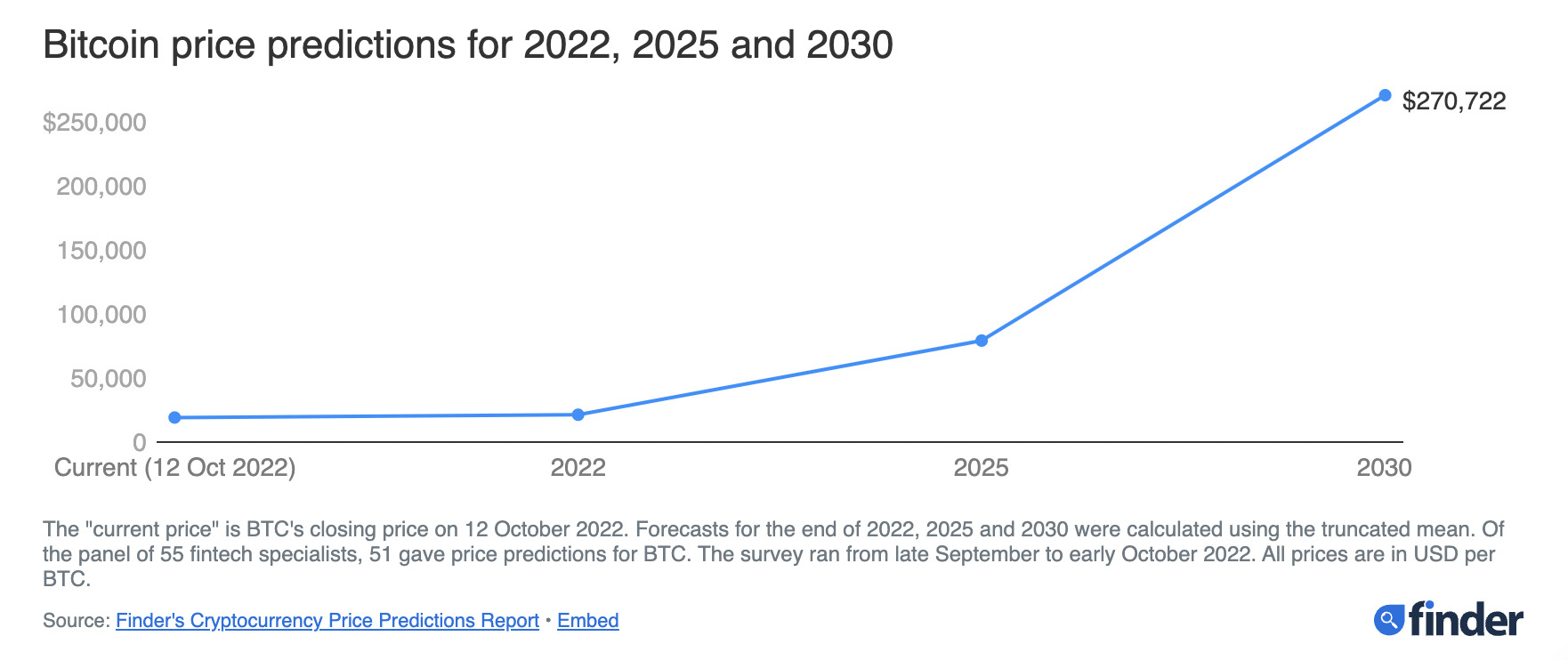

Finder panel sees a $21k Bitcoin by year’s end, $79k by 2025 and generally thinks it’s time to buy or HODL

Probably not a Finder panelist, yesterday. (Getty Images)

The soothsayers at Aussie-founded comparison website Finder are back again with a new batch of tea leaves, animal entrails and predictions for Bitcoin’s near and longer-term future. But don’t take that literally.

Following its recent Ethereum outlook, Finder has locked the same bunch of 60 or so fintech, crypto and industry experts in a large room with refreshments (again, dramatic licence taken) until they provided reasonable answers to the question we all want to know: Is Bitcoin gonna moon any time soon?

And here’s what Finder found.

Nutshelling it at the top of its latest Bitcoin (BTC) Price Prediction Report, the summary reads:

“Our panel thinks Bitcoin (BTC) will be worth US$21,344 by the end of 2022 before rising to $79,193 by 2025.”

There’s a 2030 median prediction, too, and that lands on a whopping US$270,722, although that’s still well down from the panel’s January report estimate of US$420,240.

Just a reminder about who’s making these calls. Finder’s weekly survey pulls in opinions and predictions from a rotating panel of five fintech experts, while its quarterly survey (last conducted late September to early October) gathers a broader look at BTC from 55 other industry specialists.

A US$21k Bitcoin for Christmas? It’s not the stuff dreams are made of, but at this point, in this current market, we’d readily take it. Let’s unwrap the report a little more in the meantime.

How about a Bitcoin bottom for 2022?

It’s been a hot topic for months – where will Bitcoin find its bottom in this bear market? We’ve seen many a Crypto Twitter-housed analyst say that the mid US$17k area, where it dropped to in June, was the absolute bottom. We’ve also seen US$14k as another popular target of bottoming-out support.

The Finder panel has landed on an averaged-out figure of US$15,283 at potentially some point before the end of the year. That’s not to say all panellist think it’ll make that kind of plummet, although angel investor Veronica Mihai is one who believes another sell-off will brutalise BTC down to US$10,300 by the close of 2022.

“BTC is heavily correlated to the overall current economic climate and in the spotlight of worldwide regulators,” noted Mihai. “If BTC decouples from the main economic markers, it will once again become a hedging opportunity.”

Is Bitcoin still a store of value?

Yes, according to 77% of the panelists, and that’s despite Bitcoin’s decline of roughly 70% from its all-time-high set last November.

Furthermore, 56% of the Finder panel believes BTC is currently underpriced.

“Nothing fundamentally has changed for Bitcoin,” said CEO of UK-based crypto exchange EXMO, Serhii Zhdanov, adding: “It’s a global capital crisis and Bitcoin is affected in a short term but will recover; a lot of other financial assets will not.”

“Bitcoin remains a fully decentralised network, with institutional demand as a store of value rather than a currency,” noted Digital Capital Management managing director Ben Ritchie.

Providing a counter argument, Lee Smales, professor of finance at the University of Western Australia, is predicting a further drop in the stock market and for Bitcoin by the end of the year.

“BTC will attract more bad publicity to the PoW model now that ‘the Merge’ appears to have worked out well,” said Smales.

Should I stay or should I go?

Macroeconomic factors – you know, the ones that’ve been dominating headlines pretty much all year (war, inflation, interest-rate hikes, looming recession) – are weighing down the crypto market this year, believes the panel. They’re not wrong.

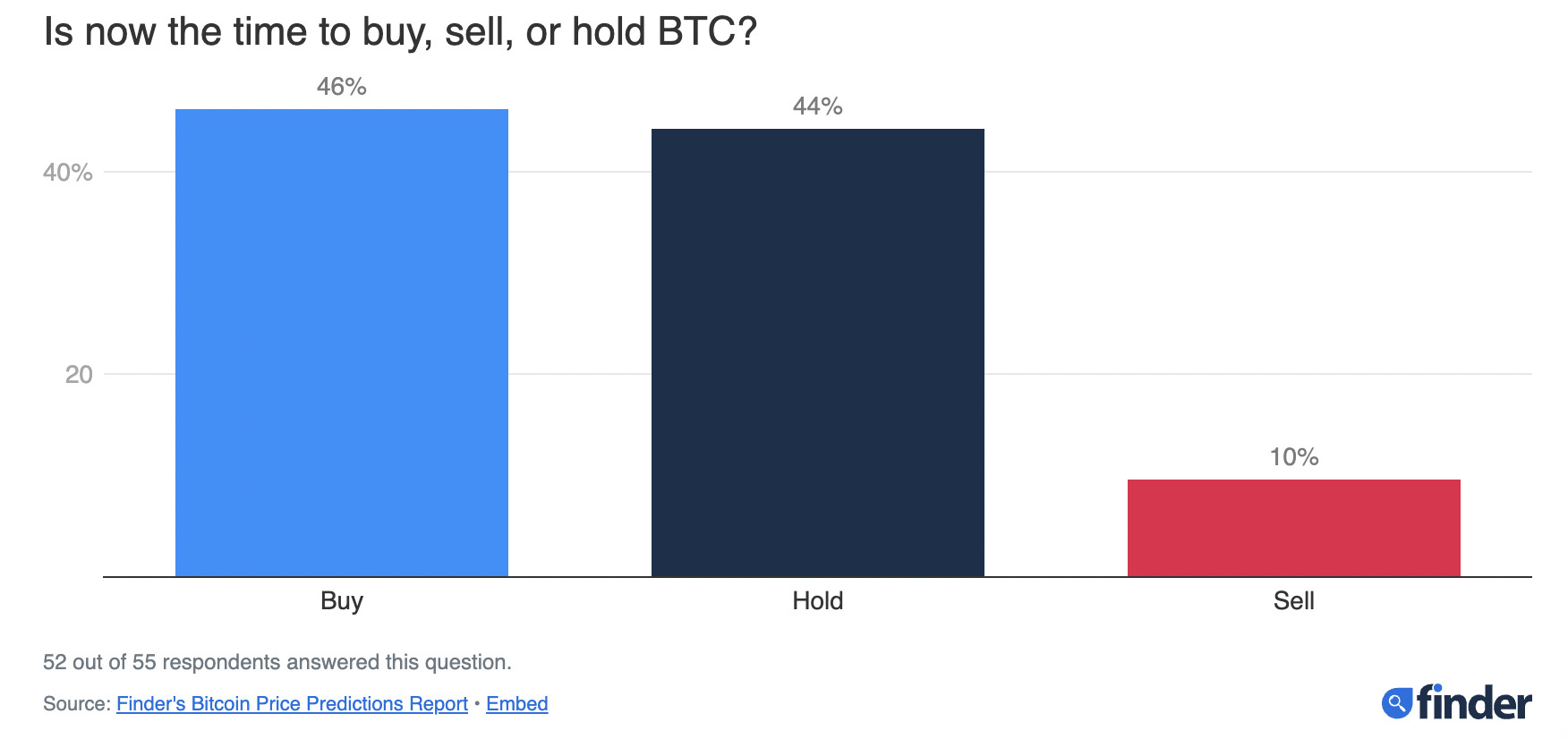

Right now, 46% of the panel thinks BTC is a buy, 44% are HODLers, while just the 10% who remain are sellers.

Justin Hartzman, CEO of CoinSmart Financial, thinks it’s a good time to purchase BTC and notes: “If macro conditions improve and the regulatory environment gets better, then BTC price should be able to rise up.”

Mitesh Shah, founder and CEO of Omnia Markets, meanwhile is in the selling camp: “The crypto market is headed into territory it has never experienced. As global traders capitulate their investments, Bitcoin will experience new lows not reached this year.”

HODLing on, though, is Ruadhan O from Seasonal Tokens who is looking ahead to the 2024 halving (the event that cuts the Bitcoin mining reward in two every four years).

“[Bitcoin will] probably recover slightly between now and the 2024 halving, because that’s what happened in previous cycles.”

And that’s an opinion that Finder’s co-founder Fred Schebesta shares, who recently spoke with Stockhead on the matter.

There’s plenty more insight to be gleaned from the report. And if you feel so inclined, take a gander at Finder’s recent Ethereum ($5k by 2025) and XRP (potentially $0.90 or US$0.24 by the end of 2022) crystal balling, too.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.