European Investment Bank signals $825m in funding for Vulcan Energy’s Zero Carbon Lithium project

The EIB has signalled project backing of Vulcan Energy’s Zero Carbon Lithium project. Pic via Getty Images

- EIB looking to back Vulcan’s Zero Carbon Lithium project with up to $825m in funding

- Vulcan to supply battery-grade lithium at below net-zero to EU partners

- Automaker Stellantis is Vulcan’s second-largest shareholder

Special Report: The European Investment Bank (EIB) has given another sign of its willingness to back Vulcan Energy’s Zero Carbon Lithium project by flagging up to €500 million (~A$825 million) of project financing.

Primary due diligence of Vulcan Energy’s (ASX:VUL) Zero Carbon Lithium project by the EIB has launched into the “under appraisal” stage with proposed funding of up to $825 million.

This could serve as a cornerstone investment into the development of the company’s flagship project in Germany, while the financial backing signals what may be one of the largest public investment pledges in Europe attached to an Australian company project.

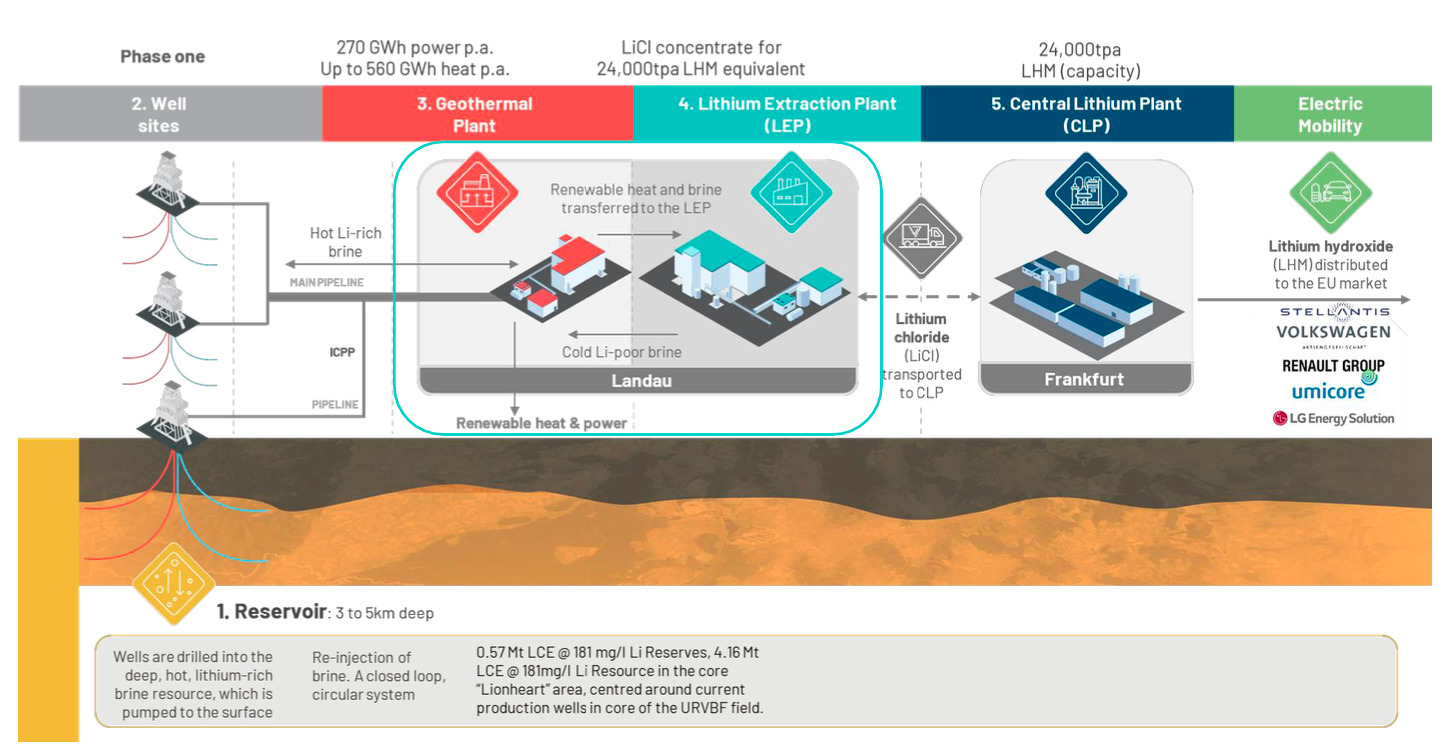

The Zero Carbon Lithium project aims to “decarbonise lithium production through developing the world’s first net carbon neutral lithium business”, with the co-production of renewable geothermal energy on a mass scale.

VUL is looking towards downstream lithium-brine production with a target of 24,000tpa lithium hydroxide using geothermal energy through its Lithium Extraction and Optimisation Plant (LEOP) in the Upper Rhine Valley around Landau, Germany.

Executive chairman Francis Wedin recently joined Stockhead’s Rock Yarns podcast with host Peter Strachan to talk about the company’s aspirations. Listen here to hear all about it.

Lithium-rich brines and hot industrial water will be transported to VUL’s G-LEP facilities in the Landau commercial park.

The geothermally-produced hot industrial water will then be used to provide carbon-neutral heat to supply green energy for the residents in Landau and the surrounding region.

Project financing

VUL has already started its debt and project-level equity financing process, supported by BNP Paribas, following positive market sounding in 2023 from commercial banks, development banks and government-backed export credit agencies.

Support from the EIB is a huge plus for VUL’s project development and comes on the back of having already received a $200 million non-binding letter of support from Export Finance Australia (EFA), as well as indications of strong support from Canada, Italy, and France during 2023.

“We welcome the support of the EIB. This is a strong and tangible signal of confidence at the European level for the Zero Carbon Lithium project, and of its capability to enable a secure, domestic lithium supply chain for electric vehicle batteries for Europe,” VUL chief executive Cris Moreno says.

“This progression in EIB’s financial appraisal is a positive step forward in the sequence of our debt and project level equity financing for phase one of the project, which is anticipated to create millions of tonnes of carbon avoidance in the EV supply chain in the years to come.”

This article was developed in collaboration with Vulcan Energy, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.