High Voltage: This is how a Biden win sparks US electric vehicle demand

Mining

Mining

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, and vanadium.

The pandemic has impacted 2020 electric vehicle sales, but will almost certainly create a more supportive EV policy and incentive environment going forward.

Sentiment is slowly recovering and battery metals stocks are beginning to find favour with investors once again.

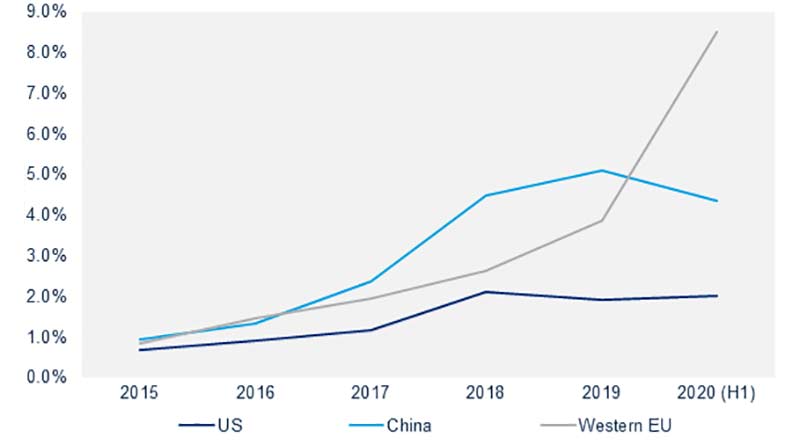

One of the world’s biggest car markets, Europe, is hellbent on fast-tracking the nascent electric vehicle ramp up as part of its economic recovery from the pandemic.

This includes building its own raw material supply chains –which is great news for Europe-focused battery metals stocks like European Metals (ASX:EMH), Talga Resources (ASX:TLG), Mineral Commodities (ASX:MRC), Vulcan Energy (ASX:VUL) and Infinity Lithium (ASX:INF), just to name a few.

Now the US – which has been an EV laggard thus far – could receive a big shot in the arm if Biden beats Trump in the upcoming US Presidential Election.

To encourage EV adoption, the Biden campaign has three key targets: deploy 500,000 new public EV charging outlets, restore the full EV tax credit, and develop a new fuel economy target.

The current tax credit system is capped at the first 200,000 vehicles sold by a manufacturer. Wood Mackenzie believes the Biden campaign’s promise to restore the full tax credit would mean increasing the cap to 600,000.

Increasing the cap to 600,000 would positively impact over 7.5 million new EV sales, whereas the current cap helps only 2.2 million EVs, Wood Mackenzie principal analyst Ram Chandrasekaran says.

“A cap change for the tax credit system would certainly boost the share of EVs in the US for the next four to five years,” Chandrasekaran said.

But the most impactful policy change for EV adoption would be increasing federal fuel economy targets.

A recent Trump administration directive reduced fuel economy targets from 5 per cent to 1.5 per cent improvement annually.

Passing stricter emissions regulations would push US EV sales over the 4 million per annum mark by 2030 – 50 per cent higher than Wood Mackenzie’s base case projection.

This approach has already been evidenced in other global markets like Europe, Chandrasekaran says.

“Setting a target at an automaker fleet level forces the automaker to manufacture more efficient cars,” he says.

“Automakers would also be required to spend more money on effective marketing campaigns and automaker-provided subsidies.”

Here’s how a basket of 68 ASX stocks with exposure to lithium, cobalt, graphite, and vanadium are performing>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | NAME | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE [INTRADAY WED] | MARKET CAP |

|---|---|---|---|---|---|---|

| ADV | ARDIDEN | 79 | 733 | 614 | 0.024 | $ 54,084,860.00 |

| RLC | REEDY LAGOON | 40 | 600 | 250 | 0.014 | $ 6,576,273.00 |

| SVD | SCANDIVANADIUM | 3 | 429 | 270 | 0.036 | $ 18,470,380.00 |

| TKL | TRAKA RESOURCES | -15 | 344 | 85 | 0.022 | $ 9,767,657.00 |

| VUL | VULCAN ENERGY RESOURCES | 47 | 305 | 467 | 0.9 | $ 51,028,220.00 |

| MLL | MALI LITHIUM | 22 | 171 | 79 | 0.17 | $ 61,882,880.00 |

| AXE | ARCHER MATERIALS | 28 | 170 | 285 | 0.495 | $ 104,324,992.00 |

| ARR | AMERICAN RARE EARTHS | 0 | 154 | 57 | 0.034 | $ 9,309,427.00 |

| CNJ | CONICO | 7 | 150 | 50 | 0.015 | $ 7,367,933.50 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | -11 | 150 | 18 | 0.195 | $ 142,976,336.00 |

| PUR | PURSUIT MINERALS | -6 | 143 | 55 | 0.017 | $ 7,016,483.50 |

| TMT | TECHNOLOGY METALS AUSTRALIA | 12 | 124 | 12 | 0.19 | $ 23,370,000.00 |

| CLA | CELSIUS RESOURCES | -5 | 122 | 11 | 0.02 | $ 14,824,144.00 |

| CLQ | CLEAN TEQ | 126 | 108 | 17 | 0.35 | $ 227,670,368.00 |

| LML | LINCOLN MINERALS | 14 | 100 | 60 | 0.008 | $ 4,024,885.75 |

| EMH | EUROPEAN METALS | 37 | 86 | 44 | 0.41 | $ 72,193,992.00 |

| TON | TRITON MINERALS | -11 | 85 | 25 | 0.05 | $ 60,126,296.00 |

| MIN | MINERAL RESOURCES | 3 | 81 | 113 | 27.645 | $ 5,365,735,936.00 |

| INF | INFINITY LITHIUM | -11 | 77 | 20 | 0.097 | $ 18,818,592.00 |

| TLG | TALGA RESOURCES | 26 | 61 | 57 | 0.625 | $ 166,394,656.00 |

| VRC | VOLT RESOURCES | -16 | 60 | 24 | 0.016 | $ 32,328,886.00 |

| GXY | GALAXY RESOURCES | 7 | 55 | 23 | 1.385 | $ 556,891,904.00 |

| VR8 | VANADIUM RESOURCES | 4 | 50 | -54 | 0.027 | $ 10,854,046.00 |

| ARL | ARDEA RESOURCES | -10 | 46 | 3 | 0.55 | $ 68,620,752.00 |

| AUZ | AUSTRALIAN MINES | -20 | 45 | -43 | 0.0155 | $ 63,383,260.00 |

| GED | GOLDEN DEEPS | 7 | 45 | -30 | 0.016 | $ 7,538,170.00 |

| LTR | LIONTOWN RESOURCES | 33 | 45 | 86 | 0.16 | $ 267,304,720.00 |

| PLS | PILBARA MINERALS | -16 | 44 | 5 | 0.345 | $ 756,410,752.00 |

| EGR | ECOGRAF | 13 | 38 | -24 | 0.08 | $ 29,482,928.00 |

| BKT | BLACK ROCK MINING | -12 | 38 | -18 | 0.052 | $ 38,758,656.00 |

| RNU | RENASCOR RESOURCES | -25 | 33 | -25 | 0.012 | $ 16,016,369.00 |

| MLS | METALS AUSTRALIA | -33 | 33 | 0 | 0.002 | $ 10,945,058.00 |

| AML | AEON METALS | -9 | 32 | 4 | 0.145 | $ 103,750,456.00 |

| JRL | JINDALEE RESOURCES | 19 | 30 | 28 | 0.41 | $ 15,932,977.00 |

| BAR | BARRA RESOURCES | -4 | 28 | 5 | 0.023 | $ 13,719,862.00 |

| CZN | CORAZON MINING | 20 | 24 | 3 | 0.003 | $ 8,133,398.00 |

| JRV | JERVOIS MINING | 0 | 23 | 16 | 0.295 | $ 189,806,704.00 |

| PM1 | PURE MINERALS | 0 | 20 | 0 | 0.018 | $ 11,935,264.00 |

| PSC | PROSPECT RESOURCES | 10 | 18 | 53 | 0.165 | $ 48,609,208.00 |

| AVL | AUSTRALIAN VANADIUM | 8 | 18 | -7 | 0.015 | $ 33,362,196.00 |

| AJM | ALTURA MINING | 0 | 13 | 4 | 0.07 | $ 209,037,024.00 |

| SYR | SYRAH RESOURCES | 4 | 12 | -42 | 0.4 | $ 161,794,736.00 |

| MVL | MARVEL GOLD | -13 | 11 | -56 | 0.052 | $ 20,682,202.00 |

| CXO | CORE LITHIUM | -15 | 11 | 3 | 0.039 | $ 38,778,884.00 |

| LIT | LITHIUM AUSTRALIA | -19 | 10 | 15 | 0.053 | $ 38,999,812.00 |

| TNG | TNG | 5 | 9 | -6 | 0.085 | $ 92,212,704.00 |

| BEM | BLACKEARTH MINERALS | -17 | 9 | -36 | 0.038 | $ 4,318,910.00 |

| WKT | WALKABOUT RESOURCES | 14 | 8 | -13 | 0.205 | $ 68,081,064.00 |

| ORE | OROCOBRE | -17 | 2 | 6 | 2.61 | $ 893,088,448.00 |

| NMT | NEOMETALS | -3 | -1 | 7 | 0.175 | $ 95,436,472.00 |

| LKE | LAKE RESOURCES | 0 | -3 | -20 | 0.035 | $ 26,422,374.00 |

| HIP | HIPO RESOURCES | -18 | -7 | 75 | 0.014 | $ 6,196,433.00 |

| FGR | FIRST GRAPHENE | 9 | -7 | -34 | 0.125 | $ 68,340,216.00 |

| PLL | PIEDMONT LITHIUM | -8 | -8 | -16 | 0.0875 | $ 101,668,176.00 |

| AVZ | AVZ MINERALS | -5 | -9 | 22 | 0.06 | $ 167,471,408.00 |

| SYA | SAYONA MINING | 0 | -10 | 0 | 0.009 | $ 25,588,722.00 |

| COB | COBALT BLUE | -4 | -17 | -48 | 0.096 | $ 18,779,474.00 |

| AGY | ARGOSY MINERALS | -16 | -17 | -39 | 0.049 | $ 47,916,600.00 |

| GME | GME RESOURCES | 3 | -19 | -42 | 0.037 | $ 20,047,210.00 |

| ESS | ESSENTIAL METALS | -3 | -26 | -56 | 0.096 | $ 14,635,013.00 |

| BSM | BASS METALS | 17 | -30 | -56 | 0.0035 | $ 10,445,027.00 |

| LPI | LITHIUM POWER INTERNATIONAL | -16 | -30 | -58 | 0.155 | $ 42,082,224.00 |

| ASN | ANSON RESOURCES | -3 | -34 | -49 | 0.018 | $ 14,885,570.00 |

| LPD | LEPIDICO | -22 | -36 | -65 | 0.007 | $ 38,893,012.00 |

| INR | IONEER | -18 | -36 | -34 | 0.099 | $ 168,191,296.00 |

| EUR | EUROPEAN LITHIUM | 7 | -37 | -43 | 0.047 | $ 31,441,114.00 |

| GLN | GALAN LITHIUM | -13 | -43 | -33 | 0.145 | $ 25,529,276.00 |

| MRC | MINERAL COMMODITIES | 4 | 49 | 21 | 0.26 | $ 118,320,000.00 |

“We are sitting at the foot of an enormous wave that is gathering momentum,” CleanTeq chairman Robert Friedland said late August.

“The transition to cleaner and more efficient forms of energy is inexorable.”

But for now, he says, the market “fails to comprehend the strategic significance” of assets like the company’s $US1.99bn ($2.8bn) Sunrise nickel-cobalt development in NSW.

The company still managed to make substantial gains over the past month after completing a desalination plant (the other part of its business) at the Fosterville gold mine in Victoria, and then again when it unveiled a substantial platinum resource at Sunrise.

Vulcan Energy Resources (ASX:VUL)

Vulcan has been a standout performer over the past 12 months, up 467 per cent.

The company recently kicked off a project pre-feasibility study on its unique, very large lithium-rich geothermal brine project in Germany, which it aims to complete by the end of the year.

Vulcan has also bolstered its leadership team with the appointment of former non-exec director Dr Katharina Gerber — a geothermal lithium expert — to the hands-on position of project manager.

Europe-based lithium industry expert Vincent Ledoux-Pedailles also joins the team as vice president of business development.

European Metals is another advanced stock riding the EU battery wave.

It’s flagship project is Cinovec in the Czech Republic — the largest hard rock lithium deposit in Europe — where it recently kicked off advanced resource drilling.

“The aim of the campaign is to convert the initial years mining into proven reserves category,” executive chairman Keith Coughlan says.

“Following consultations with potential lenders, we expect that this will assist greatly in the securing of more attractive debt finance for the project once we enter that stage of operations.”

European battery anode and graphene company Talga has also performed solidly over the past 12 months.

In August, the company raised $10m in a placement which received applications “well in excess of the amount sought to be raised”.

This reflects significant investor interest as development of its integrated graphite anode facility in Sweden progresses, Talga says.

“This strategically sized placement will enable Talga to execute the next steps in building it’s Li-ion anode production facilities in Europe, while maintaining a tight capital structure to provide shareholders best leverage to project success,” managing director Mark Thompson says.

“The raising also strengthens our position as we enter deeper finance discussions with multiple potential project partners.”

At Stockhead, we tell it like it is. While Talga Resources is a Stockhead advertiser, it did not sponsor this article.