Guy on Rocks: Soaring tin price puts spotlight on emerging ASX players

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

An interesting piece of research is out from Citi, who have quantified production guidance versus actual production rates of the larger global miners.

On a copper-equivalent basis, the data shows these projections were 4% too optimistic over the last nine years.

According to Citi, 2021 is looking like 2% with nickel (-8%), PGMs (-8%), zinc (-6%) and coal (-5%) while aluminium is looking like (+3%), copper (+1%) with iron ore and gold steady.

These variances can have significant impacts on metal prices, particularly in periods of tightening supply.

In my opinion, this is going to be the case for nickel and copper in the medium to longer term.

Iron ore prices (62% Fe) appear to have rebounded late last week and finished over US$100/t again.

While Evergrande is far from resolving its debt issues, I anticipate a Chinese style “selective” bailout is likely.

Recent China steel surveys (Macquarie Commodity Strategy Team) show a recovering in near-term steel sentiment with infrastructure and machinery demand increasing month-on-month.

Importantly, the outlook for steel margins, after being off 20% from its April 2021 peak, looks solid with iron ore stockpiles at low levels after several months of destocking.

Veteran broker Richard Morrow describes iron ore as “ridiculous” at $US220 a tonne and “ludicrous” at $US100 a tonne given Pilbara producers have “all in” sustaining costs of $40 a tonne ($US29).

Well, I think we may be looking at ludicrous margins for some time to come. Given property accounts for 28% of GDP and any discussion or actual recession in China will see a number of the Chinese Communist Party bureaucrats peeling spuds with the Uyghurs at one of their 5-star holiday camps. Failure is not an option.

With BHP and Fortescue trade on multiples of 7.4 and 7.8 times respectively, with yields of 6% and 11% respectively, I smell a buying opportunity.

And one of my favourite metals (second only to gold), nickel, looks like it may be getting another shove as there appears to be a very real possibility that Indonesia will impose an NPI (nickel pig iron) ban.

NPI accounts for around 75% of bas case nickel supply through to 2023.

Another commodity we picked up a few months ago was tin which roared past US$36,000/tonne late last week to a new all-time high of $36,770 (figure 4).

It appears that power rationing in the Chinese province of Guangxi has contributed to falls in production and corresponding spikes in the tin price, particular with the likes of tin producers such as Yunnan Tin curtailing production.

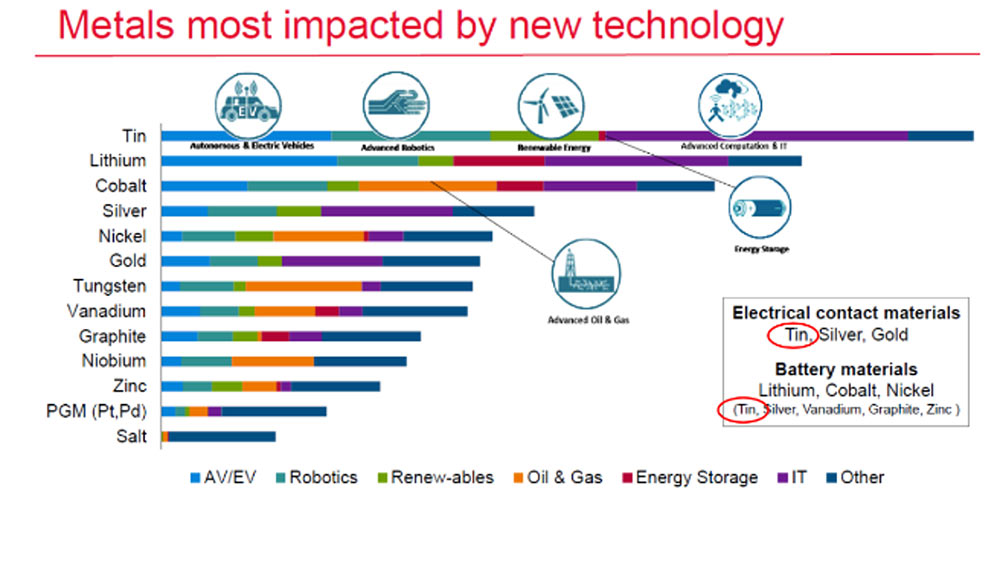

This has been further exacerbated by the closure of smelters in Hubei due to environmental issues and falling production in both Indonesia and Myanmar. As we can see (figure 5), tin is going to be a significant beneficiary of the “electrification of everything”.

Company News

The pool of ASX listed tin explorers and developers is a little thin on the ground however we did mention Stellar Resources Ltd (ASX:SRZ) back in early June of this year at around 2.5 cents which closed at 3.3 cents today (figure 6).

The company owns 100% of the Heemskirk tin project and the Company has recently completed two deep diamond drill holes from its Phase 1 drilling program in early September.

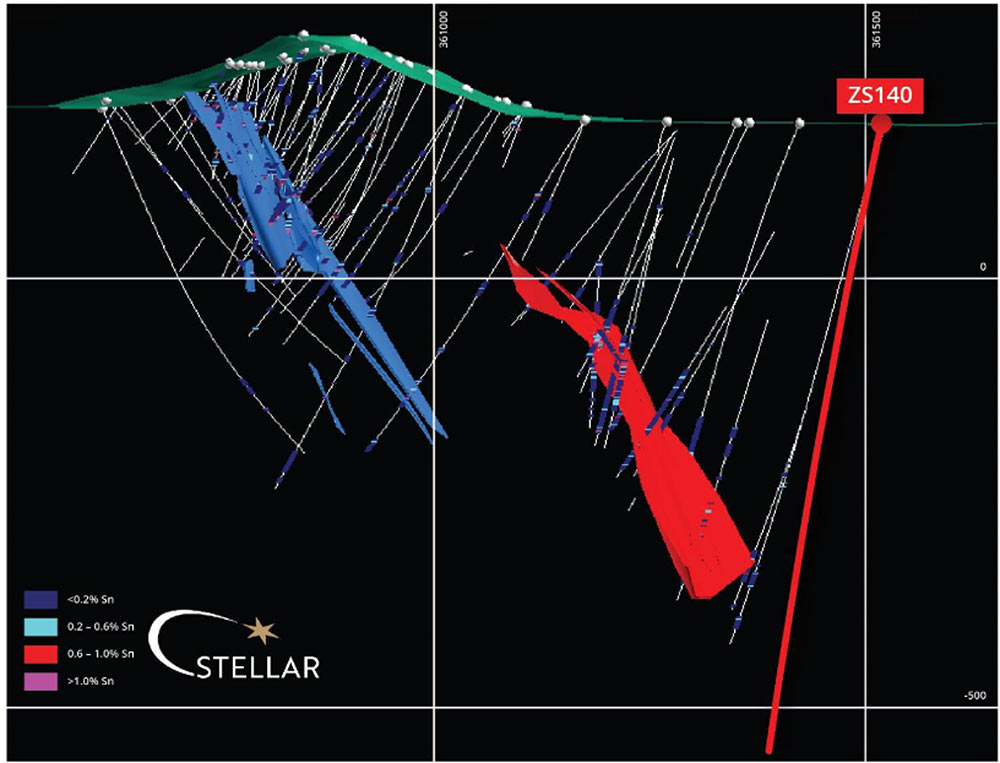

Severn Drillhole ZS140 intersected broad zones of pyritic alteration (associated with cassiterite mineralisation) at a vertical depth of 600m commencing from approximately 50m below the Severn Tin Resource (figure 7). This hole was extended from 750m to 889m due to the continuation of significant alteration and mineralisation beyond the planned depth.

High-grade mineralisation at Severn (the largest of the 4 deposits at Heemskirk) remains open at depth.

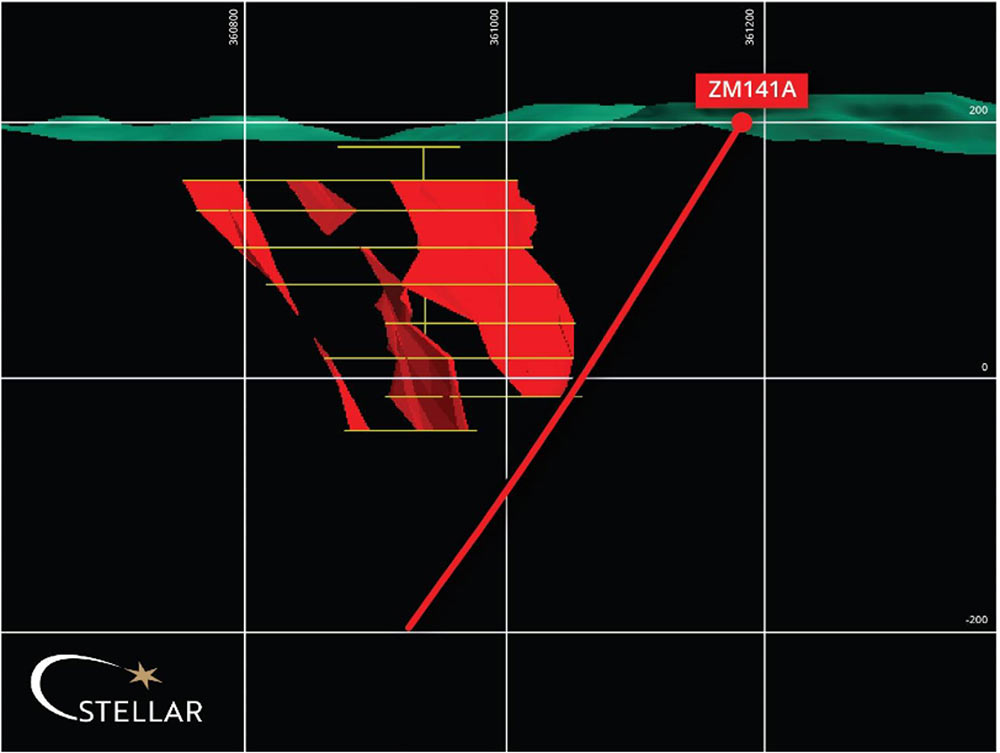

Montana Drillhole ZM141A was also a success and intersected Silver-Lead-Zinc Fissure Lodes from around 75 metres below the old Montana No. 1 silver-lead-zinc mine that was mined from surface to ~250m on 6 lodes (figure 8):

This hole was originally planned to terminate at 500m downhole but was extended to 534m due to additional siderite-sulphide veining being intersected around 500m downhole. Results are due in late October 2021.

As mentioned in the June article, the project economics based around a modest CAPEX of around $60 million and all-in-sustaining costs of around $123/tonne from the 2019 Scoping Study were reasonably solid returning a post-tax NPV of $71 million and an internal rate of return of 45%.

This should be looking a lot better based on current tin prices of $50,000 compared to $28,000/tonne used in the 2019 Scoping Study.

New Ideas

If you believe gold is going to $10,000/oz (or $3,000/oz if you are ultra-conservative) and with the gold index at a 2-year low (figure 9) I think it is time to roll back into the mid-tier gold developers/producers.

I know this sounds a bit boring but with valuations of the mid-tier gold miners at cyclical lows my experience suggests that when the gold price does turn (just before the impending financial apocalypse) then the money will flow back in to the large and mid-cap miners first, then into the larger developers/advanced explorers, such as De Grey Mining Ltd (ASX:DEG) for example.

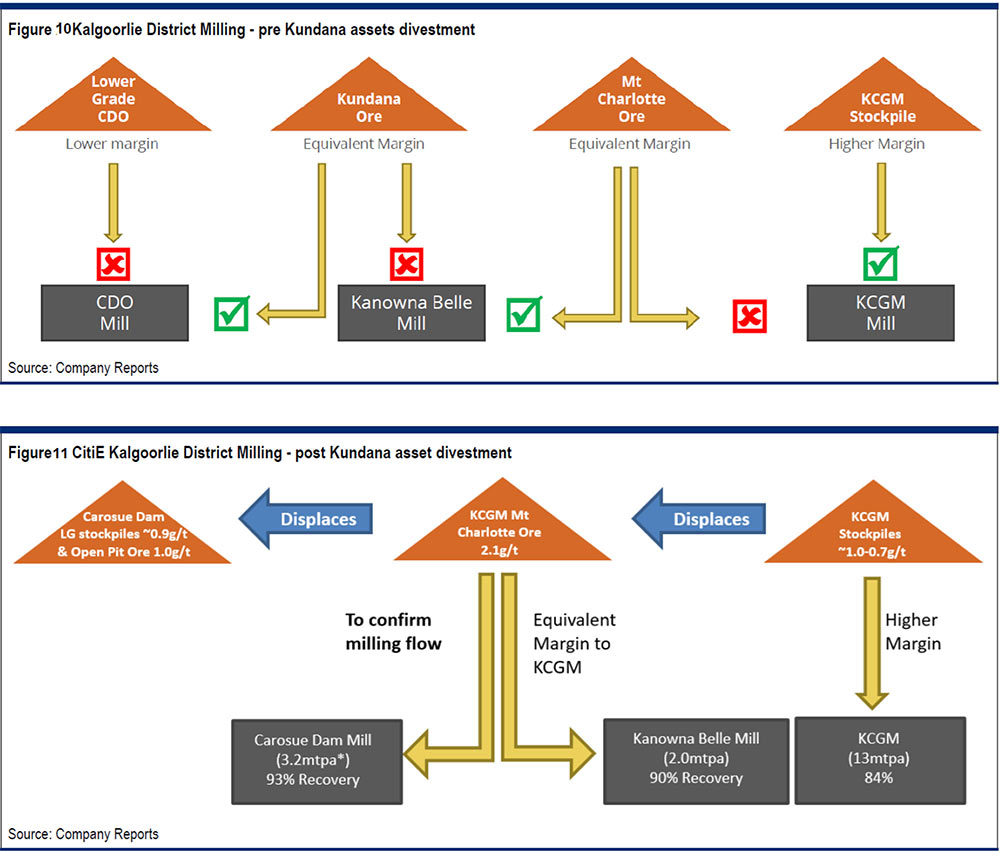

While the new look Northern Star Resources Ltd (ASX:NST) is still finding its feet under new leader Stuart Tonkin following its merger with Saracen Mineral Holdings, the synergies of the Kalgoorlie District Milling (figures 10 and 11) could add $7 million in annual EBITDA according to Citi with FY 22 production likely to lift to around $1.63 million.

Write downs are likely to lower FY22 NPAT figures, but production from KCGM stockpiles is expected yield strong cash margins given the company is only incurring processing and minimal transport costs.

While gold stocks were trading at 1.5 to 2x net asset values in September last year, assuming Citi’s numbers are correct then NST is currently trading at a 17% discount to its $10.50 valuation, assuming an $8.63 share price at last trade.

So, from a value perspective I think it is looking a lot more attractive.

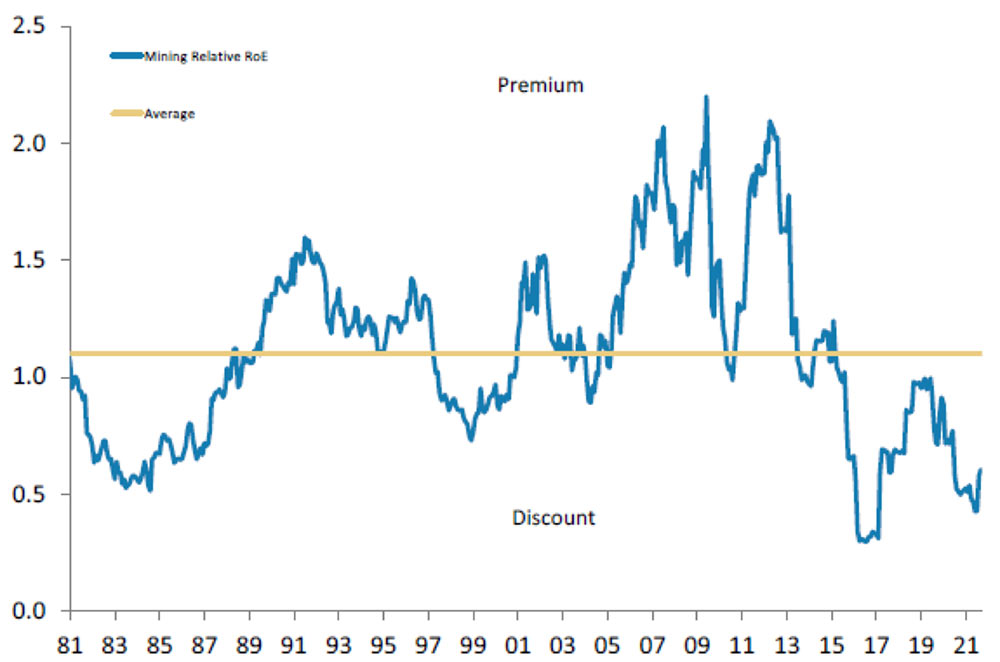

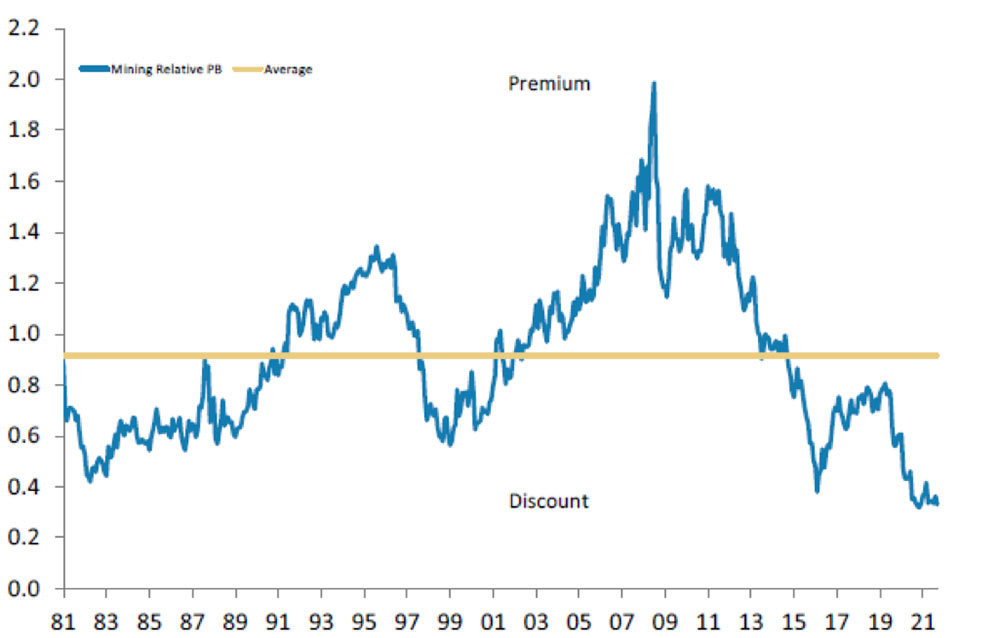

I would also put the large cap miners in the same bucket as the gold sector at the moment, with figures 12 and 13 showing the large discounts (using return on equity and price to book ratios) that the larger miners (Rio and BHP for example) are trading on currently.

So, the message is that while there is still a lot of overvalued small cap garbage trading on ASX and promoting heavily to the great unwashed*(excluding the companies I have covered here since early 2020 of course) you may as well buy the mid-large cap gold and diversified miner’s sector. That way you can take the guess work out of it and look like a hero. In the interim I will keep looking for value on the small end…

*The “Great Unwashed” are those uninformed investors who don’t subscribe to Stockhead.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.