Monsters of Rock: Can China really slash steel output? Some experts say no

Pic: Tyler Stableford / Stone via Getty Images

Iron ore is at two and half month lows after world #1 steelmaker China ostensibly committed to cutting output.

The big boys of iron ore were down for the second day in a row – BHP (ASX:BHP), Rio Tinto (ASX:RIO), Mineral Resources (ASX:MIN) and FMG (ASX:FMG) – with the mids and smalls following suit.

In May, we saw a small slump in iron ore prices after Chinese premier Li Keqiang said China needed to take more steps to curb “unreasonable” price increases for bulk commodities, but they soon bounced back.

If these cuts do happen for real, will they be substantial and sustainable? WoodMac and S&P Global Platts both reckon major steel production cuts are “virtually impossible”.

Whether steel cuts really happen or not is another story but, for China, the only thing that matters is that its straight-from-the-playbook move to disrupt high commodity prices has worked, again.

Lithium players charging up

Lithium companies dominated today’s winner’s column. It was green all round, with large cap producers Pilbara Minerals (ASX:PLS), Orocobre (ASX:ORE) and Galaxy (ASX:GXY) continuing to hit all-time highs.

+ $1 billion market cap midcap hopefuls Liontown (ASX:LTR) and Vulcan Energy (ASX:VUL) weren’t far behind.

Pilbara Minerals MD Ken Brinsden told Diggers and Dealers delegates that there is a real shortage of lithium feedstock in the supply chain.

“There is a genuine shortage, that I am certain about,” he said.

“The idea the chemical conversion industry is now stuck, they’ve built a lot of capacity without reference to the underlying raw materials supply base.

“As a result the miners are going to attract more margin, there’s just logic in it.”

Large cap news

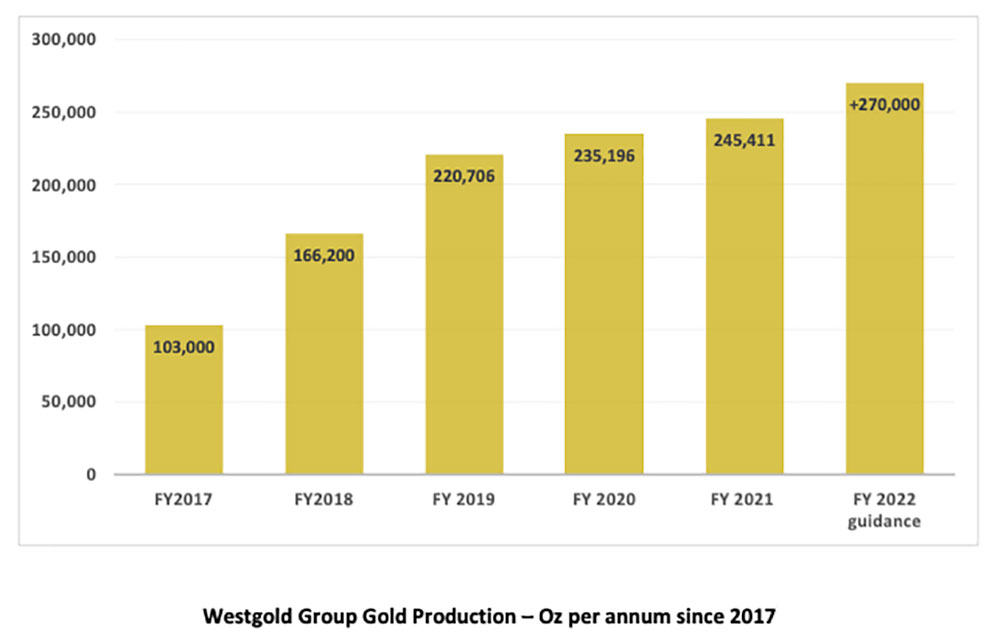

$800m market cap goldie Westgold Resources (ASX:WGX) has increased production every year for the past 5 years.

The streak continues into FY22, with the company expecting to produce +270,000 oz at all in sustaining cost $1,500 – 1,700/oz as “Big Bell, Bluebird and the South Emu-Triton mines achieve higher levels of output”.

“Provided production inputs like labour, mining equipment and consumables don’t continue to rise excessively, we are poised to deliver another solid performance in FY22,” CEO Debbie Fullarton says.

“With this backdrop and continuing proactive cost management, the strategy for FY22 is focussed on lifting grade and cost optimisation within our mines so as to continue building financial strength to fund Westgold’s organic and regional growth aspirations.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.