Resources Top 5: Could this be the next Bellevue?

Pic: Via Getty

- Poseidon spruiks “robust” 150,000oz gold and 375,000oz silver ‘Windarra’ tailings project in WA

- Viking hits more visible gold in ‘step out’ drilling at ‘First Hit’ project

- AVL (vanadium), Cokal (coal) and AGC (gold, copper) up on no news

Here are the biggest small cap resources winners in early trade, Friday July 23.

POSEIDON NICKEL (ASX:POS)

Nickel is just hot right now, thanks to taste maker Elon Musk.

But today’s announcement from WA nickel stock Poseidon was spruiking the “robust” 150,000oz gold and 375,000oz silver ‘Windarra’ tailings project.

A feasibility study ‘base case’ predicts net profits of $30.6 million over a 45-month production period, assuming a conservative gold price of US$1,750/oz.

The all-in sustaining cost (AISC) is A$1,393/oz – a nice profit margin at current Aussie gold prices.

“The results from the DFS demonstrate a robust and profitable project retreating the gold tailings at Windarra and Lancefield,” Poseidon boss Peter Harold says.

“The gold tailings present a project which can generate positive cash flows to be invested into our nickel business, which is our primary focus.”

The tailings project would be ideal for a partnership style arrangement or an outright sale, he says.

“We will be actively looking for a high-quality partner to work with to bring this project into production or a party to acquire the project so we can monetise the asset for Poseidon shareholders.”

VIKING MINES (ASX:VKA)

Could Viking be the next Bellevue?

Yesterday, ex Newmont/ current Northern Star dealmaker Dave Hall joined the board.

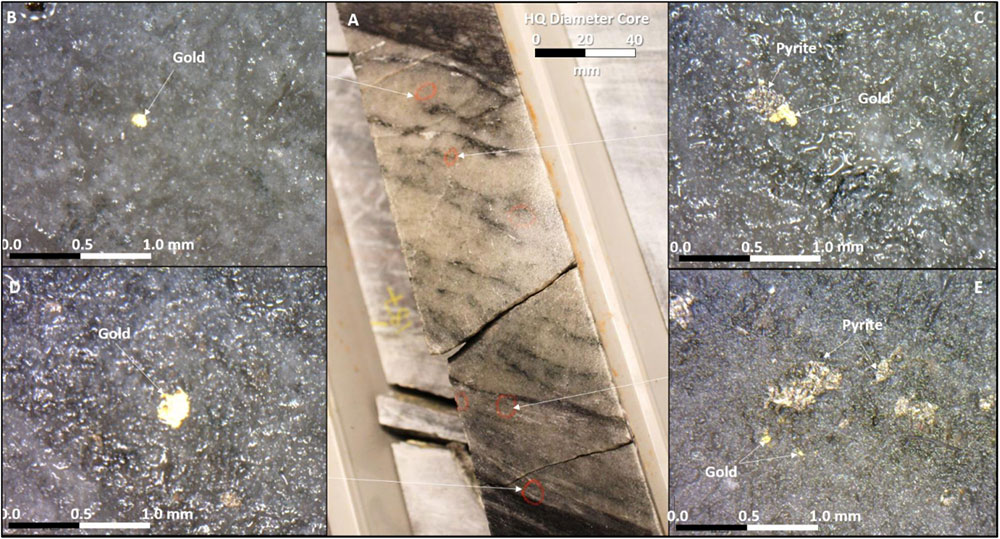

Today, the $20m market cap explorer hit more visible gold in ‘step out’ drilling 165m north of the historical workings at the ‘First Hit’ project:

Prior to closure in 2002 due to depressed gold prices below $US320/oz, First Hit produced ~30koz ounces of gold at an average grade of ~7.7g/t gold.

“What is exciting is that we have seen gold in a quartz vein in one of the step out holes located ~165m north of the historic underground workings and in a shallow position below surface,” Viking boss Julian Woodcock says.

“This confirms that the structures hosting the First Hit mineralisation contain gold beyond the previously defined limits of mineralisation.”

AUSTRALIAN VANADIUM (ASX:AVL)

(Up on no news)

Vanadium demand is rebounding fast and AVL — which has persistently advanced work programs during the not-so great times — now has one of the world’s most advanced projects, right here in WA.

Yesterday, $60m market cap AVL’s plans to design, build and operate a local vanadium battery electrolyte plant received a boost after it secured a $3.69m government grant.

“The grant will provide support to AVL to achieve production of high-purity vanadium pentoxide, which is a key input to vanadium-titanium master alloys for critical steel applications and vanadium electrolyte for batteries,” AVL managing director Vince Algar says.

“In turn this will assist development of the project, with the company now in discussion with offtakers for vanadium electrolyte in addition to vanadium pentoxide.”

COKAL (ASX:CKA)

(Up on no news)

The $90m market cap stock has a bunch of metallurgical (steelmaking) coal projects in Indonesia.

The focus is the Bumi Barito Mineral (BBM) coal project (CKA 60%), which is being developed into a 2mtpa open cut mine as we speak.

Earlier this week, Cokal made its first drawdown of $US2 million from a $US20 million facility which will fund development of BBM “through to first production and sales, which is anticipated to occur in Q4 2021”.

“With full funding in place through this facility, Cokal is wasting no time in making the necessary preparations in the development of the mine infrastructure to enable the commencement of production,” Cokal chairman Domenic Martino says.

AUSTRALIAN GOLD AND COPPER (ASX:AGC)

(Up on no news)

Newly listed AGC has three advanced gold and copper projects in the Lachlan Fold Belt of NSW.

In late June a 20-hole drilling program kicked off at the 8km-long ‘Achilles’ base metal target, where previous drilling had pulled up promising intercepts like 5m at 4.9% lead and zinc, 0.3% copper and 5g.t silver from 89m.

Down hole EM – a helpful tool to find more sulphides — will be completed shortly after drilling, the company says.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.