Pilbara Minerals just sold its lithium at auction for $US2,240/t. That’s a 550pc yoy increase

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Pilbara Minerals (ASX:PLS) has sold an 8,000t SC5.5 spodumene cargo for an extraordinary $US2,240/t via its Battery Material Exchange (BMX) digital auction platform.

The ‘icing on the cake’ for PLS is that this product – 5.5% lithium – is the low grade stuff.

The equivalent headline price achieved for industry standard 6% product would be USD$2,500/t.

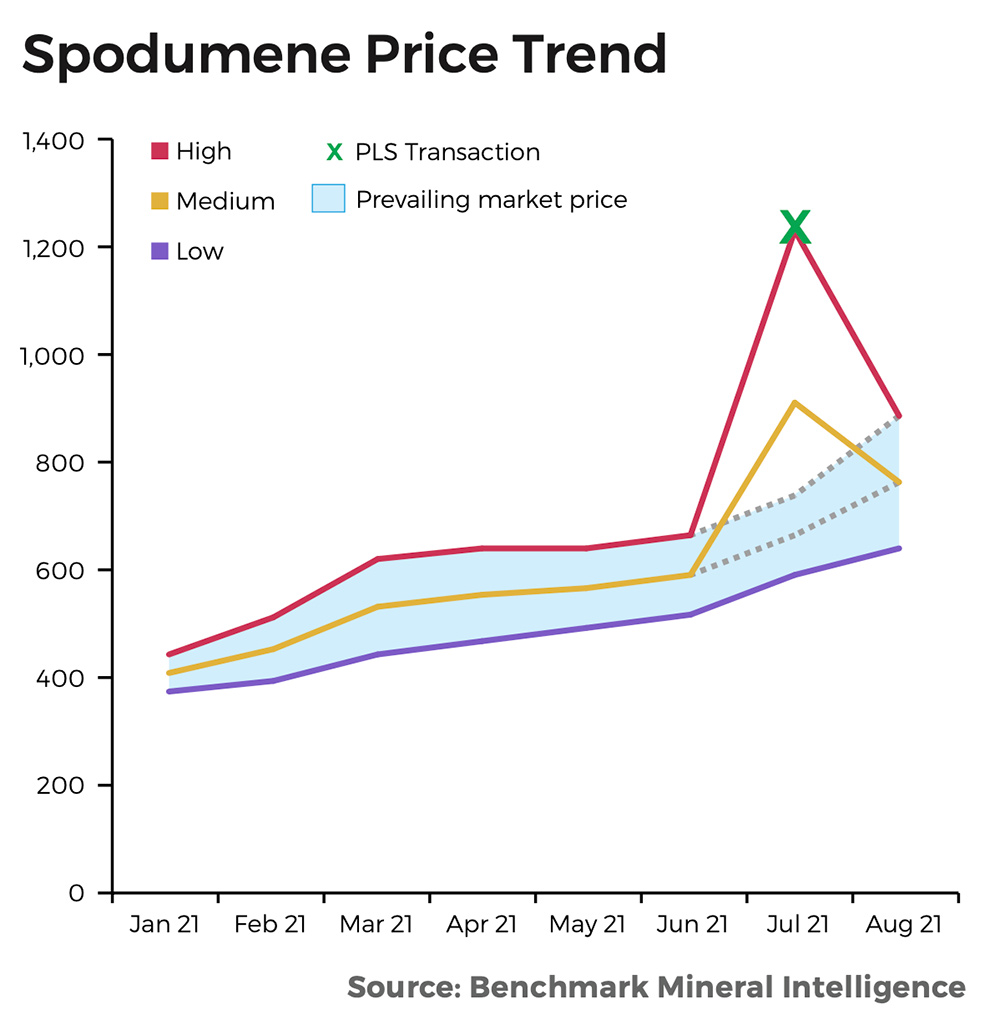

This essentially doubles the $US1,250/tonne received via the inaugural auction held late July.

It is also represents a ~550% year-on-year price increase, with spod prices last year hitting lows of ~$US380/t.

Even the experts are dumbstruck.

Wow….. $PLS pic.twitter.com/JPP2pTvAIk

— Chris Berry (@cberry1) September 14, 2021

“Given the strong margins yielded through the BMX trading platform to date, Pilbara Minerals expects to channel more concentrate sales through the platform, including concentrate generated from the recommencement of the Ngungaju processing plant,” PLS says.

These numbers are well above the standard, even in a supply constrained market like this one.

In an early September update, Benchmark Mineral Intelligence said average pricing for August was $US775/tonne, with recorded prices this month ranging between $US650-900/tonne (FOB Australia).

The first Pilbara lithium auction set the market alight because it gave punters a rare look inside the opaque lithium market.

It also indicated that lithium shortages, which were supposed to start kicking in around 2023-2024, are happening right now.

There was a rush to the doors for lithium stock exposure in August. Will lithium stocks respond again?

A point exemplified by @PilbaraMinerals second auction, which just settled at a record price of $2,240/tonne FOB Australia, for 8,000 dmt of 5.5% Li20 spodumene.

Competition surrounding tight #lithium feedstock supply beginning to see more converter margins passed upstream https://t.co/UutqLEzAcc

— George Miller (@georgemillerBMI) September 14, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.