Bulk Buys: Gina Rinehart’s coking coal ambitions hit Rockie terrain

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Gina Rinehart is used to backing a winner, so it’s unlikely she will take the latest setback for her coal hopeful Riversdale Resources lying down.

Australia’s richest person is in the doghouse with Canadian authorities over the $800 million Grassy Mountain coal mine in Alberta, which an environmental review panel has declared is not in the public interest due to its likely effects on surface water quality, as well as the local westslope cutthroat trout and its habitat.

Riversdale’s subsidiary, Benga Mining, received some other slaps over the wrist, with the review panel accusing it of painting an overly rosy picture of the project’s economic benefits.

Canada is concerned its royalty contributions may not justify allowing the mine to operate if the coal price drops.

It came after Canada’s environment minister Jonathan Wilkinson said this month the North American country would no longer approve new thermal coal projects.

The mine would produce around 93Mt of coking coal over a 23-year mine life.

Nearby juniors get short end of the stick

Riversdale said in a statement it was reviewing the panel’s decision and would be “consulting with legal counsel to review its options moving forward.”

The project, located in an area of the Eastern Rockies known as Crowsnest Pass, has emerged as a cause celebre for environmental advocates attempting to prevent the industrialisation of the Rockies.

The panel’s decision had an immediate impact on some ASX-listed juniors operating in Canada. Montem Resources (ASX: MR1), which owns the Tent Mountain coal redevelopment project in the Crowsnest Pass, suffered a 52% hit yesterday.

Montem Resources share price today:

Montem told its shareholders it is “unclear if the denial of permits for the Grassy Mountain Coal Project by the AER will have an impact on Montem’s own application process”, but stated it believed a number of factors differentiated the projects.

Atrum Coal (ASX: ATU), which owns the Elan project immediately to the north of Grassy Mountain, also took a 40% hit, telling its shareholders “it is Atrum’s expectation that the Elan Project will be judged on its own merits.”

Atrum Coal share price today:

China drives non-Aussie met coal prices up

Metallurgical coal remains a key input in steel production and is essential for producing coke to fuel blast furnaces at steel mills.

It is particularly critical in China, which does not have a high saturation of electric arc furnaces, the kind typically used in steel produced via scrap steel conversion – more on that later.

If it were to get up, the Grassy Mountain project would be well placed if China’s unofficial ban on Australian exports persists.

That, paired with safety-related shutdowns at Chinese mines and strong steel demand, has sent coking coal prices from elsewhere soaring.

Premium hard coking coal cfr Jingtang was up US$3.62/t to US$288.66/t in China according to Fastmarkets, with hard coking coal fetching $US261.73/t, up US$4.54/t.

Australian coal, meanwhile, is being directed to other markets at much higher levels than those seen at the start of the Covid-19 pandemic but at a substantial discount to Chinese pricing.

Fastmarkets saw premium hard coking coal fob Dalrymple Bay Coal Terminal at US$177.28 per tonne Monday, down US$0.54/t, with hard coking coal unchanged at US$154.93/t.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN% | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.012 | -8 | -29 | 20 | 140 | $ 16,818,514.92 |

| PDZ | Prairie Mining Ltd | 0.26 | -7 | 13 | 44 | 136 | $ 59,372,323.14 |

| AHQ | Allegiance Coal Ltd | 0.68 | -10 | 24 | 178 | 94 | $ 189,058,970.56 |

| PAK | Pacific American Hld | 0.019 | -10 | -5 | -17 | 90 | $ 6,053,113.10 |

| CKA | Cokal Ltd | 0.059 | 0 | -9 | -16 | 40 | $ 54,550,356.47 |

| NHC | New Hope Corporation | 1.89 | 2 | 41 | 36 | 34 | $ 1,552,345,957.93 |

| TIG | Tigers Realm Coal | 0.009 | 0 | 13 | -18 | 31 | $ 117,600,321.31 |

| BCB | Bowen Coal Limited | 0.066 | 0 | 3 | 38 | 22 | $ 63,885,509.29 |

| NCZ | New Century Resource | 0.2 | -11 | 3 | -20 | 22 | $ 241,985,609.20 |

| WHC | Whitehaven Coal | 1.94 | -8 | 36 | 17 | 21 | $ 1,941,371,156.16 |

| MR1 | Montem Resources | 0.031 | -69 | -68 | -86 | $ 13,750,933.77 | |

| LNY | Laneway Res Ltd | 0.0045 | -10 | 0 | -36 | 0 | $ 18,875,329.67 |

| AKM | Aspire Mining Ltd | 0.074 | -12 | -3 | -13 | -3 | $ 38,580,410.86 |

| MCM | Mc Mining Ltd | 0.105 | 0 | 0 | -45 | -5 | $ 16,214,053.28 |

| YAL | Yancoal Aust Ltd | 2.05 | -5 | 2 | -17 | -5 | $ 2,667,287,662.74 |

| SMR | Stanmore Resources | 0.695 | -4 | -1 | -13 | -15 | $ 187,932,407.00 |

| CRN | Coronado Global Res | 0.805 | -5 | 26 | -19 | -17 | $ 1,265,722,566.15 |

| TER | Terracom Ltd | 0.105 | -13 | -13 | -40 | -38 | $ 82,896,839.30 |

| BRL | Bathurst Res Ltd. | 0.31 | 0 | -3 | -21 | -43 | $ 50,430,728.79 |

| JAL | Jameson Resources | 0.087 | -3 | -3 | -21 | -44 | $ 26,389,874.43 |

| ATU | Atrum Coal Ltd | 0.028 | -38 | -52 | -91 | -88 | $ 27,350,787.69 |

Is this project the future of steelmaking?

In the current political climate it remains unlikely environmental noise about coal’s use in the steelmaking process will get quieter, with steel production accounting for about 7% of energy sector CO2 emissions according to the IEA.

Swedish scientists have reportedly pioneered a process called HYBRIT to create the world’s first sponge iron using fossil-free hydrogen gas.

Consortium SSAB, LKAB and Vattenfall says it has cut about 90% of the emissions from the steelmaking process, producing around 100 tons of product at its pilot plant, with trials to continue until 2024.

It plans to bring industrial scale green steel to market by 2026.

SSAB CEO Martin Lindqvist said the project once fully operational would cut 10% of Sweden’s CO2 emissions and 7% of Finland’s.

Iron ore to hit US$150/t by the end of the year: ANZ

Iron ore/ steel markets watching Chinese imports of scrap given target of increased self-sufficiency to be part met by raising scrap in steel to 30% by 2025. Scrap steel utilisation circa 20% China vs 55% in EU28, 42% Russia & 69% N America. May scrap imports near 3yr high 114mt. pic.twitter.com/hSDI5e0uGq

— Robert Rennie (@Robert__Rennie) June 21, 2021

There is some evidence in that China is trying to teeter towards self-sufficiency by ramping up scrap steel recycling and domestic iron ore production.

As noted in last week’s Bulk Buys, market watchers remain pessimistic China will be able to change streams at a great enough scale to use these routes to wean its reliance on Australian iron ore.

And on the topic of China targeting an increase in its ferrous self-sufficiency, worth noting that Chinese domestic production of iron ore hit a 3 1/2yr high in May. May domestic iron ore production was the highest since Dec 2017, +16%yy & +13.5%3myy while imports were +8%3myy. pic.twitter.com/wsUNfnicGJ

— Robert Rennie (@Robert__Rennie) June 21, 2021

The benchmark 62% iron ore price fell 4.9% to US$206.55/t Monday, still in the ballpark of all time highs, with Commonwealth Bank analyst Vivek Dhar attributing the drop to steel demand concerns.

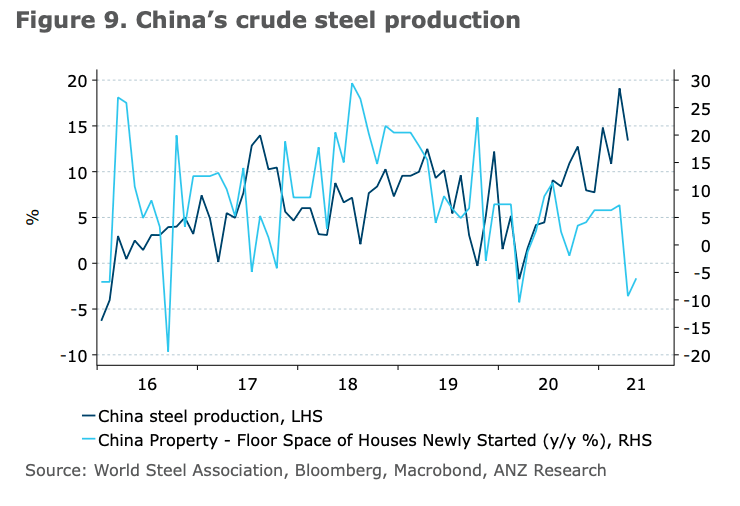

“China’s steel demand typically weakens during this time of year,” he wrote in a note.

“Steel production cuts also weighed on iron ore prices.

“Policymakers have sent out teams of inspectors from June 15 to the end of July to ensure that outdated capacity has been eliminated and that new steel plants are adhering to environmental standards.”

Futures have also been falling in recent days, with major investment bank UBS dropping the world’s biggest iron ore miner Rio Tinto to a sell on expectations of lower prices, attributed in part to the expected end of supply jitters from Brazil.

On cue, Fastmarkets reported the index price for 62% fines cfr Qingdao was back up US$6.17/t to US$214.32 per tonne Tuesday amid chatter mill restrictions would ease in steel city Tangshan. Volatile much?

Global steel production rose 16.5% year on year in May to 174.4Mt, according to the World Steel Association.

Capital Economics chief commodities economist Caroline Bain urged caution over the big rise, noting many countries outside China were coming off a low base as they remained in stringent coronavirus lockdowns this time last year and month on month output was down 0.4%.

Bain sees demand slowing in China – which saw a 1.6% month on month drop in daily output – but forecast growth in demand outside China would lead to a rise in overall production in 2021.

Of course Chinese steel production, while down from April records in May, remains around record levels, and many market experts do not see demand falling off a cliff in the near term.

ANZ Research analysts this week saw iron ore falling to US$150/t by the end of the year.

They view construction in China as cooling, saying short term support for higher iron ore prices was coming from production cuts at steel mills, who potentially upped production (and demand for iron ore) to dull the impact of Government restrictions.

“China is widely expected to phase out stimulus measures gradually, while April’s lower construction PMI suggests construction activity has already started to cool,” they wrote in their quarterly review.

“This should weigh on steel demand and exert downward pressure on the prices of steel and iron ore.”

US$150/t would still be well above prices 12 months ago and despite being around 75% of current levels, is still supportive of commercial margins for many small Australian iron ore producers.

Surefire completes scoping study on Perenjori project

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| MDX | Mindax Limited | 0.08 | -1 | 23 | 2567 | 2567 | $ 151,707,716.78 |

| MGT | Magnetite Mines | 0.07 | 4 | 17 | 483 | 2443 | $ 213,659,462.49 |

| ACS | Accent Resources NL | 0.05 | 0 | 32 | 150 | 900 | $ 23,301,364.15 |

| CAP | Carpentaria Resource | 0.205 | 41 | 105 | 318 | 754 | $ 73,739,799.98 |

| RHI | Red Hill Iron | 1.15 | -7 | 21 | 389 | 721 | $ 68,859,871.35 |

| VMS | Venture Minerals | 0.1325 | -12 | 26 | 117 | 476 | $ 186,085,099.62 |

| DRE | Drednought Resources | 0.025 | -4 | -4 | 19 | 400 | $ 61,707,294.03 |

| SRK | Strike Resources | 0.22 | 0 | -19 | 52 | 389 | $ 56,700,000.00 |

| LCY | Legacy Iron Ore | 0.0145 | -3 | -3 | -71 | 383 | $ 89,666,339.24 |

| MGU | Magnum Mining & Exp | 0.16 | -11 | -6 | 167 | 357 | $ 75,129,349.87 |

| GWR | GWR Group Ltd | 0.275 | -4 | -7 | -7 | 330 | $ 84,780,204.04 |

| TI1 | Tombador Iron | 0.09 | -14 | -14 | 70 | 328 | $ 91,583,770.92 |

| SRN | Surefire Rescs NL | 0.017 | -15 | -29 | -37 | 325 | $ 18,593,076.97 |

| RLC | Reedy Lagoon Corp. | 0.017 | -11 | 0 | -15 | 325 | $ 7,990,444.82 |

| FEX | Fenix Resources Ltd | 0.33 | 2 | 3 | 35 | 293 | $ 152,819,524.00 |

| IRD | Iron Road Ltd | 0.27 | -4 | 38 | 54 | 263 | $ 209,954,009.20 |

| ADY | Admiralty Resources. | 0.021 | 24 | 11 | 75 | 200 | $ 24,341,828.68 |

| EFE | Eastern Iron | 0.013 | 8 | -7 | 39 | 179 | $ 9,688,012.93 |

| SHH | Shree Minerals Ltd | 0.011 | -21 | -31 | -50 | 175 | $ 12,227,224.26 |

| MIN | Mineral Resources. | 48.92 | -1 | 14 | 40 | 149 | $ 9,012,143,140.50 |

| MIO | Macarthur Minerals | 0.435 | -7 | 0 | -15 | 135 | $ 66,791,714.13 |

| CIA | Champion Iron Ltd | 6.43 | -4 | -7 | 26 | 123 | $ 3,179,665,509.92 |

| HAV | Havilah Resources | 0.21 | -22 | -24 | 24 | 119 | $ 62,786,831.74 |

| GRR | Grange Resources. | 0.525 | -4 | 4 | 75 | 102 | $ 601,816,122.96 |

| BCK | Brockman Mining Ltd | 0.04 | -5 | -18 | -11 | 74 | $ 361,890,053.11 |

| FMG | Fortescue Metals Grp | 22.22 | -4 | 0 | -8 | 61 | $ 67,152,224,861.58 |

| TLM | Talisman Mining | 0.215 | 2 | 2 | 122 | 59 | $ 40,125,102.78 |

| MGX | Mount Gibson Iron | 0.905 | 5 | 1 | -6 | 37 | $ 1,055,466,288.42 |

| BHP | BHP Group Limited | 46.35 | -5 | -3 | 6 | 32 | $ 134,360,282,080.34 |

| RIO | Rio Tinto Limited | 121.42 | -3 | -1 | 2 | 26 | $ 44,564,506,490.70 |

| FMS | Flinders Mines Ltd | 0.88 | -3 | -2 | -18 | 1 | $ 148,586,747.76 |

| JNO | Juno | 0.19 | -3 | -3 | $ 25,096,730.19 | ||

| GEN | Genmin | 0.22 | -4 | -19 | $ 57,756,259.25 | ||

| AKO | Akora Resources | 0.25 | -9 | -14 | -33 | $ 12,294,144.00 | |

| CZR | CZR Resources Ltd | 0.0105 | -13 | -30 | -25 | -30 | $ 28,530,188.94 |

| MAG | Magmatic Resrce Ltd | 0.135 | 0 | -37 | -21 | -45 | $ 28,513,665.31 |

| HAW | Hawthorn Resources | 0.047 | -10 | -4 | -59 | -52 | $ 15,675,233.81 |

| FEL | FE Limited | 0.05 | -12 | 0 | 25 | 400 | $33,570,000.00 |

Higher iron ore prices have inspired a number of juniors to dust off old projects.

Gold tiddler Surefire Resources (ASX: SRN) is taking a closer look at its Perenjori iron project, a couple hundred kms from port infrastructure in Geraldton.

At 191.7 Mt at 36.6% iron content (JORC 2004 compliant) the magnetite resource would need to be beneficiated to 67.5% iron ore concentrate, a product that would gather a premium over the benchmark 62% price.

While it has not released any hard numbers, the penny stock yesterday said the study had confirmed the “economic potential” of the Perenjori project.

“Technical assessment has already indicated the ore can produce a high grade magnetic concentrate that is attractive to the market,” managing director Vladimir Nikolaenko said.

“This first-pass preliminary economic assessment has now provided the Board with confidence that the Perenjori Iron Project is commercially attractive. Surefire can now confidently plan to move the project forward.”

First steps will include resource definition work to convert the resource to JORC 2012 standards.

Surefire Resources share price today:

At Stockhead, we tell it like it is. While Surefire Resources is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.