Who made the gains? Here are July’s top 50 small cap miners and explorers

Pic: John W Banagan / Stone via Getty Images

What happened to the most talked about commodities in July?

Gold bounced back from recent lows to record a solid 2.54% gain (that’s +4.12% in Aussie dollar terms).

The base metals suite – aluminium, copper, lead, nickel, tin and zinc – all finished higher.

Battery metals, led by lithium, are absolutely flying.

The only downside in July was iron ore, which happily bounced between $US210/t and $220/t for most of the month, before plummeting to ~$US180/t when China dusted off ‘straight-from-the-playbook’ rhetoric about cutting steel production in efforts to dampen prices.

It worked – just like its similar tactics worked on copper and nickel markets — but will it cause FUD for long?

Experts are divided on whether significantly cutting steel production is even possible.

The same ploy definitely didn’t work for coal, which was the biggest gainer last month.

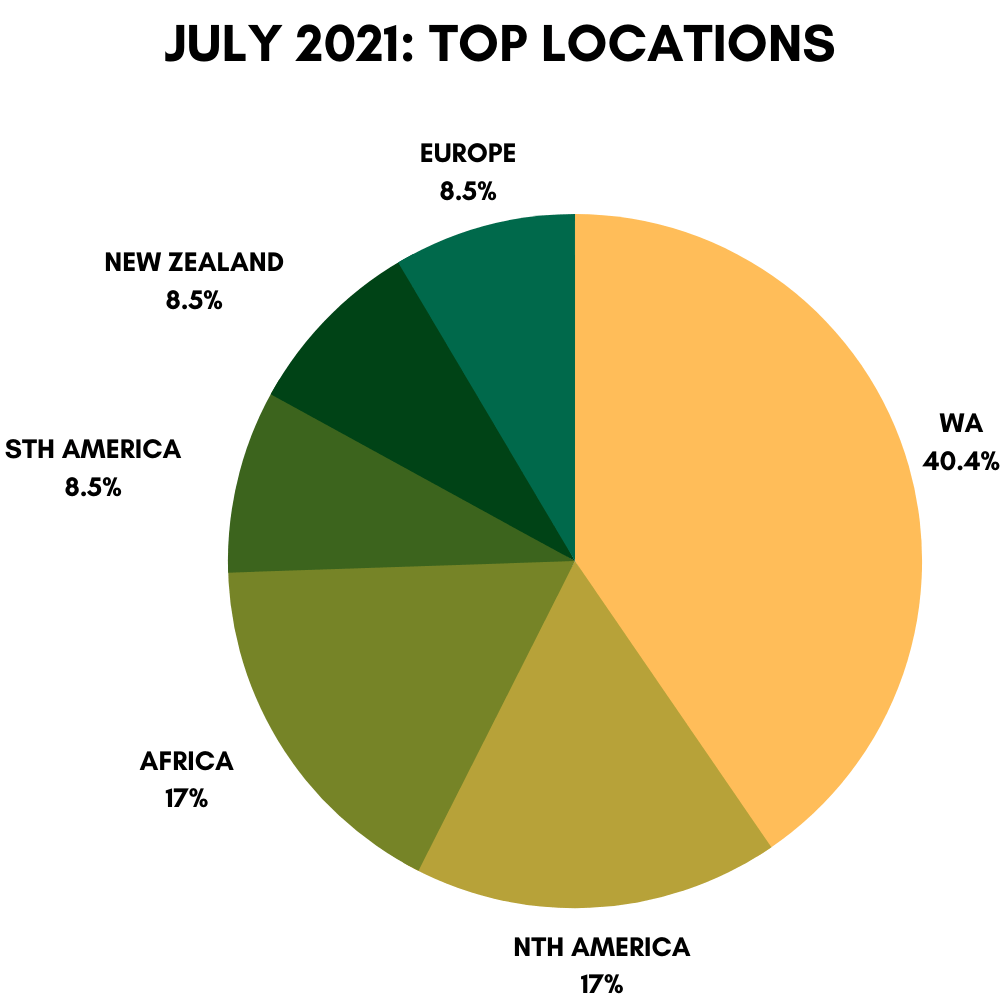

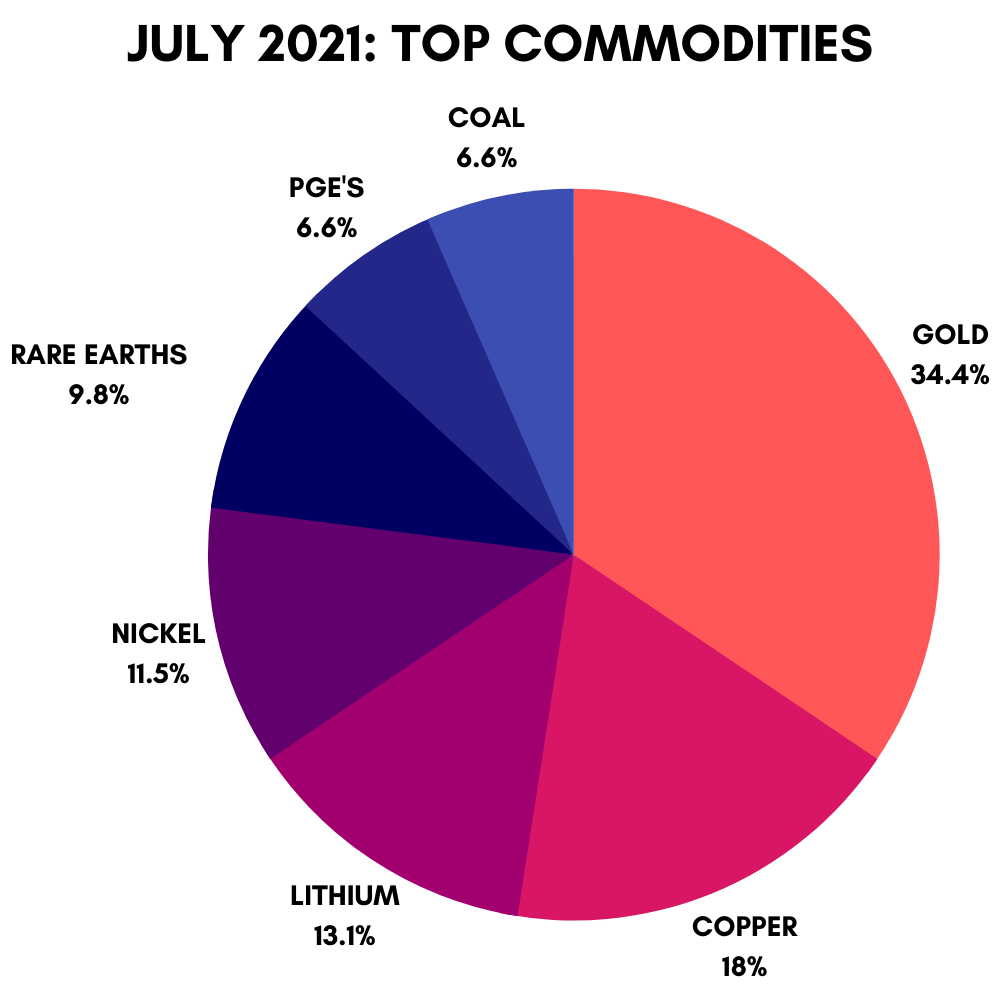

What were the top 50 resources winners for July searching for, and where?

Here are the top 50 ASX resources stocks for the month of July >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | JULY RETURN % | SHARE PRICE | MARKET CAP | LOOKING FOR | WHERE |

|---|---|---|---|---|---|---|

| AR3 | Australian Rare Earths | 155 | 0.765 | $ 34,259,245.16 | RARE EARTHS | SOUTH AUSTRALIA, VIC |

| OKR | Okapi Resources | 120 | 0.44 | $ 23,473,397.64 | URANIUM, GOLD | NSW, NORTH AMERICA |

| CNJ | Conico | 104 | 0.057 | $ 52,232,921.34 | COPPER, NICKEL, COBALT, PGE, GOLD | EUROPE |

| KOR | Korab Resources | 100 | 0.024 | $ 7,979,831.54 | MAGNESIUM, GOLD | NORTHERN TERRITORY |

| MRD | Mount Ridley Mines | 100 | 0.004 | $ 20,060,494.29 | RARE EARTHS | WA |

| PDI | Predictive Discovery | 95 | 0.15 | $ 202,510,782.30 | GOLD | AFRICA |

| ATU | Atrum Coal | 79 | 0.052 | $ 30,260,445.96 | COAL | NORTH AMERICA |

| FEL | Fe Limited | 73 | 0.088 | $ 66,119,888.12 | IRON ORE | WA |

| CKA | Cokal | 67 | 0.1 | $ 92,458,231.30 | COAL | INDONESIA |

| NME | Nex Metals Exploration | 62 | 0.042 | $ 11,214,992.21 | GOLD | WA |

| AUR | Auris Minerals | 54 | 0.074 | $ 35,270,320.82 | COPPER, GOLD | WA |

| ARN | Aldoro Resources | 54 | 0.47 | $ 38,049,968.13 | LITHIUM, NICKEL, PGE | WA |

| CY5 | Cygnus Gold | 52 | 0.16 | $ 17,347,215.68 | NICKEL, COPPER, GOLD, PGE | WA |

| PSC | Prospect Resources | 52 | 0.32 | $ 122,727,531.20 | LITHIUM | AFRICA |

| POS | Poseidon Nickel | 52 | 0.135 | $ 379,271,005.02 | NICKEL | WA |

| LPD | Lepidico | 50 | 0.015 | $ 92,281,236.69 | LITHIUM | AFRICA |

| GTE | Great Western Exploration | 50 | 0.165 | $ 22,472,689.31 | POTASH, COPPER, GOLD | WA |

| ESS | Essential Metals | 47 | 0.14 | $ 28,114,422.00 | LITHIUM, GOLD | WA |

| LPI | Lithium Power International | 46 | 0.27 | $ 81,290,935.53 | LITHIUM | SOUTH AMERICA, WA |

| GSN | Great Southern Mining | 45 | 0.061 | $ 27,756,245.62 | GOLD | WA, QLD |

| BRL | Bathurst Resources | 45 | 0.66 | $ 112,828,071.18 | COAL | NEW ZEALAND |

| AZY | Antipa Minerals | 44 | 0.059 | $ 184,751,907.46 | COPPER, GOLD | WA |

| GRR | Grange Resources | 42 | 0.845 | $ 977,951,199.81 | IRON ORE | TAS, WA |

| REE | Rarex | 39 | 0.1 | $ 43,534,320.40 | RARE EARTHS, COPPER, GOLD | WA, NSW |

| LKE | Lake Resources | 39 | 0.465 | $ 493,028,957.06 | LITHIUM | SOUTH AMERICA |

| NSM | North Stawell | 38 | 0.36 | $ 14,400,000.00 | GOLD | VIC |

| LNY | Laneway Resources | 38 | 0.0055 | $ 21,472,362.63 | GOLD | QLD, NEW ZEALAND |

| AUT | Auteco Minerals | 38 | 0.11 | $ 183,389,682.96 | GOLD | NORTH AMERICA |

| NMT | Neometals | 38 | 0.66 | $ 361,928,421.36 | VANADIUM, LITHIUM, NICKEL | EUROPE, WA |

| CXX | Cradle Resources | 37 | 0.081 | $ 15,364,224.42 | NIOBIUM | AFRICA |

| SYR | Syrah Resources | 36 | 1.405 | $ 699,987,119.57 | GRAPHITE, VANADIUM | AFRICA, NORTH AMERICA |

| PVW | PVW Resources | 36 | 0.19 | $ 12,816,585.85 | GOLD, RARE EARTHS, NICKEL, COPPER, PGE | WA |

| JAL | Jameson Resources | 35 | 0.115 | $ 34,883,167.35 | COAL | NORTH AMERICA |

| SMI | Santana Minerals | 34 | 0.11 | $ 12,543,589.96 | GOLD | NEW ZEALAND |

| NTL | New Talisman Gold | 33 | 0.004 | $ 11,168,901.45 | GOLD, SILVER, COPPER | VANUATU, NEW ZEALAND |

| STM | Sunstone Metals | 33 | 0.02 | $ 44,199,752.92 | GOLD, COPPER | SOUTH AMERICA |

| FTZ | Fertoz | 33 | 0.22 | $ 44,904,791.58 | PHOSPHATE | NORTH AMERICA |

| ATC | Altech Chemicals | 33 | 0.057 | $ 73,329,481.58 | HIGH PURITY ALUMINA | EUROPE, MALAYSIA |

| LEL | Lithium Energy | 32 | 0.49 | $ 22,050,000.00 | LITHIUM, GRPAHITE | SOUTH AMERICA, QLD |

| IXR | Ionic Rare Earths | 30 | 0.03 | $ 101,771,985.42 | RARE EARTHS | AFRICA |

| COY | Coppermoly | 30 | 0.013 | $ 27,653,781.86 | COPPER, GOLD | PAPUA NEW GUINEA |

| VKA | Viking Mines | 29 | 0.022 | $ 22,467,685.48 | GOLD | WA |

| MNB | Minbos Resources | 29 | 0.084 | $ 38,978,763.35 | PHOSPHATE | AFRICA |

| AX8 | Accelerate Resources | 29 | 0.04 | $ 6,273,911.76 | KAOLIN, MANGANESE, IRON ORE | WA |

| ADT | Adriatic Metals | 29 | 3.07 | $ 571,165,825.00 | SILVER, ZINC | EUROPE |

| LIN | Lindian Resources | 29 | 0.027 | $ 20,194,265.82 | BAUXITE | AFRICA |

| CZN | Corazon | 29 | 0.045 | $ 9,137,436.48 | NICKEL, COBALT | NORTH AMERICA, NSW |

| LYC | Lynas Rare Earths | 29 | 7.34 | $ 6,613,916,769.86 | RARE EARTHS | WA, MALAYSIA, NORTH AMERICA |

| MLX | Metals X | 28 | 0.275 | $ 249,498,168.43 | TIN | TAS |

| ORE | Orocobre | 28 | 8.25 | $ 2,840,934,706.50 | LITHIUM | SOUTH AMERICA |

Battery metals blowout

The battery metals shortfall is coming sooner than expected, experts say.

A predicted 2023-2024 demand-supply pinch point for lithium appears to be happening right now, with the inaugural Battery Material Exchange auction for spodumene from Pilbara Mineral’s (ASX:PLS) Pilgangoora operation settling at a record-high $US1,250/tonne for a 10,000/t cargo.

That’s well above prevailing market price, and streets ahead of the ~$US380/t spod producers were accepting last year.

Stocks – from early-stage explorers and project developers, through to veteran producers — are reaping the benefits.

Just check out this list of lithium-facing stocks in July’s top 50:

- Aldoro Resources (ASX:ARN) +54%

- Prospect Resources (ASX:PSC) +52%

- Lepidico (ASX:LPD) +50%

- Essential Metals (ASX:ESS) +47%

- Lithium Power International (ASX:LPD) +46%

- Lake Resources (ASX:LKE) +39%

- Neometals (ASX:NMT) +38%

- Lithium Energy (ASX:LEL) +32%

- Orocobre (ASX:ORE) +28%

Revenge: a dish best served coaled

A coal shortage in China – the world largest user by a significant margin — has been aggravated by lower global production and an ‘officially unofficial’ ban on Aussie imports.

Prices for Australian coking and thermal coal have recovered this year but are well short of the crazy prices China is paying after cutting off Australian imports, which have been redirected to other markets.

A bunch of non-Australia-based ASX stocks are benefitting.

In Atrum Coal’s (ASX:ATU) case, its gains over July were really just a partial recovery from early 2021 losses.

The Canada based coking coal stock plunged in Feb when its neighbour — Gina Rinehart’s Riversdale Resources, — copped a call from authorities that its $800 million Grassy Mountain mine was not in the public interest.

Cokal (ASX:CKA) has a bunch of coking coal projects in Indonesia.

Its focus is the Bumi Barito Mineral (BBM) coal project (CKA 60%), which is being developed into a 2mtpa open cut mine as we speak.

Last month, Cokal made its first drawdown of $US2 million from a $US20 million facility which will fund development of BBM “through to first production and sales, which is anticipated to occur in Q4 2021”.

New Zealand-focused producer Bathurst Resources (ASX:BRL) won an appeal in New Zealand’s Supreme Court that prevented a US$40 million payout to NZ based royalty holder L&M Coal Holdings.

It was the second lot of good news for Bathurst in as many months, after announcing in June it would exceed its revised EBITDA guidance of $55.4m just months after knocking it down on the back of a stunning recovery in coal prices.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.