Supercharging exploration: Companies using cutting-edge tech to find the next big deposit

Tech

Tech

For centuries the mining industry had largely relied on old school exploration, where old timers walked the ground looking for outcropping mineral deposits.

And while these traditional methods proved effective in finding potential resource near surface, most easy-to-find orebodies have already been discovered.

Geologists now regularly spend years collecting and analysing disparate data, frequently testing hypotheses, from huge areas of land, often for little or no reward.

This is because explorers are increasingly having to look deeper to find the next big deposit.

This is especially vital when you consider that the number of big, company-making mineral discoveries are declining globally.

According to MinEx Consulting MD Richard Schodde, we’re finding fewer than ever — only 12-15 ‘significant new deposits’ per year, compared to 15-25 discoveries in previous decades.

Not to mention, it’s getting more expensive.

Australia spent $4.1b on exploration last year, with junior companies accounting for 45% of the total spend over the last decade (2012-2021).

Schodde told the Mines and Money Conference earlier this year that, after adjusting for inflation, it now costs the average explorer ~US$200 million to make a significant discovery. This is 4x higher than that incurred two decades ago.

“Given the need to transition to a low-carbon future, metal demand is set to significantly rise,” he said.

“It is imperative we find major new deposits. We either need to spend more on exploration or be much better at discovery.”

That’s where innovative technology can make the hunt for deeper deposits easier, faster – and cheaper.

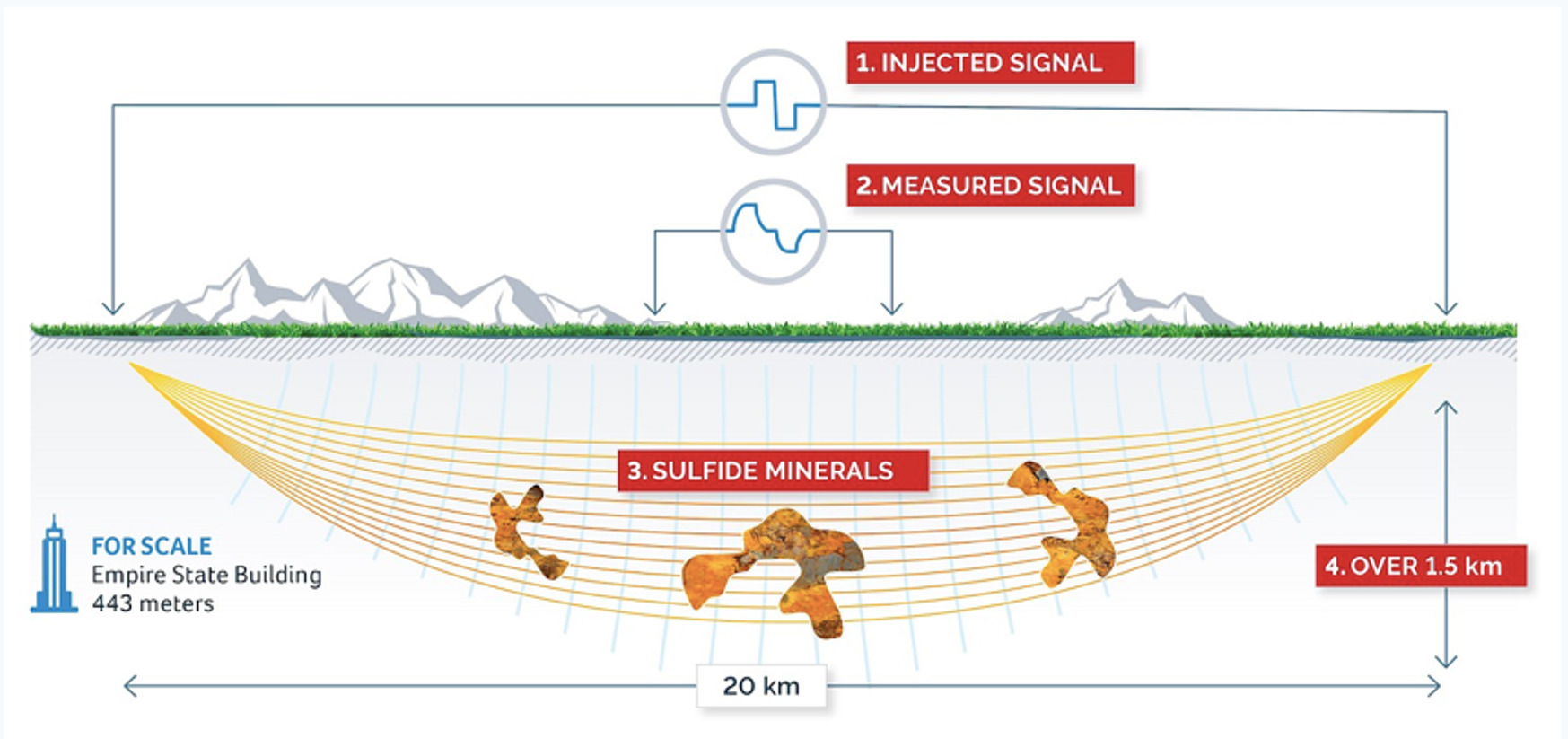

Companies like Ivanhoe Electric are seeing success with their geophysical survey tech ‘Typhoon’, which can detect the presence of sulphide minerals containing copper, nickel, gold and silver, at depths of over 1.5km.

When you consider that most of today’s copper mines were discovered from the surface, this kind of innovation opens the door for new deep high-grade copper discoveries to be found.

Typhoon uses a precisely controlled signal to provide a very high signal-to-noise ratio, for greater depth penetration – up to five times deeper than other equipment and because the company can precisely control and tune the waveform, this allows both time domain and frequency domain induced polarization (IP) and electromagnetic (EM) data to be acquired.

It’s already picked up a new copper discovery at the Santa Cruz copper project in Arizona at around 429m deep.

Then there’s artificial intelligence.

Patterns that humans might fail to notice can be detected by AI because machines can process ridiculous volumes of data at speed to identify anomalies that could be mineral deposits.

This is especially beneficial with publicly available bulk geophysical data – like that of GeoScience Australia – which companies can aggregate and apply AI to identify potential exploration targets.

The resources tech player specialises in mineral scanning, with its GeoCore X100 product able to convert drill core samples into a three-dimensional data set to provide a “through the rock” image of internal structures and texture in addition to elemental detections, and density.

In August, OXT nabbed a commercial $1.55m agreement with BHP (ASX:BHP) around the field deployment of its mobile field-scanning installation and technology to the Carrapateena copper mine in South Australia.

Orexplore will deliver site-based drill-core and sample digitisation services for BHP to unlock new rock mass characterisation and geometallurgical information to advance the short and medium-term mining and operational planning and decision processes.

The company says its Smart Domaining solution will enable “improved orebody knowledge across the deposit to drive improved modelling, with value drivers for downstream mining, processing, and reconciliation outcomes.”

Orexplore will also install three GeoCore X100 units into the core farm to transform traditional core-logging and analysis processes through augmented logging and advanced Machine Learning (ML) based analysis methods.

This company uses AI and machine learning tech, specifically Discriminant Predictive Targeting (DPT) workflow which collects all available geological information in a terran and places it in a multidimensional hypercube or data cube.

This allows the DPT predictive analytics to accurately predict known endowment and generate targets for further discovery.

The company says the combination of publicly available data in the form of geophysics, surface geochemical, drilling and geological layers and derivatives which been compiled into a massive data cube covering much of WA will provide the next generation of exploration discovery.

But SensOre operates a tad differently, rather than simply selling its services, the company has built a tenement portfolio of highly prospective, wholly-owned and joint ventured technology metals tenement packages in WA to explore.

Last month the company reported that its subsidiary Exploration Ventures AI (EXAI, 70% Deutsche Rohstoff AG: 30% S3N) confirmed the presence of lithium bearing pegmatites at the recently discovered Buttamiah prospect on the Abbotts North project leases.

“We are encouraged to see a new lithium discovery in a district with no previous lithium identified,” SensOre CEO Richard Taylor said.

“In a market where prospective lithium projects attract a significant premium, EXAI has moved on an area where conventional targeting has overlooked the prospectivity, despite the presence of previously mapped pegmatites.

“On the back of success on this and other projects, SensOre and Deutsche Rohstoff are exploring options for the EXAI portfolio using SensOre’s proprietary artificial intelligence driven targeting tools.”

While this company has recently expanded its mineral processing tech capabilities (which we’ll take a closer look at in Part 2 of this series) they recently picked up mining tech company Devico and made a 40% cornerstone investment in Krux Analytics which provides advanced drilling analytics software.

This is on top of their ioGas exploratory data analysis software and Datarock image analysis software which uses AI and machine learning.

Krux is a Calgary-based company that develops advanced drilling analytics software, which collects, aggregates and analyses drilling activity data – originated manually or collected via sensors adjacent to or embedded within the drill rig.

Imdex says the Krux software will support the digitisation of its drilling optimisation business, complementing the company’s existing fluids and equipment with a sensor and data aggregation layer.

Devico supplies directional core drilling services and borehole surveying solutions that the company says consolidates its leading market position globally and adds the leading directional drilling technology in the market.

Lithium Universe is betting AI will give it the edge in its exploration for lithium in James Bay, Canada, working with Canada’s KorrAI Technologies who use satellite data and AI to enhance field exploration practices, optimise time spent in the field, optimise cost, and improve exploration outcomes using data-driven decisions.

The tech basically uses AI to process and analyse satellite data and images to create maps that show different geological features like outcrops, pegmatites, and vein formations.

Along with the use of spectral data to identify areas that are more likely to have valuable mineral deposits, Lithium Universe says the AI will help its field teams improve the accuracy and efficiency of their exploration efforts by focusing on specific locations with high potential.

Chairman Iggy Tan noted that KorrAI has been successful at using satellite data and AI technology to optimise field exploration practices in the James Bay whilst working with companies such as Patriot Battery Metals (ASX:PMT).

“By employing advanced algorithms, KorrAI has created maps that identify geological features like outcrops, pegmatites, and vein formations, using spectral data to locate potential mineral deposits,” he said.

“This AI-driven approach enhances exploration accuracy and efficiency, allowing us to focus our field activities and resources more effectively, reducing exploration timelines and costs.”

This is especially advantageous given the shorter exploration window in the region due to winter, which would enable LU7 to potentially fast-track exploration activities that may have otherwise only been forecast to occur 12 months from now.

The explorer is using SensOre’s AI tech to target lithium and copper at its Golden Grove North project in WA while locking in drilling at its high-grade Vulcan REE prospect in a farm-in deal with the mineral technology and exploration player announced back in May.

The company reported results over 1% total rare earth oxide, ranging up to 12.5% TREO with 5460ppm (0.55%) praseodymium oxide and 14,575ppm (1.46%) neodymium oxide – two of the two rare earth metals most associated with the permanent magnets essential to electric vehicle motors.

SensOre can earn a 51% interest in the non-rare earth mineral rights in the JV by sole-funding $1.5m of expenditure over the first two years.

It can earn another 19% by spending another $3m, with Venture holding an option to claw back 10% of the project within the first two years.

It means Venture will still be able to benefit significantly from any future lithium discoveries made with SensOre’s unique technology.

“We are excited about both the copper and lithium potential of the area. With our partners at Deutsche Rohstoff, we are building a compelling portfolio of lithium projects and honing new techniques for discriminating lithium fertility over large areas,” SensOre CEO Richard Taylor said at the time.

“We bring to the joint-venture with Venture Minerals a growing body of R&D from Western Australia to New South Wales on how to narrow in on Australia’s next generation lithium targets.”

The QLD company listed in June after merging with Duke Exploration (ASX:DEX) to focus on the copper-gold Cloncurry Hub (commissioning) and the high-grade copper-cobalt Mt Oxide project.

That same month they announced a partnership with Hitachi Vantara to use AI in its production operations and processes to “gather, analyse and interpret vast amounts of real-time data across process efficiency, reagent use, minerals recovery, water use and energy use.”

TNC has already started processing Mt Norma Mine copper oxide ore commenced (95kt at 2.07% copper) via the Great Australia Mine heap leach at Cloncurry, with the plan now to prepare mine studies in Q3 for the restart of full-scale production.

The company says using learned AI will help them achieve greater transparency, accountability, and efficiency throughout operations.

It will also be used to manage environmental impacts, optimize water usage, and reduce carbon emissions, which TNC says will help them identify areas for improvement.

The explorer made a deal last year with Earth AI that will see the tech player spend up to $4.5m over two years to generate and drill test prospective targets at its Cundumbul project in NSW.

The project is in Australia’s foremost porphyry region – the Macquarie Arc in NSW’s popular Lachlan Fold Belt (LFB) – and sits 30km south of Alkane Resources (ASX:ALK) 14.8Moz Northern Molong Porphyry project and 70km north of Newcrest Mining (ASX:NCM) flagship +90Moz Cadia mine.

Earth AI says it saw an opportunity to tap into the $450bn technology metals market, of which copper is a key metal for electrification, to help fast-track big discoveries into production and speed up the clean energy transition.

The tech company reckons its vertically integrated, proprietary cloud computing and integrated geological artificial Intelligence (AI) review and machine learning process is 50x more accurate and 50% cheaper than other exploration methods.

The prize for Earth AI upon making a new discovery, and the completion of at least 1500m of diamond drilling, is an up to 3% net smelter royalty on an agreed area surrounding the discovery.

Yes it’s a lithium miner, but it’s using Fleet Space Technologies’ satellite-based mineral exploration system, ExoSphere, in untested areas to prioritise targets for drilling with the aim of expanding its lithium resource at the Finniss project in the NT.

If you’ve got 1.17mins, here’s a snazzy vid on how the ExoSphere tech works.

ExoSphere delivers 3D subsurface images more rapidly than with conventional techniques – taking days rather than months – with the data collected via Fleet’s seismic node technology or ‘Geodes’ which have been designed specifically for ambient noise tomography (ANT).

The tool uses satellite connectivity to a cloud platform, providing real-time remote access to survey results and processing data into a 3D visual representation.

Tivan (ASX:TVN) also has a deal with Earth AI to explore the Sandover lithium project in the Northern Territory which is considered prospective to host the lithium-bearing pegmatites and a sediment-hosted copper and iron oxide copper gold (IOCG) deposits identified by the Northern Territory Geological Survey.

Legacy Minerals Holdings (ASX:LGM) has drilling underway by Earth AI to target nickel sulphides at its Fontenoy project in NSW, with Earth AI to contribute $4.5m of exploration expenditure over a two-year period for a 3% net smelter royalty if/when a discovery is made.

GCX Metals (ASX:GCX) has already seen some success at its Onslow copper-gold project in WA, saying machine learning technology has independently validated the IOCG targets revealing a strong response from its hydrothermal magnetite and hydrothermal hematite models.

Lanthanein Resources (ASX:LNR) says satellite tech flagged 41 new targets at its Lyons rare earth project in WA late last year, with recently drilling extending high-grade REE and niobium – with a maiden resource expected this year.

Torque Metals (ASX:TOR) is applying advanced geoscience and AI-powered smart exploration to unlock high-value gold deposits at its flagship Paris project in WA.

Gateway Mining (ASX:GML) has a farm-in agreement with SensOre, whereby SensOre has the right to earn up to 80% of the lithium (and associated minerals) rights within selected tenements of the Montague gold project in WA, while Gateway continues its precious metal focused exploration activities.

At Stockhead we tell it like it is. While Lithium Universe, GCX Metals, Venture Minerals, Lanthanein Resources and Torque Metals are Stockhead advertisers, they did not sponsor this article.