Fear and Greed: Crypto year of fear trembles on, despite huge institutional interest

Coinhead

Coinhead

The crypto market has been harder to predict this year than a cane toad race. Just ask the mob over at Finder. It’s not that there hasn’t been consistency, mind – fear has dominated sentiment for nearly 12 months.

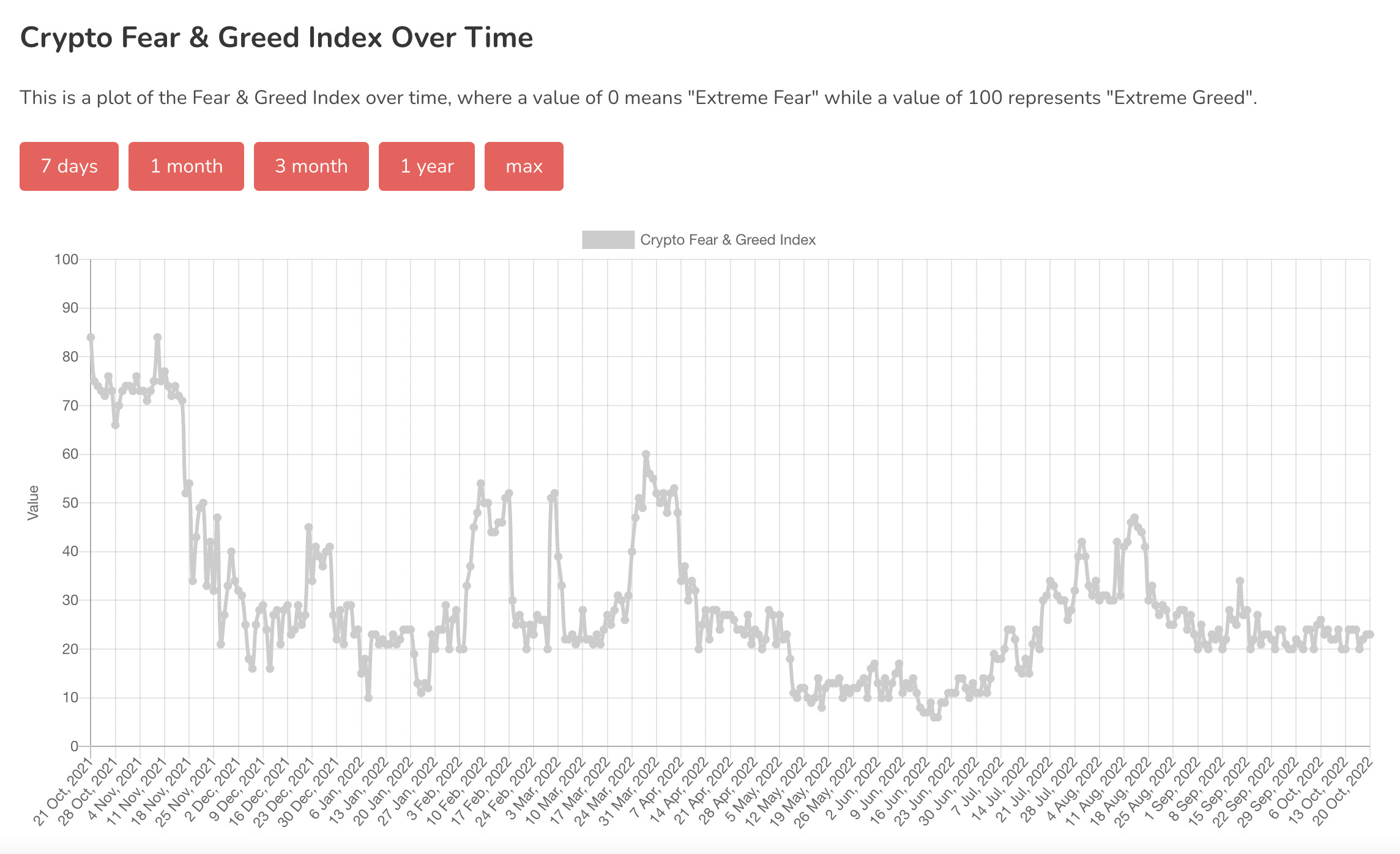

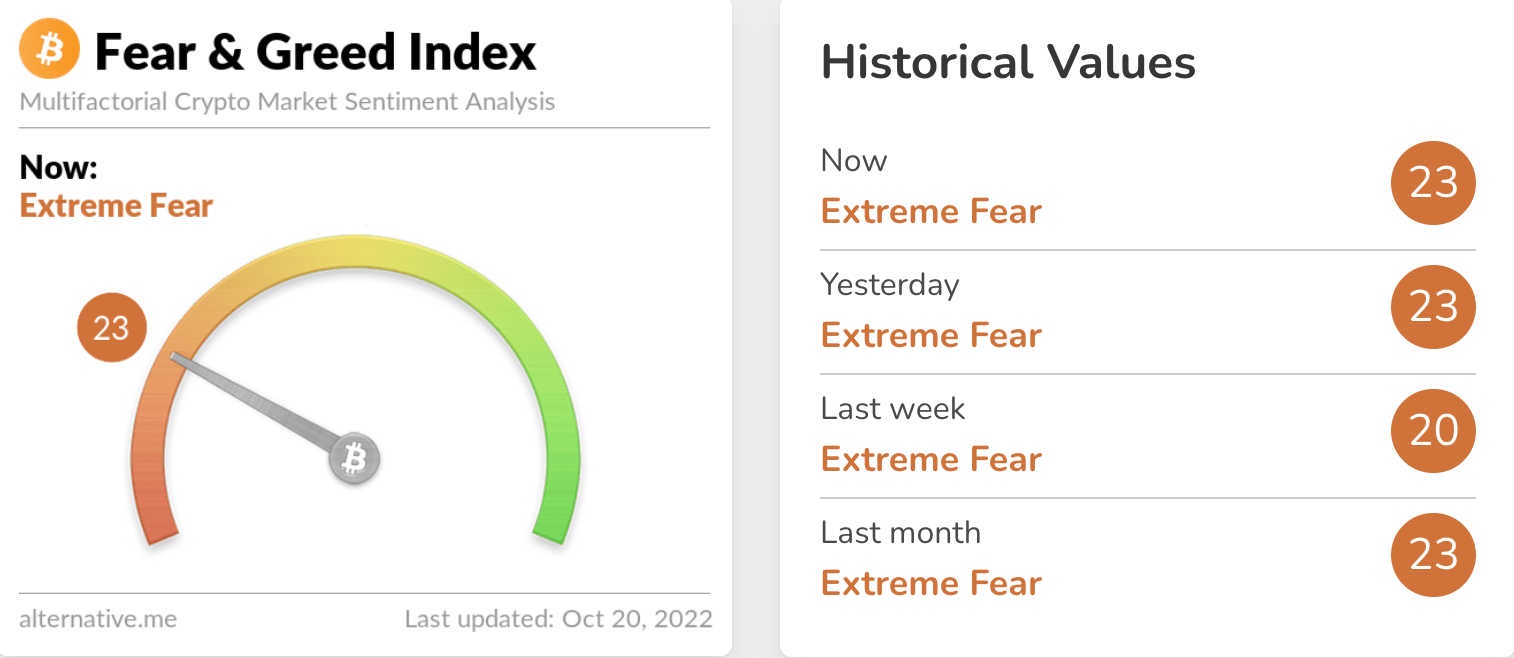

And if you need proof of that, alternative.me, creator of sentiment tracker the Crypto Fear & Greed Index, has the stats.

The first chart there shows that from about November 19, 2021 right up to present day, the reading has only seen a few very short-lived spikes barely into the “Greed” side of the equation, above a valuation of 50.

It probably comes as no surprise to anyone that it’s so far very much been a year of crypto-related fear.

Still, here are a couple of thoughts to make you potentially feel a little, if not greedy, then somewhat peckish. (Let’s not go overboard, eh?)

Given the recent news regarding BlackRock, Fidelity, Charles Scwhab, Citadel Securities, and Bank of New York Mellon all making major crypto-related moves, we’ve been well aware there’s great interest in the sector from big players for some time now.

Cointelegraph Research’s latest survey, however, rams it further home.

Taking feedback from 84 professional investors from various corners of the planet, the New York-headquartered crypto media site’s top reveal was that “most institutional investors hold or plan to buy cryptocurrencies”.

And of the US$316 billion in assets managed by the respondents, 3.3% (about US$10.42 billion) is invested in cryptos, with some investors reporting more than 50% exposure to the asset class.

The research also shows that Bitcoin (BTC) is the most popular institutional hold (as you’d expect), with 94% of respondents revealing its part of their portfolio. And that’s closely followed by Ethereum (ETH), security tokens (31%) and stablecoins (also 31%).

As we flagged somewhere deep down in our morning crypto-market roundup, Bloomberg Intelligence senior commodity strategist Mike McGlone has been singing Bitcoin’s praises again – particularly its diminishing-supply narrative.

He’s gone further than that on Twitter over the past 24 hours, though, citing “rising demand, adoption and regulation” as key reasons for the leading crypto asset’s potential “inexorable phase of its migration into the mainstream”. And at a “relatively discounted price”, no less.

Bitcoin Primer: Rising Demand, Adoption, Regulation –#Bitcoin may be entering an inexorable phase of its migration into the mainstream, and at a relatively discounted price. FASBA's recent decision that companies should use fair-value accounting for measuring crypto assets pic.twitter.com/zejOCcTwXQ

— Mike McGlone (@mikemcglone11) October 19, 2022

That discount, says McGlone is relative to Bitcoin’s high “hash rate” in October – which is the largest it’s been since the first quarter of 2020.

Hash rate is the measure of the computational depth and processing power of a proof-of-work (PoW) blockchain network. It’s used to determine the health, security, and mining difficulty of a blockchain.

The Bloomberg analyst appears to be suggesting that Bitcoin’s “advancing hash rate” relative to its current price could present an opportunity for those interested in an asset that might be “entering an unstoppable maturation phase” and could be forming a solid “price foundation”.

#Bitcoin May Be Entering Unstoppable Maturation Stage: BI Crypto — The fact that Bitcoin didn't exist in October 2007, when WTI #crudeoil rose to its current $84 a barrel for the first time, may indicate the appreciation advantage of the nascent technology. pic.twitter.com/5WZIV7PmXL

— Mike McGlone (@mikemcglone11) October 19, 2022

Another quick trip around Crypto Twitter in search of searing analysis, out-and-out hopium, FUD, reality checks and/or general weirdness.

BlackRock and Bitcoin pic.twitter.com/fjBDNpyKif

— Crypto memes (@CryptoSportsIO) October 17, 2022

A Crypto Cringe Compilation pic.twitter.com/Avf5OZA1Ez

— John W. Rich Kid (Wendy’s Fry Cook) (@JohnWRichKid) October 18, 2022

The greatest shooter of all time chooses to rep BAYC in his Twitter Bio. pic.twitter.com/c1Bj0hKJwG

— just1n.eth (@just1n_eth) October 19, 2022

beautiful abc done on low timeframes with all subwaves accounted for, correcting last weeks reversal impulse.#btc heads back up above 20k from here imo. pic.twitter.com/rt2RGiYO4H

— Bluntz (@SmartContracter) October 20, 2022

Just a reminder, we have never had a market bottom without hitting this line. In most cases that last spike has taken under a week to play out. We are now sitting bang on the trend line with the market reversing and the pre covid high within reach. October bottom, I standby it. pic.twitter.com/bSwPLjSRch

— Tom Selleck’s forgotten moustache (@Matthew76197677) October 20, 2022

If you only read one article today, make it this one.https://t.co/yQzJnDxsST

It's not about Bitcoin, but it's mega-bullish for Bitcoin.

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) October 16, 2022