THE COMPLETE CRYPTO GUIDE: Where it’s been, where it’s at, where it’s heading

Coinhead

It’s been around for more than a decade and, according to a recent Finder survey, one in six Australians now own some. It’s no longer going out on a limb to say this: cryptocurrencies are here to stay.

The crypto market has been through booms and busts as well as countless scams, hacks, “rugpulls” and China bans. Yet still it survives and thrives to the point where old-money institutions and fund managers are piling in as serious projects aim to completely disrupt finance and regulators scramble to get it all under control.

In this guide and general overview, we look at some crypto basics, the industry’s recent past, and where it all could be going from here.

A cryptocurrency – crypto for short – is a code-based digital asset or form of digital money enabled by blockchain technology. They’re often referred to as “coins” or “tokens” and they function outside of traditional banking and government systems.

That’s the short-ish answer. Feel free to use it down the pub.

“Okay, but what’s blockchain?” It’s a distributed ledger of transactions that’s publicly available and secured by cryptography. “Right… so how do I buy Dogecoin?” We’ll get to that.

There are many different types of cryptos (more than 9,600 at the time of writing according to CoinGecko) and many have different purposes and utility beyond being a medium of exchange.

The first crypto to achieve mainstream success was Bitcoin (BTC). For many crypto investors, Bitcoin is viewed as a “store of value”, akin to gold. It can also be seen as a barometer for the health of the entire crypto market. (In fact, it’s on a bit of a fun run as we write this, having jogged past US$57K for the first time since April 2021.)

Bitcoin led the way for the proliferation of what have become known as “altcoins” (alternative coins) – which simply refer to cryptos that aren’t Bitcoin.

“Bitcoin maxis” tend to call altcoins “shitcoins”. And, while it’s probably true that the vast majority of those 9000+ coins are utter crap, there are gems among them, too – with serious teams building serious levels of innovation, backed by some seriously big investors.

Maths. A Beautiful Mind-level maths. Cryptocurrencies are created by “consensus mechanism” algorithms that rely on cryptography, which is a significant part of blockchain technology.

These algorithms participate in every transaction of a cryptocurrency in order to reach a mathematical/cryptographic agreement on the state of the blockchain ledger, including the order of the transactions.

There are different types of consensus mechanisms that different crypto projects can use to create their tokens. Most projects traditionally use either what is known as Proof of Work (PoW) or Proof of Stake (PoS), although it’s a constantly evolving space and other consensus models are also coming to the fore, such as Solana’s Proof of History (PoH).

For further explanation on the main crypto-creating consensus mechanisms, head to “P” in our Cryptionary crypto glossary.

The straightforward way of answering this is: market capitalisation. And this refers to the total dollar (US) market value of a company’s shares of stock, or in the case of crypto, its tokens. Market cap is calculated by multiplying the circulating supply of a crypto by the individual price of the token.

When looking for crypto buying opportunities and considering all angles, it’s important to remember that market cap is generally a more useful metric than price. A “cheaper” crypto at, say, less than US$10, isn’t necessarily a bargain compared to one with a considerably higher individual price. In other words, unit bias is no basis for an investment decision.

Also, cryptos with lower market caps have potential to offer greater reward, but at greater investment risk than established cryptos with higher market caps.

Other factors that can help determine a crypto’s value include good old supply and demand (the scarcity level of the supply and the user demand for, and utility of, the token); level of community engagement and sentiment; the competence and reputation of the team; and the type of investors (e.g. VCs) and backers it’s attracted.

With all this in mind, it should be remembered that cryptocurrencies are highly speculative and unpredictable assets that are difficult to value with a complete level of accuracy.

When first buying cryptocurrency, most new investors do so through a centralised cryptocurrency exchange (although crypto ATMs can also be used, but often charge pretty high fees).

Creating an account on major exchanges is reasonably quick and easy – you’ll just need some identification as part of their KYC (Know Your Customer) setup process, and a bank account that lets you participate in crypto trading.

There are several reputable exchanges that serve the global and Australian crypto market, some of which include: CoinJar, BTC Markets, Binance Australia, Coinspot, eToro, Swyftx, Coinbase, Kraken and Independent Reserve. All these exchanges deal in a multitude of different cryptos – from Bitcoin and Ethereum to Cardano and Dogecoin to tokens you’ve almost certainly never heard of.

The rise of decentralised exchanges (DEXs) in the past couple of years, such as Uniswap, Balancer and SushiSwap, now provide crypto investors and traders with even greater choice, as well as extra flexibility and control with peer-to-peer swapping and trading.

There are no fiat on-ramps or off-ramps associated with DEXs at this time, however, so moving your old money in and out of crypto is still achieved through centralised means.

The crypto market has got to be the wildest ride in finance. Its history is worth delving into, including Bitcoin’s inception, wilderness years, the Initial Coin Offering (ICO)-led bullrun of 2017, the bubble burst of 2018 and the subsequent “crypto winter”.

But the past year and a half is what we’ll focus on here – a period that has seen huge growth in the industry shaped by at least three big factors…

COVID-19 isn’t a great reference point for anyone but there’s no denying the pandemic’s effect on the growth of Bitcoin and crypto has been significant as the world has delved further and further into digitally dominated lifestyles.

When news of the spread of coronavirus really began to hit the mainstream, financial markets took a hit amid the immediate uncertainty. Bitcoin’s price took a nosedive from about $US10K to US$5,389 in March 2020.

Its rise from there, however, was nothing short of astonishing, reaching an all-time high of US$64,804 a bit over one year later in April 2021.

The US government’s fiscal stimulus policy during that time, printing more than US$5 trillion, served to strengthen the narrative of crypto (particularly Bitcoin) as an investment hedge against a weakening US dollar.

The ex-Goldman Sachs hedge fund manager Mike Novogratz, now CEO of crypto investment firm Galaxy Digital, was telling anyone who cared a good two years ago that “the herd is coming”. He was referring to institutional players – Wall Street, big banks, significant fund managers, big corporates – entering the crypto-investment world.

He wasn’t wrong. One by one, significant players in US and global finance have shown they’ve been dipping a toe, sometimes much more, into digital assets and blockchain tech. This part of the story has been a big factor in the 2020/21 crypto rise.

Bitcoin has been the gateway drug, so to speak, for institutional entry, closely followed by Ethereum.

And due to their relentless bullishness on Bitcoin, two of the most important entities driving the narrative have been US asset management company Ark Invest, headed by Cathie Wood, and US business intelligence firm MicroStrategy, led by Michael Saylor.

If I had chosen #Gold instead of #Bitcoin last year, it would have been a multi-billion dollar mistake. It doesn't help to diagnose the problem if you don't choose the right solution. pic.twitter.com/UrYksm7X6w

— Michael Saylor⚡️ (@saylor) September 5, 2021

Both can be directly attributed to kicking off serious institutional FOMO for Bitcoin and Ethereum over the past 18 months. And you can throw in the digital asset specialist Grayscale Investments into the mix, too.

Its GBTC trust product offers big investors exposure to Bitcoin through a traditional investment vehicle in lieu of a Bitcoin ETF (Exchange Traded Fund), which is still yet to be approved in the US (although this is looking more and more likely to happen as October rolls on).

Just some of the significant names now with hooks into crypto and blockchain in one form or another include: Goldman Sachs, JP Morgan Chase, Morgan Stanley, Barclays, Rothschild Investment Corporation, Fidelity Investments, BlackRock, Paul Tudor Jones, Ray Dalio, George Soros, BNY Mellon, Bank of America, Standard Chartered, Mitsubishi UFJ Financial Group, Fenbushi Capital, Andreessen Horowitz, PayPal, Visa, Mastercard, Square/Twitter, Walmart, AMC… and let’s not forget Tesla.

This is tip-of-iceberg stuff – there are many more. Google? Apple? Nothing too FOMO-inducing just yet, but there have been some tentative toe-dipping and rumours. As for Facebook, it’s definitely interested – largely in its own thing, including metaversal moves, but it’s interested.

Not surprisingly, quite a change in tune from @jpmorgan. One by one….. https://t.co/HYmcQId4iX

— Henrik Andersson (@phenrikand) August 5, 2021

Australian institutional moves

In Australia, the institutional rush is perhaps yet to really kick into gear, but there are signs…

The leading managed fund performer for the 2021 financial year, for instance, was the Apollo Capital Fund, which is blockchain-focused and diversified across a variety of crypto assets.

It blew out of the water 9,000 or so other funds vying for top dog on the annual Morningstar performance table, returning almost 700% in the year to April 30, according to the Australian Financial Review.

And then there’s this news: Australian neobank Volt has joined forces with Melbourne-based digital asset exchange BTC Markets, in what’s believed to be a world-first partnership between a traditional regulated financial institution and a cryptocurrency platform.

Perhaps this is the spark the Australian crypto scene needs for greater institutional adoption. BTC Markets chief executive Caroline Bowler certainly believes it’s the start of something:

“Crypto in Australia – it’s gone from a standing start, from nothing, to where we are now, and the technology has gone along with it. This is the inflection point, the tipping point, where the whole thing is going to go gangbusters.”

The third big factor in crypto’s boom in 2020/21 has been the rise of decentralised finance (DeFi) – a suite of smart-contract-powered financial products and applications that attempt to improve upon, and disrupt, traditional financial services by operating without intermediaries.

Popular DeFi applications include decentralised exchanges (DEXs) and Automated Market Makers (AMMs) such as Uniswap and SushiSwap; lending and yield-farming platforms such as MakerDAO, Compound and Aave; derivatives liquidity protocols such as Synthetix; stablecoins such as USDT and USDC; and yield-farming optimisers such as yearn.finance.

DeFi’s Total Value Locked (TVL) metric saw a rise from less than $700 million in January 2020, to about US$20 billion by the end of that year, despite cooling off somewhat in August 2020. It’s been an incredible surge of use and users.

According to analytics platform DeFi Llama, the DeFi TVL figure now stands at more than US$206 billion. As long as the crypto market remains healthy, and unless regulators manage to significantly stifle the sector, this growth has strong potential to continue for quite some time yet.

Why DeFi?

The main drawcard of DeFi, for savvy investors and crypto degenerates alike, is clear. It’s the stupendously high levels of annualised percentage yield (APY) on offer. And this can be achieved through means of staking, yield farming and liquidity mining.

These are all ways of putting idle digital assets to work, and the returns can be extremely lucrative compared with traditional finance. In fact, in most cases it’s no contest. Large banks might earn you 0.01% to 0.25% annual interest at best, which simply can’t hold a green candle to the 20% or even 200% returns some DeFi protocols offer.

While the returns can be staggering, locking funds into DeFi comes with substantial risk, as this sector of crypto has had more than its fair share of hacks and exploits – with some protocols taking horrendous losses this year.

But that’s why the continued evolution of smart-contract-cover insurance projects such as Nexus Mutual are so important to a sector of finance that lacks the protection that regulated, traditional financial products receive.

(Note, we’re not forgetting the significance of the NFT boom, either. See further below.)

In March this year, Elon Musk, the enigmatic Tesla and SpaceX CEO, tweeted that Tesla vehicles could now be bought using Bitcoin. This came on the back of news that Tesla had invested US$1.5 billion into the OG crypto asset.

It sent an already thriving Bitcoin price soaring like a SpaceX rocket to its US$64K all-time high. The cryptoverse could barely contain its euphoria, with $100K+ price targets before the end of the year suddenly seeming conservative to many.

And then… Musk made another tweet. On May 13, he informed the crypto world he’d changed his mind on the whole Tesla-accepting-Bitcoin-as-payment thing due to environmental concerns based around excessive amounts of electricity being consumed by Bitcoin mining.

It’s a contentious point, as Bitcoin’s strongest proponents believe the majority of the original crypto is now mined using renewable energy – especially since China’s latest crackdown forced almost all crypto-business activities from the formerly proof-of-work, mining-dominant nation.

Nevertheless, the price of BTC consequently crashed by almost 50 per cent, bringing the rest of the crypto market down dramatically further in many instances. And this is despite the fact Musk, overall, has long held a positive view on the outlook for Bitcoin and crypto.

According to many technical analysts, however, the market was heading for a dip irrespective of Elon-induced FUD (Fear Uncertainty and Doubt). It was all apparently right there for anyone to see in the natural gravitational pull of the charts, the “Wyckoff patterns”, the “Pi Cycle Top” indicator, and probably the tea leaves, too.

One thing that Elon Musk doesn’t seem to waver on, however, is his love affair with Dogecoin (DOGE), which is also the beneficiary of wild price swings based on the whims of the billionaire and his thumbs.

This year, the Tesla CEO has made it clear in numerous tweets, interviews, and even a Saturday Night Live hosting appearance that DOGE is his favourite crypto. If only for the memes.

ur welcome pic.twitter.com/e2KF57KLxb

— Elon Musk (@elonmusk) February 4, 2021

On top of the Elon effect, China, previously one of the world’s biggest crypto markets, decided to get in on the buzzkill act in May and June by banning cryptocurrency mining in the country and restricting all crypto trading by its financial institutions and citizens.

This prompted a crypto mining-business exodus out of China, dispersing to neighbouring central Asian countries such as Kazakhstan and then on to North America. And it also triggered further crypto price stagnation, with Bitcoin dipping just under US$30K in mid July.

China then went a step further in September, announcing what is tantamount to a full-on ban for most crypto activities in the nation. That said, there have been some pretty clear signs that even a determined authoritarian state may never be able to completely control Bitcoin and crypto usage.

With surges in decentralised exchange usage since centralised crypto exchanges have ceased trading in China, it’s suspected many Chinese citizens are still finding ways to stay in the market.

Bitcoin and crypto have been recovering in stages since these bans and many crypto proponents believe there are net positives to be found in both the Elon-highlighted Bitcoin environmental concerns and even in the China crackdowns.

In the wake of the Chinese mining ban, for instance, MicroStrategy’s Michael Saylor and Elon Musk announced the formation of the Bitcoin Mining Council, which has a focus on pushing the crypto mining industry further into sustainable energy usage.

In fact, Elon Musk has said that if it can be proven that more than 50% of Bitcoin mining is achieved by renewable energy, then Tesla would begin accepting BTC as a payment method once again. According to Michael Saylor, that 50% was achieved some time ago, in the first half of 2021.

As for Chinese mining movements, the dispersing of mining activities away from the dominance of one economic region might be viewed as ultimately a good thing for bolstering the decentralisation of the Bitcoin network and effecting a fairer distribution of hashing power geographically.

As of September 7 2021, El Salvador has become the first country in the world to make Bitcoin legal tender, which can now be used as an option in addition to the country’s main currency – the US dollar.

The country’s president, Nayib Bukele, used the Bitcoin 2021 conference in Miami to announce this goal to the world via a video-recorded message in June. Politicians then put the bill to vote and the law was passed in double quick time, although not everyone in the country is happy about their president’s plan to turn El Salvador into a Bitcoin paradise.

Why has El Salvador done this? Probably the biggest reason is Bukele’s aim to independently stabilise his country’s economy, which has been at the mercy of the performance of a consistently weakening US dollar being printed to excessive levels by the US Federal Reserve.

🇸🇻Let that sink in for a second…

This Tuesday you will be able to buy a Big Mac at @McDonalds @McElSalvador with #Bitcoin in El Salvador

You'll be able to pay at @sheratonhotels for your room with #Bitcoin

And you'll be able to buy groceries at @Walmart with #Bitcoin pic.twitter.com/lklguBQpvc

— ₿itcoin Meme Hub 🔞 (@BitcoinMemeHub) September 6, 2021

Another motive reportedly stems from Bukele’s desire to “bank the unbanked” and increase financial inclusion for his citizens. El Salvador is a country where 70 per cent of the population has no access to banking or borrowing facilities. To quote a common crypto catch cry: “Bitcoin fixes this”.

And then there’s the fact that Bitcoin can completely cut out the extreme middleman (we’re looking at you, Western Union) fees for remittances. Financial service institutions take roughly a 30 per cent cut of cross-border money transfers from workers employed in, say the US, sending their funds back home to poorer countries. Bitcoin fixes this, too.

Other Latin American countries now looking to either follow El Salvador’s lead, or at least increase involvement with Bitcoin and cryptocurrencies, include Panama, Brazil, Argentina Paraguay, Uruguay and Colombia. The Pacific Islands nation Tonga is showing interest, too.

Venezuela, meanwhile has had a high usage of cryptocurrencies for some time. According to blockchain intelligence firm Chainalysis, the South American nation has one of the highest levels of everyday crypto usage in the world. This is due to hyperinflation pulverising its own national currency, the bolivar.

Following in China’s footsteps, several nations this year have been reportedly ramping up efforts to create guidelines for Central Bank Digital Currencies (CBDCs) in order to put them to trial before rollout.

Not to be confused with the digital currencies the majority of the crypto world covets, CBDCs are digital versions of nations’ national fiat currencies.

China is well ahead of the game here with the development of its digital yuan, which it has been gradually rolling out nationally in 2021.

There have been CBDC pilots in parts of Europe, such as France and Switzerland, and in the Bahamas this year as well. Most recently, Nigeria and Singapore have been making moves in this regard, too, with the latter shortlisting 15 “Global CBDC Challenge” participants to help build an in-house retail CBDC.

And Australia’s Reserve Bank is reportedly involved in a joint initiative called “Project Dunbar” with the central banks of Singapore, Malaysia and South Africa, to trial international settlements using CBDCs.

CBDCs, although seemingly inevitable, are generally treated with suspicion and scepticism from much of the libertarian, freedom-loving cryptoverse, or indeed with anyone who views them as a tool for further government control.

Telling that western developed countries are promoting control coin (CBDC) while 3rd world countries are promoting Bitcoin

— Dan Held (@danheld) June 9, 2021

Another narrative that’s come to the fore in 2021 is the increasing regulatory scrutiny on the crypto industry, particularly in America, the world’s leading economy.

Led by the US Securities and Exchange Commission and its Chairman Gary Gensler, regulators are now targeting almost every cryptocurrency except Bitcoin and have been asking politicians for more power to police and regulate the cryptocurrency industry in general, including DeFi.

Given the less-than-positive crypto stance of certain powerful politicians in the US, such as Democratic Senator Elizabeth Warren, and Treasury Secretary Janet Yellen, it would seem likely that the SEC will be granted certain regulatory powers it needs to try to keep on top of crypto and its users. All under the guise of investor protection.

The SEC contends that most cryptos should be classified as securities and therefore fall under its tight framework of regulation. The reason Bitcoin is excluded from this is because it does not have any single entity that is leading investors to expect profit from buying BTC. There is no third party involved with Bitcoin that can possibly be singled out to gain from investor profits.

The SEC vs XRP

A cryptocurrency such as XRP, on the other hand, could in theory be classified as a security simply because anyone invested in XRP is expecting profits based on the actions of Ripple Labs, the company behind XRP.

And, in fact, this is the subject of an ongoing lawsuit levelled at Ripple Labs by the SEC, which contends that the XRP founders broke the law by selling the asset without first registering it as a security.

Ripple Labs’ defence is based on its belief that it, and XRP, is sufficiently decentralised to not meet the SEC’s security criteria.

How this legal drama plays out is important to the future of the crypto space and will affect how every cryptocurrency is regulated and treated into the future. The lawsuit is not likely expected to reach a resolution, however, until sometime in early 2022.

Stablecoins in their sights

Senator Warren, meanwhile, has a bee in her pretty full bonnet about stablecoins, recently commenting in a New York Times interview that, in her view, “it’s worth considering” banning US banks from holding the reserves to back private stablecoins. A move that she believes “could effectively end the surging [stablecoin] market.”

Stablecoins have developed over the past two years as a hugely important and highly traded sector of cryptocurrency.

Pegged to external assets, such as the US dollar or a commodity such as gold, stablecoins effectively offer a solution to the volatility risk of cryptos, offering a fast and reliable option for traders and investors to move their crypto positions into “stable” digital assets with low volatility.

In mid-July, US Treasury Secretary Janet Yellen called on financial authorities to establish a proper regulatory framework for stablecoins.

The Australian regulatory landscape

Australia’s position on cryptocurrencies and blockchain technology meanwhile has, for the most part been pretty encouraging in the past couple of years.

The government has even committed significant funding towards innovation and growth in the space, with initiatives such as its Blockchain Pilot Grants as well as forking out $60 million worth of funding for the country’s Digital Finance Cooperative Research Centre.

And, while Steve Vallas, the head of the country’s peak crypto industry body Blockchain Australia, believes the government could be doing more to engage on the topic of regulatory clarity, Senate conversations at least seem to be attempting to find constructive paths ahead.

As it stands, crypto trading is legal within Australia and is subject to capital gains taxation (CGT), with various stipulations pertaining to staking, airdrops, mining and more.

Cryptocurrencies had previously been subject to a controversial double-taxation law in Australia, but the change in this policy shows the government’s overall progressive and adaptable approach to crypto so far.

CoinJar has put together an excellent, comprehensive guide to crypto taxation in Australia, which you can read here.

When it takes breaks from aping into animal-themed NFT avatars and pixelated punks, the crypto world still keeps half a concerned eye on exactly how the US plans to treat crypto regulations and taxation.

A controversial crypto-related amendment to the trillion-dollar US infrastructure bill has currently been pushed through the US Senate and is awaiting passage through the House of Representatives.

The TLDR on that is: if passed and signed off by President Biden, it’s an amendment that could place stifling taxation implications on the cryptocurrency industry in America due to its extremely vague classification of “crypto brokers”.

It could, for instance, make operating mining pools and DeFi protocols in the US untenable as collecting KYC (Know Your Customer) information on everyone the protocols interact with, would be virtually an impossible task.

The infrastructure bill is estimated to add another $256B to the federal budget deficit. It will not be fully paid for. The plunder of future generations continues. #Bitcoin fixes this. https://t.co/dsGsE8UUpf

— Cameron Winklevoss (@cameron) August 5, 2021

If the infrastructure bill passes as is, the crypto-related section could result in one big wet blanket being thrown over US-led innovation in the space. There are fears that it could force US crypto and blockchain businesses to relocate offshore to other countries, such as Singapore or Switzerland, and provide a major setback to the industry as a whole.

That said, as SEC commissioner Hester Peirce (aka “Crypto Mom”) hinted in early August, the best path forward for crypto projects in the US is to set up from inception as being truly decentralised – like Bitcoin.

“If you want to be decentralised, you really need to be decentralised,” Peirce told crypto media channel The Defiant. “That is going to put you in a different category from the perspective of regulators because that’s just not something we’ve dealt with before.”

One boost the SEC could actually give the crypto market, and potentially as early as this month, is the long-awaited approval of a Bitcoin ETF (Exchange Traded Fund) in the US.

A Bitcoin ETF might be seen as a coming-of-age moment for the cryptocurrency industry in the US. It could do wonders for the perception of Bitcoin and crypto as a legitimate investment, bringing a new level of mainstream trustworthiness, potentially instigating another new wave of money to flood into Bitcoin and, by proxy, the wider crypto market. Well, that’s the theory.

It seems, however, that although “physically backed” spot-market Bitcoin ETFs are operating in Canada and parts of Europe, the type of Bitcoin ETF likely to be approved in the US will initially be CME Futures-backed. At least, this is what market participants have taken from recent comments from SEC Chairman Gary Gensler regarding the matter.

This may not have the desired price-booming effect that many have been hoping for from a crypto ETF.

Physically-backed Bitcoin ETFs require the fund to buy the Bitcoin and store it with a custodian, removing it from circulation.

This would not be the case with a futures-backed Bitcoin ETF, which would be backed effectively by “IOU” agreements that don’t necessarily reflect the performance of the spot Bitcoin price.

That said, even a futures-backed Bitcoin ETF has potential to be a positive step forward for the cryptocurrency industry. And, according to some market participants, it may be a required one on the path to the eventual approval of a spot-backed product that the likes of ProShares, Valkyrie, Galaxy Digital, VanEck and many others crypto-investment players have been craving for a good couple of years now.

Irrespective of regulators muddying the waters in the US and elsewhere, there are many positive signs for the continued growth of the crypto industry globally, as it moves further into the mainstream.

Bitcoin’s case as an inflationary hedge and store of value continues to grow, particularly in countries affected by economic hardship.

Layer 1 blockchain projects such as Ethereum, Cardano, Solana, Avalanche and more are hitting important roadmap targets and are building momentum by the day.

Layer 2 scaling solutions for Ethereum, such as Arbitrum and Optimism are coming to the fore, strengthening its case further as the leading smart-contract platform and one of the most important pieces of infrastructure for the next generation of the internet.

And blockchain-based games are building strongly and could form the sector that truly brings mass-market adoption to crypto. Several influencers and notable crypto figures believe this, including Tron‘s Justin Sun, who said in late August: “GameFi is going to be the next big thing that makes the DeFi, NFT, and larger crypto space easy to understand and be involved in.”

You only need to look at the success of play-to-earn phenomenon Axie Infinity this year to understand where that could go. People in the Philippines, for example, have been giving up their day jobs to focus on grinding out gaming time on Axie Infinity, due to its potential to net them far more than an average salary.

And this is only the first major play-to-earn gaming cab off the rank, too. Others, such as the buzzy Star Atlas and Illuvium metaverse games have been attracting serious attention and investment, even in the early stages of their development.

Meanwhile, IDOs (Initial DEX Offerings) and launchpads have overtaken ICOs as the new way for fledgling crypto projects to hit the market and, like at the peak of the ICO boom/bubble, there are a spate of new tokens launching every week.

On top of all that, the NFT (non-fungible token) and DeFi sectors have been booming again in the latter half of 2021, too, in terms of volume traded and Total Value Locked respectively.

It’s enough to make any seasoned crypto veteran prettty wary, however, as we head towards the end of the year. Memories of the great crypto blow-off top of January 2018 and brutal bear market that followed still linger with long-term crypto investors.

The spike in sales of NFTs (nonfungible tokens) and NFT-related projects in 2021 has mirrored the DeFi mania of 2020 for its frenzy.

The year has seen eye-watering valuations and sales (notably Beeple’s piece Everyday: The First 5,000 Days, which sold through Christie’s in March for more than $US69 million), plus celebrities such as Jay-Z, Tom Brady, Snoop Dogg, Mike Tyson, Gary Vaynerchuk and countless more participating in NFT buying and trading.

Even Visa recently bought a CryptoPunk for US$150K, which is nothing compared to the millions of dollars some NFTs have been trading for.

But a question still worth posing is: after countless profile-pic avatars and generative AI art projects have flooded the market this year, causing Ethereum network clogging and surging gas fees… have we reached saturation point on NFTs?

Our answer is: like crypto in general, the NFT space will continue to innovate and surprise, will continue to expand into the mainstream and beyond Ethereum to other blockchains, as it’s been doing with Solana, and will likely continue to spew out crap and quality in near equal measures.

over the next few months, NFTs will likely get a ton of exposure

we'll see some huge, eye-watering sales getting media attention. we'll see the world learn about on-chain gen art, avatars, etc.

but many won't be able to buy

what will they buy instead? $ETH

you've been warned

— DCinvestor.eth ⌐◨-◨ (@iamDCinvestor) August 31, 2021

But, as a sub-section of crypto, it’s the view of many that NFTs will remain a powerful force within the space – especially as they continue to intertwine with the mass-market-attracting world of gaming, metaverse, sport, art, music and film.

As CurrencyWorks executive chairman Cameron Chell told Stockhead in August:

“I see [NFTs] as part of the blockchain revolution. So, like how email was the first killer application for the internet… for blockchain, the first killer app was cryptocurrencies. And I think the second killer app is NFTs in the form of digital collectibles.

“But NFTs will end up being much broader than that. They’ll drive down into contract management, legal documents and so much more – the sky’s the limit.”

While Stockhead isn’t in the habit of making $500K+ crypto predictions, a la Ark Invest CEO Cathie Wood, (at least not publicly), there are plenty of industry luminaries and influencers who regularly do…

Nigel Green, chief executive and founder of UAE-based deVere Group, for instance, has been pushing the case for the “Flippening”, which describes a hypothetical moment when the total market cap of Ethereum passes the total market cap of Bitcoin.

Pointing to a combination of Ethereum’s smart-contract utility, vast network effect, and 2.0 Proof-of-Stake upgrade set to come into effect in early 2022, Green recently commented:

“Ethereum is more useful than Bitcoin… Ultimately, this will mean its value will exceed that of Bitcoin – probably within five years.”

Adding further speculative weight to the Flippening narrative for Ethereum fans is something known as the “Triple Halving” – an extreme “supply shock” that will supposedly set in motion sell pressure for Ethereum that will be the equivalent to three Bitcoin halving events.

This seems aggressive:

I believe a $150,000 Ethereum price target is achievable by January 2023. I base this claim on the concept of ‘The Triple Halving.’ https://t.co/oNIftFNzRP

— zerohedge (@zerohedge) September 2, 2021

Ethereum’s gas-fee-burning protocol EIP-1559 implemented in August, combined with the merge to Ethereum 2.0 and the integration of scaling solutions such as Optimism and Arbitrum, are factors that could supposedly create the perfect storm for the Triple Halving and for Ethereum to become a truly deflationary asset.

Triple Halving$ETH will undergo a massive supply shock equivalent to a total of 3 halving events for $BTC

This is a 90% drop in sell pressure from miners thanks to changes to $ETH including POS, deflation, as well as liquidity

It will be known as the “triple halving” https://t.co/IuP2Ifgzz0 pic.twitter.com/G9SXmIzuiz

— 👨🍳.eth (@CroissantEth) July 18, 2021

As for specific Ethereum price predictions, a Finder panel of 27 experts gave their thoughts in July, with their resulting average price being US$4,596 per ETH by 31 December 2021.

Their average price for 2025 was US$17,810, and US$71,763 by the end of 2030.

If Flippenings, Triple Halvings and ETH in excess of US$70,000 sounds crazy bullish to you, check out one of the world’s biggest asset manager’s most recent ultimate Bitcoin price prediction.

Fidelity Investments has predicted a… wait for it… one billion dollar Bitcoin by 2038…

#bitcoin to a billion dollars per coin by 2038?

What are they smoking over at Fidelity?

I want some… https://t.co/XXtqDgo5C1— Lark Davis (@TheCryptoLark) September 1, 2021

Sure, that’s 17 years away, so maybe don’t go picking out the colour of your Lambo just yet, but it’s certainly the most outlandish long-term prediction we’ve seen to date.

It appears to be an extension of PlanB’s famed Stock to Flow (S2F) model that is often referenced within crypto and has so far proven pretty accurate.

#Bitcoin currently at $50,400

Baseline S2F forecast of $100K by Christmas still stands (or more precise: $100K average for this halving period 2020-2024)

On-chain (non-S2F) indicator shows no sign of a top yet (no red dots). This is in line with S2F forecast pic.twitter.com/1lGguuhyST

— PlanB (@100trillionUSD) September 5, 2021

If Bitcoin does continue to roughly follow the S2F model, it could mean a Bitcoin price in the vicinity of US$135,000 by the end of the year. And that’s something that looked close to being out of the question a few short months ago when the price was dipping below US$30K.

The crypto market loves a good prediction, though, and loves getting ahead of itself. At the time of writing Bitcoin is taking a shot at turning US$56K into support. It’s really not too far off it’s all-time high right now, but there’s still a way to go to hit the magical US$100K mark.

We certainly wouldn’t want to bet against it, or PlanB’s model, for that matter.

As previously mentioned, there are more than 9,600 cryptocurrency projects to look into if you have a spare hundred hours or so up your sleeve to scroll through CoinGecko or CoinMarketCap.

With good fundamental research, you might even find the odd low, or even micro market-cap gem within those lists. Here, however, is a selection of some of the more well-established cryptocurrencies and their historical price charts.

Bitcoin (BTC) #1

The original cryptocurrency – a peer-to-peer network of nodes that maintain a blockchain-based distributed ledger of BTC balances. Established in 2009, Bitcoin pioneered the Proof-of-Work (PoW) technology for reaching consensus on a decentralised network. Bitcoin is considered a “store of value” by its proponents.

Ethereum (ETH) #2

An open-source, decentralised, blockchain infrastructure transitioning from a Proof-of-Work protocol to Proof-of-Stake. Launched in 2015, Ethereum has become a vast ecosystem of interoperable decentralised applications (dApps) powered by automated smart contracts. Ethereum is the no.2 crypto by market cap, and is hugely important to the industry for its innovation, which includes helping to spawn DeFi, stablecoins and NFTs.

Cardano (ADA) #3

Number three by market-cap, Cardano is a Proof-of-Stake smart-contract platform competitor to the more widely used Ethereum. Built from the ground up by Charles Hoskinson’s IOHK company, the project is notable for its academic and peer-reviewed approach to development.

Bitcoin Cash (BCH) #19

Don’t make the mistake that this is Bitcoin. BCH is a “hard fork” of the Bitcoin network and a completely different crypto in its own right. It pitches itself as a more practical, transactional cryptocurrency than BTC.

Litecoin (LTC) #13

Introduced in 2011 by Charlie Lee, Litecoin is forked from Bitcoin’s code but is optimised for lower cost transactions. Along with Bitcoin, Ethereum and Bitcoin Cash, it is one of the cryptocurrencies so far favoured for transactional usage on PayPal.

Solana (SOL) #7

Solana is a high-performance, high-speed Proof-of-History smart-contract blockchain that aims to solve many of the scaling and congestion issues potentially faced by other networks. Solana began gaining traction and high volume of usage in July and August, especially in the realm of NFTs, offering a cheaper and faster transactional alternative to Ethereum.

Polkadot (DOT) #8

Polkadot is a Nominated-Proof-of-Stake (NPoS) smart-contract blockchain protocol founded by former Ethereum co-founder Dr Gavin Wood. One of its core aims is to allow independent blockchain networks to connect and transfer data through cross-chain interoperability.

Avalanche (AVAX) #15

Avalanche self describes as “the fastest smart contracts platform in the blockchain industry, as measured by time-to-finality, and has the most validators securing its activity of any proof-of-stake protocol.”

Uniswap (UNI) #12

A decentralized exchange (DEX) and Automated Market Maker (AMM) that is used to exchange cryptocurrencies on the Ethereum blockchain through the use of smart contracts and without centralised intermediaries.

Polygon (MATIC) #21

Polygon, formerly known as the Matic Network, is an Ethereum-based scaling solution and sidechain framework for building and connecting Ethereum-compatible blockchain networks.

Aave (AAVE) #45

A DeFi “blue chip” coin, Aave is a decentralised lending and borrowing platform built on Ethereum. Users can take out loans by providing crypto asset collateral. Lenders who provide collateral to Aave receive aTokens, which pay interest to the holder with funds earned from platform trading fees.

Synthetix (SNX) #89

Synthetix is a DeFi protocol and token-trading platform built on Ethereum that allows users to exchange tokenised “synthetic” representations and derivatives of cryptocurrencies, stocks, currencies, precious metals, and other assets in the form of ERC-20 (Ethereum-based) tokens.

The Graph (GRT) #50

The Graph is an open-source protocol designed to index and query data from blockchains to facilitate information retrieval. In simple terms, it’s sometimes referred to as “Google for blockchain”. Its native cryptocurrency, GRT, is a utility token used to ensure the integrity of the stored data and reward the network’s indexer, curator and delegator participants.

Axie Infinity (AXS) #28

A metaverse crypto in which players collect and breed digital pets called Axies that can be used to compete in a turn-based battler game. Axies can also be bred and sold.

XRP (XRP) #6

A cryptocurrency created by Ripple Labs, designed primarily as a medium of exchange and a low-cost bridge between fiat currencies for a range of fast and seamless global transactions.

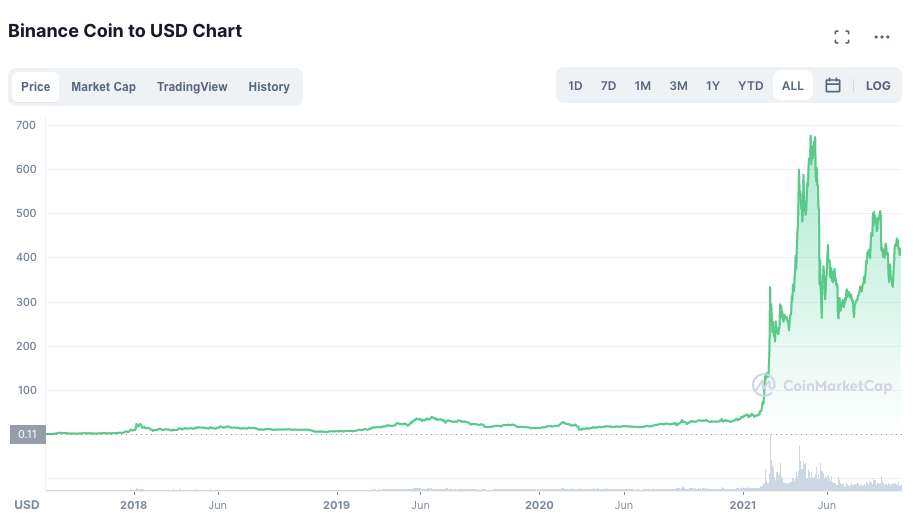

Binance Coin (BNB) #4

The native cryptocurrency of the Binance Smart Chain (BSC) smart-contract blockchain ecosystem and, at the time of writing, a top 5 crypto by market capitalisation.

Chainlink (LINK) #18

A decentralised “oracle” network that provides real-world data to smart contracts on the blockchain. There are other oracles, but LINK is important as it is the first innovator in this area of crypto/blockchain and, like Ethereum has the “network effect” as the most widely used.

Dogecoin (DOGE) #10

A crypto “memecoin” that began life as a joke in 2013, but, incredibly, is now a top 10 crypto by market cap and a pet project of Elon Musk. It’s based on a Shiba Inu dog meme that was initially popular around the time of the crypto’s creation. Dogecoin was forked from something called Lucky Coin, which was forked from Litecoin, which was forked from Bitcoin. A fair bit of forking around going on there.