When zero is hero: Why Vulcan’s Zero Carbon Lithium Project is ahead of the pack

Mining

Mining

Vulcan Energy Resources’ Zero Carbon Lithium Project is a unique, world class development that seeks to produce renewable heat and power as well as enough lithium hydroxide for 1 million electric vehicles each year.

Most lithium traded to Asian chemical producers, battery and carmakers currently is sold as lithium carbonate from brine operations in South America or spodumene from hard rock mines in Western Australia.

Since 2018, Vulcan Energy Resources (ASX:VUL) has been proving up an improved process.

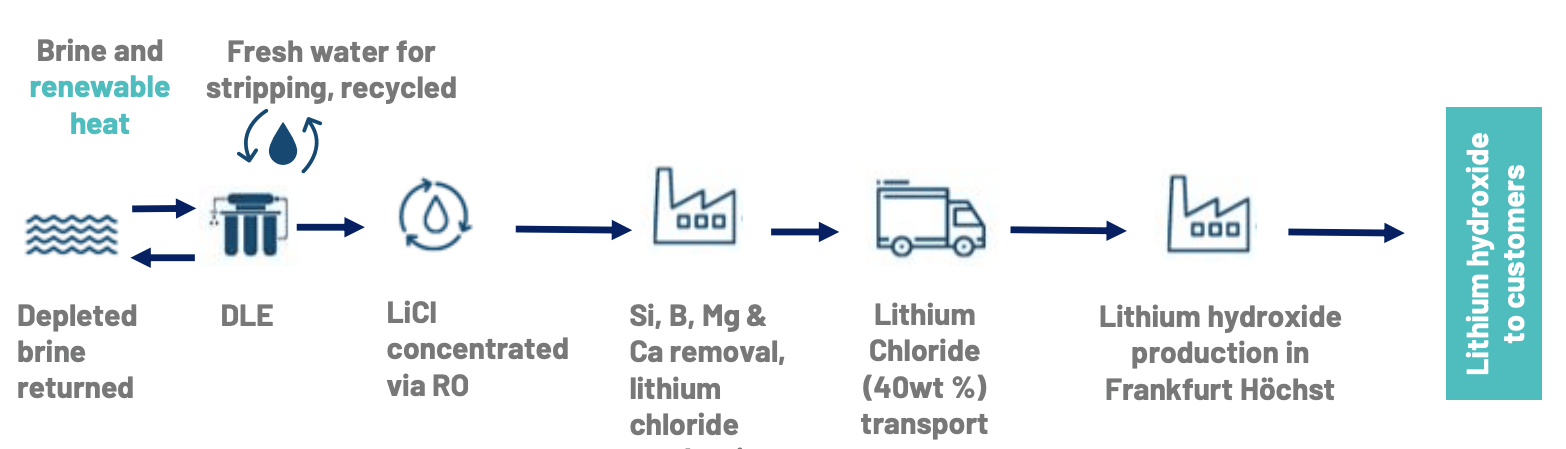

It will be using adsorption-type direct lithium extraction (A-DLE) to produce battery grade chemicals from lithium rich brines in geothermal energy wells in the Upper Rhine Valley Brine Field of Germany.

This lithium will be produced free of the drawbacks of other waste-and-energy-intensive production methods, because the geothermal wells will generate more green energy than the operations require.

In fact, this energy will also be on-sold, providing the company with two important streams of revenue.

The Zero Carbon Lithium™ Project now contains the largest lithium resource in Europe, and is globally significant.

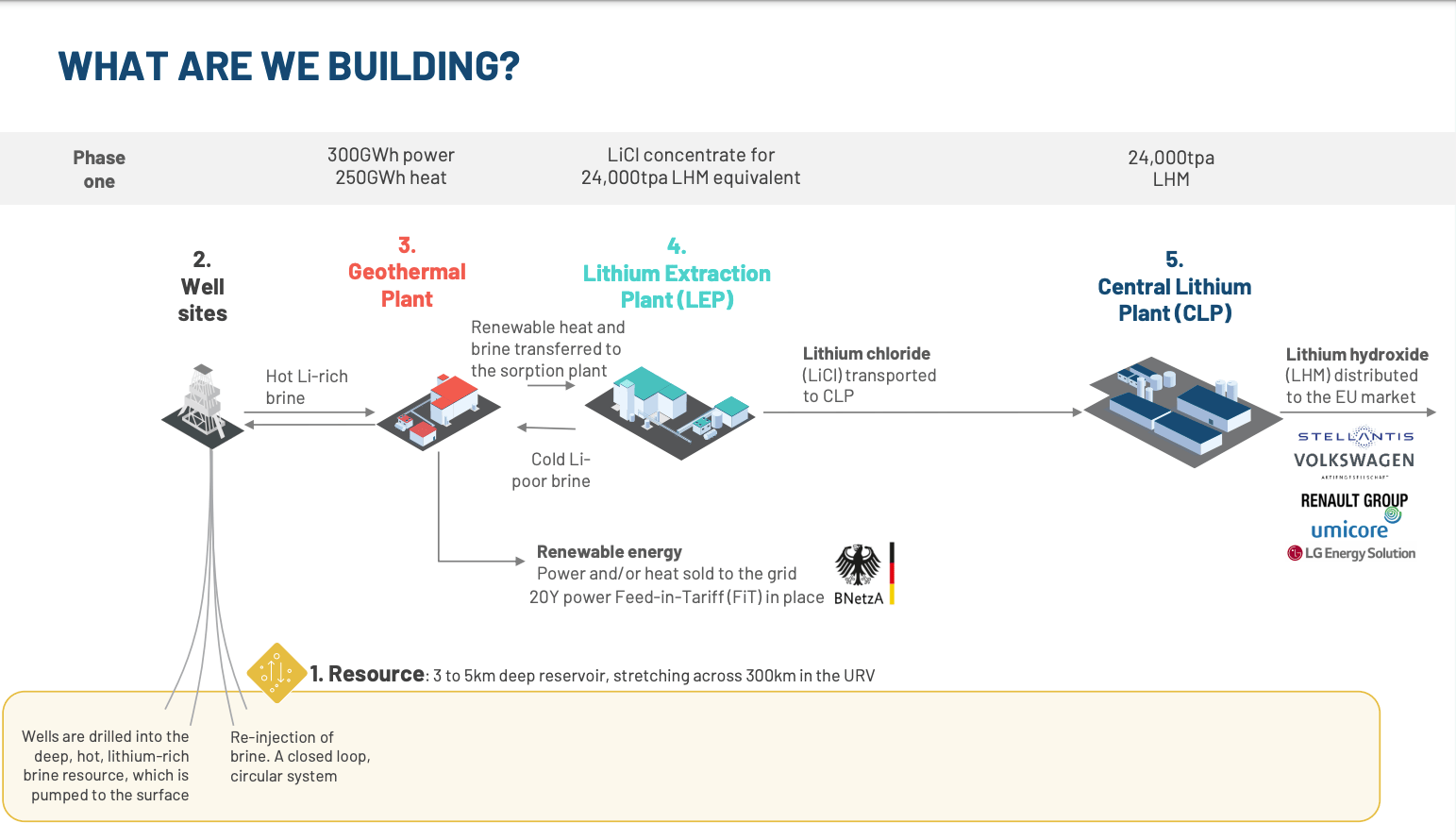

The Phase 1 project is currently planning to produce 24,000tpa lithium hydroxide with co-product renewable heat and electricity from late 2025.

This will deliver post-tax net present value and internal rate of return of €2.6Bn and 26% respectively.

Opex will be lowest industry quartile, estimated at €4,359/t lithium hydroxide, while payback is targeted to occur in 3.5 years.

The scale and green credentials of the project has attracted a healthy pipeline of cornerstone investments and offtakes with a range of OEMs.

The next steps are financing and construction. Vulcan is closing in on being ready to start pursuing some €1.5bn in financing in earnest in mid-November this year.

Executive chairman Dr Francis Wedin told Stockhead that the company was putting in place the last pieces of the puzzle for securing financing, which will be a big proof point for the Phase 1 Zero Carbon Lithium Project.

“We are actively preparing for the execution phase right now” he says.

“We bought the main piece of land [for] Phase 1, which is a 24,000tpa lithium hydroxide operation with a co-product of roughly 30 megawatts of heat and 30 megawatts of renewable power production.

“That’s from the core producing parts of our field. We already have a commercial geothermal plant there and wells already in production and are basically adding more wells to increase the brine production.

“We are building the lithium extraction plant and lithium hydroxide plant downstream as well.”

It would be inaccurate to describe Zero Carbon Lithium™ as a mining project, rather, it has far greater similarities to an integrated oil and gas project, minus the oil and gas.

Unlike most lithium brine projects, the brines targeted by Vulcan’s project are located deep underground, which imbues the liquid with plenty of heat.

These brines are pumped out at high temperatures exceeding 160 degrees centigrade and are used to produce both renewable electricity and heating through well-understood geothermal processes that are used extensively throughout the Upper Rhine Valley, including by Vulcan.

Once this process is completed, the brines are passed through the adsorption columns when they are about 60 degrees – the perfect temperature for the aluminate-based adsorbents to do the job of extracting lithium chloride from the brines.

This well-understood and commercially proven method of extraction dates back to the 1970s when it was developed by Dow and has been commercially used by Livent and other producers globally since the 1990s. In fact, this type of DLE currently accounts for 10% of global lithium production, and its share of production is set to increase in the coming years.

Vulcan’s project provides a significant benefit over other lithium brine projects in not having to heat the brines to the right temperature – a distinction that is expected to deliver lower operating costs compared to its peers.

Once the lithium chloride is extracted, the remaining water is reinjected into the brine reservoir while the lithium chloride concentrate is further concentrated, using steam generated from the geothermal component to force the evaporation process.

The lithium chloride concentrate is then sent through green energy-powered electrolysis that uses an electric current to produce lithium hydroxide – a key battery chemical used in the production of lithium-ion batteries.

Wedin noted that like an LNG project, Zero Carbon Lithium has upstream, midstream and downstream components.

“Upstream, you have the wells, the pipeline infrastructure. Then you basically have the energy production and lithium extraction, then the chemical refining downstream,” he says.

“That’s also why we have so many ex-oil and gas people in the company to help us execute the project, which also helps with redeploying skills towards decarbonisation as well.”

Vulcan managing director and chief executive officer Chris Moreno, a former Santos, Woodside and Shell executive, has previously worked on projects with a capex of US$40bn, substantially higher than the €1.5bn Capex for Zero Carbon Lithium.

Vulcan is currently moving into the execution phase for the project, deploying ~$200m of the $500m in capital it had raised towards preparatory works.

The company is currently awaiting on the results of the Bridging Study, which is expected to deliver some capex savings as the company is moving from having two plants to just one plant.

“We are also awaiting a last piece of land from the local city council, which will be our lithium extraction plant and also for the renewable heat plant that will make us the main supplier of heat to the local city,” Wedin says.

Vulcan is also commissioning its optimisation plant – the upstream Lithium Extraction Optimisation Plant (LEOP) at Landau, and the downstream Central Lithium Electrolysis Optimisation Plant (CLEOP) at the Frankfurt Hoechst Chemical Park, which represent a €40m investment, as the final piece of the puzzle.

These will serve to train the production team. Wedin says the team will be fully trained by the time the commercial plant is completed, which should reduce the time needed to get into production. They will soon start producing the first tonnes of lithium chemicals ever fully domestically produced in Europe.

This will position the company to launch the financing process in mid-November.

Whilst the current €1.5bn capex is substantial, Vulcan does have substantial conditional commitments from export credit agencies, which essentially offer cheap government-backed loans, in France, Italy and Canada.

“That is obviously subject to the full process of due diligence, etc, but we have seen indications of support from European Export Credit Agencies (ECAs) for a substantial part of our debt requirements already,” Wedin says.

He added that in terms of raising equity funding, the company was looking to do so at the project level rather than at the top tier (company) level.

Once again, this is similar to how LNG projects work with Wedin noting that the company could have multiple partners in different parts of the project.

“We already have interest from chemicals companies, and also from energy companies like oil and gas companies who want to come in for parts of the project,” he says.

“The aim is we have a pretty tight capital structure, and we aim to get into production with that tight capital structure and not to raise much more top tier equity.”

Vulcan will also be looking to get grant funding from the German Government, which would further reduce the amount of capital that it would have to raise to get its asset under way.

While Vulcan’s immediate focus is on starting the financing phase, the company is also keeping a keen eye on the future.

Notably, the last three years of pilot work has allowed the company to develop its own inhouse adsorbents, which places it in the same league as major companies such as Eramet and Livent.

“You will see a lot of brine developers buy adsorbents off the shelf from technology companies,” Wedin says.

“We think that’s not the right approach because while the adsorbents work fine when tested, ultimately you need control of your adsorbent technology because it is such a core part of the project.

“We have labs in Germany which are constantly iterating and improving the adsorbents.”

Having its own inhouse adsorbents developed using European and Australian intellectual property is also a strategic advantage.

“Some companies give away project equity to a technology provider, we don’t need to do that, we worked to get control over that,” Wedin says.

“They are all aluminate-based adsorbents. They all date back to that original recipe by Dow back in the 70s. But everyone has their own tweaks and if you have control over it, you can lower costs and improve performance as a result of that.”

Having its own adsorbents also opens the way for an intriguing business option, namely providing adsorbents to other lithium brine companies.

“We have had enquiries from South America, North America and North Africa as well for brines there that want to use our adsorbents and want to use Western technology,” Wedin explained.

“In the medium term, there is a lot of value there for us in terms of the application of that technology.

“We want it for our own uses, but we are actually looking at licensing, we are getting licensing enquiries right now, so it might not be too far away.”

Separately, the company could see further integration with offtake partner Stellantis that would have Vulcan provide geothermal heating to the automobile manufacturer’s plants.

It could also develop further phases of the Zero Carbon Lithium project or even expand across the Upper Rhine Valley.

“Ultimately, wherever we build the renewable energy infrastructure, we can build more lithium production as well,” Wedin concluded.

This article was developed in collaboration with Vulcan Energy Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.