Mooners and Shakers: Crypto moon bois and gals froth as Bitcoin bursts to ANOTHER all-time high

Coinhead

Coinhead

Welcome back … to the BCG (erm, Bullish Crypto… Ground) for the first time… in quite some time.

This column has been on ice, and we’re not saying it’s back just yet, either. But we’re sneaking this one in under various radars, because, well, Bitcoin is doing things it’s NEVER done before in the history of being Bitcoin.

And what does this mean?

It means all-time high levels, beyond the old crypto-bro/meme-appropriate mark of $69,000.

It means bursting past the market cap of silver, to make it the world’s eighth most valuable property.

And it also means busting to new highs before the Bitcoin halvening.

Halvening? What the Fibonacci? If you’ve been here before, if you kinda know crypto, you’ll probably know what that is. But we’ll come back to it momentarily.

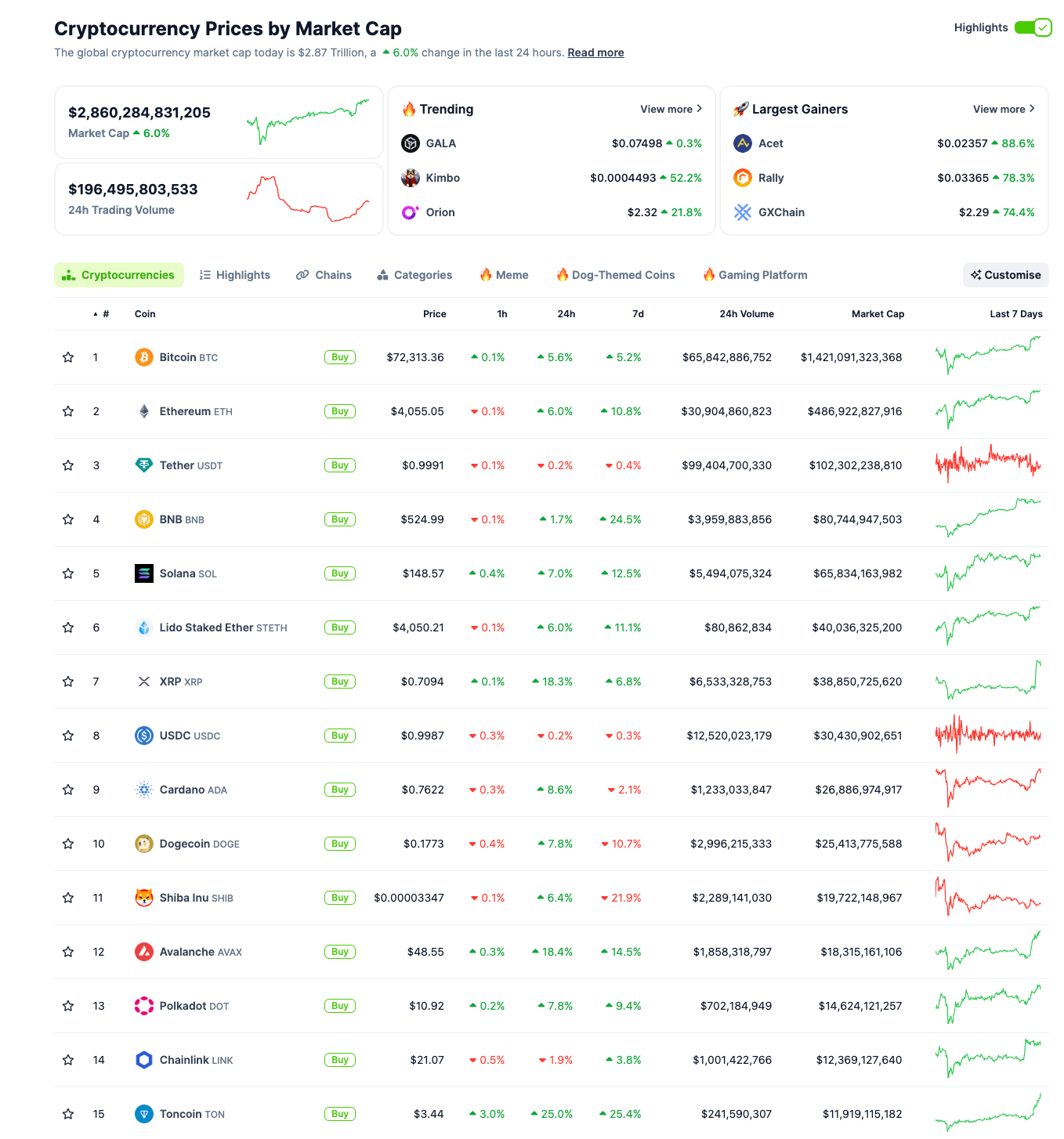

First, cop a gander of this largely verdant-looking chart, courtesy of crypto trackers extraordinaire CoinGecko…

Some nice green in there, but what’s doing Chainlink? Lift your game.

Bitcoin’s market cap is, at time of checking this, and portfolio for the fifth time in the past minute, frothing around 1.42 TRILLION dollars, changing sticky, clammy, disgusting hands at more than US$72,300 per coin – another new all-time high.

“Why is it so?” Why the glass-and-a-half of full cream dairy PUMP, Professor Julius Sumner Miller?

The biggest factor right now is the record amounts of billions of dollars flowing into US Bitcoin spot ETFs.

And all that is largely pouring into the BlackRock and Fidelity BTC ETFs, increasing their outsized slices of increasingly large pie.

Here’s Bloomberg ETF expert Eric Balchunas. He speaks truths…

First two months officially in the books (it's felt like six) and the ten bitcoin ETFs now have over $55b in assets with exactly double that in volume at $110b. If these were the numbers at the end of year I'd call them a success. To do it in eight weeks is simply absurd. pic.twitter.com/8YvzQZdYyJ

— Eric Balchunas (@EricBalchunas) March 11, 2024

Institutional money… It’s woken up to this asset. BlackRock CEO Larry Fink’s positive rhetoric about Bitcoin and crypto as an asset class seems to be sinking in and the Wall Street herd appears very much snortingly here.

But what if we told you… that’s not even the half of it…

Because the famed Bitcoin HALVING, or to be more Highlander about it, THE HALVENING… is not even here at this point.

It will be soon – mid April, folks.

What is it? It’s an event baked-in to the workings of the Bitcoin protocol that occurs once every four years. Essentially what happens is the reward for mining new blocks of Bitcoin is cut in half.

And if that makes zero sense to you, that’s fine and completely unsurprising.

All you really need to know is that the issuance of new Bitcoins into circulation gets cut in half every four years, which has always been a most excellent outcome for the supply and demand narrative of Bitcoin. And its price.

All prior three Bitcoin halvings have… a few months after the event… coincided with crypto bull runs of simply epic proportions. The money tends to flow into Bitcoin, then, later, altcoins (every other half decent crypto that isn’t Bitcoin).

An all-time high is very unprecedented for the figurehead asset of the much-maligned, misunderstood batshit crazy world of magic internet money. And that fact alone has some/many daring to believe “this time is different” and in a “supercycle” for BTC.

Hell, here’s ARK Invest’s Cathie Wood, revising her “ONE MILLION DOLLAR” Bitcoin target timeline to some time before 2030.

NEW: “Our #Bitcoin price target is now well above 💵 $1M by 2030, and with our new expectations for institutional involvement, the incremental price that we assume for institutions actually has more than doubled," says ARK Invest CEO Cathie Wood 👀🙌 pic.twitter.com/PTaK4mWqoI

— Bitcoin News (@BitcoinNewsCom) March 10, 2024

With that in mind, we do know crypto is more volatile than Sonic the Hedgehog hepped up on a cocktail of speed, Cottees red cordial and anabolic horse steroids.

But maybe just maybe, this asset class is shaping up to be the investment story of the year. (Cue black swan event… annnny second now.)

A must watch interview!

Tick tock next block. #Bitcoin https://t.co/0oEsPvGdJb

— Preston Pysh (@PrestonPysh) March 12, 2024