Fintech lender MoneyMe delivers $6 million profit in H1 FY24

Tech

Tech

Special Report: MoneyMe has delivered a $6m statutory NPAT for H1 FY24, reflecting strong credit performance, effective interest rate management and tech-driven cost efficiencies.

Despite a higher interest rate environment, persistent inflation and growing cost-of-living challenges affecting Australian consumers, non-bank lender MoneyMe (ASX:MME) was able to continue its profit delivery during H1 FY24.

Loan originations increased to $277 million, up 23% on H2 FY23, facilitating the company’s further shift to high credit quality assets. The total loan book balance was $1.2 billion for H1 FY24.

MME put down a 9% reduction this half in its revenue from $108 million in H2 FY23 to its shift to a much higher credit quality loan book with a lower risk and associated yield.

The company finished H1 FY24 with $15 million in unrestricted cash, down 7% on the previous quarter.

Net assets were $173 million, up 4% on H2 FY23.

Source: MoneyMe

Source: MoneyMe

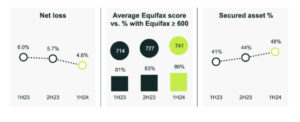

During the half, MME continued to enhance the credit profile of its loan book, focusing on attracting borrowers with higher credit quality and elevating the ratio of secured assets.

The approach has resulted in net credit losses reducing further to 4.6% in H1 FY24, further providing investors with confidence amid challenging market conditions for lenders.

The average Equifax score of MME’s loan book was 741 for H1 FY24, up from 727 in the previous half.

Secured loan assets increased to 48% of the book from 44% in H2 FY23.

MME says the ongoing uplift in the customer credit profile will provide significant benefits

over time.

Source: MoneyMe

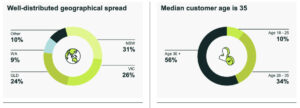

Furthermore, MME says strong customer diversification continues to reduce risk and promote resilience.

The fintech caters to the aspirations of ambitious Australians, whom it refers to as ‘Generation Now’, offering near real-time credit decisions with car loans, personal loans and credit cards that settle in minutes.

The median age of MME customers is 35 with geographical spread aligned to the Australian population.

Source: MoneyMe

MME says its predominantly variable rate book (74%) allowed for effective interest rate management during the half.

Rising interest rates were largely offset by customer pricing adjustments, achieving a

net interest margin (NIM) of 10%.

The fintech says variable rates also present competitive pricing opportunities when interest rates come down.

MME says it has continued to drive efficiencies and enhance customer experience on its platform through new innovation.

The fintech’s customer net promoter score increased to 68, up from 60 in the previous half and in contrast to the 8.4 average of major banks.

The company undertook further automation of customer onboarding processes and launched Autopay for caravans, including the Autoscan feature enabling customers to obtain personalised repayment details for different vehicles on the spot.

MME is also developing an internal application leveraging generative AI to speed up and enhance the accuracy of customer service responses, with a beta version of the tool set to launch in H2 FY24.

READ: ‘Innovation at our core’: ASX fintechs leverage AI to further disrupt banking sector

MME became a Certified B Corporation in August 2023, verifying that it meets high standards of social and environmental performance, accountability, and transparency.

MME says a recent customer survey revealed 82% of its customers care about the sustainability performance of lenders.

The company achieved a 91.2 Certified B Impact Assessment (BIA) score, compared to a median score of 50.9 for ordinary businesses and the certification threshold of 80.

READ: Just 13 Aussie finance providers are B Corp certified. These two are on the ASX

Managing director and CEO Clayton Howes says MME delivered a “solid first half result” with $6 million in NPAT, reflecting technology-driven cost efficiencies, strong credit performance, and effective interest rate management.

“We increased originations in the half, maintaining a relatively stable book balance, while continuing the shift to high credit quality assets,” he says.

The stronger credit profile of the book delivered a further reduction in net loss rate.

“Our loan book now has an average Equifax credit score of 741 and 48% secured loan assets, both up on the prior periods,” Howes says.

“The strength of our loan book portfolio has also been recognised by two recent Moody’s credit rating upgrades of our term securitisations.”

Howes says MME continues to execute its key strategies, which include extending its technology advantage through product innovation, automation and expanded AI capabilities.

He adds the company is optimising the business for future growth, capitalising on the significant market opportunity to grow its award-winning car loan product, and strengthening cybersecurity defences.

“Our current strategy and proven agility position us well to deliver increased scale and returns as conditions evolve,” he says.

This article was developed in collaboration with MoneyMe, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.