Crypto roundup: Market cap hits $2.5 trillion as ETH, DOT and others make a move

Coinhead

Coinhead

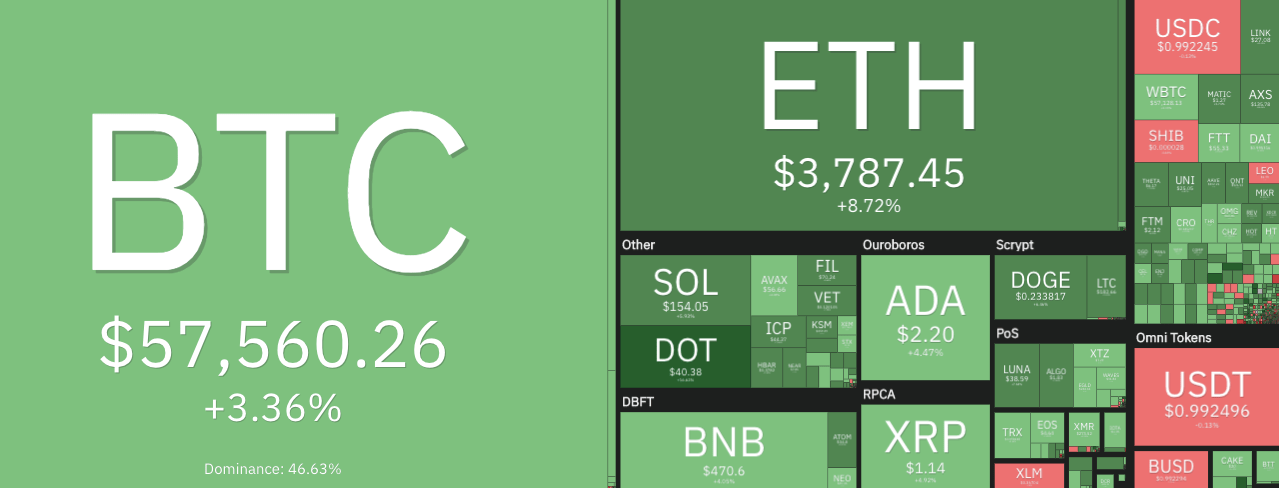

It’s a green-candle day in the cryptoverse so far, with plenty of solid gains on notable coins, including Ethereum (ETH), Polkadot (DOT) and Chainlink (LINK). And yep, Bitcoin’s doing pretty well, too.

At the time of writing, the entire crypto market cap has just surpassed US$2.5 trillion, according to CoinGecko at least. CoinMarketCap actually has it a bit lower. But, for the sake of a bullish narrative, let’s go with the former figure – up 5.6 per cent since this time yesterday.

Bitcoin (BTC), meanwhile, is hovering about $500 below the major resistance of US$58K – a level at which the OG crypto has now faced rejection numerous times.

It’s going just fine for now, however, consolidating a bit as it lets some of the altcoins grab the spotlight. It might steal it back soon, though, judging by some of the technical analysis we’ve been following today.

Based purely on the charts, Vailshire Capital Management’s Dr Jeff Ross thinks another burst might be imminent…

#Bitcoin technical update: Continued period of bullish consolidation with series of higher lows.

Macro: Bullish

To news: Acting well

On-chain: BullishOpinion: I expect burst higher in RSI to ~90, with concurrent burst higher in #bitcoin price… first to ATHs, then onto $100k+ pic.twitter.com/JzEgnvBkGx

— Dr. Jeff Ross (Pleb counselor) (@VailshireCap) October 14, 2021

… while Rekt Capital makes the point that a weekly close above US$60K for Bitcoin is what’s really required to see sustainable bullish action. As you can see from his chart below, the red box he’s drawn between about US$58K and $60K denotes heavy resistance.

But crack through it, and flip it to support, and BTC is then in unchartered, “price discovery” territory and looking at all-time highs once again.

A #BTC Weekly Close above the psychological level of $60,000 would be a momentous technical step towards securing further upside & breaking to new ATHs

That said, the previous 4 Weekly Closes below/inside the red box preceded rejections

Confirmation is needed#Crypto #Bitcoin pic.twitter.com/0Md6nOp6bG

— Rekt Capital (@rektcapital) October 14, 2021

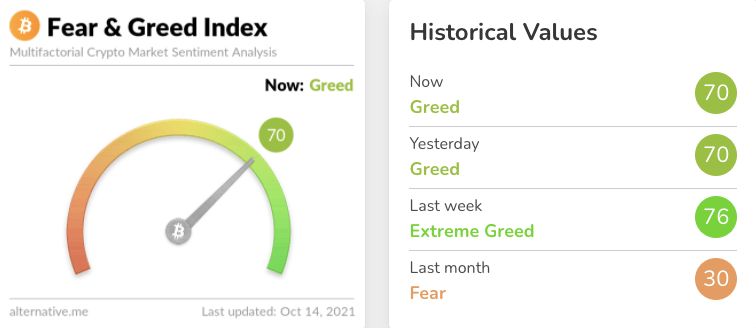

A look at one of the crypto market’s go-to sentiment analytics tools, the Fear & Greed Index, and things aren’t looking quite as greedy right now as we’d anticipated. And that’s not a bad thing.

Prices trending upwards without mouths absolutely foaming with FOMO just yet could actually mean the market is undergoing some nice, healthy, sustainable growth.

Well, here’s hoping. Another check of the index tomorrow could just as easily invalidate and knock that little theory on its butt…

It’s not as if we aren’t seeing plenty of bullish sentiment on Crypto Twitter, mind, but there’s something else that might show there’s a reasonably contained level of froth in the market right now.

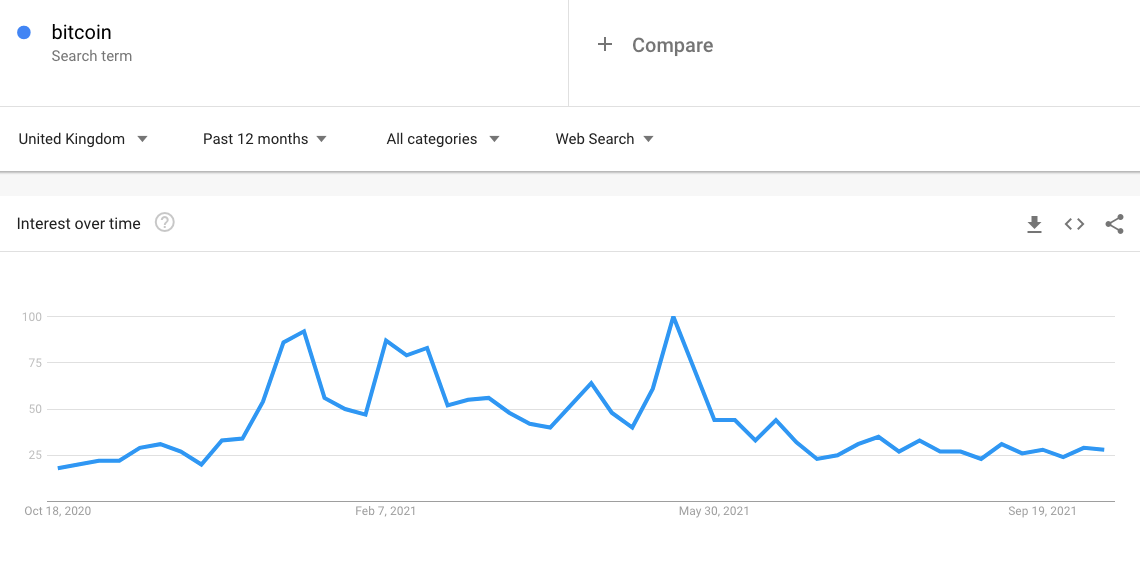

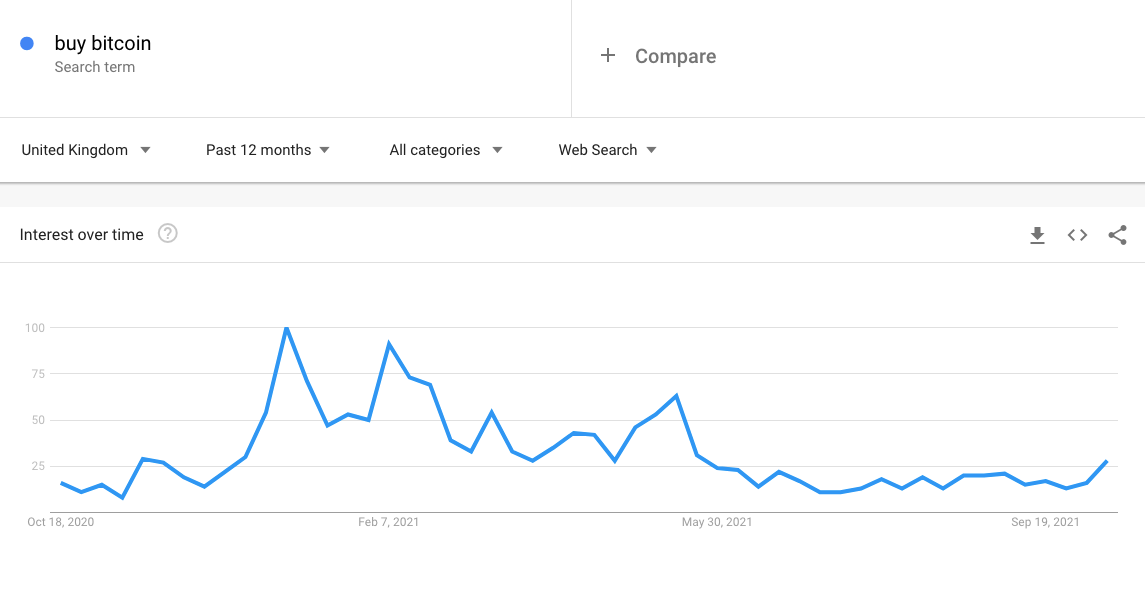

And that’s the fact Google Trends data is still showing that worldwide “Bitcoin” and “Buy Bitcoin” searches are well below higher levels seen earlier in the year. Bitcoin hit its all-time high of US$64,804 on April 14, before a fateful Elon Musk tweet a month later helped crash the market.

When it crashes, of course, the retail FOMO crowd doesn’t want to know any more. Which is probably just about the time the smartest investors become interested. (“Not financial advice.”)

Some top coins are showing plenty of strength today. The no.2 crypto by market cap, Ethereum (ETH), is now posting a double-digit percentage gain as we write this, changing hands for US$3,808, up 10 per cent since this time yesterday.

Fellow “layer 1” smart-contract platform Polkadot (DOT), ranked #8 on the market cap lists, is still surging, too – up 16.51 per cent and trading at US$40.67.

It’s still riding high with anticipation for the beginning of its parachain auctions – newly announced with a November 11 date.

#Polkadot to $100+ is programmed.

— Michaël van de Poppe (@CryptoMichNL) October 14, 2021

When you invest everything in #Polkadot pic.twitter.com/ZKMD2CF2HD

— Polkadot Boss (@PolkadotBoss) October 13, 2021

Just a short-ish trip down the market-cap list, the leading “oracle” project in the space, Chainlink (LINK), is also up about 10 per cent in 24 hours, finally getting a bit of love after a long period of stagnant price action. It’s currently moved up to US$27.45.

Meanwhile, if you’re into both crypto and US politics, here’s a somewhat different take on some Chainlink analysis…

Good thread

Ppl analyzing Gensler today as if he will even be relevant in a year after Dems get rugged in midterm elections https://t.co/4oJ93kD6OT

— Zhu Su 🔺 (@zhusu) October 14, 2021

Other notables in the top 100 posting strong gains today include: play-to-earn gaming beast Axie Infinity (AXS) +16%; a slightly lower-capped layer 1: Near Protocol (NEAR) +12%; and Polkadot’s “canary” test network, Kusama (KSM) +14%.

Heading deeper into lower-cap territory, Aussie DeFi project Maple (MPL) is still generally enjoying its great run this week, up 38.66 per cent since this time yesterday, and 72 per cent on the week. It hit an all-time high of US$42.80 roughly 10 hours ago, but has since settled back a bit, currently changing hands for a fraction under US$34.

On the downside, some coins catching our eye that are having a bit of a (ahem) spell right now, include Spell Token (SPELL) -16%; Cardano launchpad OccamFi (OCC) -10%; and the “pointless” dog meme coin Shiba Inu (SHIB) -7.5%.

SPELL is the governance and utility token for the cross-chain DeFi project known as Abracadabra.Money, which enables a stablecoin called Magic Internet Money (MIM).

Although SPELL’s having a pullback today, Abracadabra.Money has been building buzz just recently as part of the #OccupyDeFi movement, which advocates for “true decentralisation” in crypto.

This thread explains a bit about what the project is currently aiming to achieve, including collaborative efforts with Terra Luna.

1/ So is finally time to reveal the strategy for what i call new2pool and the future of Decentralised Stablecoin liquidity. A Thread about $TERRA $UST and $MIM . A partnership Between @anchor_protocol 🤝 @MIM_Spell 👇👇

— Daniele never asks to DM (@danielesesta) October 14, 2021