Why Ark Invest dumped $75m of COIN… ahead of Coinbase’s head-turning deal with BlackRock

Coinhead

Coinhead

Ark Invest CEO and major Bitcoin and Ethereum bull Cathie Wood has revealed why her firm recently dumped a bunch of Coinbase (COIN) stock. Which at this stage, incidentally, appears to be absolutely woeful timing – because… BlackRock.

Speaking during a Bloomberg TV interview today, the famously tech-hungry chief exec cited a warning from the US Securities and Exchange Commission (SEC) regarding nine tokens trading on the Coinbase exchange.

The SEC believes AMP (AMP), Rally (RLY), DerivaDEX (DDX), XYO (XYO), Rari Governance Token (RGT), LCX (LCX), Powerledger (POWR), DFX Finance (DFX), and Kromatika (KROM) are all unregistered securities.

What’s more, the regulator also filed a complaint late last month against a former Coinbase employee, who it has accused of insider trading in a scheme based around leveraging advance knowledge of token listings.

Wood reasoned that the SEC’s claim had created further regulatory uncertainty within the crypto industry. And that was clearly enough for Ark Invest to tread with some caution as it sold more than 1.4 million shares of COIN on July 26, worth about US$75 million at the time.

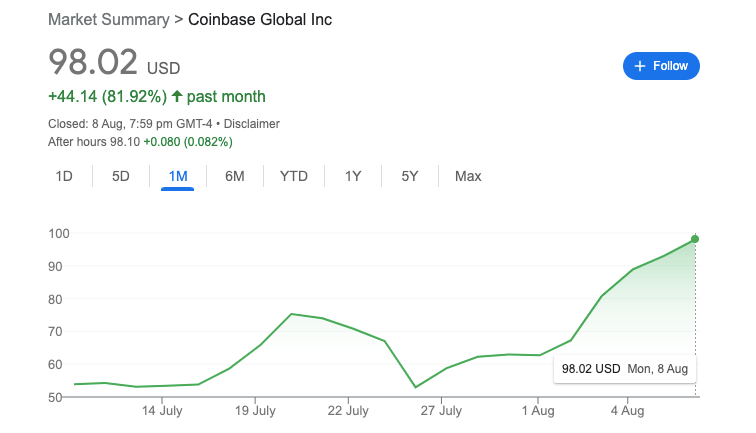

Here’s how that little decision has worked out since then…

Since Ark Invest made its move, the COIN stock price has increased 85% from US$52.93 on July 26 to US$98 at the time of writing.

Ah well, you win some, you lose some, right? Unfortunately for Wood, Ark Invest and its investors, so far this year it’s been more a case of you win bugger all and lose a shedload.

As of July 30 according to Business Insider, Ark Invest’s flagship fund – the Ark Disruptive Innovation ETF – has fallen by about 30% over the past six months.

Things have at least picked up a little bit for Ark in general over the past few months since April. And they needed to – that month’s stats were shocking, with the firm’s assets under management in all of its ETFs down from a peak of more than US$60 billion in February 2021 to US$16 billion by the month’s end.

But at least Wood and Ark Invest had the good sense not to knee-jerk dump all its COIN stock. According to the firm’s website, it still holds more than US$451 million worth of shares in the crypto exchange giant.

You may have lost it all on jpegs, but at least you didn't buy the top of Coinbase and sell the pico bottom right before a partnership with Blackrock was announced (looking at you Cathie Wood)

— FUD | NRN (@FUDdlemint) August 4, 2022

That deal is with the world’s biggest asset manager, BlackRock, which can boast roughly 10 times the current entire crypto market cap in assets under management. And that’s more than US$10 trillion (BlackRock, not crypto unfort).

The partnership will reportedly involve BlackRock and Coinbase facilitating crypto-trading capabilities for the asset manager’s many fatcat institutional investors, using its Aladdin platform. Kind of a very big deal, potentially.

“BlackRock’s decision to partner with Coinbase is a strong signal that institutions consider Bitcoin and crypto a new asset class,” reads the latest Ark Invest newsletter, published yesterday.

Said after dumping 1.41 million $COIN shares on July 26

(and after $COIN rallied +80%) https://t.co/7oECKCuDoL pic.twitter.com/3RZVysKcmI

— Res ®️ (@resdegen) August 8, 2022