Crypto: Bitcoin breaches $58k, Ethereum at key level, Polkadot nears important milestone

Coinhead

Coinhead

Bitcoin has breached US$58,000 for the first time since the May crash – and a top Aussie crypto analyst says Ethereum is at a key inflection point on the trading charts.

“Ethereum is eyeing significant resistance [at] US$3,680/US$$3,700 this morning,” City Index analyst Tony Sycamore told Stockhead.

“If it can make a sustained break above this resistance I think it’s set to take another leg higher and retest/break the Sep $4025 high.”

At 12.18am AEST, Ether was trading at US$3,623, up 3.3 per cent from yesterday. A little earlier this morning it had hit a five-day high of US$3,626.

Meanwhile Bitcoin was changing hands for US$58,207, up 3.3 per cent from yesterday.

Sycamore is expecting the original cryptocurrency to retest its all-time high near $65,000. “I would only reconsider the bullish view if Bitcoin were to break below and close below $50,000,” he wrote in his morning brief.

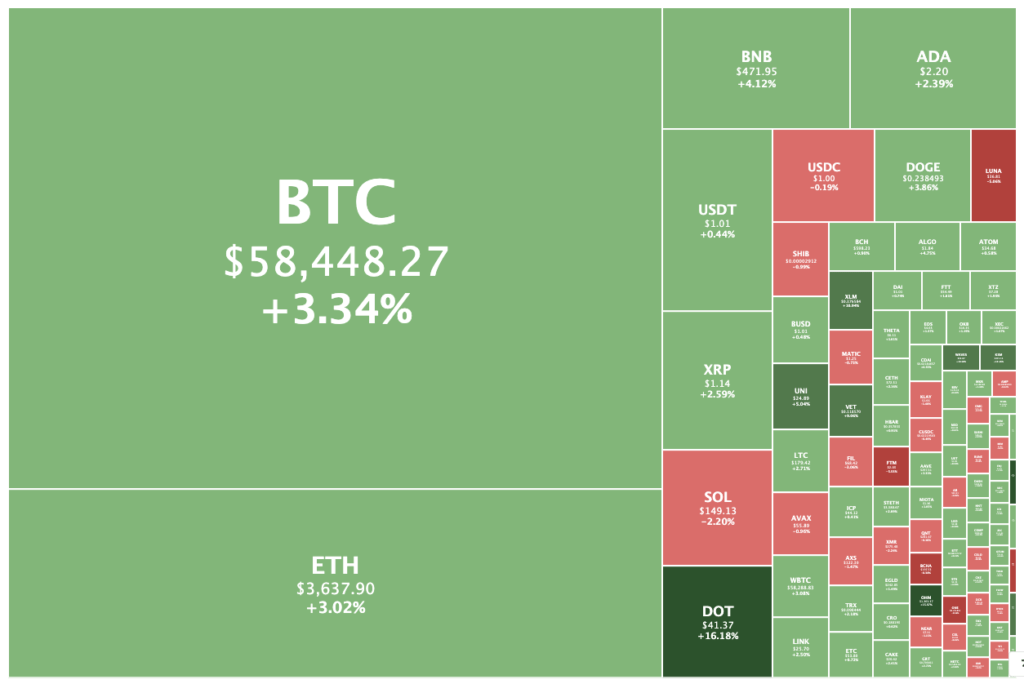

Overall the total crypto market was at over US$2.4 trillion (just) for the first time since May, according to Tradingview.

Most cryptos were in the green.

At noon (Sydney time) remittance crypto Telcoin was the biggest gainer in the top 100, up 18 per cent from yesterday.

Polkadot, the No. 8 crypto, was the second-biggest gainer, rising 14.8 per cent to US$40.95 as it reached a key milestone.

Founders Gavin Wood and Robert Habermeier have proposed finally holding parachain auctions, which would fulfil their vision of an interoperable “blockchain of blockchains” they outlined almost exactly five years ago.

The auctions are set to begin November 11, with projects competing against one another in a crowd-loan process to see which will be the first to gain slots in the network. Supporters will loan their DOT tokens to a project for nearly two years, in return for project tokens.

The proposal to begin the auctions is expected to pass overwhelmingly – voting is currently at 31.8 million in favour to just 122 against.

Meanwhile, Aussie-based institutional lending project Maple Finance has continued its pump, currently trading at US$33.20, up 35.5 per cent from 24 hours ago, and had reached an all-time peak of US$37.59 yesterday.

When Stockhead covered the surging crypto yesterday afternoon, it was trading at a record of $27.71.

Maple co-founder Sidney Powell told Stockhead the price action likely had to do with the Melbourne-headquartered project announcing its total value locked had reached US$217 million, up from $17m in May.