Fintech lender MoneyMe rides up the wave with $6m profit and stronger credit profile for H1 FY24

Tech

Tech

Special Report: After a solid Q1 for FY24, MoneyMe has backed it up with another stellar quarter to round off H1 with a net profit after tax (NPAT) of $6m and >$105m in revenue for its digital lender offering.

MoneyMe (ASX:MME) services what it calls ‘Generation Now’ – ambitious Australians who expect more from life and the companies they engage with.

Powered by smart-tech, the digital lender offers near real-time credit decisioning and loans that settle in minutes across products such as car loans, personal loans and credit cards.

Despite the rising interest rate environment, continued high inflation, and mounting cost-of-living pressures impacting Australian consumers, MoneyMe continued its delivery of statutory profits in 1H24.

MoneyMe delivered a $6m statutory NPAT for H1 FY24, reflecting tech-driven cost efficiencies, strong credit performance and effective interest rate management.

With ~70% of the loan book variable rate, MME says it has pivoted customer pricing in line with the Reserve Bank of Australia’s rate rises.

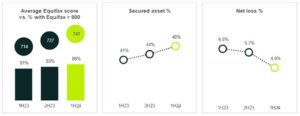

The stronger credit profile of the book delivered a net loss rate of 4.6% for H1 FY24 – a further reduction from H2 FY23 and H1 FY32. The loan book now has an average Equifax score of 741, with 48% as secured car loans, both figures up on prior reporting periods.

Gross revenue was >$105m and originations were $277m, while the total loan book balance was $1.2bn for H1 FY24.

Revenue reduced as expected, says MME, “reflecting our moderated growth strategy and move towards higher credit quality and secured assets to reduce credit risk and losses”.

MoneyMe’s sustainable profits and stronger loan book. Pic: Supplied (MME)

During H1 FY24, MoneyMe continued to lift the credit profile of the loan book by targeting higher credit quality borrowers and increasing the ratio of secured assets to in turn deliver lower loan book losses – a move that is giving investors reassurance in challenging market conditions for lenders.

As a result, the closing average Equifax credit score increased to 741 in 1H24. 86% of the loan book had an Equifax score >600, up from 81% in H1 FY23 and 83% in H2 FY23.

Secured assets increased to 48% of the loan book in H1 FY24, up from 41% in H1 FY23 and 44% in H2 FY23.

“We increased originations in the half, maintaining our book balance relatively stable, while continuing the shift to high credit quality assets,” MME chief executive Clayton Howes says.

“The strength of our loan book portfolio has also been recognised by two recent Moody’s credit rating upgrades of our term securitisations.”

Higher credit quality assets deliver lower book loan losses. Pic: Supplied (MME)

Howes says the company continues to execute its key strategies, including extending its technological advantages through product innovation, automation and expanded AI capabilities, as well as cost management and effective cybersecurity defences.

“Our current strategy and agility to navigate the macroeconomic environment position us well to deliver increased scale and returns as conditions evolve,” he says.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.