Build Your Own Portfolio – lithium: Experts say start with these 8 ASX stocks

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

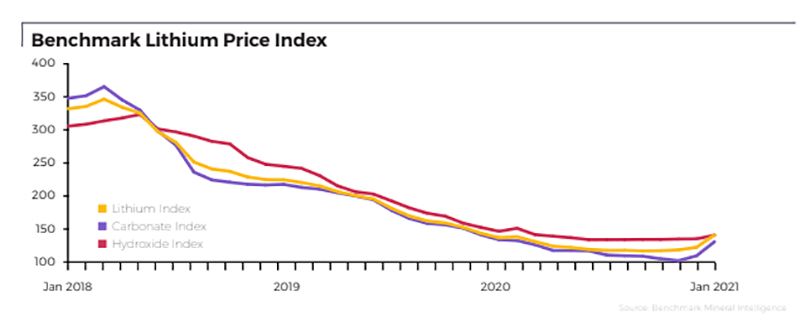

Lithium prices are seeing their first sustained rise for three years as carmakers and cell manufacturers respond to the strong upward trend in EV sales.

The long term outlook is strong. New research from Wood Mackenzie predicts EV sales to reach 62 million units per year by 2050, with a total global EV stock of 700 million.

It’s hard to deny investor sentiment has been high lately – Aussie lithium stocks have been flying. Just check out this sea of green:

| CODE | COMPANY | PRICE | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP ($) |

|---|---|---|---|---|---|---|

| VUL | Vulcan Energy | 7.2 | 78 | 1130 | 3170 | $827.5M |

| RLC | Reedy Lagoon | 0.032 | 88 | 256 | 967 | $13.6M |

| LKE | Lake Resources | 0.325 | 317 | 803 | 733 | $352.7M |

| CXO | Core Lithium | 0.27 | 19 | 482 | 664 | $275.7M |

| ADV | Ardiden | 0.021 | 0 | 40 | 600 | $47.1M |

| PLL | Piedmont Lithium | 0.375 | 56 | 658 | 513 | $1.1B |

| JRL | Jindalee Resources | 1.66 | 114 | 312 | 492 | $78.0M |

| EMH | European Metals | 1.35 | 4 | 335 | 400 | $177.0M |

| LTR | Liontown Resources | 0.425 | -7 | 240 | 325 | $741.3M |

| INF | Infinity Lithium | 0.23 | 21 | 149 | 301 | $68.8M |

| AVZ | AVZ Minerals | 0.21 | 5 | 218 | 239 | $563.5M |

| FFX | Firefinch | 0.255 | 11 | 55 | 227 | $195.5M |

| PLS | Pilbara Minerals | 0.95 | -13 | 152 | 215 | $2.8B |

| SYA | Sayona Mining | 0.04 | 186 | 300 | 192 | $157.1M |

| ASN | Anson Resources | 0.099 | 183 | 395 | 191 | $84.9M |

| TKL | Traka Resources | 0.019 | -17 | -32 | 174 | $10.1M |

| AGY | Argosy Minerals | 0.18 | 50 | 227 | 147 | $193.7M |

| LIT | Lithium Australia | 0.15 | 100 | 121 | 142 | $137.4M |

| INR | Ioneer | 0.425 | 35 | 270 | 136 | $741.8M |

| GXY | Galaxy Resources | 2.48 | -14 | 99 | 132 | $1.3B |

| GLN | Galan Lithium | 0.525 | 30 | 239 | 128 | $129.4M |

| MIN | Mineral Resources | 37.34 | -8 | 33 | 122 | $6.9B |

| LPD | Lepidico | 0.026 | 44 | 225 | 103 | $134.9M |

| ORE | Orocobre | 5.01 | 0 | 57 | 46 | $1.7B |

| PSC | Prospect Resources | 0.19 | 12 | 31 | 21 | $61.4M |

| ESS | Essential Metals | 0.13 | 41 | 24 | 8 | $26.1M |

| LPI | Lithium Power International | 0.31 | 15 | 59 | 7 | $89.9M |

| EUR | European Lithium | 0.071 | 31 | 45 | -13 | $68.5M |

| HWK | Hawkstone Mining | 0.045 | 309 | 181 | 800 | $72M |

| CXO | Core Lithium | 0.265 | 22 | 511 | 686 | $265.64M |

And after three years of solid declines, prices have noticeably turned a corner.

But the best indicator is this – an initial $5000 investment in the above basket of lithium stocks 12 months ago is now worth about $20,000.

Not bad.

We asked a couple of experts how they would allocate $5000 in a hypothetical lithium portfolio.

This bag of stocks includes miners, up and coming producers, and the more risky, speculative low market cap explorers.

NIV DAGAN

Peak Asset Management

“It’s certainly an interesting time in the lithium space, with many market watchers expecting demand to surge in the coming years due to the metal’s use in lithium-ion batteries,” Dagan says.

“Here are our top picks in relation to ‘building’ our own lithium portfolio: The first is a producer, the second is an up and comer and the third would be potentially higher risk, with a relatively low market cap.”

Market Cap: $6.93 billion

Share price: $36.72

“Perth-based Mineral Resources is a leading mining services provider, with a particular focus on the iron ore and hard-rock lithium sectors in WA,” Dagan says.

“The top Australian lithium stock’s current lithium projects include Mount Marion and Wodgina.

“The Mount Marion lithium project, which is located in Kalgoorlie, WA, is jointly owned by Mineral Resources and top lithium producer Jiangxi Ganfeng Lithium.

“The asset was initially expected to produce over 206,000 tonnes of spodumene concentrate per year, but the mining companies are completing an upgrade project to increase production to 450,000 tonnes of all-in 6 percent spodumene concentrate per year.

“The company’s recent joint venture with top producer Albemarle (NYSE:ALB) for its Wodgina hard-rock mining lithium project to produce spodumene concentrate, has really put it on the map.”

Market cap: $1.02 billion

Share price: 74c

“Piedmont Lithium’s flagship project is located in North Carolina, host to the world-class Carolina Tin-Spodumene Belt,” Dagan says.

“Major mining companies such as Livent (NYSE:LTHM) and Albemarle (NYSE:ALB) have longstanding operations in this region.

“Piedmont Lithium has signed a binding five-year agreement with US electric vehicle maker Tesla (NASDAQ:TSLA) for the supply of spodumene concentrate from Piedmont’s North Carolina deposit.

“This partnership has seen the stock price ‘skyrocket’ from $0.10 in September to $0.74 as of today.”

Market cap: $84 million

Share price: 9.4c

“Anson is developing the Paradox Basin Brine Project for recovery of valuable chemicals from a unique salt brine resource in southern Utah, USA,” Dagan says.

“The project will supply lithium chemicals to the rapidly growing battery market, and will produce high value by-products including bromine, iodine, and boron.

“The company recently announced that it will use ASX listed battery tester Novonix (ASX:NVX), which anticipates this testing to take 4-5 months beginning early February.

“Key focus areas were advancing a Pre-feasibility Study (PFS) and commissioning of performance testing of lithium hydroxide and lithium carbonate in lithium-ion battery test cells.

“Anson intends to use these results to further discussions with prospective offtake partners.

“Following a strategic review and recognition of changing market conditions for lithium, Anson has now decided to accelerate the production of lithium chemicals to Stage 1 of the Project.”

GAVIN WENDT

MineLife

“I’ve come up with five suggested lithium stocks,” Wendt says.

“There is a heap of others of course, but these are companies that I have followed for a while and seem to be doing well.

“They all are quite different in terms of market size, level of advancement, project location etc – so a little something for everyone!”

Market Cap: $2.74 billion

Share Price: 94c

“The company is an established Western Australian producer that’s ridden the ups-and-downs of the lithium market over the past five years, with its share price reflecting underlying volatility in lithium prices,” Wendt says.

“Its Pilgangoora project is a well-established, long-life spodumene operation that has significant expansion potential, with production spoken-for under off-take agreements.

“Its biggest attraction is that it has managed to achieve production status (no easy task for any junior), meaning it is now directly leveraged to lithium price movements, which are now very much working in its favour.”

Market Cap: $317 million

Share Price: 32c

“The only lithium-brine company in our list, it maintains one of the largest lithium tenement packages in Argentina’s Lithium Triangle, a renowned province that produces around 50 per cent of the world’s lithium resources at the lowest cost,” Wendt says.

“Its Kachi project already ranks amongst the top 10 global lithium brine resources worldwide and will utilise an innovative direct-extraction technique, based on a well-used ion exchange water treatment method, which has resulted in the production of battery-quality lithium carbonate (99.9 per cent purity) with very low impurities.”

Market Cap: $266 million

Share Price: 26c

“Well positioned to be Australia’s next lithium producer, its near construction-ready Finniss spodumene project in the Northern Territory has arguably the best supporting infrastructure and logistics chain to Asia of any domestic lithium project,” Wendt says.

“It lies within 25km from port, power station, gas and rail, and is just one hour by sealed road from Darwin Port – our nearest port to Asia.

“Core has already established binding offtake and is in the process of negotiating further agreements within the lithium battery supply chain and electric vehicle industry.”

Market Cap: $146 million

Share Price: 3.9c

“Another international player, which aims to develop a spodumene production hub in Quebec, Canada,” Wendt says.

“A recent significant corporate tie-up with Piedmont Lithium will underwrite the future of the company’s advanced Authier project, assist with growth plans in Québec, and access to investors in the US market.

“Sayona will profit directly from the Québec government’s aim of developing a complete lithium value chain, from mining through to downstream processing, benefitting from its proximity to US battery markets and competitive advantages including access to low‐cost hydropower.”

Market Cap: $23 million

Share Price: 18c

“The tiddler of our group with a market value of just $21m, it only listed in late 2020,” Wendt says.

“It maintains a 100 per cent interest in two lithium exploration projects within the southern Thai part of the South East Asian tin-tungsten belt.

“Recent exploration drilling has focused on its Bang I Tum lithium project, targeting lithium-bearing pegmatites up to 25m wide and associated dykes below an old pit that was previously mined for tin.

“The rig has since moved on to the company’s other lithium project, Reung Kiet, where drilling is target lepidolite-rich pegmatites.

“With Pan Asia you also get exposure to the company’s tungsten exploration assets.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.