Coal prices are hitting record highs. Here’s why that’s a ‘once in a generation’ opportunity

Pic: Tyler Stableford / Stone via Getty Images

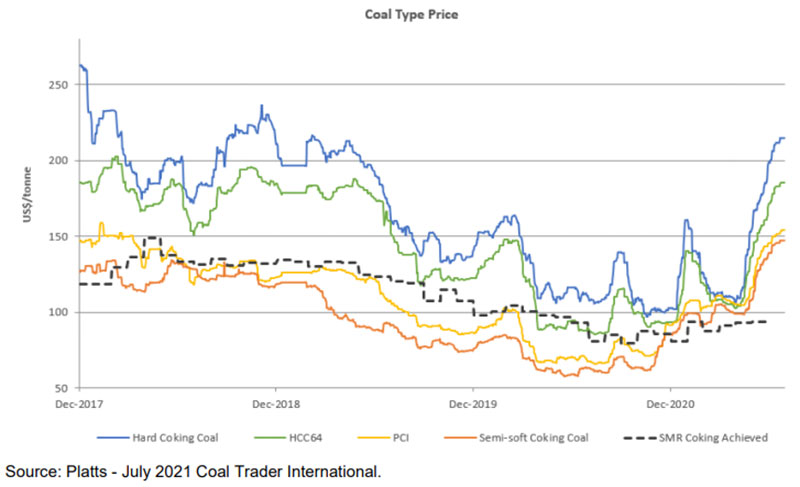

Coal players — both coking (steelmaking) and thermal (power) — have ridden rough seas for the past few years.

Things are now starting to get better. A lot, lot better.

Premium Low Vol CFR China – a benchmark for Chinese coking coal imports — hit an all-time high of $US410/t last Wednesday.

That’s a 248% increase over the past year.

The previous high for the steelmaking ingredient was $US392.50/t in January 2011, after cyclone Yasi devastated the coal-producing region of Queensland.

The root cause of the price rally is the unofficial ban on Australian coal since late last year, compounded by the closure of the border with Mongolia on Monday.

$1.72bn market cap Coronado Global Resources (ASX:CRN) which recorded a net loss of $96m for H1, would be breathing a sigh of relief as coking coal prices begin to climb.

Its US and Aussie operations are set to benefit from current higher prices, the company said August 10, which should translate into a big boost to bottom line earnings in the second half.

“As we look to the second half of 2021, we are buoyed by the prospect of prolonged higher metallurgical coal prices as steel demand continues to rise faster than supply growth driven by ongoing robust industrial output,” it says.

Prices for thermal coal are doing even better.

Cyclical lows in thermal coal have been replaced with record highs, Whitehaven Coal (ASX:WHC) CEO Paul Flynn said in the company’s earnings report.

Whitehaven said it expects high quality, high-CV thermal coal supply to remain tight, with prices forecast to continue to remain strong through the 2023 calendar year.

How did we reach this point?

The coronavirus pandemic in 2020 saw demand destruction in both seaborne thermal and metallurgical coal markets, says Matthew Boyle, Head of Coal & Asia Power, S&P Global Platts Analytics.

“This saw a supply response, particularly in thermal coal, when coal producers reduced output to better match customer demand,” he told Stockhead.

“The culmination of this pullback in exports moved the seaborne metallurgical and thermal coal markets into balance.”

In 2021, weather-related events — including La Nina rains in Indonesia and bushfires in Australia — coupled with continuing coronavirus cases saw short term supply impacts on the seaborne market, particularly in thermal coal.

“Weather also saw some demand-related spikes in Northeast Asia and Europe in February and July 2021 respectively,” Boyle says.

“Metallurgical coal market fundamentals have remained stable, despite geopolitical tensions impacting traditional trade routes.”

The ‘geopolitical tensions’ Boyle is talking about? China’s unofficial ban on Australian coal late last year, which resulted in a divergence between the two trade-flows.

While price rally mostly benefits North American and Russian producers, as well as smaller exporters such as Indonesia, Mozambique, and Colombia, the Aussie guys are still doing well.

Australian export prices have still been rising, with premium Low Vol FOB Australia hitting $US232/t last Wednesday.

At these prices Aussie producers are still making strong profits.

“The impact of the trade dispute has not greatly affected coal export volumes, as producers are matching production to customers receiving coal on a quarterly through to annual basis, rather than buyers of spot coal,” Boyle says.

“The reduction in spot coal output and availability has shielded Australian producers from any large impact of an ongoing trade dispute. “

Small cap coal stocks in the box seat for big gains

| CODE | COMPANY | MARKET CAP | STATUS | TYPE | WHERE |

|---|---|---|---|---|---|

| CKA | Cokal | $ 120,195,700.69 | Near Term Producer | Coking | Indonesia |

| BCB | Bowen Coking Coal | $ 118,693,679.27 | Near Term Producer | Coking | Australia |

| AKM | Aspire Mining | $ 38,072,773.88 | Advanced Explorer | Coking | Mongolia |

| AHQ | Allegiance Coal | $ 220,293,349.48 | Producer | Coking | North America |

| YAL | Yancoal Aust | $ 3,076,623,888.21 | Producer | Thermal/ Coking | Australia |

| NHC | New Hope Corporation | $ 1,673,037,734.82 | Producer | Thermal | Australia |

| TIG | Tigers Realm Coal | $ 124,133,672.50 | Producer | Thermal | Russia |

| SMR | Stanmore Resources | $ 196,044,597.23 | Producer | Coking | Australia |

| WHC | Whitehaven Coal | $ 2,364,755,291.28 | Producer | Thermal/ Coking | Australia |

| MR1 | Montem Resources | $ 8,311,855.61 | Advanced Explorer | Coking | North America |

| BRL | Bathurst Resources | $ 114,537,587.41 | Producer | Thermal/ Coking | New Zealand |

| CRN | Coronado Global Resources | $ 1,743,511,879.20 | Producer | Coking | North America, Australia |

| JAL | Jameson Resources | $ 28,816,529.55 | Advanced Explorer | Coking | North America |

| TER | Terracom | $ 120,577,220.80 | Producer | Thermal | Australia, South Africa |

| ATU | Atrum Coal | $ 27,452,357.87 | Advanced Explorer | Coking | North America |

| MCM | MC Mining | $ 19,302,444.38 | Producer | Thermal/ Coking | South Africa |

| IKW | Ikwezi Mining | $ 19,510,000.00 | Producer | Thermal | South Africa |

There’s a small but vibrant list of small cap coal stocks on the ASX.

Seven stocks with a sub $220m market cap are in production. Another two will join them within the next year.

One of these near term producers is Bowen Coking Coal (ASX:BCB).

The stock recently inked a deal to buy 90% of the Lenton JV in NSW, which includes the mothballed ‘Burton’ mine and associated infrastructure, plus the high-quality ‘New Lenton’ development project.

Bowen will pay miner New Hope Corp (ASX:NHC) $20m upfront (of which $10m can be cash or scrip at Bowen’s election) plus potential milestone and royalty payments up to the maximum value of $77.5m.

These coal assets have a replacement value of ~$300m, the company says.

This delivers on Bowen’s strategy to be the “next leading independent ASX coal producer” – targeting production of approximately 5mtpa by 2024.

BCB exec chairman Nick Jorss was founding managing director of Stanmore Coal (ASX:SMR) where he led the company from explorer to producer through the acquisition of the Isaac Plains operation for $1.

You read that right — $1.

The BCB deal has similar hallmarks, he says.

“I like both deals, to be honest. I wish Burton Lenton only cost us a dollar, that would be fantastic,” he told Stockhead.

“I think Isaac Plains came with about $300m of infrastructure – this is a similar number.

“But this has a lot more coal. When we bought Isaac Plains the reason it was a dollar was it had almost run out of coal, so we also bought the deposit next door.

“That gave us another eight years or so of mine life.”

Burton Lenton is a bit different because it comes with 30-odd million tonnes of reserves, Jorss says.

“It’s comfortably a 10-year mine life – probably more – of high quality met coal with a brand name attached to it,” he says.

“It needs a coat of paint and a bit of work on the wash plant, and some of the gear because it has not operated since a couple of years — but this is the full package.

“And what’s important for us is that we also have surrounding deposits – Broadmeadow East slightly to the south, and Hillalong up to the northeast.

“We are building a footprint around this hub.”

Then there are a bunch of other small caps looking to do similar things.

“A lot of the existing players, like BHP, are turning away from the market which throws up a lot of opportunities [for the smaller companies],” Jorss says.

“We are actively considering other assets that would make sense for us and are too well priced to ignore.

“That is a tremendous opportunity for companies, like BCB, to look at assets of increasing size and quality and continue to try and grow the business.

“It a once in a generation opportunity.”

Economics of hydrogen fuelled ‘green steel’ don’t add up

Could hydrogen be a coking and thermal coal killer? The potential use of hydrogen as a fuel is an exciting development in electricity markets, and Platts Analytics believes hydrogen could be a key fuel as markets undergo energy transition.

But there are a couple of key caveats that need to be considered before punters get too excited about hydrogen as a coal replacement, in both energy production and steelmaking.

First, thermal coal.

“Asia produces more than half of the world’s electricity, and the majority of this is via coal-fired generation,” says Boyle.

“Most of these coal-fired power plants are relatively young, averaging around 13 years (in a 40+ year lifespan).

“With a growing population in Asia and Africa still without cheap, reliable power, from an economical point of view, to ensure cheap electricity for people, it is expected coal will continue to play a key role in power generation.

“This will ensure coal import demand will continue for the next 15 years from these key demand markets mainly in Asia.”

This is likely to continue until there is new capacity from renewables that can replace this coal generation.

The potential replacement of coal used in steelmaking is even more problematic.

Over 75% of the world’s steel generation is through the Basic Oxygen Furnace (BOF) method, which involves iron ore and metallurgical coke (from metallurgical coal) heated in a blast furnace to make pig iron and then crude steel.

It is possible to make steel by taking steel scrap and iron pellets and melting this in an Electric Arc Furnace, which does not require metallurgical coal as a feedstock.

However, this process can be expensive, as it requires steel scrap, iron ore and electricity.

“It’s very much early days for green steel initiatives and the steel industry will continue to be iron ore and coking coal based for decades to come,” Boyle says.

“There are a few MoUs and partnerships among Asian and European mills, but most of these projects are still in a pilot stage.

“Green steel is much more expensive so economics will play a big role in take-up.”

Even if you put aside the safety and transport issues for hydrogen there are a lot of bridges to cross before it is viable, Nick Jorss says.

“The big commentators like the IEA and Woodmac all say that by 2050 hydrogen – assuming we can get it to work economically – is going to play a very small part in the reduction of iron ore,” he says.

“Sub 10% or so, on a pretty aggressive case.

“Put aside the costs, which are many times greater than using met coal. Hydrogen is a very volatile, flammable asset to manage and transport.”

There is also the issue of transportation.

“The energy density of met coal is about seven times that of compressed hydrogen, so you’ll need seven times the number of boats to transport the same amount,” Jorss says.

“That’s a big deal.

“I don’t see [hydrogen] as a real threat to coking coal,” Boyle says. “Certainly not anytime soon.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.