Mooners and Shakers: BlackRock apes into Bitcoin further with BTC private trust; sentiment rises

The BlackRock HQ boardroom, yesterday. Probably. (Getty Images)

Mooners and Shakers is sponsored by Dacxi, the world’s first purpose-built Crypto Wealth platform.

Okay, this might be official now. The world’s biggest asset-managing hog, BlackRock, totes digs Bitcoin.

Following the news it’s jumping into bed with US crypto exchange Coinbase, the US$10 trillion+ asset manager is at it again, announcing overnight it’s launched a spot Bitcoin trust for private institutions.

“Bitcoin is the oldest, largest, and most liquid cryptoasset, and is currently the primary subject of interest from our clients within the cryptoasset space,” wrote the US/global finance titan in a statement.

Is this a good thing? Like the Coinbase deal, potentially very much so for the price of BTC. That said, there’s probably some level of caution to consider regarding various market-manipulating tactics from faceless power brokers.

Last comment on the matter: Think the Blackrock news is probably the most bullish news for a long term Bitcoin holder ever.

Not just the news itself, but that it signals to some the water is fine and to others if they don’t offer their clients BTC they’ll get their lunch ate.

— Will (@WClementeIII) August 11, 2022

Among several others this morning, US entrepreneur/investor/YouTuber Anthony “Pomp” Pompliano is certainly upbeat about the news. Interestingly, he thinks it signals BlackRock’s potential interest in entering the crowded Bitcoin spot ETF race. Maybe it’ll be the one to finally receive the SEC’s “APPROVED” rubber stamp… if it actually has one.

So how’s the market reacting to the news today? Nothing’s heading too parabolic, but Bitcoin and Ethereum both seem to be maintaining most of the gains made over the past 48 hours or so reasonably well for now, if flattening out a tad.

Market sentiment, on the other hand, has really shot up since yesterday judging by the crypto Fear & Greed Index – the popular sentiment tracker. Nice to see it moving into a different shade of citrus for a change…

That could, however, also have something to do with Ethereum and its proof-of-stake Merge, which now has an even closer tentative date after another successful testnet completion.

BREAKING:

The Ethereum Merge has been scheduled for TTD 58750000000000000000000

This is approximately Sept 15-16th

The Merge is officially scheduled 📆

— Bankless (@BanklessHQ) August 11, 2022

I ran into @VitalikButerin yesterday, and had a brief chat. Ethereum is likely moving from proof-of-work to proof-of-stake next month. This "merge" is an important moment in the history of crypto. Good luck to everyone involved! Vitalik and I will do a podcast after The Merge. pic.twitter.com/P4uZp8orLT

— Lex Fridman (@lexfridman) August 11, 2022

Onto some daily price action…

Top 10 overview

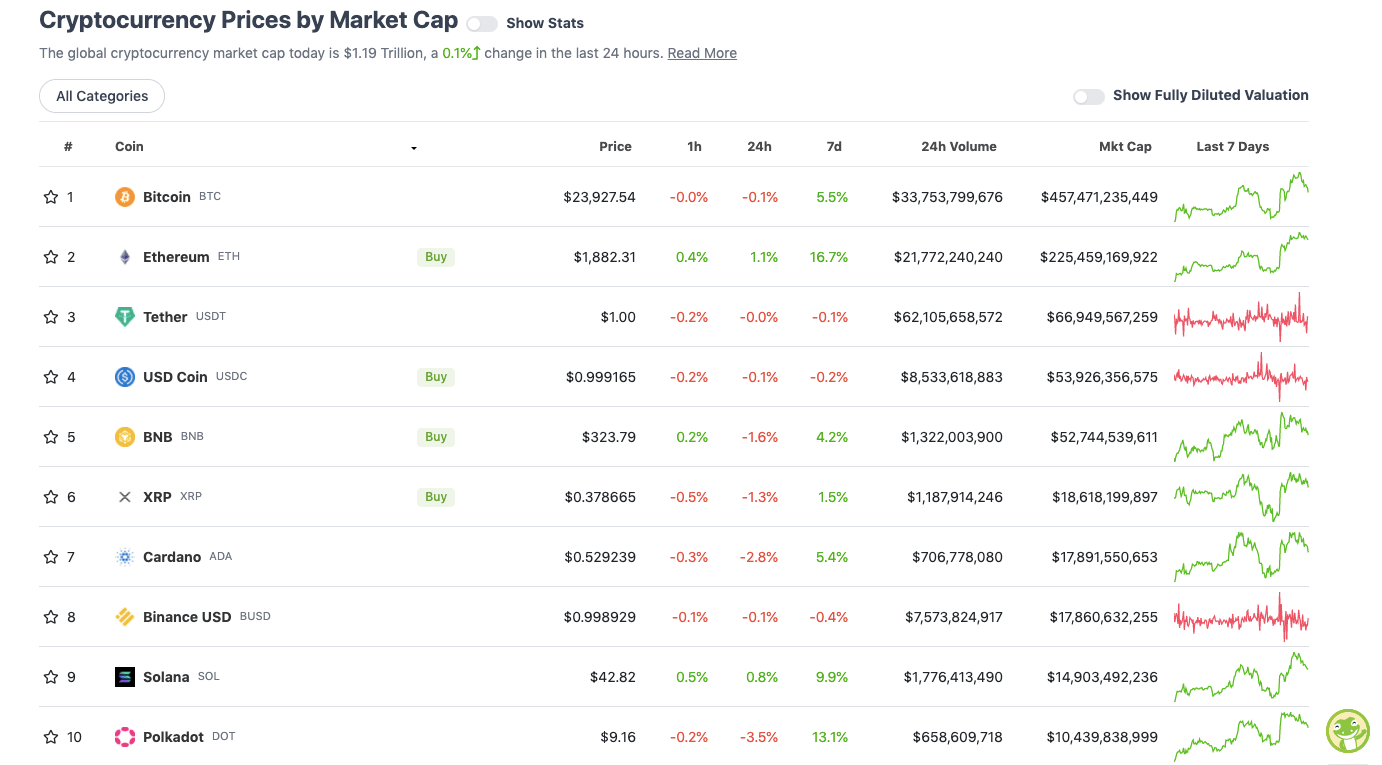

With the overall crypto market cap at US$1.19 trillion and levelling out since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

There’s not much to say about the top 10’s movements over the past 24 hours, but we’ll grab a few short-term thoughts from some go-to Twitter-based crypto analysts.

The trader account called “John Wick”, aka @ZeroHedge, isn’t loving the fact Bitcoin has again been rejected at about US$24.5k. For some bullish bias, he’s targeting a daily close, in a few hours’ time (EDT), above that level.

@Roman_Trading also isn’t too positive for a further upswing just at the moment… which has been his overriding bearish narrative so far this year…

$BTC H4

Pretty clean ascending wedge (bearish reversal pattern) which matches the divergences across many indicators outside the RSI/MACD I have shown below.

Daily PA looks exhausted as well.

All the signs point down. Let’s see.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/9Xe1ATLWor

— Roman (@Roman_Trading) August 11, 2022

So who’s actually feeling positive then? Dutch trader Michaël van de Poppe is seeing a bit of sunshine ahead…

Honestly, #Ethereum is the actual asset that is carrying the markets, as some FOMO is starting to get some grip on the markets with the merge and ETH 2.0 coming up.

Through that, expecting to see $ETH continue towards $2.5K and $BTC towards the $30K region in the coming month.

— Michaël van de Poppe (@CryptoMichNL) August 11, 2022

The Ethereum mainnet merge has been tentatively scheduled for around September 15th/16th.

The Merge is coming 🐼

— sassal.eth/acc 🦇🔊 (@sassal0x) August 11, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$9.4 billion to about US$504 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Ethereum Classic (ETC), (mc: US$5.7 billion) +7%

• Celsius Network (CEL), (mc: US$1.05 billion) +3%

• Nexo (NEXO), (mc: US$509 million) +3%

• Hedera (HBAR), (mc: US$1.83 billion) +2%

• Zcash (ZEC), (mc: US$1 billion) +1%

DAILY SLUMPERS

• Lido DAO (LDO), (mc: US$1.4 billion) -7%

• BitDAO (BIT), (mc: US$786 million) -6%

• Monero (XMR), (market cap: US$2.88 billion) -5%

• Fantom (FTM), (market cap: US$990 million) -5%

• Arweave (AR), (market cap: US$741 million) -4%

Around the blocks

A selection of randomness and pertinence that stuck with us on our daily journey through the Crypto Twitterverse…

Every hedge fund manager that expected new lows & now sees futures relentlessly squeezing higher week after weekhttps://t.co/UlK0Zeoaei

— Sven Henrich (@NorthmanTrader) August 11, 2022

pov: nft project founder updates the community (ft. @3LAU) pic.twitter.com/7N5u5YnojQ

— kmoney (@kmoney_69) August 11, 2022

Where is Ukraine? pic.twitter.com/awS9tlCKrO

— Fomocap (@fomocapdao) August 11, 2022

And lastly… the NRL meets GameFi. For the full story on this one, check out our latest catch-up with Illuvium co-founder Kieran Warwick…

🗣 The Bulldogs and innovative AAA collectible NFT RPG game @illuviumio have launched a custom jersey for Round 25.

— Canterbury-Bankstown Bulldogs (@NRL_Bulldogs) August 10, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.