Ethereum price prediction: ETH can still hit $5k USD by 2025, believes Finder panel experts

Probably not on Finder's expert panel. (Getty Images)

Aussie-founded comparison website Finder has unleashed its latest expert-proffered price predictions for leading layer 1 crypto Ethereum (ETH). And, as you might expect, it’s a mix of bullish and bearish crystal balling.

In an NFT of a nutshell, here’s the key soothsaying. According to the panel, Ethereum could:

• drop as low as US$963 this year, before ending 2022 at about US$1,377,

• hit as high as US$5,154 by 2025,

• soar to US$11,727 by 2030.

Bear market wrecks Finder’s earlier ETH predictions

With about three and a half months to go before we hit 2023, Finder, which Stockhead chats with from time to time, has this week published its updated Ethereum (ETH) Price Prediction 2022 report. It measures expert predictions of the future ETH price using two surveys.

Finder’s weekly survey pulls in opinions and predictions from a rotating panel of five fintech experts, while its quarterly survey (last conducted late September to early October) gathers a broader look at ETH from 55 other industry specialists.

Reflecting what, let’s face it, has been a pretty crappy year for crypto and risk assets, the Finder panel predictions for ETH have shown lowered price targets since the beginning of the year.

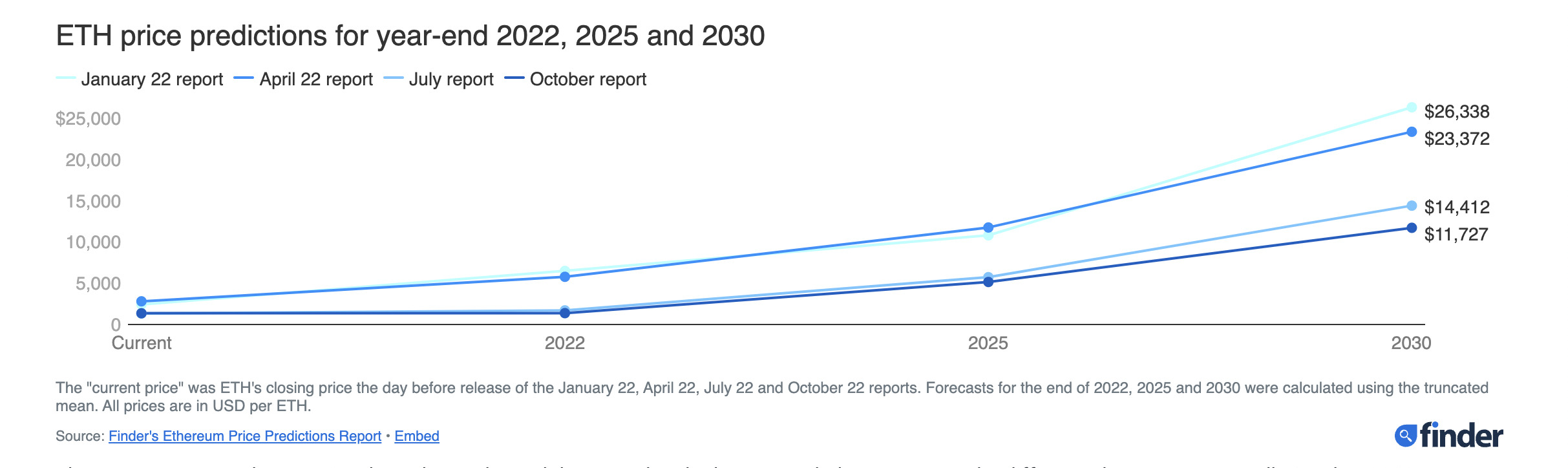

“Back in January, the average prediction of our panel said that ETH would be worth $26,338 by 2030,” the report notes, “which fell slightly in the April report ($23,372) and then to $14,412 in July. In October, the average price prediction for 2030 stood at $11,727.”

The difference between the Finder panel’s October 2022 prediction for ETH is about 55% lower than it was in January, as you can see from the chart below. It’s proof (that you absolutely shouldn’t need) that price predicting is most certainly an inexact science.

Some bullish expert take-aways

CEO and co-founder of Osom Finance, the somehow appropriately surnamed Anton Altement, is one of the more optimistic panel members and thinks ETH could rally as high as US$2,750 by the end of this year (it’s currently changing hands for about US$1,300).

His reasoning centres around the newly acquired deflationary aspect of the ETH token since the advent of the network’s “Merge” to become a Proof-of-Stake consensus protocol, as well as a yield-bearing asset.

He added: “Allround market pessimism driven by Fed’s actions and still locked ETH staking are the key factors holding back the price. Former should disappear by December, latter by next spring – those 2 events will unlock the next legs of the rally.”

Ben Ritchie, managing director at Digital Capital Management, concurs with Altement’s leading altcoin sentiment, also pointing to ETH’s newfound deflationary nature.

“If the force that is preventing the Ethereum price from increasing has finally pivoted, we are likely to see a massive demand for this asset,” he noted.

Okay, some bearish ones, too

Finder does a very good job of giving balance a fair chance in its reports, so we’d best not skip out on the more negative voices in the room.

Bearing in mind, he’s nearly always the main voice of negativity in these Finder panel roundups, here’s what senior lecturer at the University of Canberra, John Hawkin had to say:

“[Ether] remains volatile in price and in the longer term, the uses will better be met by central bank digital currencies [CBDCs]. As Hyun Song Shin from the BIS has put it, ‘anything crypto can do, CBDCs can do better’.”

Clearly a fan of centralised, government-controlled digital currencies, then. Possibly George Orwell’s 1984, too.

Hawkins sees ETH closing this year at US$1,200, but ending the decade at, erm… US$100.

Another less-than-optimistic view came from Walker Holmes, co-founder and vice president at MetaTope, who sees the price trading at US$800 at year’s end. He’s not on the same page as Hawkins, however, as he’s calling for a US$30k ETH by 2030.

“As long as the FED continues to hike interest rates, while also selling assets to the market, the path of least resistance is down for most risk assets,” believes Holmes.

Some further key points

It’s a comprehensive report but short of just regurgitating it all here for you, here are some more nuggets of interest:

• 46% of Finder’s experts think Ethereum is undervalued, while 31% think the price is right.

• Almost half of the panel (48%) say the decline in issuance – the amount of new Ether entering circulation – will have the biggest positive impact on ETH post-Merge.

• 83% of panelists say ETH’s price dropped following the Merge because the transition was intended to have a long-term impact, not a short-term one.

• 60% of panelists think more cryptocurrencies will move to a PoS model following the Merge, while 27% don’t think they will and 13% are unsure.

• Almost half the panel reckons now is the time to buy ETH (48%), while just 13% believe it’s time to sell. The rest of the panel (38%) say to HODL it!

We’ll leave you with this positive thought from Alexander Kuptsikevich, senior analyst at FxPro:

“Ethereum has found itself in an area where it receives support from long-term investors. Crypto investors may remain cautious for a few more months or a couple of quarters, but we can expect an active bull market to return as soon as next year.”

For further Ethereum-related insights, take a dive into the full report here.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.