Mooners and Shakers: Major Bitcoin move expected as crypto market awaits CPI data; Huobi pumps

Getty Images

US dollar up, stocks down, crypto kinda flat (okay trending slightly down). As far as the latter is concerned, it hasn’t been going too badly over the past few days and has actually been outperforming major stock benchmarks.

Investors and traders on the digital side of the coin are more used to seeing the crypto market overreact to stock market dips and plunge even harder. That said…

Markets are on a knife’s edge this week. And that’s partly because more numbers are coming our way from the US Bureau of Labor Statistics – October 13, 8.30am EDT (11.30pm AEDT) to be precise. It’s the updated Consumer Price Index (CPI) inflation data, which will have the usual bearing on how the Fed treats its next rate-hiking move – to be announced on November 2.

How’s that going to play out, then? Crypto Twitter is in guess mode, although consensus at least seems to be on the idea that an end to the recent flat trading for Bitcoin and pals is imminent and a big move in either direction is coming. (Although that was also predicted based on the jobs/employment data last week.)

So this week, another CPI data is coming.

Is it Pumptober or Pumpsover? 🎃

— CryptoBusy (@CryptoBusy) October 10, 2022

Market has been sideways for a month

Volatility reaching levels which have historically preceded a big move

CPI/inflation data on Thursday

If the range finally breaks, I'd give it some time & space before jumping in

Longer consolidation = bigger expansion

Up or down?

Yes.

— Cred (@CryptoCred) October 10, 2022

The BVOL points to a big Bitcoin move

Some analysts have been highlighting what’s known as the BVOL this week, which is the Bitcoin Volatility Index. It’s actually an ERC20 (Ethereum-based) token that attempts to track the implied volatility of Bitcoin.

Umlaut-sporting chart obsessors Michaël van de Poppe and Alex Krüger point out in recent tweets (below) that there have been three previous moves for the BVOL below a specific level (25), which all triggered big volatility and HUGE moves. Twice bullish, once utterly rubbish. (Two outta three ain’t bad, right?)

The BVOL has just moved under this level again. Which way will it go? The UN has reportedly been calling for the Fed to soften its rate-hiking stance. That gives the tiniest of fractionalised hope for risk markets. The overall horrible macroeconomic climate and desperate situation in Eastern Europe doesn’t.

A very big move is on the horizon for #Bitcoin, as $BVOL drops sub 25.

Historically, that's a guaranteed recipe for massive volatility.

1; crash to $3K in 2018.

2; break above $4K to $14K in 2019.

3; break above $10K in 2020 (kickstart bull 2021).C/ @krugermacro pic.twitter.com/QvKXT9Ql28

— Michaël van de Poppe (@CryptoMichNL) October 10, 2022

Core CPI this coming Thursday above or below consensus by 0.2% or more would do it.

— Alex Krüger (@krugermacro) October 9, 2022

Onto some general daily crypto price action.

Top 10 overview

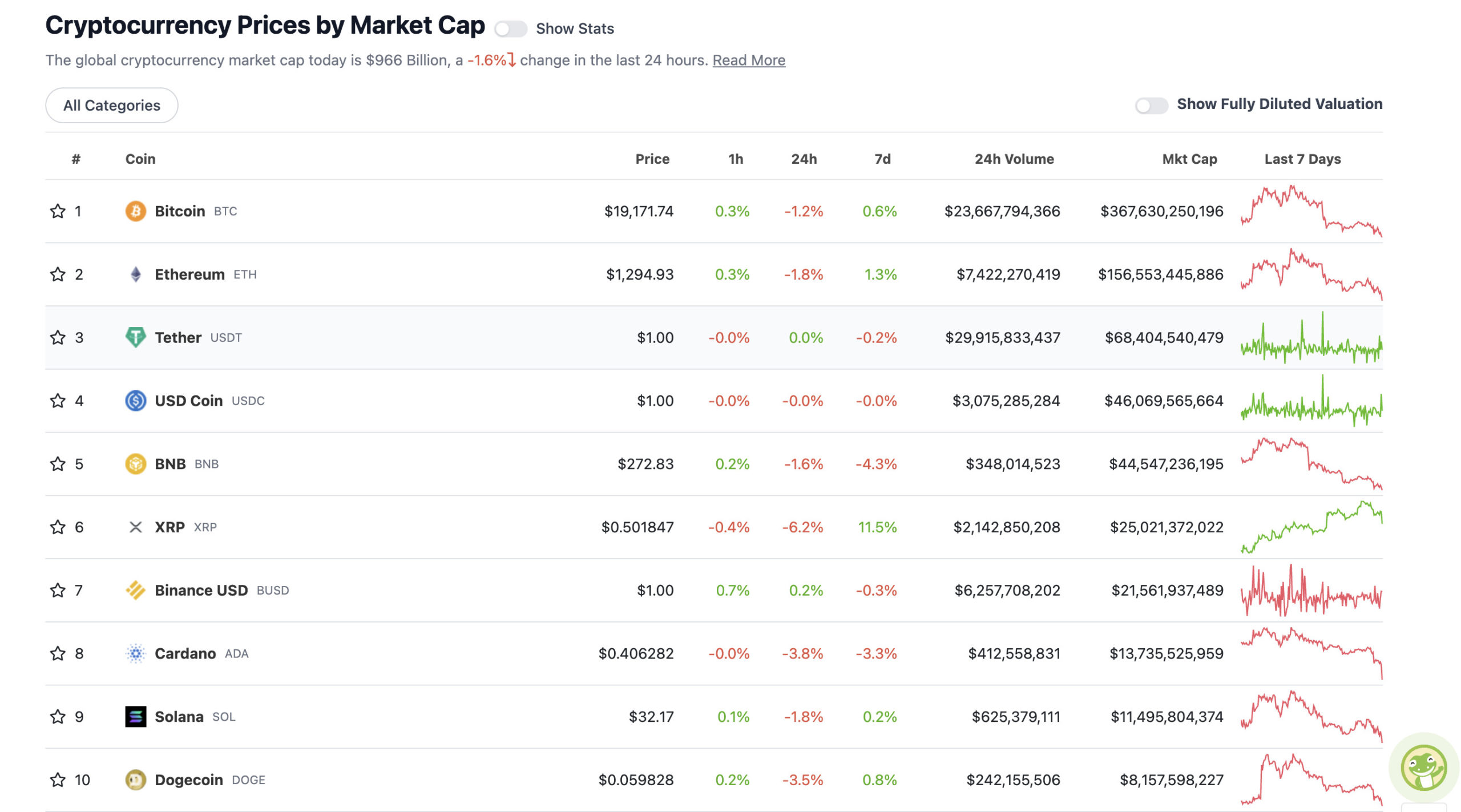

With the overall crypto market cap at US$966 billion, down 1.6% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

XRP is the biggest daily mover in the majors, down more than 6%. It’s still up 11.5% on a weekly timeframe, though and has been clearly outperforming the top coins of late (SEC lawsuit, hope for positive outcome/settlement soon, yada yada).

True story this ☺ $XRP #xrpthestandard @Ripple pic.twitter.com/CC808Z83RG

— Luke Thomas (@DEarthshaker) October 10, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$7.3 billion to about US$394 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Huobi (HT), (market cap: US$673 million) +24%

• TerraClassicUSD (USTC), (mc: US$416 million) +23%

• Tokenize Xchange (TKX), (mc: US$1 billion) +10%

• Maker (MKR), (mc: US$883 million) +10%

• Chain (XCN), (mc: US$1.52 billion) +2%

Alright then, what’s up with crypto exchange Huobi’s token HT? Why’s that one going slightly ballistic today?

It’s reportedly because the founder of Ethereum-code copycat TRON (TRX) has taken a major stake in Huobi Global. TRX is currently a top 15 crypto with a market cap of US$5.79 billion.

Huobi Global is the owner of the eighth-largest crypto exchange by trading volume and is headquartered in Seychelles, although has close ties with both Korea and Singapore.

Tron founder Justin Sun is reportedly the real buyer of Huobi in a deal valued at $1 billion@shaliniX0 reportshttps://t.co/gxDyh1R5JA

— Blockworks (@Blockworks_) October 10, 2022

The only thing Sun, however, has officially confirmed at this stage is an advisory role with Huobi.

DAILY SLUMPERS

• Chiliz (CHZ), (market cap: US$1 billion) -12%

• Ethereum Classic (ETC), (mc: US$3.3 billion) -10%

• Ethereum Name Service (ENS), (mc: US$417 million) -10%

• Lido DAO (LDO), (mc: US$893 million) -9%

• Rocket Pool (RPL), (mc: US$427 million) -8%

Around the blocks

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

— OVEX (@OVEXIO) October 10, 2022

Smart money/dumb money confidence spread has crossed above 0.5

Similar occurrences produced an average annualized return of 55.1% on the S&P 500 since 2000

Are we going to see a massive rally? pic.twitter.com/ci18EEbe1U

— Bravos Research (@bravosresearch) October 7, 2022

#Bitcoin and Halvings

in terms of timing, this current cycle ressembles the last one a lot.

This chart is merely descriptive, but depicts the repetitive nature of #Bitcoin sentiment phases very well

☀️☀️☀️ pic.twitter.com/JtJ4y5vjnR

— Stockmoney Lizards (@StockmoneyL) October 10, 2022

This indicator has never failed to represent a historical #Bitcoin buying opportunity.

And it's currently doing so for the 5th time in BTC history pic.twitter.com/B2JX3sP2lw

— Stockmoney Lizards (@StockmoneyL) October 8, 2022

JUST IN: I still own Bitcoin, says Billionaire Paul Tudor Jones

— Bitcoin Archive (@BTC_Archive) October 10, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.