You might be interested in

Experts

CRITERION: Got a chip on your shoulder over missing Nvidia? Here's the latest intel on AI stocks

Tech

ASX Tech March Winners: Sector up 55% YTD as Aussie retail investors still love 'Magnificent 7'

News

Tech

It’s no secret that the semiconductor sector has been experiencing supply shortages since the onset of the COVID pandemic.

When times are good the chip makers invest in more chip capacity to the point where there’s oversupply and prices and production comes down – and no one invests anymore.

And about 12-18 months down the line this translates to shortages, and investment picks up again.

But COVID triggered a complete halt in investment in production capacity and at the same time demand increased for laptops with people around the world working from home.

And now there’s a global shortage which is impacting supply chains and production levels – but could the sector be reaching a turning point?

Mark Kennis from Stocks Down Under and Pitt Street Research says that if investors want to keep close tabs on the sector, they should keep an eye on the Philadelphia Semiconductor Index.

“It’s by far the most important index for semiconductor stocks,” he told the Stocks Down Under Semiconductor Conference last week.

“It’s a basket for US based stocks listed in the US, equipment players, fabs companies, and a few foundries.

“Right now, it’s near all-time highs, and it’s a really good index to watch because typically the investors in this space look about six to nine, sometimes even 12 months ahead.

“So, if you see a turning point in stocks, that’s usually a good indicator that the industry is turning, maybe going back to an oversupply situation again.”

Here are how the stocks presenting at the conference see 2022 playing out.

The company is by far the biggest player by market cap in the sector, with its Akida 1000 Neuromorphic System-on-Chip able to learn in real time, mimicking neurobiological architectures and working like a mini brain.

The company made a swathe of announcements in November, entering into a four-year licence agreement for its Akida IP with MegaChips – a pioneer in the Application Specific Integrated Circuit (ASIC) industry.

BrainChip also completed functionality and performance testing of Akida, which achieved performance and lower power consumption results.

Company founder and chief technology officer Peter van der Made – who handed over the CEO reins to Sean Hehir last month – told the conference that the extremely low power consumption is good for the planet compared to current AI computing which generates huge amounts of greenhouse gases.

“If you look at the collected data centres of the world, they emit around 600 million pounds of greenhouse gases,” he said.

“An Akida 1000 is estimated to be around 97-99% more energy efficient processing.

By 2030 if we continue the way we’re going, data centres will account for 30% of global electricity – and Akida can solve that problem with its low processing power.

And Akida is independent from the cloud, doesn’t require an internet connection to operate and can learn in milliseconds as opposed to weeks with traditional AI.

“With Akida, it’s completely independent of the cloud, all the information is processed on the chip itself, so it’s very secure, whatever stays within the chip itself cannot be hacked,” van der Made said.

The production chips are now being integrated into complete PCIe and Mini-PCIe boards, with these boards and evaluation systems being shipped to Early Access Customers for further testing and verification to see how they work as part of customers’ products.

The company’s core technology is a MEMs device which sits sort of adjacent to the semiconductor market.

Managing director Andrew McLellan addressed the conference fresh off the back of the company’s announcement that its own branded cryovials have been registered with the United States FDA (USA) and received European CE IVD certification.

The company’s Bluechiip-Enabled sample management solutions product line includes sample storage consumables, readers, and stream sample management software.

“We target very highly sophisticated markets, IVF marketplace, clinical trials, cell therapies, population cryobanking, vaccines, that all require ultra low temperature ID and traceability,” he said.

“There’s well over 300 million high value bio samples that are stored, and preserved and processed in minus 196 °C environments – and this is a well over $600 million annual target market for us.

“There’s also applications emerging in the vaccine developed to be shipped and transported at minus 80 degrees.”

And the McLellan says the company has been untouched by supply chain disruptions.

“We’ve got capacity to manufacture up to 10 million chips a year, we’ve got 3 million chips in stock as it stands,” he said.

“They’re worth around $2.5-3 each, so easily valued at around $10 million.

“And we can scale that very rapidly and quickly.”

The ReRAM player announced a $25.7 million placement to 4 Israel-based institutional investment and pension funds, and a $9 million entitlement offer this month.

CEO Coby Hanoch told the conference that since the company has made progress since signing its first commercial agreement with US based fab SkyWater in September.

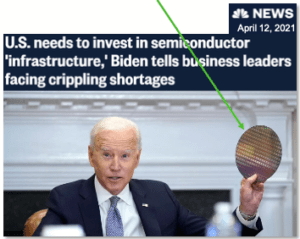

“When President Biden announced a $52 billion investment in semiconductors he was holding the Skywater wafer in his hand,” he said.

“By the end of next year, we should be qualified and then be able to start mass production.”

It certainly helps that Weebit uses standard material in the fab, making it as simple as possible to ramp up manufacturing, which adds a 5% cost to the wafer – as opposed to 10-20% with flash.

Plus, Hanoch said the embedded memory market – where you embed a memory system on a chip – is growing rapidly and is expected to reach over US$100 billion in just a few years.

“One of the big advantages we have in the embedded space is that we can go down to very small geometry, the smaller nanometres,” he said.

“And flash basically is stuck at about 40 nanometres so all of the advanced applications today have to jump through hoops to really connect to the non-volatile memory.

“We already announced we scaled our tech to 28 nanometres, which is one of the sweet spots of our industry.”

Laser diode player BluGlass executive chair James Walker said that the company is soon to be the fourth gallium nitride (GaN) laser diode supplier in the game.

“We are well on our way for transitioning from an R&D company to a product manufacturing technology development company,” he told the Stocks Down Under Semiconductor Conference.

“We can operate in the high value high margin product space where there are very few players.

“GaN laser diodes sell for tens of thousands of dollars, so it’s high margin, low volume and fits beautifully into our capacity.

“We have enough capacity that we can actually make enough epitaxy – which is the first component of a laser diode – to generate over $170 million worth of revenue.”

Plus, the company has demonstrated working remote plasma chemical vapour deposition (RPCVD) tunnel junction laser diodes in a world-first proof-of-concept.

The prototypes have demonstrated good lasing behaviour, with potential to address the 50% performance loss presently sufferance by GaN laser diodes due to excess heat.

The company is confident that the GaN laser diode market is a $735 billion opportunity.

4DS raised $2.5 million via a placement at $0.048 per share last month, and launched an SPP to raise a further $2.5 million to fund the development of its Interface Switching ReRAM technology with imec in 2022.

But the company also recently reported testing results from its Third Non-Platform Lot and Second Platform Lot wafers which showed that the endurance of the Third Non-Platform Lot memory cells has potentially degraded when compared to the Second Non-Platform Lot performance reported in February.

The company highlights the need to switch from using Non-Platform Lots to using Platform Lots which include imec access transistors.

The Third Platform Lot will also include a test chip – an imec 1 megabit array using 4DS’ ReRAM cells, with executive director David McAuliffe telling the conference the company expects to be out of fab in early Q3 2022.

“Between now and then I think we’ll see a significant increase in the valuation of the company,” he said.

“Our end goal in 2022, is to show that the technology is able to be put on a megabit array – which I think the industry will be very interested in.

“That’s the goal for 2022 – challenging, but achievable.”

CEO Dr Mohammad Choucair told the conference straight up that there’s a need to differentiate Archer from other groups in the semiconductor sector.

“The only similarity between Archer and the others in this important sector is the word semiconductor,” he said.

“Other than that, we’re in completely different arenas. And this is because Archer is developing a quantum chip and is really the only company on the ASX doing so and in fact, one of only a few in the world doing so.

“We have a unique value proposition that holds up the world first in that we’re building a qubit processor that could potentially allow for quantum computation at room temperature and onboard modern devices.”

Last month the company successfully fabricated microfluidic channels required for its biochip, integrated sensor components and other features within them on a silicon wafer.

The fabrication, miniaturisation, and integration of the microfluidic channels is a vital step on the development pathway for the company’s biochip, that would allow tiny amounts of liquid or gas samples (e.g. saliva, blood, breath, etc.) to be analysed.