High Voltage: Battery metals price rally to be ‘higher and longer’ as project delays pile up

(Pic: Getty Images)

Each fortnight our High Voltage column wraps all the news driving ASX battery metals stocks with exposure to lithium, cobalt, graphite, and vanadium.

Big project deferrals will just amplify the size and length of a lithium price rebound in ~2023 when supply struggles to maintain pace with battery demand growth, Benchmark says.

The coronavirus pandemic has disrupted almost every global supply chain in the truest sense of the word.

For the embryonic lithium-ion supply chain – which is truly global – that disruption has been most pronounced, says Benchmark Minerals Intelligence. It’s going to be a disappointing 2020.

“What had been marked as a year that would take us into a new generation of EV expansions, now faces a more uncertain future – at least in the short-term,” Benchmark analyst George Miller says.

“Almost every section of this supply chain has been impacted in different ways, and to different extents. Those which have not will undoubtedly feel the effects in Q2.”

READ: The outlook for lithium demand in 2020 is looking pretty bleak, Orocobre reports

Benchmark now forecasts a lithium market surplus through to 2023; but then comes the sustained rally in pricing.

Miller says this rally will now be higher and longer as this prolonged period of low pricing impacts “availability of capital into the sector over the medium term”.

Even prior to the pandemic, lithium producers were ‘girding their loins’ by deferring unnecessary expenditure. That meant delaying production expansions.

“These [current] pressures will only serve to prolong a period of low-pricing and negative sentiment, that will put more obstacles in the way of developing new projects and increase the risk of supply chain bottlenecks in the years to come,” he says.

As challenging as it is, COVID-19 is an “anomalous event” which will not stop EV adoption in the medium to long term, says Wood Mackenzie.

“Automakers haven’t changed their carbon-neutral goals and we don’t expect governments to defer or cancel policies designed to phase out internal combustion engine (ICE) vehicles,” Wood Mac says.

“And while it’s tempting to think that the oil price crash is bad news for EV adoption, in reality the purchase price, charging infrastructure and available models currently have a much greater impact on sales.”

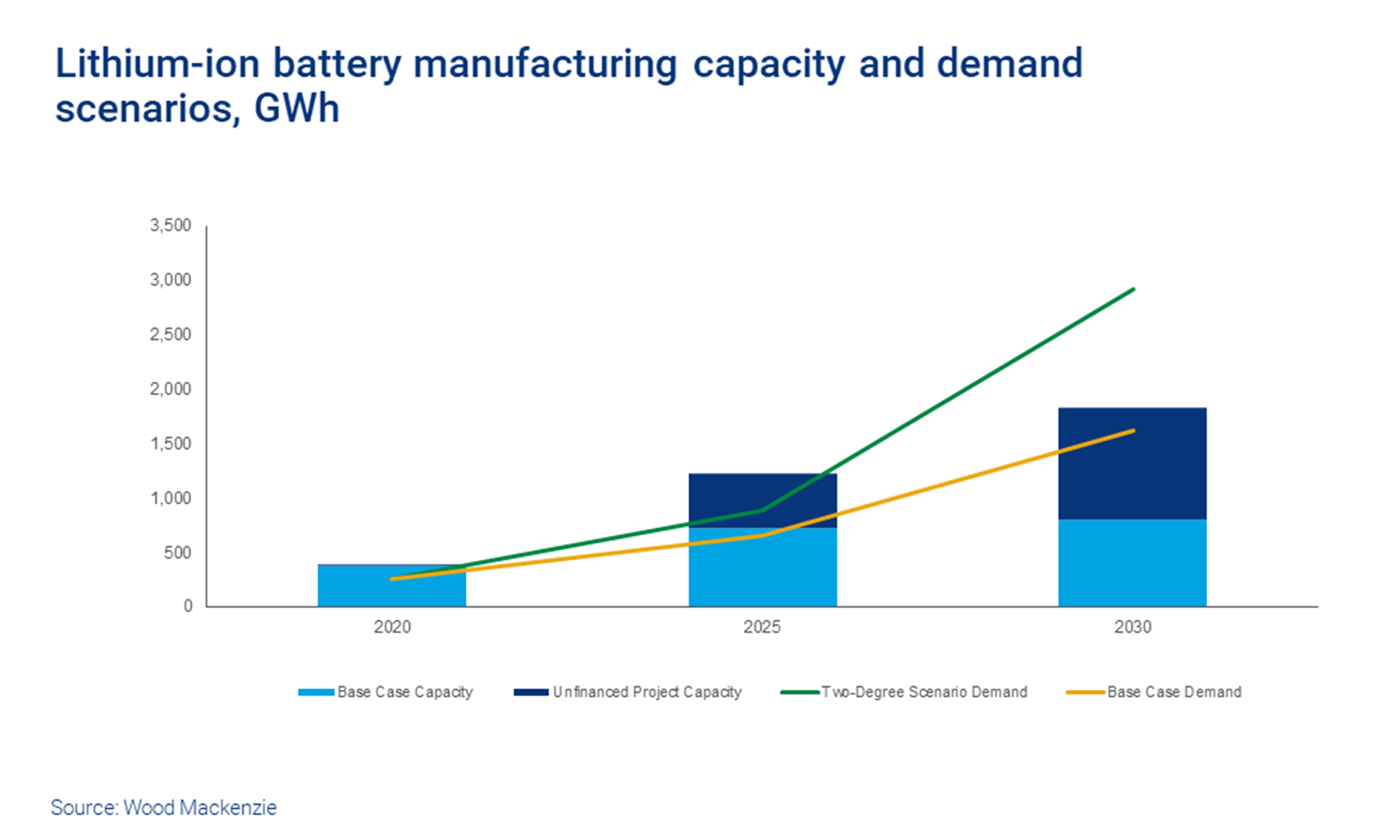

For a sense of the potential demand, under the Wood Mackenzie 2°C pathway battery manufacturing capacity must grow 10-fold to just under 3,000 gigawatt hours (GWh) in 2030.

If all currently planned manufacturing plants are constructed on schedule (“a big if,” Wood Mac says) the industry will still only grow to around 1,800GWh by 2030.

Less than half this 1,800GWh capacity has been financed right now which is where some fundamental issues emerge.

“Take the raw materials required for battery production,” Wood Mac says.

“The nickel industry would need to double, cobalt supply would need to grow five times its current size while lithium would need to [grow] nearly 12 times to meet the requisite demand.

“The lithium industry must add capacity equivalent to the size of the entire industry in 2019 every year for the next decade.

“Meanwhile, the nickel industry alone would require over US$100bn investment to build new capacity.”

For the next crop of producers that’s great news.

SMALL CAP FOCUS

Here’s a table of ASX battery metal stocks with exposure to lithium, cobalt, graphite, and vanadium>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop:

| CODE | NAME | SHARE PRICE [Intraday April 30] | TOTAL FORTNIGHTLY RETURN % | TOTAL YEARLY RETURN % | MARKET CAP |

|---|---|---|---|---|---|

| SVD | SCANDIVANADIUM | 0.007 | 150 | -42 | $ 3,518,661.00 |

| AML | AEON METALS | 0.094 | 78 | -57 | $ 65,046,692.00 |

| TMT | TECHNOLOGY METALS AUSTRALIA | 0.135 | 71 | -29 | $ 12,828,805.00 |

| BSM | BASS METALS | 0.004 | 67 | -56 | $ 14,049,373.00 |

| MLL | MALI LITHIUM | 0.07 | 56 | -50 | $ 22,214,368.00 |

| LML | LINCOLN MINERALS | 0.006 | 50 | 0 | $ 3,449,902.00 |

| CZN | CORAZON MINING | 0.003 | 50 | 0 | $ 7,229,688.00 |

| VR8 | VANADIUM RESOURCES | 0.018 | 42 | -82 | $ 6,362,716.50 |

| PIO | PIONEER RESOURCES | 0.013 | 40 | 0 | $ 21,122,622.00 |

| ADV | ARDIDEN | 0.004 | 33 | 33 | $ 7,154,081.00 |

| EMH | EUROPEAN METALS | 0.22 | 33 | -46 | $ 25,797,186.00 |

| TON | TRITON MINERALS | 0.03 | 26 | -32 | $ 32,899,202.00 |

| WKT | WALKABOUT RESOURCES | 0.15 | 16 | -38 | $ 50,624,380.00 |

| LTR | LIONTOWN RESOURCES | 0.105 | 15 | 289 | $ 177,868,448.00 |

| JRV | JERVOIS MINING | 0.195 | 15 | -22 | $ 121,910,208.00 |

| BKT | BLACK ROCK MINING | 0.033 | 14 | -56 | $ 20,755,142.00 |

| INR | IONEER | 0.1425 | 13 | -27 | $ 218,384,816.00 |

| AVL | AUSTRALIAN VANADIUM | 0.009 | 13 | -53 | $ 23,051,906.00 |

| AXE | ARCHER MATERIALS | 0.185 | 9 | 140 | $ 38,235,524.00 |

| TLG | TALGA RESOURCES | 0.34 | 9 | -52 | $ 75,531,232.00 |

| PLL | PIEDMONT LITHIUM | 0.091 | 9 | -30 | $ 71,889,856.00 |

| CLQ | CLEAN TEQ HOLDINGS | 0.205 | 5 | -34 | $ 145,559,744.00 |

| AJM | ALTURA MINING | 0.049 | 4 | -53 | $ 127,500,360.00 |

| TNG | TNG | 0.062 | 4 | -48 | $ 64,099,072.00 |

| NMT | NEOMETALS | 0.165 | 3 | -7 | $ 87,122,704.00 |

| LKE | LAKE RESOURCES | 0.04 | 3 | -17 | $ 25,515,554.00 |

| AGY | ARGOSY MINERALS | 0.044 | 0 | -40 | $ 40,780,084.00 |

| EUR | EUROPEAN LITHIUM | 0.046 | 0 | -56 | $ 29,204,984.00 |

| AEE | AURA ENERGY | 0.003 | 0 | -70 | $ 5,960,316.50 |

| BAR | BARRA RESOURCES | 0.019 | 0 | -34 | $ 8,351,220.50 |

| CLA | CELSIUS RESOURCES | 0.01 | 0 | -38 | $ 7,572,181.00 |

| PUR | PURSUIT MINERALS | 0.004 | 0 | -83 | $ 1,412,937.25 |

| PM1 | PURE MINERALS | 0.011 | 0 | -15 | $ 6,557,889.50 |

| MLS | METALS AUSTRALIA | 0.001 | 0 | -33 | $ 3,207,352.75 |

| GME | GME RESOURCES | 0.04 | 0 | -25 | $ 20,249,716.00 |

| JRL | JINDALEE RESOURCES | 0.32 | 0 | 5 | $ 12,318,161.00 |

| TKL | TRAKA RESOURCES | 0.004 | 0 | -71 | $ 1,601,851.88 |

| RLC | REEDY LAGOON | 0.002 | 0 | -60 | $ 804,543.44 |

| MIN | MINERAL RESOURCES | 16.6 | -1 | 10 | $ 3,058,865,408.00 |

| AVZ | AVZ MINERALS | 0.059 | -2 | 48 | $ 142,200,384.00 |

| GLN | GALAN LITHIUM | 0.155 | -3 | -40 | $ 25,531,460.00 |

| ORE | OROCOBRE | 2.21 | -3 | -34 | $ 590,206,656.00 |

| SYR | SYRAH RESOURCES | 0.235 | -4 | -78 | $ 95,348,704.00 |

| EGR | ECOGRAF | 0.063 | -5 | -48 | $ 19,385,966.00 |

| INF | INFINITY LITHIUM | 0.035 | -5 | -59 | $ 8,356,855.00 |

| GXY | GALAXY RESOURCES | 0.76 | -6 | -48 | $ 303,014,720.00 |

| BPL | BROKEN HILL PROSPECTING | 0.014 | -7 | -12 | $ 3,562,046.00 |

| PLS | PILBARA MINERALS | 0.2125 | -7 | -65 | $ 466,977,920.00 |

| CXO | CORE LITHIUM | 0.041 | -7 | -2 | $ 31,700,980.00 |

| FGR | FIRST GRAPHENE | 0.135 | -7 | -25 | $ 61,759,112.00 |

| ARL | ARDEA RESOURCES | 0.265 | -9 | -26 | $ 29,325,108.00 |

| COB | COBALT BLUE | 0.14 | -10 | 3 | $ 20,792,344.00 |

| MNS | MAGNIS ENERGY TECHNOLOGIES | 0.05 | -12 | -81 | $ 32,250,312.00 |

| VUL | VULCAN ENERGY RESOURCES | 0.21 | -13 | 31 | $ 11,270,700.00 |

| SYA | SAYONA MINING | 0.008 | -13 | -43 | $ 17,282,710.00 |

| CNJ | CONICO | 0.006 | -14 | -59 | $ 2,306,389.25 |

| LIT | LITHIUM AUSTRALIA | 0.046 | -17 | -40 | $ 26,499,882.00 |

| VRC | VOLT RESOURCES | 0.005 | -17 | -75 | $ 8,694,184.00 |

| AUZ | AUSTRALIAN MINES | 0.0095 | -18 | -59 | $ 32,633,932.00 |

| BEM | BLACKEARTH MINERALS | 0.029 | -19 | -52 | $ 3,409,665.75 |

| ASN | ANSON RESOURCES | 0.017 | -19 | -75 | $ 10,199,350.00 |

| LPI | LITHIUM POWER INTERNATIONAL | 0.135 | -21 | -41 | $ 35,506,876.00 |

| HIP | HIPO RESOURCES | 0.01 | -23 | 0 | $ 3,865,104.50 |

| RNU | RENASCOR RESOURCES | 0.007 | -25 | -67 | $ 7,908,909.50 |

| GED | GOLDEN DEEPS | 0.005 | -29 | -82 | $ 1,403,042.75 |

| PSC | PROSPECT RESOURCES | 0.09 | -35 | -44 | $ 23,331,216.00 |

| LPD | LEPIDICO | 0.0075 | -41 | -79 | $ 32,950,530.00 |

| GPX | GRAPHEX MINING | 0.039 | -48 | -82.2727 | $ 4,485,450.50 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.