Mooners and Shakers: New crypto Aptos plummets on debut; Bitcoin? ‘C’mon, do something’

Getty Images

Bitcoin is still hanging out on the sideline, desperately trying to impress the coach with some vigorous warm-up routines, meanwhile the new “Ethereum killer” Aptos enters the fray and is immediately poleaxed.

That imminent volatility crypto analysts have been banging on about this week? Yeahnah. Well, not at the time of writing anyway. Bitcoin seems fine to basically continue doing nothing.

Me thinking this week was gonna be a big week

😮

Me Now:

— Kevin Svenson (@KevinSvenson_) October 19, 2022

“Uptober”? More like Crabtober at the moment. Where’s that “C’mon, do something” meme when you need it? (Here it is):

Hey #Bitcoin! C'mon, do something… pic.twitter.com/yOaQhvgmT4

— Helin Ulker (@beautyofhelin) October 18, 2022

Will the second scenario there play out? Unless you desperately want to accumulate more at fire sale prices, then let’s hope not. But as boring as this broken-record statement is, it all hinges on the US Federal Reserve’s next inflation-combatting move.

Singaporean crypto asset trading firm QCP Capital thinks so.

“With little calendar events till the next FOMC in early November, crypto continuing to lag behind equities, and skews near flat, protective downside structures are the cheapest levels they have been since June,” the firm has been quoted here and there today.

The next Fed flip flop will be their wildest yet.

— Sven Henrich (@NorthmanTrader) October 19, 2022

Onto some daily price action.

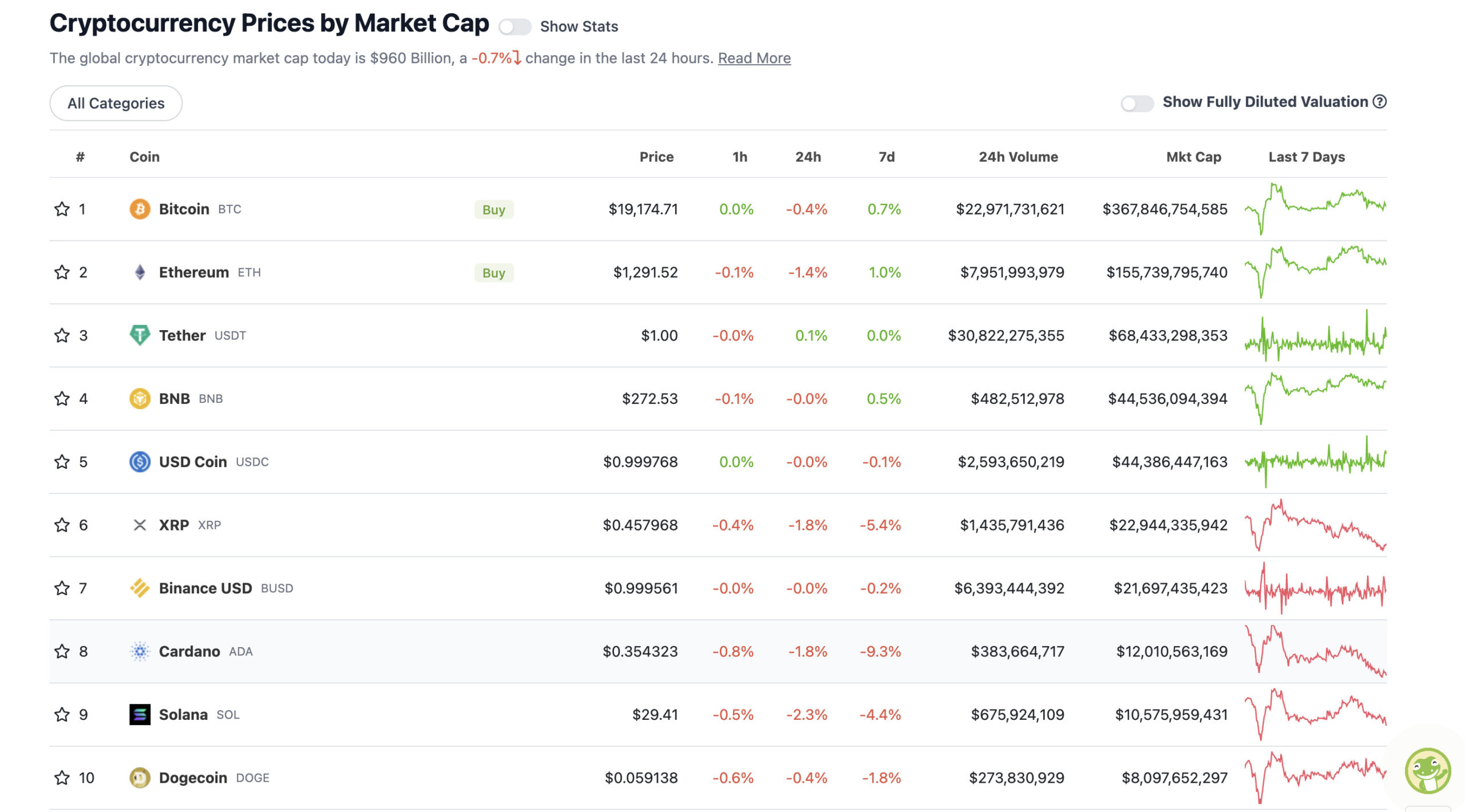

Top 10 overview

With the overall crypto market cap at US$960 billion, down about 1% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

That’s a pretty uninspiring 24-hour and weekly price-action chart for the crypto majors, so let’s look for some positivity to brighten things up a tad.

Here’s Bloomberg Intelligence’s chief commodity strategist Mike McGlone, with a reminder of Bitcoin’s diminishing-supply narrative.

Bitcoin Primer: Supply Is Straightforward, Declining#Bitcoin's definable diminishing supply is unprecedented on a global scale, and so prices should continue to rise over time unless something unlikely reverses demand and adoption trends, given the laws of supply and demand. pic.twitter.com/wzzhYN5sNL

— Mike McGlone (@mikemcglone11) October 19, 2022

And here’s something else – apparently Tesla didn’t sell any Bitcoin in Q3 this year. That’s positive… right?

🔥 – BREAKING: $TSLA didn’t sell their $BTC in Q3 2022 and still hold 11,000 #Bitcoin

You should hold too.

— Michaël van de Poppe (@CryptoMichNL) October 19, 2022

Bringing the mood back down again for a sec, though, @ZeroHedge, aka John Wick, has taken time out from stabbing bad guys with a pencil and is pointing to possible further crypto market pain. That said, he’s only asking the question.

Are we repeating 2018?

– In 2018 we went sideways and people stopped being bearish bc we had already dropped -70%. This was followed by another 50% drawdown.

– Now in 2022 we are seeing people think that there is no ways #BTC could fall more bc we are down -70% 🤔 pic.twitter.com/Z1og40sceY

— Wick (@ZeroHedge_) October 19, 2022

Here’s another question. If BTC were to plummet again from these levels down to something like US$14k or less, would you “back up the truck”, like Austrian fund manager Larry Lepard?

Coinhead knows what it would do, but won’t share lest it somehow be construed as financial advice.

Uppers and downers: 11–100: Aptos dumps

Sweeping a market-cap range of about US$7.23 billion to about US$399 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Celsius (CEL),(market cap: US$422 million) +5%

• Trust Wallet (TWT), (mc: US$464 million) +4%

• Aave (AAVE), (mc: US$1.18 billion) +2%

• Uniswap (UNI), (mc: US$5 billion) +2%

• Polkadot (DOT), (mc: US$7.2 million) +1%

DAILY SLUMPERS

• Aptos (APT), (market cap: US$921 million) -48%

• Casper (CSPR), (mc: US$429 million) -10%

• Frax Share (FXS), (mc: US$418 million) -7%

• EthereumPoW (ETHW), (mc: US$678 million) -7%

• Quant (QNT), (mc: US$2.9 billion) -5%

In terms of “mooning and shaking” coins today, Aptos is the headline “shakeout” act.

The highly anticipated newcomer to the increasingly crowded layer 1 blockchain race tanked in value overnight (AEDT) as it hit major crypto exchanges including Binance, Coinbase, FTX and Huobi.

According to CoinGecko data, APT debuted at about US$13.73, swiftly plunging more than 50% to US$6.73, and has seemed to find a level not much higher than that, presently, a shade above $7.

Founder Mo Shaikh and others have been in damage control following a lot of Crypto Twitter negativity regarding the project’s rocky start. The criticism has centred around supposedly a less-than-transparent token-model distribution structure, as well as a network with far lower transactional processing speed than had been expected at this stage.

It’s exciting to finally bring Aptos to mainnet.

Acknowledged that it could have gone better. Building a decentralized protocol from the ground up is tough! Aptos is fortunate to have a fantastic community that's constantly evolving together.

Addressing some concerns below:

— Mo Shaikh 🌐 aptOS (@moshaikhs) October 18, 2022

Meanwhile, more than 100,000 participants in Aptos’ early testnet program are able to claim an APT airdrop. Judging by this tweet from airdrop guru Olimpio, below, it looks to have been a reasonably lucrative opportunity based on doing not much.

All the people that followed this strategy got between 1500 USD and 6000 USD $APT airdrop yesterday

The only thing you had to do was fill out a form

Thread: how to potentially get other pending tokens that are launching soon / $ZKS, $ARB, $OP, $STARKhttps://t.co/ZTKwqgFBu8

— olimpio (@OlimpioCrypto) October 19, 2022

We missed the boat on that one, unfortunately, but it’s a reminder to keep one eye on the airdrop “free money” scene.

Around the blocks: another airdrop op?

A selection of randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

JUST IN: The number of addresses with over .01 #bitcoin hit a new ATH 🙌

— Bitcoin Magazine (@BitcoinMagazine) October 19, 2022

Of course, there is still some scope for potential downside for #BTC to register its absolute bottom

But definitely the majority of the downside Bear Market move has already occurred$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) October 19, 2022

Crypto volatility is down. Is crypto dead?

🧵👇

— Cumberland (@CumberlandSays) October 18, 2022

This analysis is deeply problematic, however, because it obfuscates the critical difference between trading volumes and price volatility. Volatility is indeed muted, but volumes, while certainly off the highs of the year, remain absolutely massive:

— Cumberland (@CumberlandSays) October 18, 2022

https://twitter.com/BillyM2k/status/1582399450466557952

50 iconic NFTs from 50 of the best cryptoart artists!!!!!!

⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️⬇️ pic.twitter.com/OXDHpv56XH

— TodoNFTs (@TodoNFTs) October 18, 2022

And speaking of airdrops (see APT, further above), the excellent Olimpio Twitter account has one here that you might well be able to take advantage of, if you’re an OpenSea user and holder/trader of NFTs.

$BLUR Airdrop confirmed for OpenSea/NFT users 🟠🪂

🚨 13 days to claim 🚨@blur_io is a marketplace (like OS) and an Aggregator (like Gem). Backed by Paradigm

Check eligibility: https://t.co/VjI8GSmRcJ

To claim you need to list an NFT in their marketplace. Here's how:

— olimpio (@OlimpioCrypto) October 19, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.