Mooners and Shakers: Crypto market flat despite Google and BNY Mellon adoption; APE dumps on SEC probe news

Coinhead

Coinhead

Bitcoin and the crypto market in general are having another “meh” morning. And yet… huge adoption news has landed involving Google and Coinbase, and BNY Mellon. Bear markets, eh?

Also, ApeCoin (APE) – the Bored Ape Yacht Club ecosystem token – has copped a double-digit dump based on some SEC-probing news. The word “probe” has a tendency to do that to crypto tokens. More on that further below, but first…

The world’s largest internet company has just partnered with the largest US crypto company. Yeah, as Digital Currency Group CEO Barry Silbert says in his tweet, below, it’s “probably nothing”.

Tech giant Google will start accepting crypto payments for cloud services next year, in collaboration with Coinbase.

The announcement was made at Google’s Cloud Next conference in California, where Google also revealed it will be using the exchange’s custody service, Coinbase Prime.

“We want to make building in Web3 faster and easier, and this partnership with Coinbase helps developers get one step closer to that goal,” said Thomas Kurian, CEO of Google Cloud.

BlackRock, Google, BNY Mellon

Probably nothing

— Barry Silbert (@BarrySilbert) October 11, 2022

Meanwhile, America’s oldest bank, the Bank of New York Mellon Corporation (aka BNY Mellon), has announced that it can now custody crypto (initially just BTC and ETH), after it received regulatory approval.

According to a report by the Wall Street Journal, BNY Mellon was approved for this by the New York State Department of Financial Services (DFS), and the bank said it was one of eight financial heavyweights to start crypto-asset custody services.

“The bank will store the keys required to access and transfer those assets, and provide the same bookkeeping services on those digital currencies that it offers to fund managers for their portfolios of stocks, bonds, commodities and other assets,” reads the WSJ report.

The move comes after other major financial US-based global institutions, including BlackRock, Fidelity, Citadel and Charles Schwab recently made strong Bitcoin/crypto-related moves.

The report also noted that BNY Mellon is leveraging Fireblocks software for its custody solution and has also partnered with blockchain surveillance firm Chainalysis for asset-analytics purposes.

BNY Mellon starting crypto custody

Coinbase and Google partnership thingyNot a peep, bear market innit

— Rob Paone (@crypto_bobby) October 11, 2022

🔥 – BREAKING: BNY Mellon, a $47 trillion banking corporation, will offer #Bitcoin custody services to clients.

Fidelity also starts adoption towards crypto.

The fundamental growth is still there. Price will follow soon.

Accumulate.

— Michaël van de Poppe (@CryptoMichNL) October 11, 2022

Onto some general daily crypto price action.

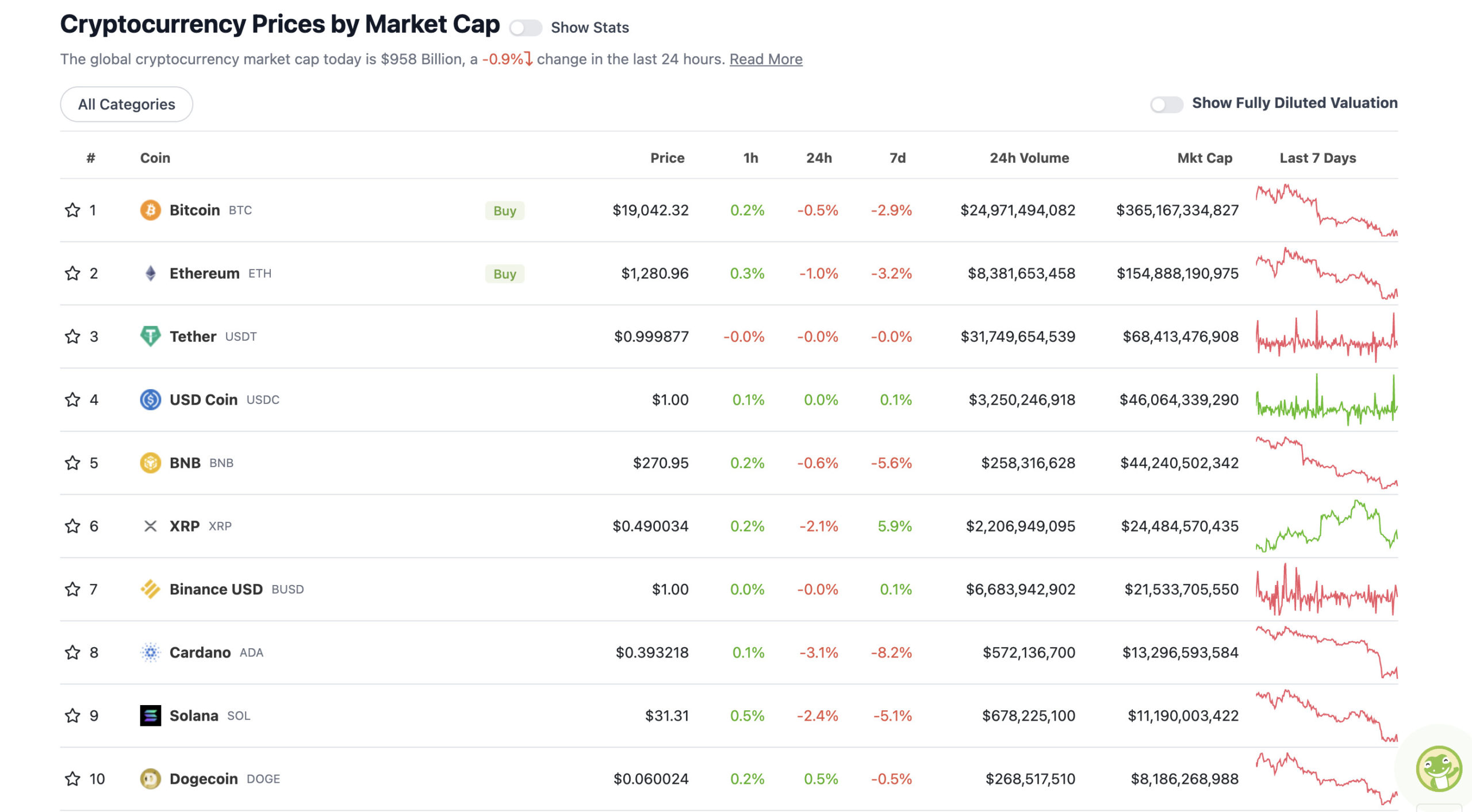

With the overall crypto market cap at US$958 billion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

As we inch towards the seemingly all-important US CPI data announcement later this week, the crypto market’s pace setter (that’d be Bitcoin) has managed to hold reasonably firm at support around US$19k. “Calm before storm” tweets are being bandied about, though, so perhaps a big move is imminent.

Popular US analyst Justin Bennett has been pointing to BTC’s support hold and still appears to be expecting a significant Uptober move before the Fed’s next inflation/rate-hiking meeting and announcement on November 2. A move that, judging by his October playbook when you dig in to it, hits as high as US$26k.

Guess what's still holding. $BTC #Bitcoin https://t.co/ICHbqXYl4z pic.twitter.com/vKz4m45MnH

— Justin Bennett (@JustinBennettFX) October 11, 2022

Here’s another well-followed crypto chartist, Charles Edwards, with a cautious take, though:

This is not a reflection on my long-term view of Bitcoin, which still remains in deep value. Locally I am seeing more risk than before at the $19K region which could see heightened volatility.

— Charles Edwards (@caprioleio) October 11, 2022

Plus, “Game of Trades” believes it’s a watch-and-wait game with the US Dollar.

U.S Dollar appears to be back in an uptrend.

This might be a headwind for risk assets.

Close eyes on the MACD. pic.twitter.com/dHFYtCvSMO

— Game of Trades (@GameofTrades_) October 11, 2022

You could, of course, ignore all the short-term noise, and tune into what Rekt Capital’s telling you here about a possible Bitcoin bottom based on previous “halving” cycles.

Historically, #BTC has bottomed 517-547 days before its Halving

If $BTC is to bottom 547 days pre-2024 Halving, a bottom would occur even this month

517 days before?

Then November 2023 would be the bottom

486 days before?

December 2023 would see a bottom#Crypto #Bitcoin pic.twitter.com/VCLHSLIC5l

— Rekt Capital (@rektcapital) October 11, 2022

Oh and don’t forget, there’s been more than one legendary US investor (nah, not Buffett) predicting a rosy long-term future for Bitcoin/crypto just lately.

Sweeping a market-cap range of about US$7.2 billion to about US$390 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• TerraClassicUSD (USTC),(market cap: US$577 million) +39%

• Huobi (HT), (mc: US$706 million) +6%

• Hedera (HBAR), (mc: US$1.49 billion) +4%

• BitDAO (BIT), (mc: US$472 million) +3%

• Chiliz (CHZ), (mc: US$1.04 billion) +3%

DAILY SLUMPERS

• ApeCoin (APE), (market cap: US$1.47 billion) -10%

• Uniswap (UNI), (mc: US$4.5 billion) -7%

• Stellar (XLM), (mc: US$2.98 billion) -6%

• Chainlink (LINK), (mc: US$3.51 billion) -6%

• The Sandbox (SAND), (mc: US$1.17 billion) -4%

ApeCoin (APE), the governance and utility token for the Bored Ape Yacht Club (BAYC) ecosystem is double-digits down based on news that the US Securities and Exchange Commission is poking its nose into its affairs.

According to a Bloomberg report, the SEC is probing Yuga Labs over potential securities violations via the sale of Bored Ape Yacht Club NFTs.

The report, which cites an unnamed source, details that the agency is also investigating the startup over the distribution of ApeCoin, which was airdropped to BAYC NFT holders in March.

yuga labs: literally turns a bunch of regular everyday people into millionaires

SEC: we need to protect Americans from this!!!!

— ⚽ DANIEL GOT HITS | 260.eth (@danielgothits) October 11, 2022

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

“I don’t have a lot of time, it’s called Yuga, Y-U-G-A…” pic.twitter.com/qHZoNPMNeE

— Alan Carroll (@alancarroII) October 11, 2022

Investigated by the SEC: Bored Apes, Kim Kardashian, guy who made $5k on an options trade

Not investigated by the SEC: Members of congress

— Genevieve Roch-Decter, CFA (@GRDecter) October 11, 2022

Meta introduces a new version of Mark Zuckerberg, who is a lot more expressive, capable of non-verbal cues like raising an eyebrow and squinting pic.twitter.com/La7KTd2ibc

— Jane Manchun Wong (@wongmjane) October 11, 2022

Now that the Fed has everyone convinced it won't pivot the pivot will slap even harder.

— Sven Henrich (@NorthmanTrader) October 10, 2022

BREAKING: 🇺🇸 Target is now selling Bitcoin hardware wallets in some stores. 😳

h/t: @mikuhl_

— Bitcoin Archive 🗄🚀🌔 (@BTC_Archive) October 11, 2022

For banks to hold their value, they'll need to hold what their clients value. #Bitcoinhttps://t.co/8iMGllPJ3J

— Michael Saylor⚡️ (@saylor) October 11, 2022

Nobody should trust Bremmer

— Elon Musk (@elonmusk) October 11, 2022