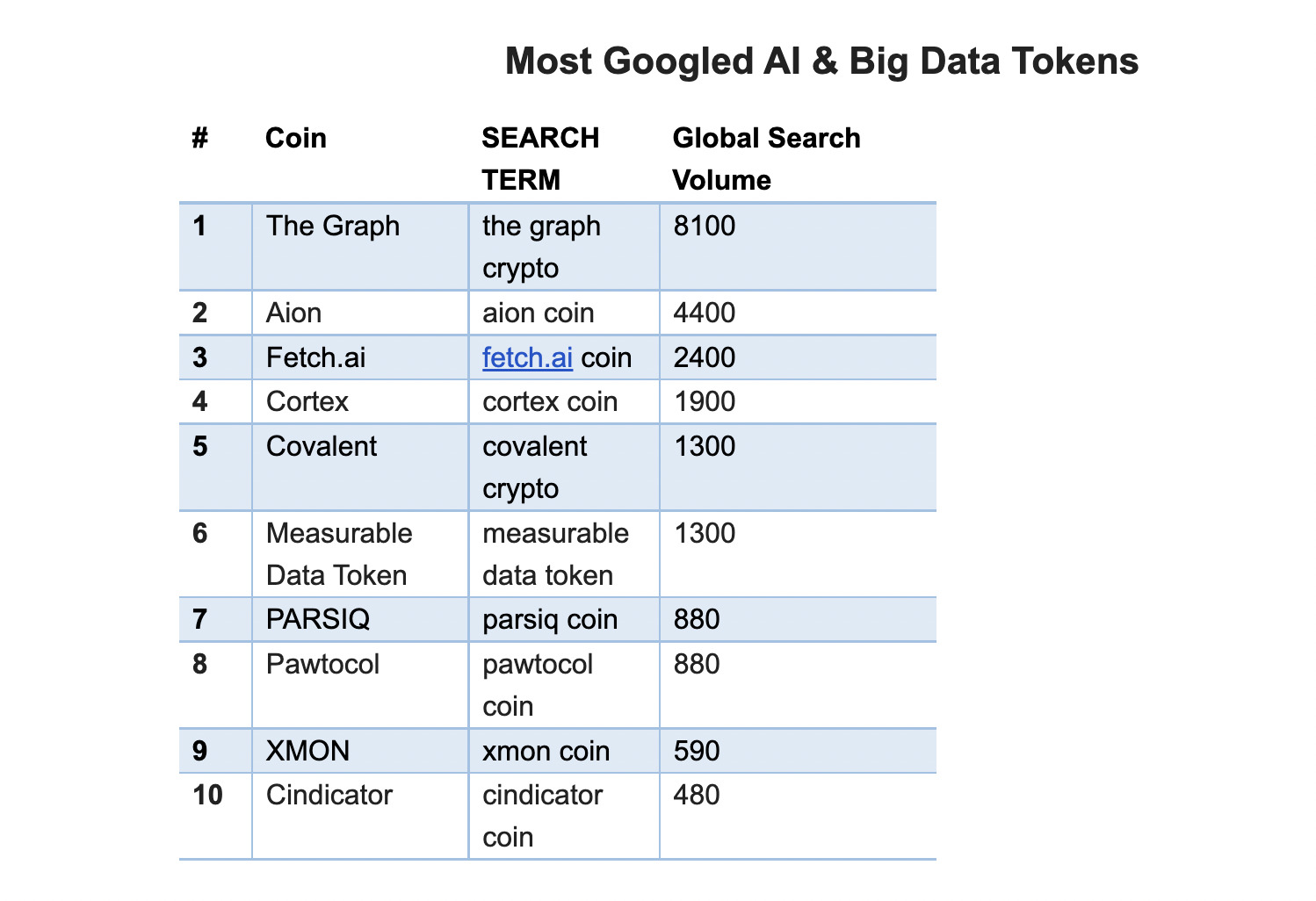

The Graph leads the searches

The reason we’ve headlined The Graph (GRT) is that it’s come to our attention via a recent study from tradingbrowser.com that it was by far the most-searched AI/data-related crypto over the past 12 months, with a monthly average global search volume of 8,100 at the time of the study being published a handful of days ago.

The study analysed Google search data for the top 100 AI tokens as per CoinMarketCap to reveal the most Googled AI-related coins.

The Graph, sometimes referred to as “the Google of blockchain” is a heavily VC-backed indexing protocol for querying networks like Ethereum and IPFS, along with numerous other top blockchains, such as Near, Polygon, Avalanche, Fantom and the list goes on.

Multi-chain is accelerating on The Graph Network ⏩

Now announcing *four* new chains coming soon to the decentralized network via the MIPs program 🫡

Indexers are adding support for devs across the following chains, providing access to secure, reliable & decentralized data ⬇️

— The Graph (@graphprotocol) January 18, 2023

GRT burst onto the scene in late 2020, quickly pumping to its all-time-high of US$2.81 in mid Feb 2021. It’s since down about 97% from those brief, heady days – a common crypto tale.

A bit like the Chainlink oracle network, though, The Graph is a something of a partnership beast and a top 100 by market cap stayer, with wide-reaching, collaborative tentacles right across the industry.

Part of the reason for that is its popularity with crypto developers, as the protocol is designed to make their life much easier when it comes to building decentralised applications – by providing a super-fast, efficient means of querying the data they need from various blockchain networks.

According to the Trading Browser study, the highest search was seen with the term “Graph Crypto”, last May.

GRT has pulled back about 8% over the past 24 hours at the time of writing, but is up about 58% in price over the past month. It has a market cap of US$777.5 million, and now has about 88% of its total supply in circulation.

AION, FET, CTXC and CQT

Rounding out the runners-up for searches, per the study, we have:

• Aion (AION), with an average of 4,400 monthly searches over the past 12 months. The token is used to secure and access The Open Application Network and enable the execution of smart contracts and data transfers on other blockchains, such as Ethereum. It’s essentially a top interoperability play as much as it is a AI/data-themed project.

In fact, looking a bit deeper into it, in terms of how this one slots into the AI or “big data” narrative isn’t entirely clear, apart from two of its letters being A and I. But we’ll roll with it.

The AION token is up about 22% over the past month and has a market cap of about US%16.5 million.

• Fetch.ai (FET) grabs the bronze medal, hitting a monthly average of 2,400 worldwide searches over the past year.

There’s no such issue categorising this one. According to the crypto research outfit Messari, Fetch.ai is an AI-tech-backed blockchain “building a decentralized machine-learning platform based on a distributed ledger, that enables anyone to share or exchange data”.

The FET token is down about 7% over the past 24 hours but has had a pump-tastic start to 2023, up 186% over the past 30 days. It sports a market cap of US$272.2 million.

• Cortex (CTXC) coin is the fourth most Googled AI cryptocurrency globally, with 1,900 monthly searches in the past 12 months, says Trading Browser.

“The first decentralized world computer capable of running AI and AI-powered dApps on the blockchain,” Cortex proudly proclaims on its website.

Whether that’s tantamount to a pie shop proclaiming “World’s Best Pies” we can’t be entirely certain, but it’s a low-market-cap coin with around 70% of supply in circulation, and clearly attracting some attention, so it could be worth a cautious further investigation.

CTXC is up about 33% over the past month and has a market cap a bit over US$44m.

• Covalent (CQT), a direct, data-indexing/querying, API competitor to The Graph, gained 1,300 monthly searches over the past year. This makes it the fifth-most Googled crypto in the big-data and AI sectors.

Which is better – The Graph or Covalent? The Graph got here earlier and might have some level of network dominance, but here’s how Messari explains the difference between the two techs:

“While The Graph is currently most suitable for projects that require specialized datasets, Covalent is currently best suited to serve applications that require general-purpose, widely applicable data.”

The Graph folk might not completely agree with that, but as a topline explainer, we’ll take it for now until we can delve deeper ourselves.

CQT is up 21% over the past 30 days, and has a market cap of US$60.5m.

Referring to the study, a spokesperson from Trading Browser supplied us with this overarching commentary on the AI crypto theme:

“Following Crypto’s tumultuous journey in the previous 12 months, many are searching for a more secure way of trading and investing in Crypto, and that is what AI brings to the game, a prompter detection of fraud, risk protection and autonomous trading opportunities.”

Epilogue

Yeah, we probably shouldn’t have tempted fate by asking it that question.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.