China’s paying twice as much for US coking coal… but these ASX coal stocks are benefiting

Chinese steel mills are opting for North American coking coal over Australian despite the added cost. Image: Getty

- Chinese coking coal buyers giving a wide berth to cheaper-priced Australian cargoes

- $US100 per tonne premium paid by Chinese buyers for North American cargoes

- Several ASX coal companies have coking coal projects in Canada, Russia, Mongolia and the US

Chinese steel mills and traders are paying up to $US100 per tonne ($128/tonne) more for cargoes of North American coking coal than similar quality Australian coal.

The reasons for this market peculiarity are unclear, and on the surface it does defy rational economic behaviour as Australian coking coal has been a mainstay of China’s steel industry, and is renowned for its very high quality.

Recent deals in the seaborne market for coking coal show Chinese buyers are picking up cargoes of Canadian and US coking coal for prices of around $US200 to $US210 per tonne on a delivered-China price basis.

Chinese buyers appear to be avoiding cargoes of comparable quality Australian coking coal, which is mostly shipped from Queensland, according to price reporting agency Argus Media.

This is despite attractive offers priced around $US100 to $US110 per tonne on a free-on-board basis; that is, excluding any shipping costs.

Availability for North American coking coal is fairly limited due to the small number of export terminals on the Pacific coast of Canada and America.

In addition, most Canadian and US shipments are already pledged to long-term customers, leaving relatively small volumes for spot buyers.

As a result, prices for North American coking coal sold to China are likely to stay elevated for a while, according to market experts.

“Most market participants agreed that US and Canadian coal would continue to face upward pressure, given limited options for the premium low-volatile segment in the absence of Australian coal,” said Argus Media in a report.

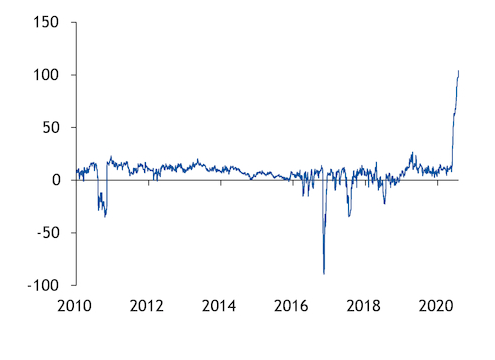

Chinese coking coal buyers are paying $US100 per tonne more for North American cargoes

Australian cargoes fall out of favour in China market

Australian shipments of coking coal to China have tailed off in recent months, as shown in Chinese import data and Australian port statistics.

Import statistics for China show the country imported only 1.4 million tonnes of Australian coking coal in November, down 64 per cent on year.

Gladstone port in Queensland shipped only 407,000 tonnes of coal to China in the December 2020-ended quarter, down from 2.5 million tonnes for the corresponding December 2019-ended quarter, according to port data.

Recently ASX-listed Dalrymple Bay Infrastructure (ASX:DBI) operates Queensland’s Dalrymple Bay coal terminal that handles 15 per cent of the global seaborne market’s coking coal shipments.

The terminal is used by a number of coal companies including Anglo American, BHP (ASX:BHP) and its Japanese joint venture partners Glencore, Peabody, Stanmore Coal (ASX:SMR) and Terracom (ASX:TER).

Australian coking coal is having to find alternative buyers to China in countries such as India, Japan, South Korea and Taiwan.

Beijing operates an annual quota system for coal imports and in previous years quotas have tended to get used up before the end of each year.

“Policymakers are reportedly targeting coal imports of ~270 million tonnes in 2020,” said Commonwealth Bank of Australia analysts in a recent report.

Last year’s quota number equates to imports of around 22.5 million tonnes per month for all types of coal, including coking coal.

Quotas are usually reset on January 1 each year, and in theory, Chinese buyers should be able to buy more imported coking coal from Australia.

Market participants have advanced other reasons for the apparent aversion Chinese buyers are displaying toward Australian coking coal.

Some reports state that trade and diplomatic tensions between Beijing and Canberra are at the root of the issues affecting the Australian coal market.

ASX coal companies with non-Australian coking coal projects

Investors looking to capitalise on the higher prices paid by Chinese coal buyers for North American coking coal can do so through the ASX.

There are five ASX-listed coal producers that have operations in Canada, namely, Allegiance Coal (ASX:AHQ), Atrum Coal (ASX:ATU), Jameson Resources (ASX:JAL) and Montem Resources (ASX:MR1) and Pacific American Holdings (ASX:PAK).

Allegiance Coal is aiming to ramp up production to 2.5 million tonnes per year at its New Elk coking coal mine in the US state of Colorado.

The company has a 10-year rail contract with Union Pacific to deliver New Elk cargo to ports in Houston, Texas or New Orleans, Louisiana.

Atrum Coal has its tier-one quality Elan hard coking coal project in Alberta, western Canada, that lies near to Teck Resources’ Elkview coking coal mine.

A pre-feasibility study for Elan is expected to be completed by mid-year, and its coal quality is similar to that of Queensland premium hard coking coal.

Jameson Resources’ flagship asset is its Crown Mountain coking coal project in British Columbia, western Canada.

Montem Resources is planning to restart production in 2022 at the Tent Mountain coking coal mine that sold product to Japanese steel mills.

Tent Mountain mine is on the border of Canada’s British Columbia and Alberta provinces, and has a production cost of just under $US100 per tonne.

Pacific American has its Elko coking coal project also in British Columbia for which it is carrying out a resource drilling program.

Aspire Mining (ASX:AKM) is fast-tracking the development of its Ovoot coking coal project in Mongolia on China’s northern border.

Tigers Realm Coal (ASX:TIG) is expanding its Russian coal operation that ships from the Pacific port of Beringovsky to customers in China, Japan and Korea.

The ASX company is investing in a coal handling plant that will increase its production of higher-priced coking coal to 85 per cent of its total shipments.

ASX share prices for Aspire Mining (ASX:AKM), Allegiance Coal (ASX:AHQ), Atrum Coal (ASX:ATU), Jameson Resources (ASX:JAL), Montem Resources (ASX:MR1), Pacific American (ASX:PAK), Tigers Realm Coal (ASX:TIG).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.