Who Made The Gains? Here are September’s top 50 miners and explorers

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

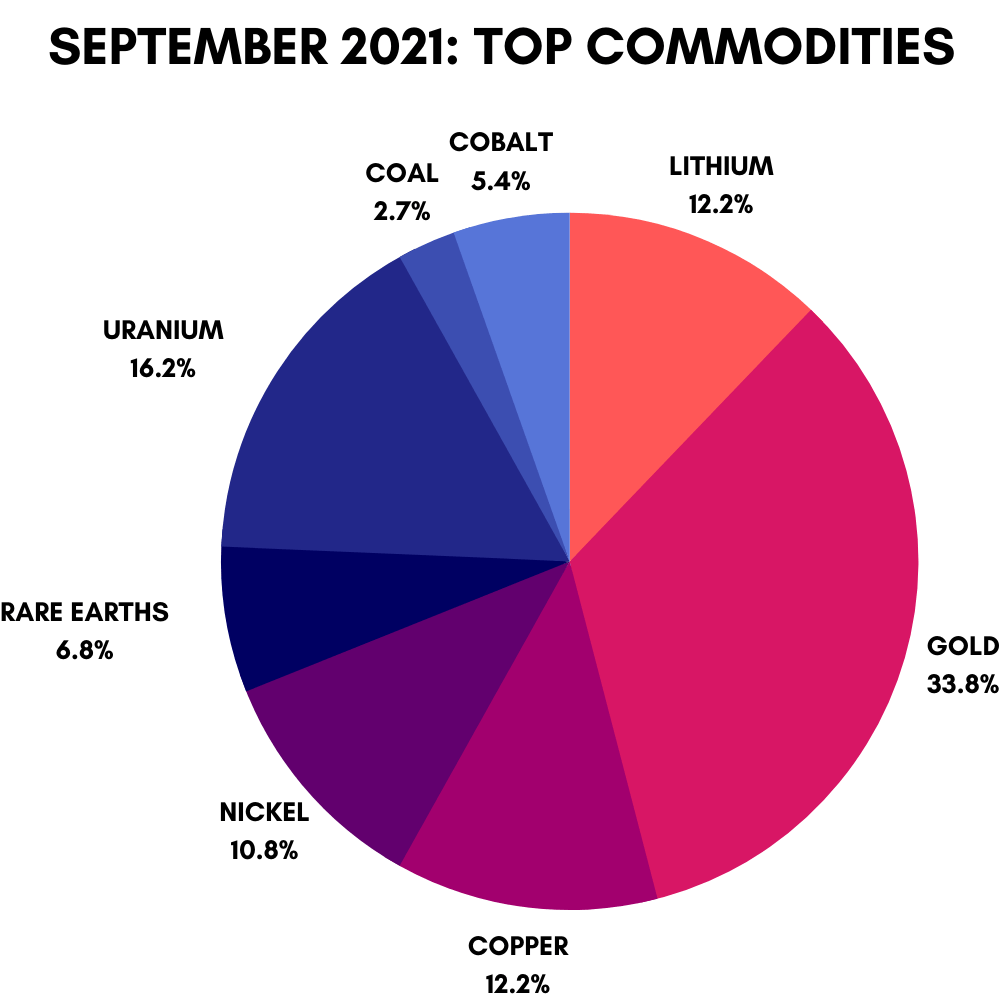

Those stocks exposed to the mushrooming clean energy thematic likely did very well in September 2021, but there were two massive standouts: lithium and uranium.

It was a wild month for Chinese lithium carbonate prices, which surged to another historical high as supply struggled to keep up with surging demand.

Raw material prices are also running hot, with WA producer Pilbara Minerals (ASX:PLS) selling an 8,000t SC5.5 spodumene cargo for an extraordinary $US2,240/t via its Battery Material Exchange (BMX) digital auction platform on September 14.

This time last year producers were lucky to get $US400/t.

Uranium was the other big story. The spot price punched through $50/lb for first time in nine years, sparked by the Sprott Physical Uranium Trust (SPUT), which started buying up physical uranium and taking it out of market circulation in August.

Unsurprisingly, investor sentiment went through the roof.

Elsewhere, prices for coal – both thermal and metallurgical – are going gangbusters, and tin is at all-time highs.

Volatile nickel touched the magic $US20,000/t mark on September 10, before plummeting to $US18,175/t by the end of the month.

Gold trod water, again, but the inevitable breakout is coming soon, some say.

Iron ore is officially in the crapper, hitting ~$US90/t for benchmark 62%Fe – a huge +60% drop from record high seen in May — before staging a small recovery.

The last time iron ore prices fell by this magnitude over such a short space of time was during the 2008 global financial crisis, Fastmarkets says, when the index dropped by 68% over three months.

What were our winners looking for?

Here are the top 50 ASX resources stocks for the month of September >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | LAST SHARE PRICE | MONTHLY RETURN % | MARKET CAP | MARKET CAP |

|---|---|---|---|---|---|

| VIA | Viagold Rare Earths | 0.48 | 1043 | $ 38,323,705.84 | Rare Earths |

| HNR | Hannans | 0.034 | 386 | $ 80,239,224.53 | Nickel, Battery Recycling |

| AEE | Aura Energy | 0.21 | 385 | $ 83,822,892.72 | Uranium |

| RDT | Red Dirt Metals | 0.6 | 253 | $ 91,996,240.00 | Lithium, Gold |

| EFE | Eastern Iron | 0.038 | 217 | $ 36,772,278.35 | Lithium, Iron Ore |

| PAM | Pan Asia Metals | 0.46 | 207 | $ 33,882,976.24 | Lithium, Tungsten |

| 92E | 92Energy | 0.765 | 206 | $ 26,588,250.68 | Uranium |

| MTC | Metalstech | 0.655 | 167 | $ 93,258,894.35 | Gold, Lithium |

| MHK | Metalhawk | 0.58 | 158 | $ 23,858,012.50 | Nickel, Gold |

| A8G | Australasian Gold | 0.43 | 153 | $ 14,454,424.63 | Gold, Lithium |

| MRD | Mount Ridley Mines | 0.007 | 133 | $ 35,105,865.00 | Rare Earths, Iron Ore |

| KWR | Kingwest Resources | 0.14 | 115 | $ 27,076,034.83 | Gold |

| KCN | Kingsgate Consolidated | 1.58 | 115 | $ 370,711,758.78 | Gold |

| NXM | Nexus Minerals | 0.32 | 113 | $ 79,349,293.08 | Gold, Copper |

| AGE | Alligator Energy | 0.068 | 113 | $ 195,592,518.94 | Uranium |

| CAE | Cannindah Resources | 0.135 | 111 | $ 75,237,887.25 | Gold, Copper, Silver |

| VAL | Valor Resources | 0.016 | 100 | $ 47,971,969.36 | Uranium, Rare Earths, Silver, Lead, Copper |

| DLC | Delecta | 0.012 | 100 | $ 11,480,337.05 | Uranium, Vanadium, Gold |

| EME | Energy Metals | 0.38 | 100 | $ 77,582,825.44 | Uranium |

| TOE | Toro Energy | 0.029 | 93 | $ 116,920,265.40 | Uranium |

| GBR | Great Boulder Resources | 0.155 | 82 | $ 53,585,371.35 | Gold, Copper, Nickel, Cobalt |

| GMD | Genesis Minerals | 0.135 | 80 | $ 287,656,358.40 | Gold |

| BMN | Bannerman Energy | 0.25 | 79 | $ 337,348,977.84 | Uranium |

| PDI | Predictive Discovery | 0.24 | 78 | $ 236,514,311.78 | Gold |

| IBG | Ironbark Zinc | 0.039 | 77 | $ 48,111,667.76 | Zinc, Lead |

| EL8 | Elevate Uranium | 0.535 | 70 | $ 127,805,241.76 | Uranium |

| VMY | Vimy Resources | 0.195 | 70 | $ 205,042,238.51 | Uranium |

| LTR | Liontown Resources | 1.44 | 69 | $ 2,742,540,978.17 | Lithium, Nickel, Copper, PGE, Gold |

| QXR | Qx Resources | 0.018 | 64 | $ 8,662,710.17 | Lithium, Gold |

| LMG | Latrobe Magnesium | 0.029 | 61 | $ 35,473,605.78 | Magnesium |

| ACB | A-Cap Energy | 0.077 | 61 | $ 72,366,443.88 | Uranium |

| MRL | Mayur Resources | 0.255 | 59 | $ 47,733,393.78 | Cement, Lime, Gold, Copper |

| AVZ | AVZ Minerals | 0.335 | 56 | $ 1,126,360,438.00 | Lithium |

| RMI | Resource Mining Corp | 0.028 | 56 | $ 9,125,034.30 | Nickel, Cobalt |

| ARU | Arafura Resources | 0.225 | 55 | $ 379,737,096.34 | Rare Earths |

| PNN | PepinNini Minerals | 0.425 | 55 | $ 19,834,913.37 | Lithium, Copper, Gold |

| STK | Strickland Metals | 0.057 | 54 | $ 62,136,441.23 | Gold |

| BMG | BMG Resources | 0.075 | 53 | $ 25,279,340.98 | Gold |

| KP2 | Kore Potash | 0.026 | 53 | $ 15,270,189.74 | Potash |

| QPM | Queensland Pacific | 0.27 | 50 | $ 372,793,611.03 | Nickel, Cobalt |

| CVS | Cervantes Corp | 0.009 | 50 | $ 13,986,112.18 | Gold |

| SBR | Sabre Resources | 0.006 | 50 | $ 8,415,318.25 | Gold, Nickel |

| REZ | Resources & Energy Group | 0.046 | 48 | $ 18,130,593.14 | Gold, Nickel |

| SMI | Santana Minerals | 0.155 | 48 | $ 18,245,221.76 | Gold |

| ELT | Elementos Limited | 0.025 | 47 | $ 89,096,766.90 | Tin |

| GTR | Gti Resources | 0.027 | 46 | $ 23,128,777.22 | Uranium, Vanadium, Gold |

| TIG | Tigers Realm Coal | 0.016 | 45 | $ 235,200,642.62 | Coal |

| SCI | Silver City Minerals | 0.042 | 45 | $ 38,101,518.13 | Copper. Gold, Cobalt, Rare Earths |

| BRL | Bathurst Resources | 0.875 | 43 | $ 152,146,944.47 | Coal |

| MRZ | Mont Royal Resources | 0.4 | 43 | $ 15,718,836.73 | Copper, Gold |

Uranium wakes up

Uranium stocks – from near term miner to newly minted explorers – were standouts last month.

There were 12 stocks in the top 50, led by long-suspended Aura Energy (ASX:AEE) (+385%), which re-joined the bourse with a bang late in the month.

Aura’s focus is the advanced ‘Tiris’ project in Mauritania, which the company calls “one of the most compelling uranium development projects in the world today”.

Hot on its heels were popular explorers 92 Energy (ASX:92E) (+206%), Alligator Energy (ASX:AGE) (+113%) and new kid on the block, Delecta (ASX:DLC) (+100%).

Delecta chose a good time to resume exploration at the early-stage Rex uranium project in Colorado.

92E just chose the perfect time to make a uranium discovery.

On September 20 the company announced that a drill hole hit an “extraordinary” 5.5m of 0.12% U3O8 at the ‘Gemini Mineralised Zone’ (GMZ), part of the Gemini project in the Athabasca Basin, Saskatchewan.

Gemini is 27km away from McArthur River, one of the largest and highest-grade uranium deposits in the world.

“To identify 5.5m of 0.12% U3O8 on the fourth drill hole of our inaugural drilling program is an extraordinary result for 92 Energy,” 92E managing director Siobhan Lancaster says.

“Importantly, the assays from this drill hole display similarities to other early holes at major Athabasca Basin uranium discoveries, in terms of grade, width, alteration types and intensity, and we look forward to the follow up drilling to determine the extent of the mineralisation.”

Lithium recharged

The amount of lithium required by the battery sector over the next decade is truly formidable.

The lithium deficit in 2025 will be bigger than industry was in 2016. @benchmarkmin #EV #Battery pic.twitter.com/lBnGxLmnf7

— Simon Moores (@sdmoores) September 22, 2021

Which is why explorers are jumping on lithium exposure where they can, with positive results.

Red Dirt Metals (ASX:RDT) (+253%) soared after uncovering lithium potential at the newly acquired 141,000oz ‘Mt Ida’ gold project in WA.

Former iron ore minnow Eastern Iron (ASX:EFE) (+217%) pivoted to lithium, with Chinese lithium giant Yahua partnering with the explorer to find and develop Aussie lithium projects.

Pan Asia Metals (ASX:PAM) (+207%) announced the acquisition of a geothermal lithium project in (very) late August.

And newly listed Australasian Gold (ASX:A8G) (+153%) kicked off exploration activities at the ‘Mt Peake’ lithium project in the North Territory – right next door to developer Core Lithium’s (ASX:CXO) ‘Anningie’ and ‘Barrow Creek’ projects.

A golden renaissance?

Gold stocks did remarkably well in September, considering the price fell ~4% to $US1,742/oz.

It’s clear punters still respond positively to good news stories, regardless of the macro story.

Good news stories like MetalsTech (ASX:MTC) (+167%), which keeps hitting thick, bonanza grade gold at the 1.5Moz ‘Sturec’ project in Slovakia.

It probably doesn’t hurt that MTC spin out, Winsome Resources (expected code: WR1), will have a bunch of advanced exploration stage lithium assets in the James Bay region of Quebec, Canada.

Kingwest Resources (ASX:KWR) (+115%) made a gold discovery under a WA salt lake called ‘Goongarrie’.

Nexus Minerals (ASX:NXM) (+113%) keeps hitting high-grade gold at the emerging ‘Wallbrook’ gold project in WA.

And there’s light at the end of the tunnel for former high-flying gold producer Kingsgate Consolidated (ASX:KCN) (+115%), with a settlement in sight to restart the flagship ‘Chatree’ gold mine in Thailand.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.